Va Form 21P-8416

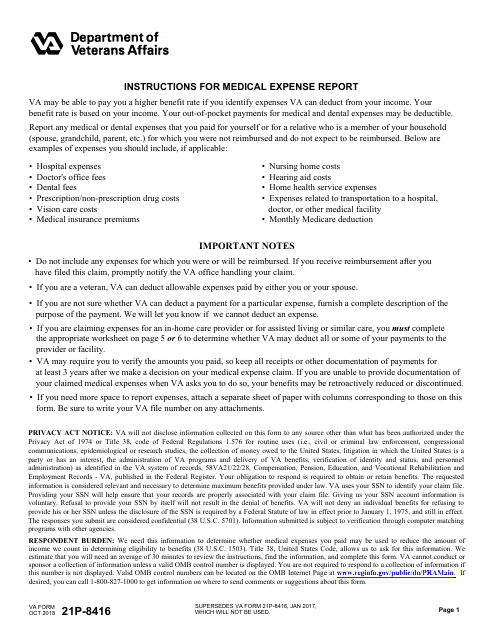

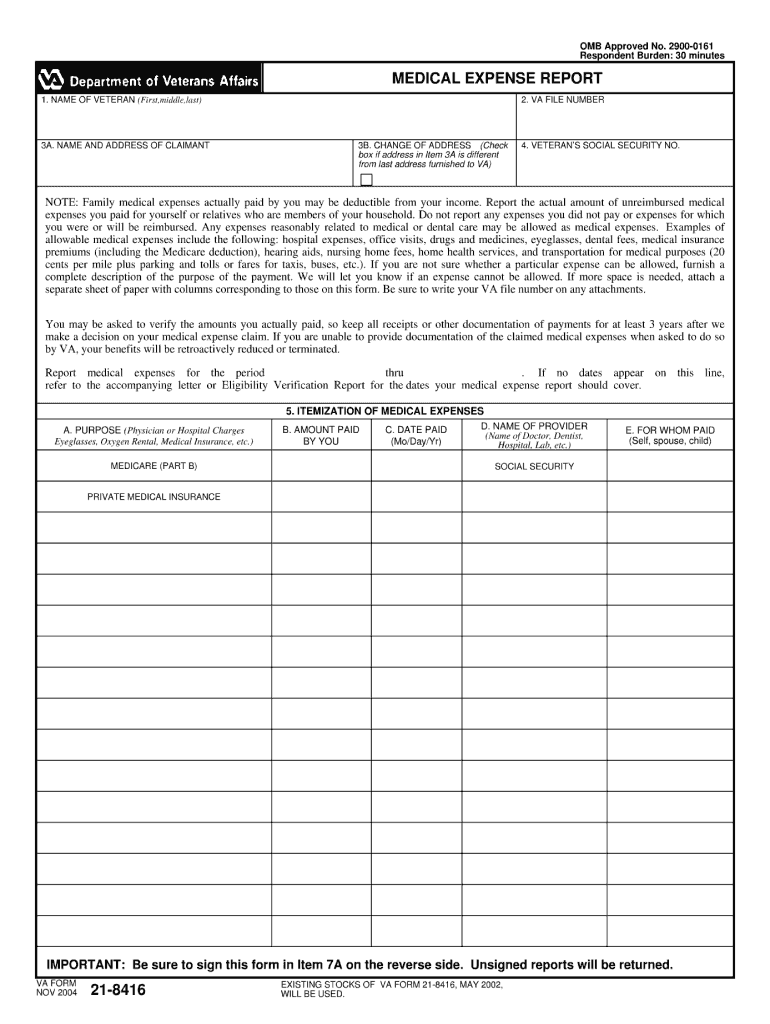

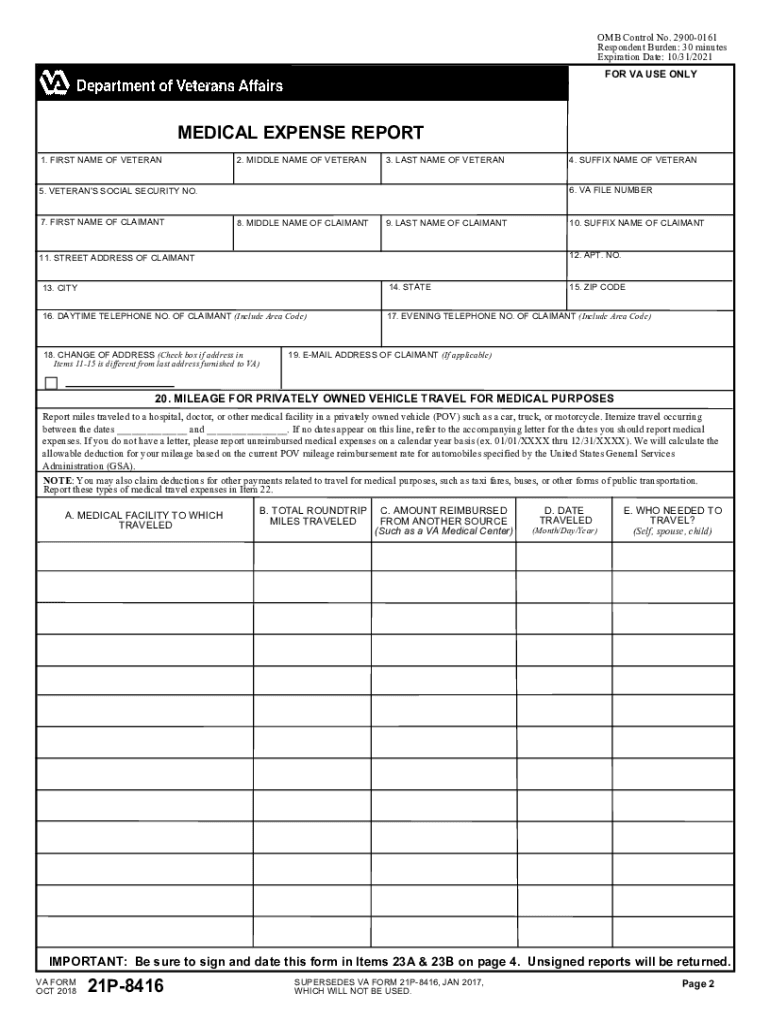

Va Form 21P-8416 - Medical and dental expenses paid by you may be deductible from the income va counts when. Which will not be used. Medical expense (physician or hospital charges, eyeglasses, oxygen rental, medical insurance, etc.) d. Which will not be used. Va may be able to pay you at a higher rate if you identify expenses va considers allowable. Instructions for medical expense report. Web search for va forms by keyword, form name, or form number. In most instances, the amount received will be countable income for va purposes. For whom paid (self, spouse, child, etc.) a. Mileage for privately owned vehicle travel for medical purposes.

Worksheet for an assisted living, adult day care, or a similar facility. Quickly access top tasks for frequently downloaded va forms. Name of provider (name of doctor, dentist, hospital, lab, etc.) medicare (part b) private. If no dates appear on this line, refer to the accompanying letter or eligibility verification report for the dates you should report medical expenses. Instructions for medical expense report. Va may be able to pay you at a higher rate if you identify expenses va considers allowable. In most instances, the amount received will be countable income for va purposes. Medical expense (physician or hospital charges, eyeglasses, oxygen rental, medical insurance, etc.) d. Medical and dental expenses paid by you may be deductible from the income va counts when. For whom paid (self, spouse, child, etc.) a.

