941X Form 2021

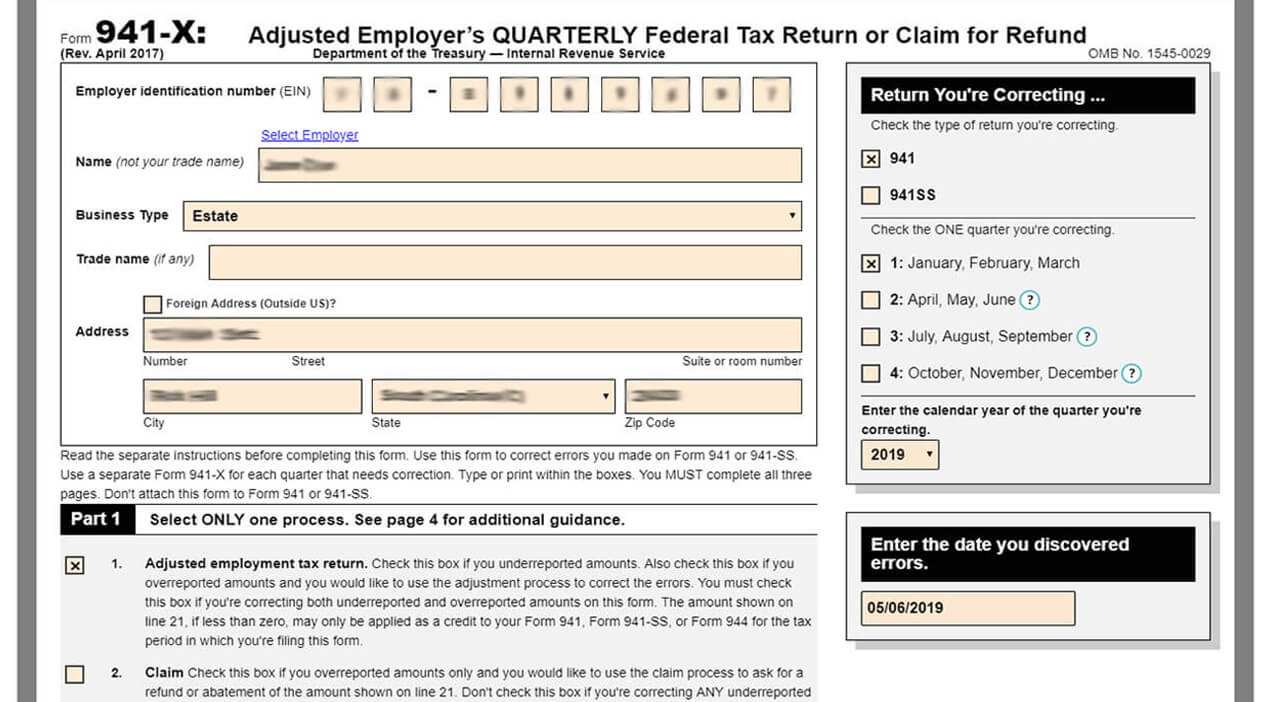

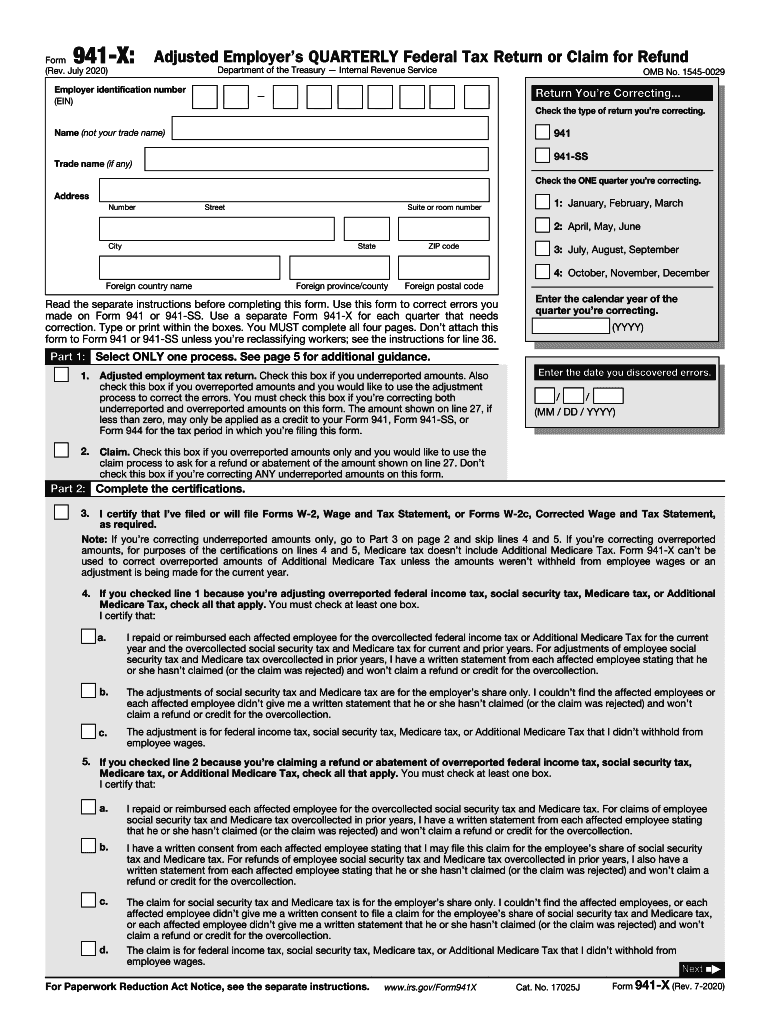

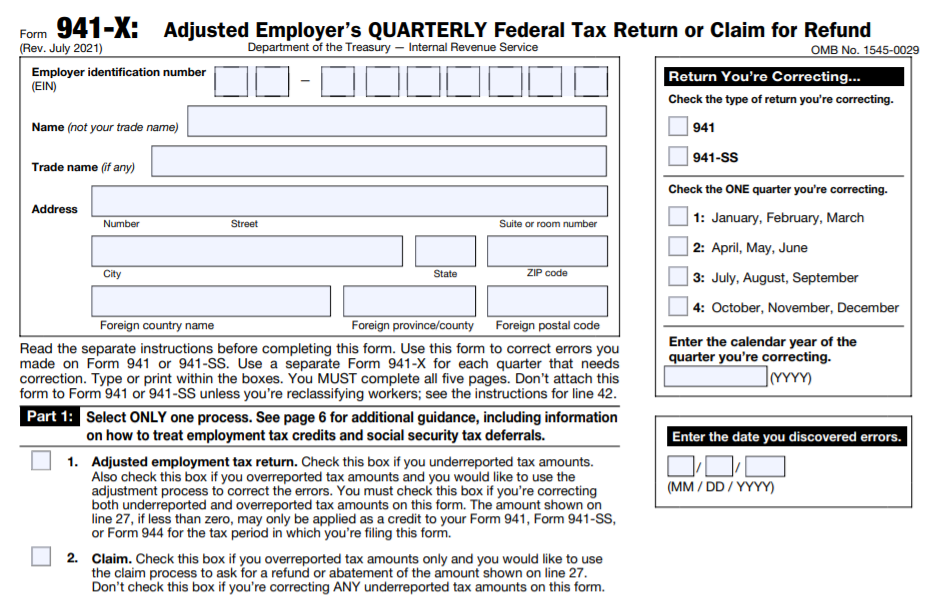

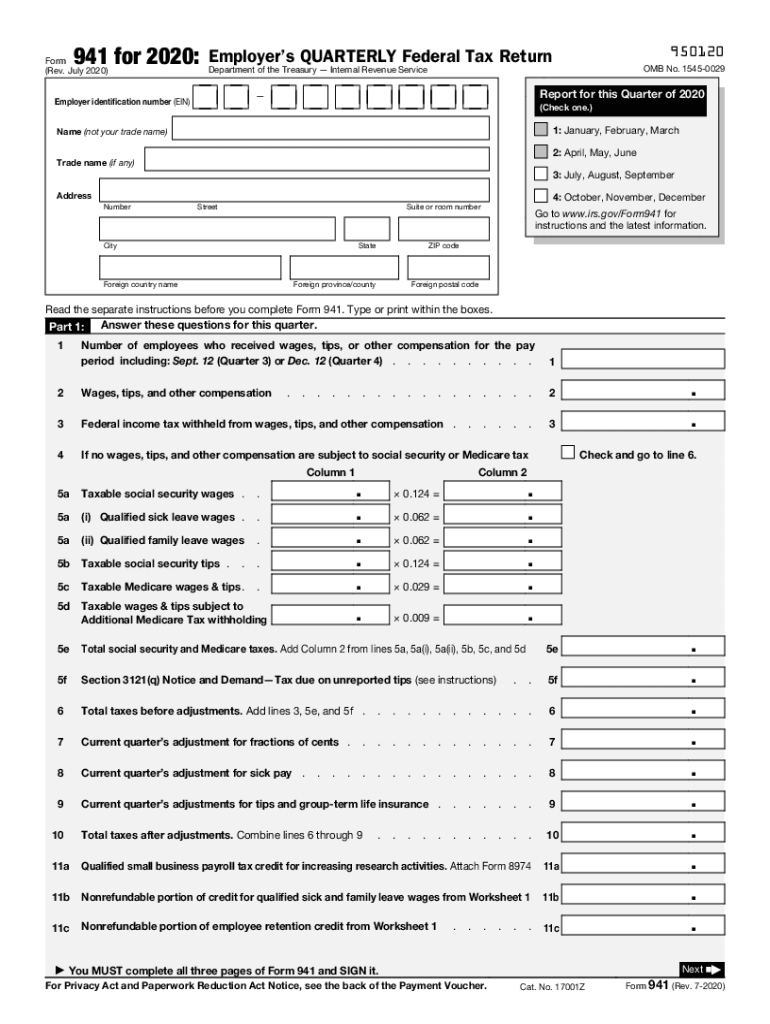

941X Form 2021 - April, may, june read the separate instructions before completing this form. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. File 941 x for employee retention credit is it possible to file both an erc and a ppp in the same tax year? See the instructions for line 42. Web the third round of economic impact payments occurred in 2021, more than two years ago. If you're correcting a quarter that began Web there is no wage base limit for medicare tax. These messages can arrive in the form of an unsolicited text or email to lure unsuspecting victims to provide valuable personal and financial information. Social security and medicare taxes apply to election workers who are paid $2,000 or more in cash or an equivalent form of compensation in 2021. July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.

Type or print within the boxes. An employer is required to file an irs 941x in the event of an error on a previously filed form 941. July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Read the separate instructions before you complete form 941. For instructions and the latest information. Taxpayers can use form 941x to make changes to the original form 941 that they’ve already filed. When it comes to worksheet 2, there are two steps. This worksheet 2 is applicable only for the second quarter of 2021. April, may, june read the separate instructions before completing this form. 1 choose the tax year & quarter.

Is it possible to incorporate pay from qualified leave wages? File 941 x for employee retention credit is it possible to file both an erc and a ppp in the same tax year? Click the arrow with the inscription next to jump from field to field. Web the third round of economic impact payments occurred in 2021, more than two years ago. Find which payroll quarters in 2020 and 2021 your association was qualified for. See the instructions for line 42. These messages can arrive in the form of an unsolicited text or email to lure unsuspecting victims to provide valuable personal and financial information. Type or print within the boxes. The form 941 worksheet 4 will be used by employers to calculate their refundable and nonrefundable portions of the employee retention credit during the third and fourth quarters of 2021. If you're correcting a quarter that began

