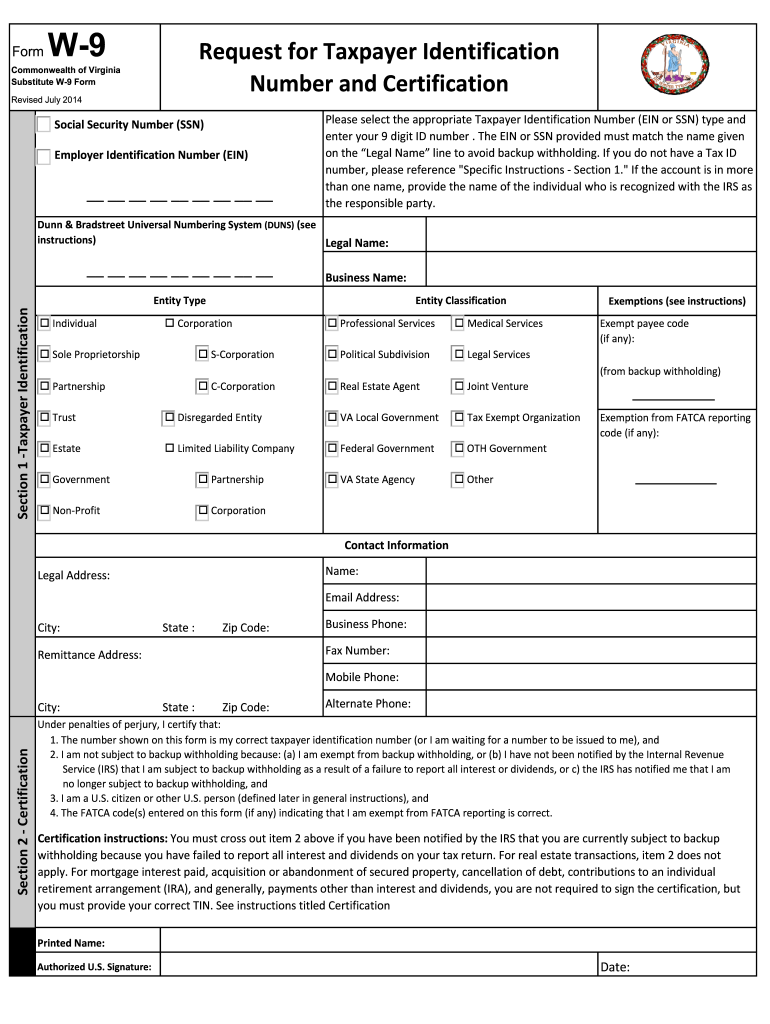

W9 Form Nevada

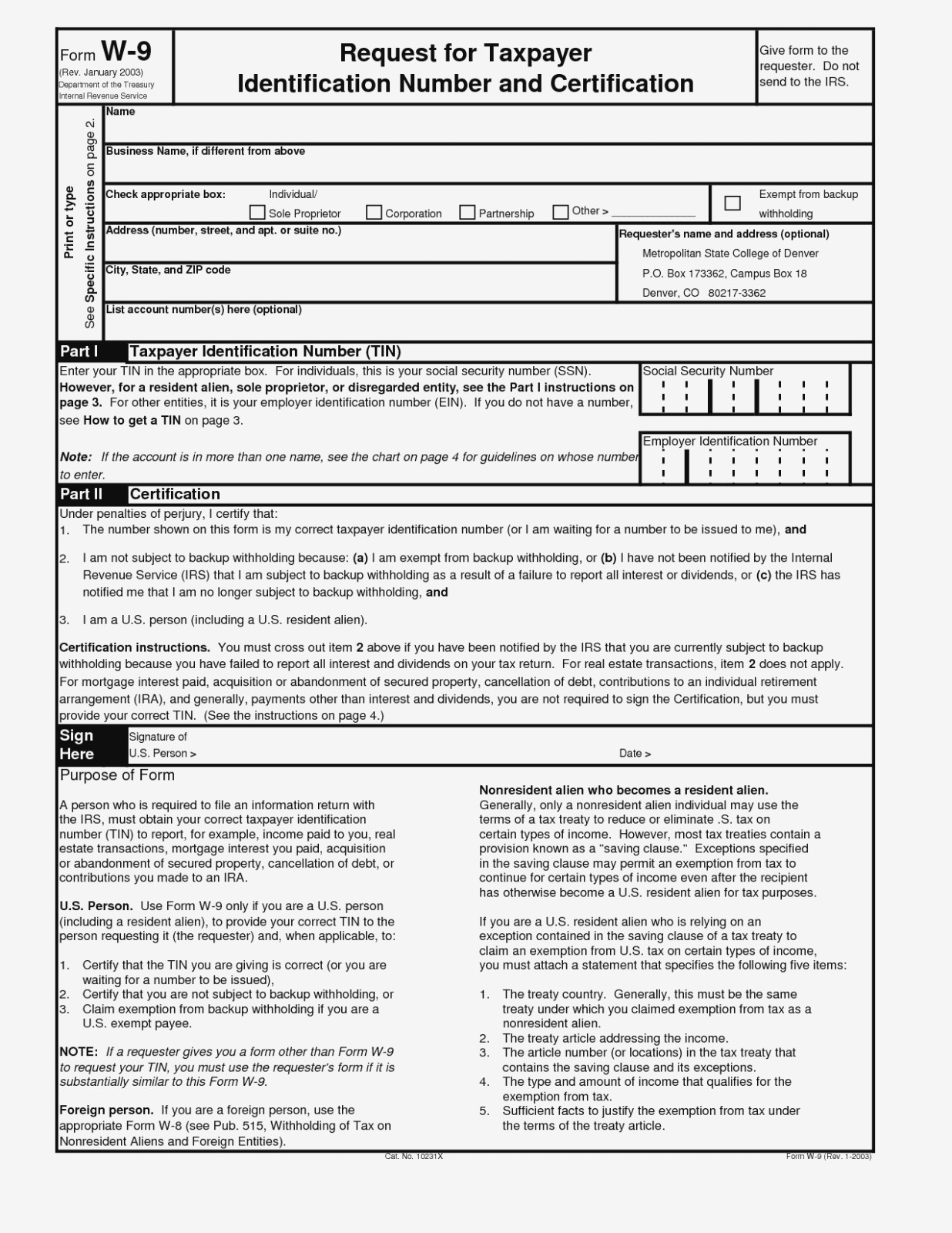

W9 Form Nevada - General, it, and email request forms. Web the w9 tax form also called the request for taxpayer identification number and certification form, is a document in the us income tax system used by a third party who. This can be a social security. Web nevada secretary of state nevada secretary of state nevada secretary of state. By signing it you attest that: Person (including a resident alien), to provide your correct tin. December 2014) department of the treasury internal revenue service. It may take 30 business days, from approval,before i receive the funds. Ad access irs tax forms. Request for taxpayer identification number and certification.