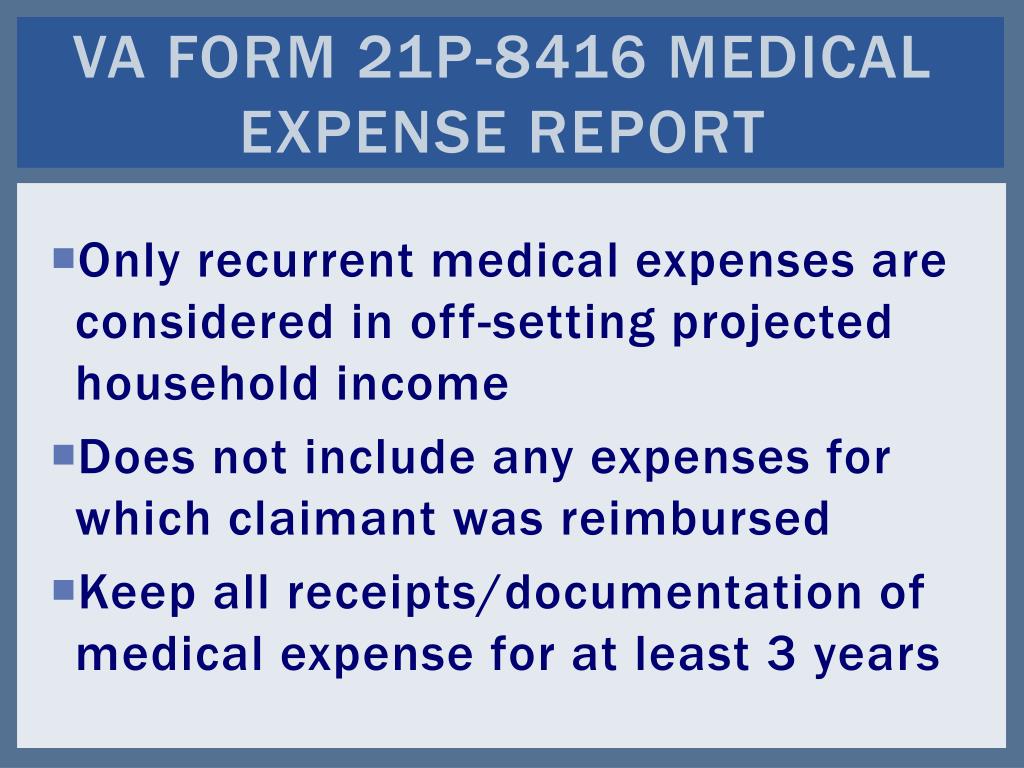

Mileage for privately owned vehicle travel for medical purposes. Instructions for medical expense report. These must be expenses you weren’t reimbursed for and don’t expect to be reimbursed for. Va may be able to pay you at a higher rate if you identify expenses va considers allowable. Medical expense (physician or hospital charges, eyeglasses, oxygen rental, medical insurance, etc.) d. In most instances, the amount received will be countable income for va purposes. Which will not be used. Medical and dental expenses paid by you may be deductible from the income va counts when. If no dates appear on this line, refer to the accompanying letter or eligibility verification report for the dates you should report medical expenses. Name of provider (name of doctor, dentist, hospital, lab, etc.) medicare (part b) private.

VA Form 21P8416 Download Fillable PDF or Fill Online Medical Expense

Instructions for medical expense report. Which will not be used. Web search for va forms by keyword, form name, or form number. In most instances, the amount received will be countable income for va purposes. Name of provider (name of doctor, dentist, hospital, lab, etc.) medicare (part b) private.

2004 Form VA 218416 Fill Online, Printable, Fillable, Blank pdfFiller

Which will not be used. Name of provider (name of doctor, dentist, hospital, lab, etc.) medicare (part b) private. These must be expenses you weren’t reimbursed for and don’t expect to be reimbursed for. Instructions for medical expense report. Medical expense (physician or hospital charges, eyeglasses, oxygen rental, medical insurance, etc.) d.

Fill Free fillable INSTRUCTIONS FOR MEDICAL EXPENSE REPORT VA may be

Which will not be used. Instructions for medical expense report. For whom paid (self, spouse, child, etc.) a. Name of provider (name of doctor, dentist, hospital, lab, etc.) medicare (part b) private. Worksheet for an assisted living, adult day care, or a similar facility.

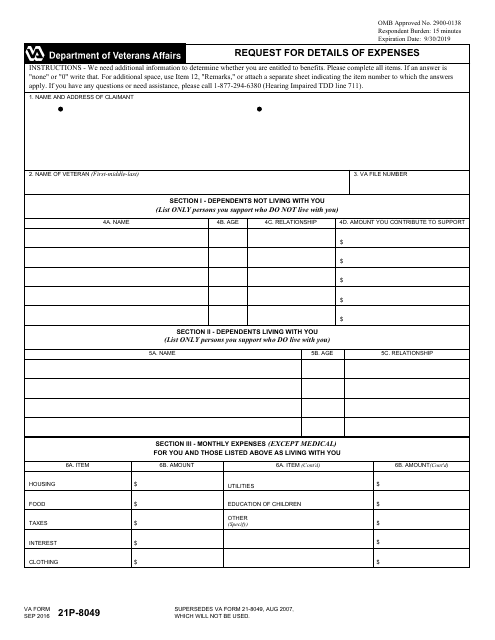

VA Form 21P8049 Download Fillable PDF or Fill Online Request for

Name of provider (name of doctor, dentist, hospital, lab, etc.) medicare (part b) private. Medical expense (physician or hospital charges, eyeglasses, oxygen rental, medical insurance, etc.) d. Mileage for privately owned vehicle travel for medical purposes. These must be expenses you weren’t reimbursed for and don’t expect to be reimbursed for. In most instances, the amount received will be countable.

Va Form 21P 4706B Fill Out and Sign Printable PDF Template signNow

Name of provider (name of doctor, dentist, hospital, lab, etc.) medicare (part b) private. Which will not be used. In most instances, the amount received will be countable income for va purposes. Quickly access top tasks for frequently downloaded va forms. Medical expense (physician or hospital charges, eyeglasses, oxygen rental, medical insurance, etc.) d.

VA Form 21p 0969 Printable VA Form

Which will not be used. Medical expense (physician or hospital charges, eyeglasses, oxygen rental, medical insurance, etc.) d. Worksheet for an assisted living, adult day care, or a similar facility. For whom paid (self, spouse, child, etc.) a. Mileage for privately owned vehicle travel for medical purposes.