Updated Form 941 Worksheet 1, 2, 3 and 5 for Q2 2021 Revised 941

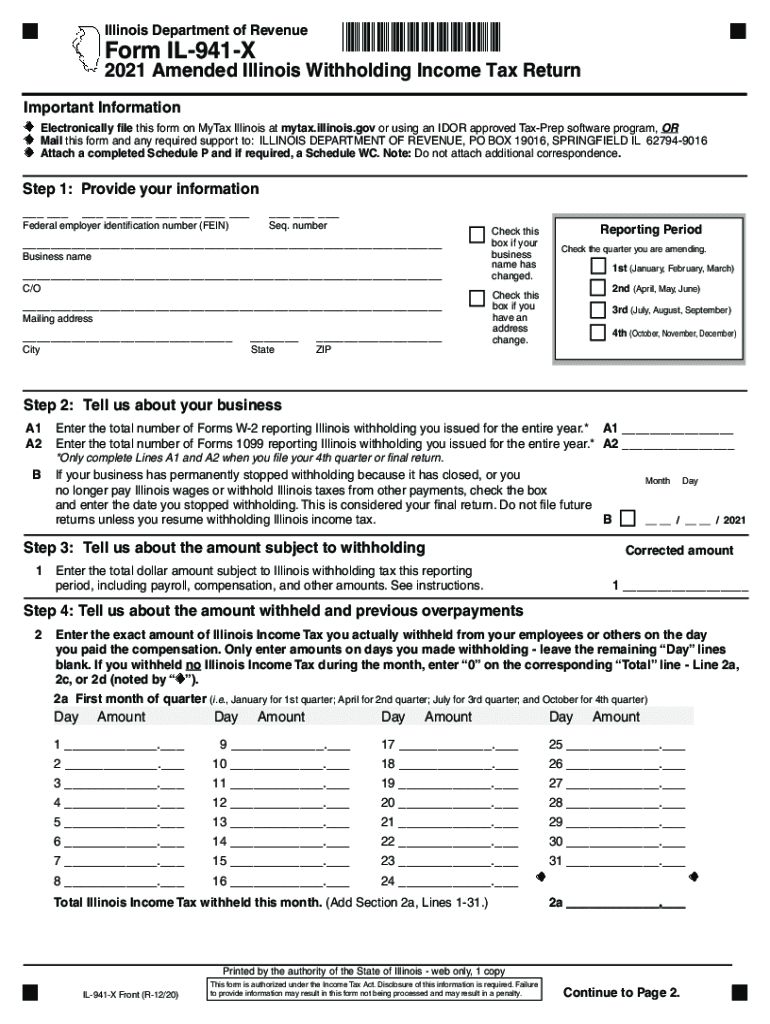

If you're correcting a quarter that began Type or print within the boxes. This form on mytax illinois at. Click the arrow with the inscription next to jump from field to field. Purpose of the form 941 worksheet 4.

Simple Form 941X 2018 Fill Out and Sign Printable PDF Template signNow

July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Type or print within the boxes. For instructions and the latest information. April, may, june read the separate instructions before completing this form. Web there is no wage base limit for medicare tax.

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

Type or print within the boxes. The form 941 worksheet 4 will be used by employers to calculate their refundable and nonrefundable portions of the employee retention credit during the third and fourth quarters of 2021. Web the third round of economic impact payments occurred in 2021, more than two years ago. This worksheet 2 is applicable only for the.

Worksheet 2 941x

Click the arrow with the inscription next to jump from field to field. Type or print within the boxes. July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and.

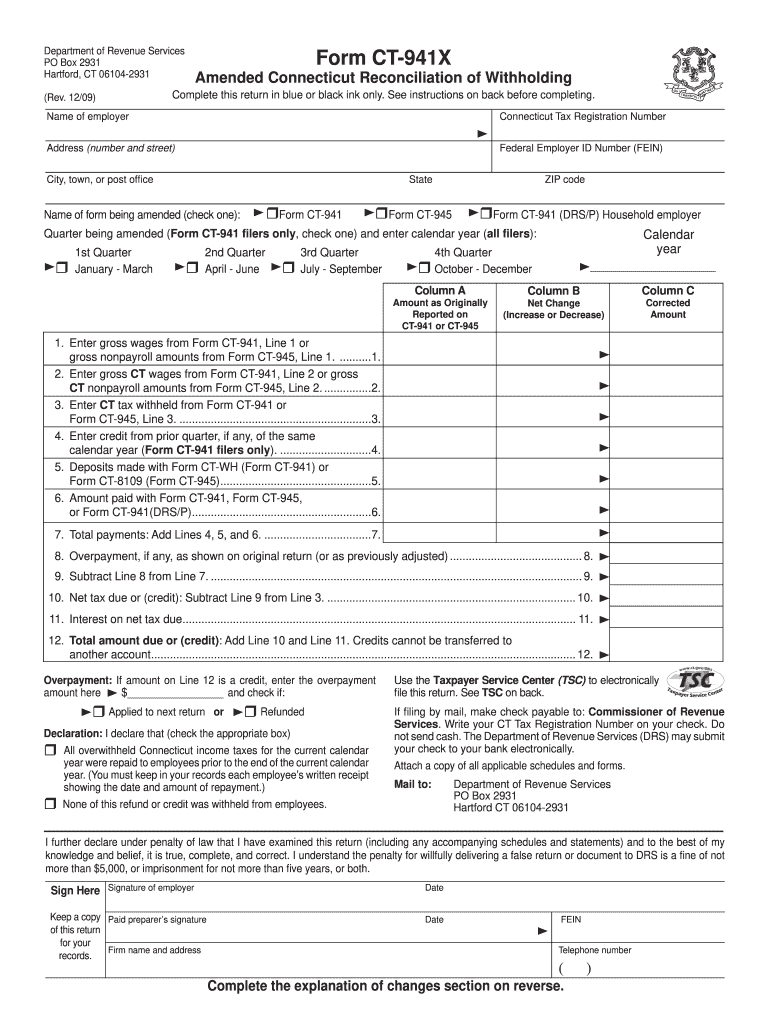

Ct Form 941 X Fill Out and Sign Printable PDF Template signNow

The adjustments also entail administrative errors and alterations to employee retention tax credits. When it comes to worksheet 2, there are two steps. Type or print within the boxes. You must complete all five pages. Web there is no wage base limit for medicare tax.