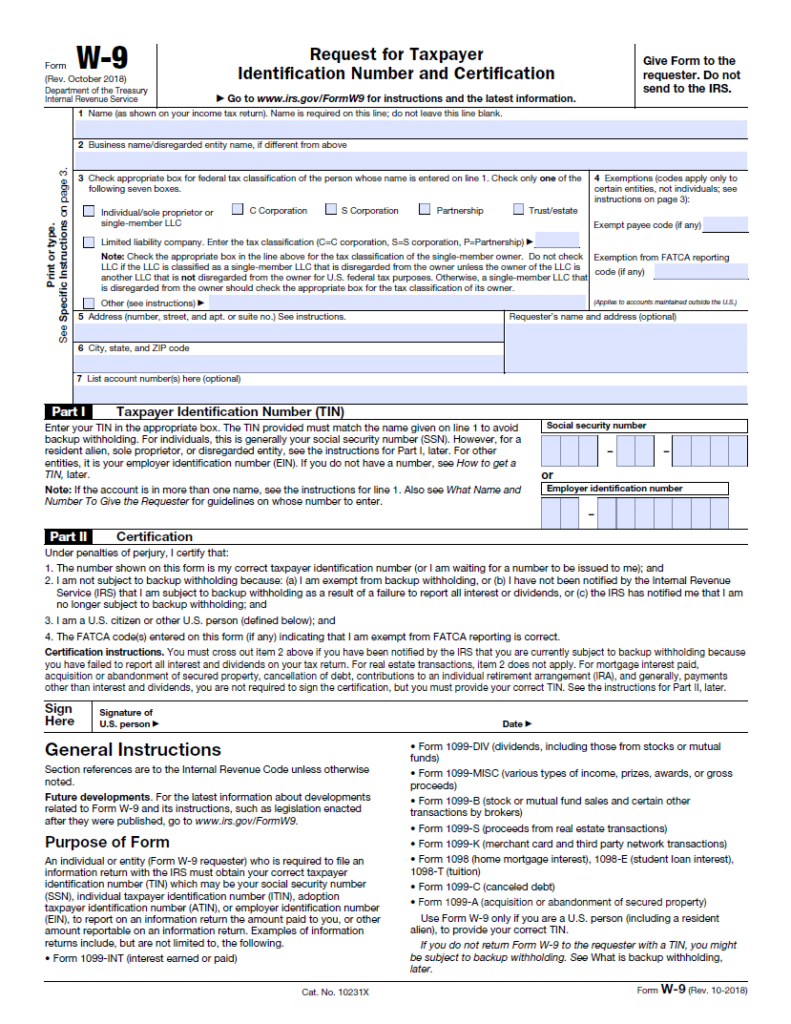

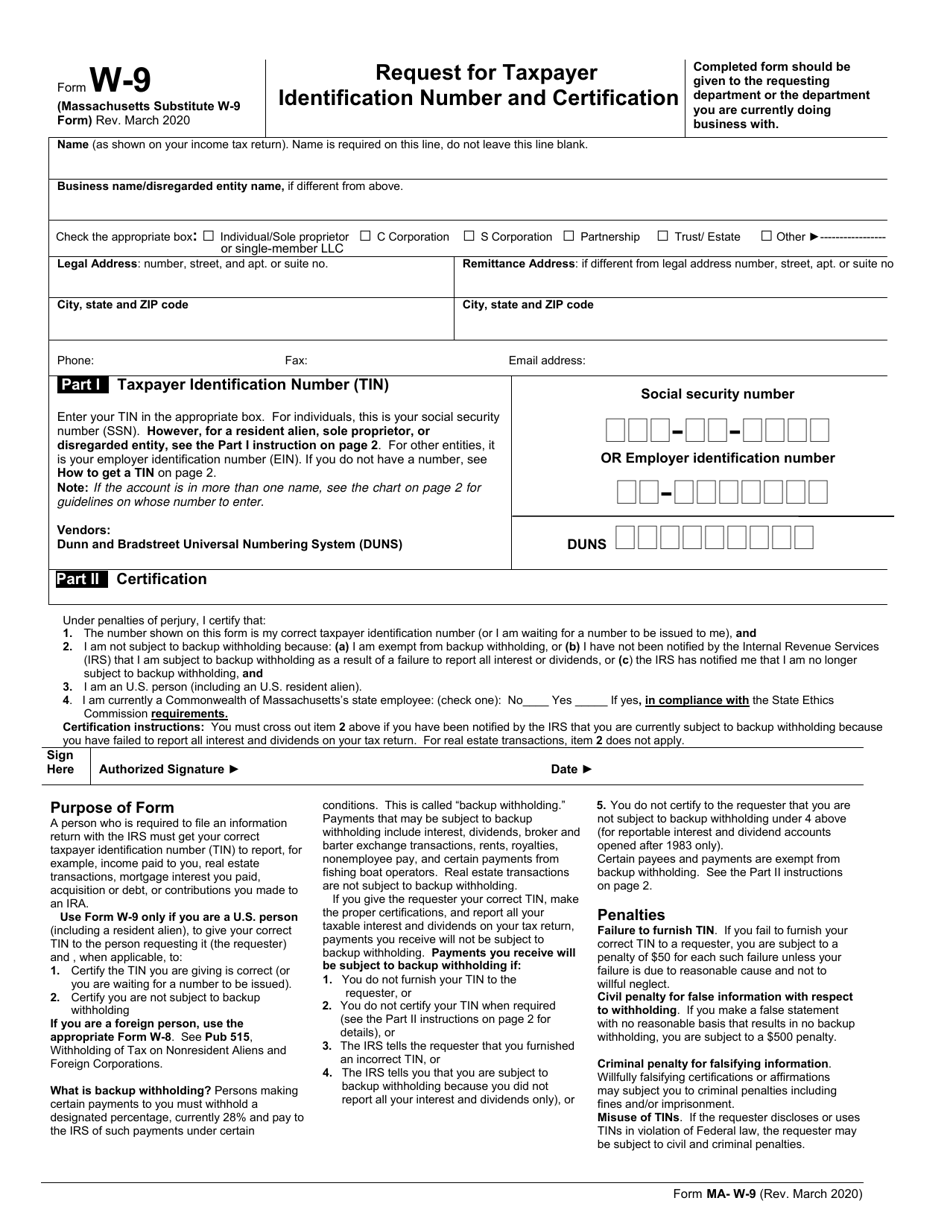

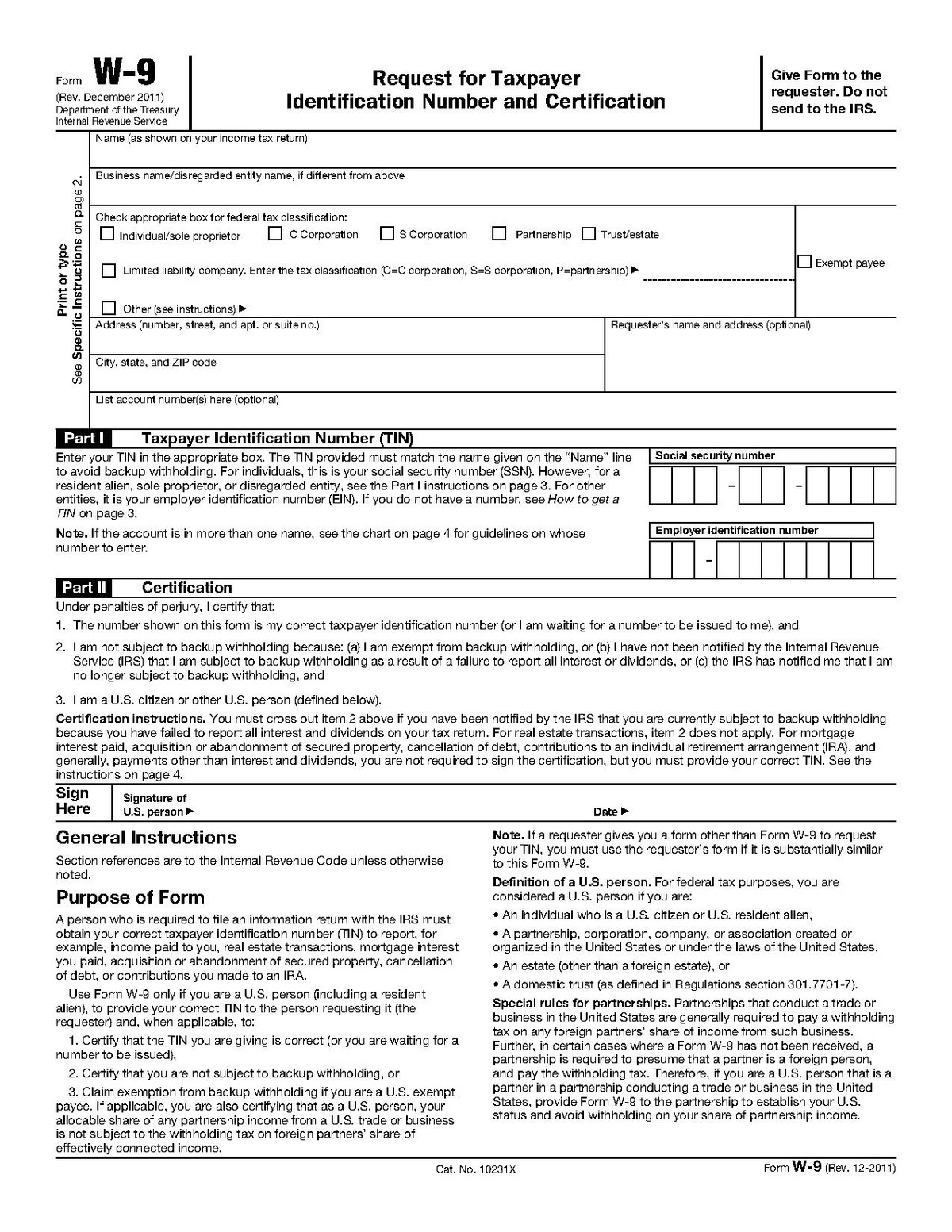

It may take 30 business days, from approval,before i receive the funds. The tin you gave is correct. Web university departments should establish tax exemption status before making purchases on behalf of the university by submitting the following forms to suppliers. Web the w9 tax form also called the request for taxpayer identification number and certification form, is a document in the us income tax system used by a third party who. Web forms are organized by divisions. Complete, edit or print tax forms instantly. • processing will only begin once the client/tenant. Do not october 2018) rtment of the treasury send to the irs. Person (including a resident alien), to provide your correct tin. Web request for taxpayer form give form to the identification number and certification requester.

Web nevada secretary of state nevada secretary of state nevada secretary of state. Web forms are organized by divisions. Nevadatax is our online system for registering, filing, or paying many of the taxes administered by. Person (including a resident alien), to provide your correct tin. The taxpayer identification number for the. Request for taxpayer identification number and certification. This can be a social security. Web in many cases, you can skip the paper process and sign up to use nevadatax! Use get form or simply click on the template preview to open it in the editor. December 2014) department of the treasury internal revenue service.

2022 Form W9

Web forms are organized by divisions. Request for taxpayer identification number and certification. Complete, edit or print tax forms instantly. Person (including a resident alien), to provide your correct tin. • processing will only begin once the client/tenant.