VA Form 21P601 Printable, Fillable in PDF VA Form

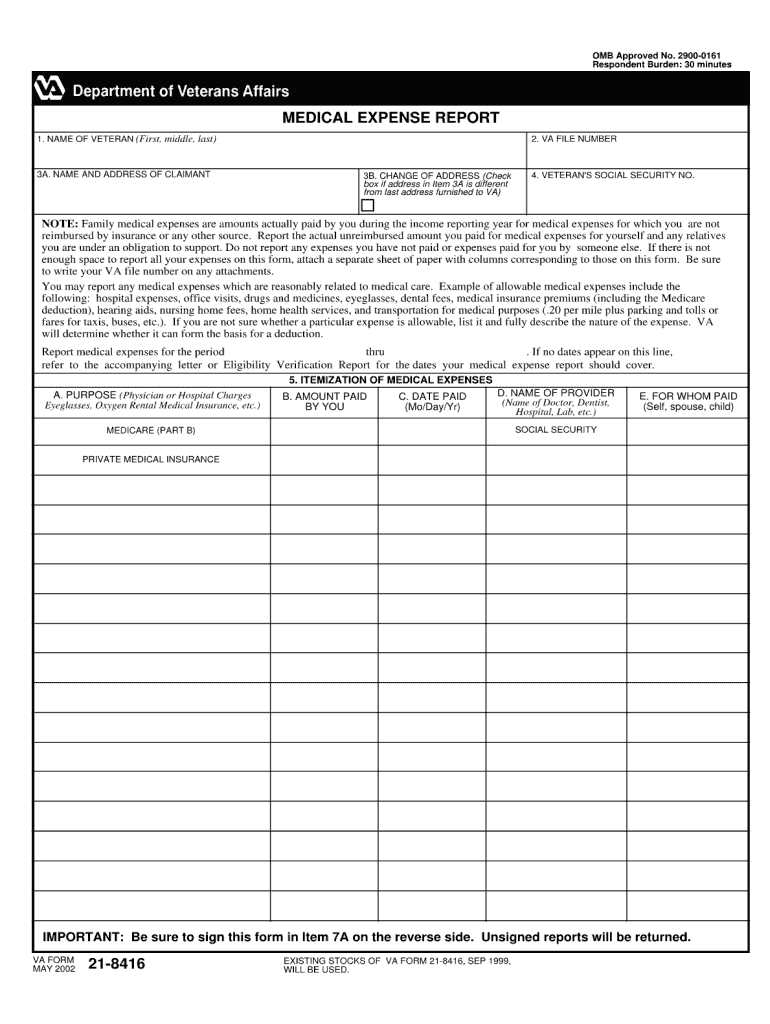

Medical and dental expenses paid by you may be deductible from the income va counts when. For whom paid (self, spouse, child, etc.) a. Instructions for medical expense report. Quickly access top tasks for frequently downloaded va forms. These must be expenses you weren’t reimbursed for and don’t expect to be reimbursed for.

2018 Form VA 21P8416 Fill Online, Printable, Fillable, Blank pdfFiller

Instructions for medical expense report. Va may be able to pay you at a higher rate if you identify expenses va considers allowable. Medical and dental expenses paid by you may be deductible from the income va counts when. Worksheet for an assisted living, adult day care, or a similar facility. These must be expenses you weren’t reimbursed for and.

Va Form 21P 8416 ≡ Fill Out Printable PDF Forms Online

If you or a family member received compensation for injury, illness or death, you must report the date and amount of the recovery to va. Which will not be used. Name of provider (name of doctor, dentist, hospital, lab, etc.) medicare (part b) private. These must be expenses you weren’t reimbursed for and don’t expect to be reimbursed for. Medical.

PPT MO f/k/a Medicaid and Veterans Administration

Mileage for privately owned vehicle travel for medical purposes. These must be expenses you weren’t reimbursed for and don’t expect to be reimbursed for. Which will not be used. Medical and dental expenses paid by you may be deductible from the income va counts when. Va may be able to pay you at a higher rate if you identify expenses.

If You Or A Family Member Received Compensation For Injury, Illness Or Death, You Must Report The Date And Amount Of The Recovery To Va.

Quickly access top tasks for frequently downloaded va forms. Which will not be used. Mileage for privately owned vehicle travel for medical purposes. Va may be able to pay you at a higher rate if you identify expenses va considers allowable.

These Must Be Expenses You Weren’t Reimbursed For And Don’t Expect To Be Reimbursed For.

Instructions for medical expense report. For whom paid (self, spouse, child, etc.) a. If no dates appear on this line, refer to the accompanying letter or eligibility verification report for the dates you should report medical expenses. Name of provider (name of doctor, dentist, hospital, lab, etc.) medicare (part b) private.

Which Will Not Be Used.

Worksheet for an assisted living, adult day care, or a similar facility. Web search for va forms by keyword, form name, or form number. In most instances, the amount received will be countable income for va purposes. Medical and dental expenses paid by you may be deductible from the income va counts when.