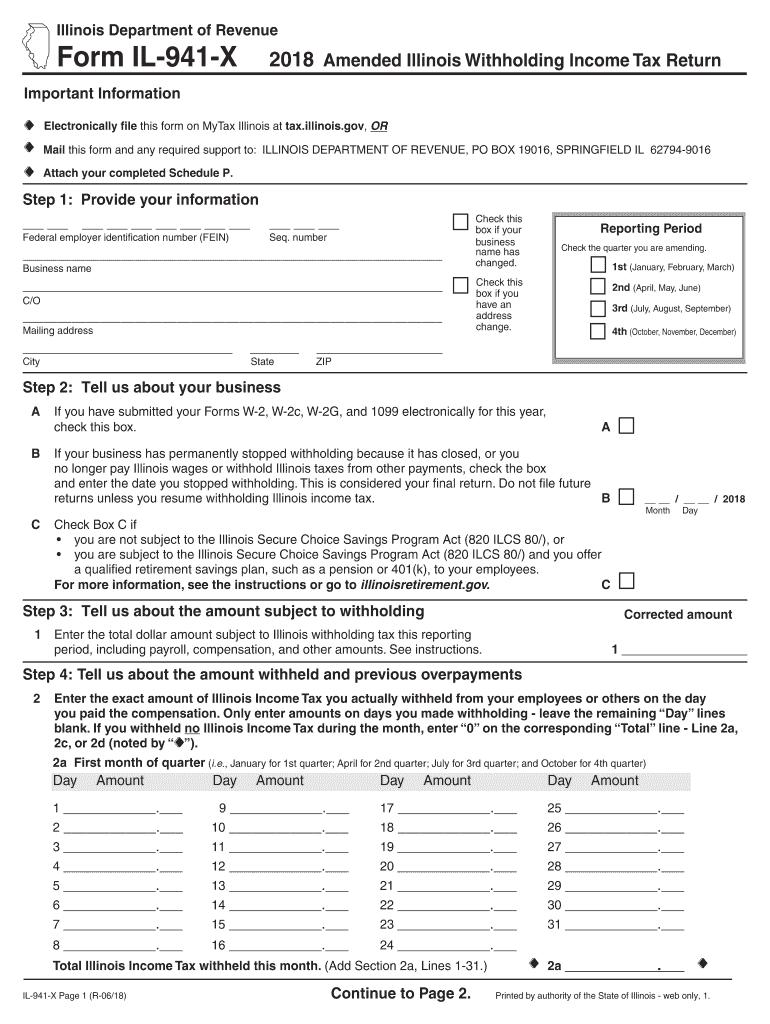

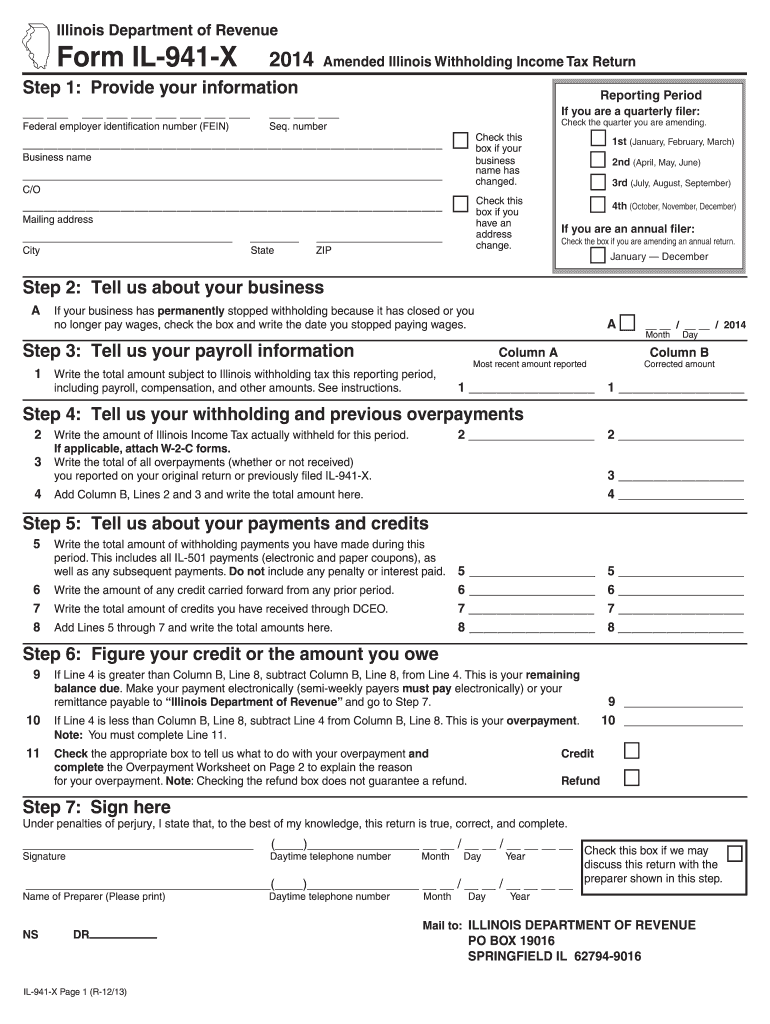

Il 941 X Form Fill Out and Sign Printable PDF Template signNow

Find which payroll quarters in 2020 and 2021 your association was qualified for. Web the third round of economic impact payments occurred in 2021, more than two years ago. The form 941 worksheet 4 will be used by employers to calculate their refundable and nonrefundable portions of the employee retention credit during the third and fourth quarters of 2021. Is.

941x Fill out & sign online DocHub

Click the arrow with the inscription next to jump from field to field. The term “nonrefundable” is a misnomer if the taxpayer did not claim the erc, and instead paid the employer’s share of the social security tax via federal tax deposits. Taxpayers can use form 941x to make changes to the original form 941 that they’ve already filed. Web.

IL DoR IL941X 2021 Fill out Tax Template Online US Legal Forms

Web the third round of economic impact payments occurred in 2021, more than two years ago. Taxpayers can use form 941x to make changes to the original form 941 that they’ve already filed. As soon as you discover an error on form 941, you must take the following actions: Web what is form 941x? See the instructions for line 42.

IRS Form 941X Complete & Print 941X for 2022

The form 941 worksheet 4 will be used by employers to calculate their refundable and nonrefundable portions of the employee retention credit during the third and fourth quarters of 2021. An employer is required to file an irs 941x in the event of an error on a previously filed form 941. 1 choose the tax year & quarter. Web the.

Irs Forms 2020 Printable Fill Out and Sign Printable PDF Template

