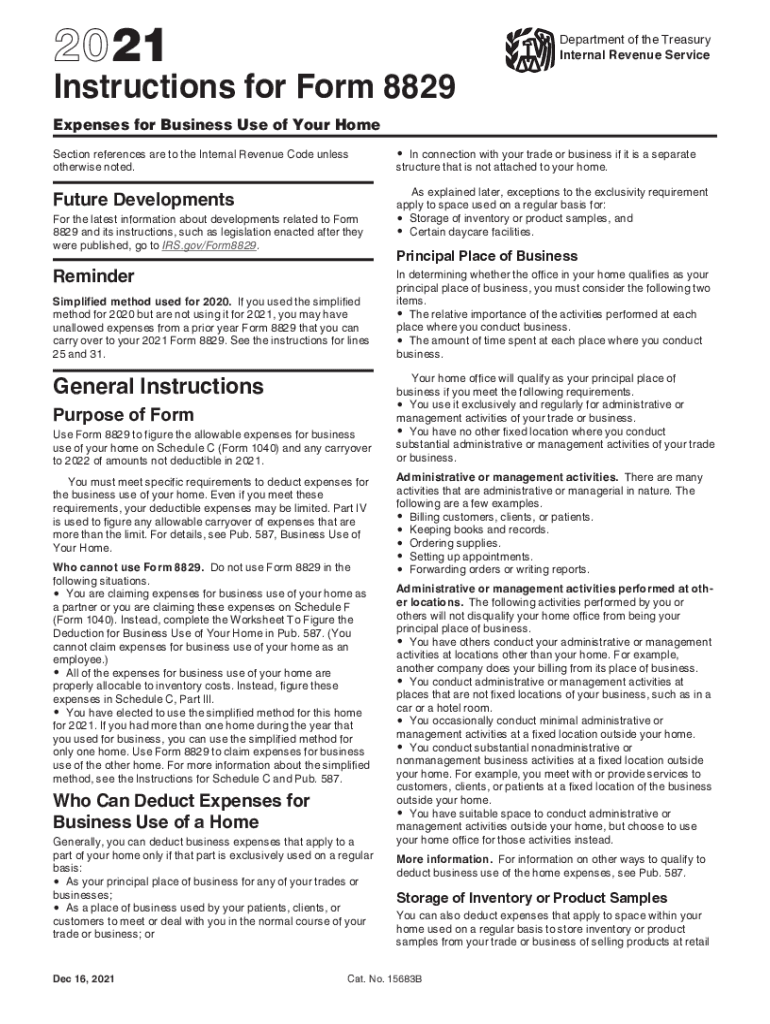

Form 8829 2021

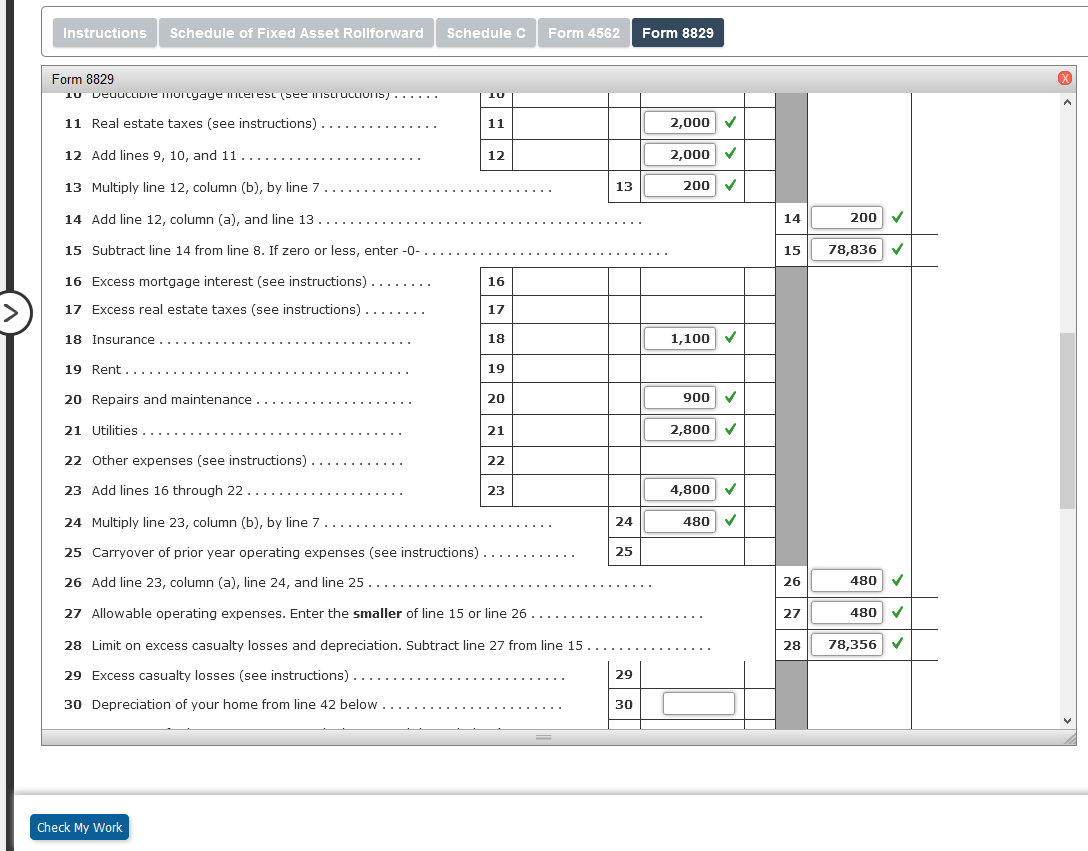

Form 8829 2021 - Web internal revenue service (irs) form 8829 is the form used to calculate these deductions. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Use a separate form 8829 for each home you used for business during the year. This form is for income earned in tax year 2022, with tax returns due in april 2023. Use get form or simply click on the template preview to open it in the editor. Go to www.irs.gov/form8829 for instructions and the latest information. Web irs form 8829 helps you determine what you can and cannot claim. Use a separate form 8829 for each home you used for the business during the year. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web we last updated federal form 8829 in december 2022 from the federal internal revenue service.

Irs form 8829 is used by small business owners to calculate the allowable expenses for business use of their home or apartment and total the amount of allowable deductions for operating expenses and losses. You must meet specific requirements to deduct expenses for the business use of your. Web form 8829 2021 expenses for business use of your home department of the treasury internal revenue service (99) file only with schedule c (form 1040). Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Web we last updated federal form 8829 in december 2022 from the federal internal revenue service. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Use a separate form 8829 for each home you used for business during the year. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web form 8829, also called the expense for business use of your home, is the irs form you use to calculate and deduct your home office expenses.