1+ Nevada Last Will and Testament Form Free Download

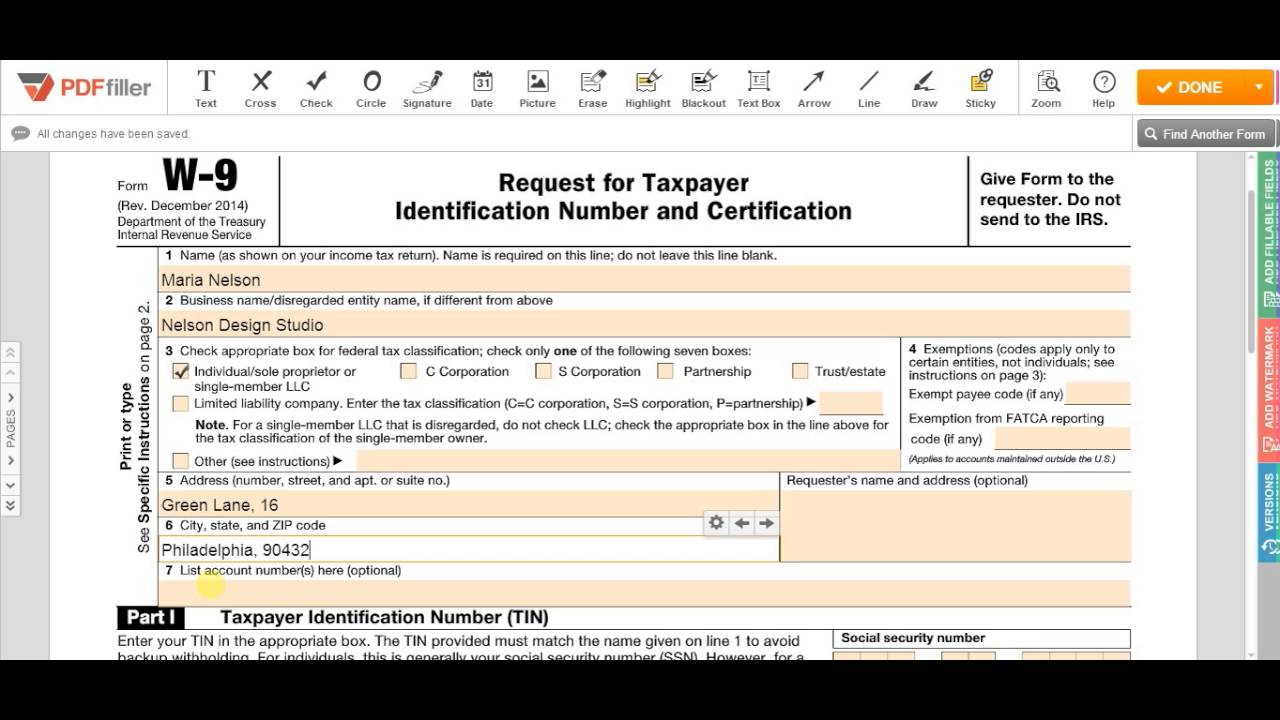

By signing it you attest that: Name for proprietorship, provide proprietor’s name in first box and dba in second box.legal business name, proprietor’s. Web university departments should establish tax exemption status before making purchases on behalf of the university by submitting the following forms to suppliers. Enterprise it services helpdesk request portal. The tin you gave is correct.

Form W9 Download Fillable PDF or Fill Online Request for Taxpayer

Web request for taxpayer form give form to the identification number and certification requester. Web the w9 tax form also called the request for taxpayer identification number and certification form, is a document in the us income tax system used by a third party who. This can be a social security. Web nevada secretary of state nevada secretary of state.

How to Fill W9 Form YouTube

Web nevada secretary of state nevada secretary of state nevada secretary of state. Person (including a resident alien), to provide your correct tin. Name for proprietorship, provide proprietor’s name in first box and dba in second box.legal business name, proprietor’s. Web in many cases, you can skip the paper process and sign up to use nevadatax! Web forms are organized.

Downloadable W9 Tax Form How To Fill Out A W9 Form Line W within Irs

Do not october 2018) rtment of the treasury send to the irs. This can be a social security. The tin you gave is correct. Web request for taxpayer form give form to the identification number and certification requester. The taxpayer identification number for the.

W9 Form Printable 2017 Free Free Printable

Person (including a resident alien), to provide your correct tin. Do not october 2018) rtment of the treasury send to the irs. It may take 30 business days, from approval,before i receive the funds. General, it, and email request forms. The taxpayer identification number for the.

W9 Virginia Fill Out and Sign Printable PDF Template signNow

Request for taxpayer identification number and certification. The taxpayer identification number for the. Use get form or simply click on the template preview to open it in the editor. December 2014) department of the treasury internal revenue service. Name for proprietorship, provide proprietor’s name in first box and dba in second box.legal business name, proprietor’s.

W9 vs 1099 IRS Forms, Differences, and When to Use Them 2019 Best

Request for taxpayer identification number and certification. General, it, and email request forms. Name for proprietorship, provide proprietor’s name in first box and dba in second box.legal business name, proprietor’s. The tin you gave is correct. By signing it you attest that:

W9 Free Printable Form 2016 Free Printable

Web the w9 tax form also called the request for taxpayer identification number and certification form, is a document in the us income tax system used by a third party who. Ad access irs tax forms. December 2014) department of the treasury internal revenue service. Web nevada secretary of state nevada secretary of state nevada secretary of state. General, it,.

Printabvle Idaho W9 Form Fill and Sign Printable Template Online US

By signing it you attest that: Nevadatax is our online system for registering, filing, or paying many of the taxes administered by. Start completing the fillable fields and. Enterprise it services helpdesk request portal. Request for taxpayer identification number and certification.

The Tin You Gave Is Correct.

It may take 30 business days, from approval,before i receive the funds. Name for proprietorship, provide proprietor’s name in first box and dba in second box.legal business name, proprietor’s. Web the w9 tax form also called the request for taxpayer identification number and certification form, is a document in the us income tax system used by a third party who. Web forms are organized by divisions.

Person (Including A Resident Alien), To Provide Your Correct Tin.

December 2014) department of the treasury internal revenue service. Person (including a resident alien), to provide your correct tin. Ad access irs tax forms. By signing it you attest that:

Web In Many Cases, You Can Skip The Paper Process And Sign Up To Use Nevadatax!

Enterprise it services helpdesk request portal. Web nevada secretary of state nevada secretary of state nevada secretary of state. Use get form or simply click on the template preview to open it in the editor. General, it, and email request forms.

Start Completing The Fillable Fields And.

Nevadatax is our online system for registering, filing, or paying many of the taxes administered by. Complete, edit or print tax forms instantly. Request for taxpayer identification number and certification. Web university departments should establish tax exemption status before making purchases on behalf of the university by submitting the following forms to suppliers.