You must complete all five pages. Social security and medicare taxes apply to election workers who are paid $2,000 or more in cash or an equivalent form of compensation in 2021. Purpose of the form 941 worksheet 4. Click the arrow with the inscription next to jump from field to field. Fill in the required details on the page header,.

Is It Possible To Incorporate Pay From Qualified Leave Wages?

This is reported on the revised form 941 worksheet 1. As soon as you discover an error on form 941, you must take the following actions: The adjustments also entail administrative errors and alterations to employee retention tax credits. Taxpayers can use form 941x to make changes to the original form 941 that they’ve already filed.

You Must Complete All Five Pages.

The form 941 worksheet 4 will be used by employers to calculate their refundable and nonrefundable portions of the employee retention credit during the third and fourth quarters of 2021. See the instructions for line 42. This worksheet 2 is applicable only for the second quarter of 2021. Type or print within the boxes.

Web The Third Round Of Economic Impact Payments Occurred In 2021, More Than Two Years Ago.

April, may, june read the separate instructions before completing this form. For instructions and the latest information. Social security and medicare taxes apply to the wages of household workers you pay $2,300 or more in cash wages in 2021. Find which payroll quarters in 2020 and 2021 your association was qualified for.

An Employer Is Required To File An Irs 941X In The Event Of An Error On A Previously Filed Form 941.

If you're correcting a quarter that began This form and any required support to: For more information, see the instructions for form 8974 and go to irs.gov/ researchpayrolltc. 1 choose the tax year & quarter.

.jpg)