Web form 8829, also called the expense for business use of your home, is the irs form you use to calculate and deduct your home office expenses. Start completing the fillable fields and carefully type in required information. Web form 8829 2021 expenses for business use of your home department of the treasury internal revenue service (99) file only with schedule c (form 1040). Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Use get form or simply click on the template preview to open it in the editor. Web we last updated federal form 8829 in december 2022 from the federal internal revenue service. Use a separate form 8829 for each home you used for business during the year. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web irs form 8829 helps you determine what you can and cannot claim.

Form 8829 for the Home Office Deduction Credit Karma

Irs form 8829 is used by small business owners to calculate the allowable expenses for business use of their home or apartment and total the amount of allowable deductions for operating expenses and losses. Web internal revenue service (irs) form 8829 is the form used to calculate these deductions. Web the irs and most states collect a personal income tax,.

2018 Irs Instructions Form Pdf Fill Out and Sign Printable PDF

Go to www.irs.gov/form8829 for instructions and the latest information. Web form 8829 2021 expenses for business use of your home department of the treasury internal revenue service (99) file only with schedule c (form 1040). Use a separate form 8829 for each home you used for the business during the year. Irs form 8829 is used by small business owners.

Simplified method worksheet 2023 Fill online, Printable, Fillable Blank

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Web irs form 8829 helps you determine.

Simplified Method Worksheet 2021 Home Office Simplified Method

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Irs form 8829 is used by small business owners to calculate the allowable expenses for business use of their home or apartment and total the amount of allowable deductions for operating expenses and.

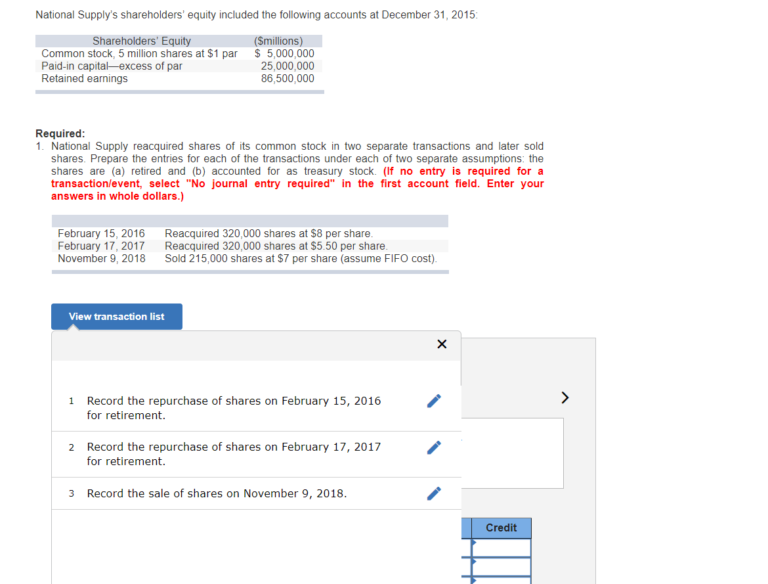

I NEED HELP WITH THE BLANKS PLEASE. """ALL

You must meet specific requirements to deduct expenses for the business use of your. Web irs form 8829 helps you determine what you can and cannot claim. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Web the irs and most states.

Revisiting Form 8829 Business Use of Home Expenses for 2020 Lear

Use a separate form 8829 for each home you used for business during the year. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Start completing the fillable fields and carefully type in required information. Irs form 8829 is used by small.

Form_8829_explainer_PDF3 Camden County, NJ

Web internal revenue service (irs) form 8829 is the form used to calculate these deductions. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Web form 8829 2021 expenses for business use of your home department of the treasury internal revenue.

U.S. Tax Form 8829—Expenses for Business Use of Your Home FreshBooks Blog

Use the cross or check marks in the top toolbar to select your answers in the list boxes. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Use a separate form 8829 for each home you used for business during the year. Go to www.irs.gov/form8829 for.

Form 8829 Expenses for Business Use of Your Home (2015) Free Download

Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Go to www.irs.gov/form8829 for instructions and the latest information. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web form 8829 2021 expenses for business use of your home department of the treasury.

Deadline Corp. reported net of 1,692,900 for 2017. Deadline's

You must meet specific requirements to deduct expenses for the business use of your. Web we last updated federal form 8829 in december 2022 from the federal internal revenue service. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Web internal.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Web internal revenue service (irs) form 8829 is the form used to calculate these deductions. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Use the cross or check marks in the top toolbar to select your answers in the list boxes.

Use Form 8829 To Figure The Allowable Expenses For Business Use Of Your Home On Schedule C (Form 1040) And Any Carryover To Next Year Of Amounts.

Use get form or simply click on the template preview to open it in the editor. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Irs form 8829 is used by small business owners to calculate the allowable expenses for business use of their home or apartment and total the amount of allowable deductions for operating expenses and losses. Web the irs and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments.

Web Form 8829 2021 Expenses For Business Use Of Your Home Department Of The Treasury Internal Revenue Service (99) File Only With Schedule C (Form 1040).

Go to www.irs.gov/form8829 for instructions and the latest information. Web form 8829, also called the expense for business use of your home, is the irs form you use to calculate and deduct your home office expenses. Web we last updated federal form 8829 in december 2022 from the federal internal revenue service. You must meet specific requirements to deduct expenses for the business use of your.

Web Irs Form 8829 Helps You Determine What You Can And Cannot Claim.

Use a separate form 8829 for each home you used for the business during the year. One of the many benefits of working at home is that you can deduct legitimate expenses from your taxes. Use a separate form 8829 for each home you used for business during the year. Start completing the fillable fields and carefully type in required information.