Virginia Form 500

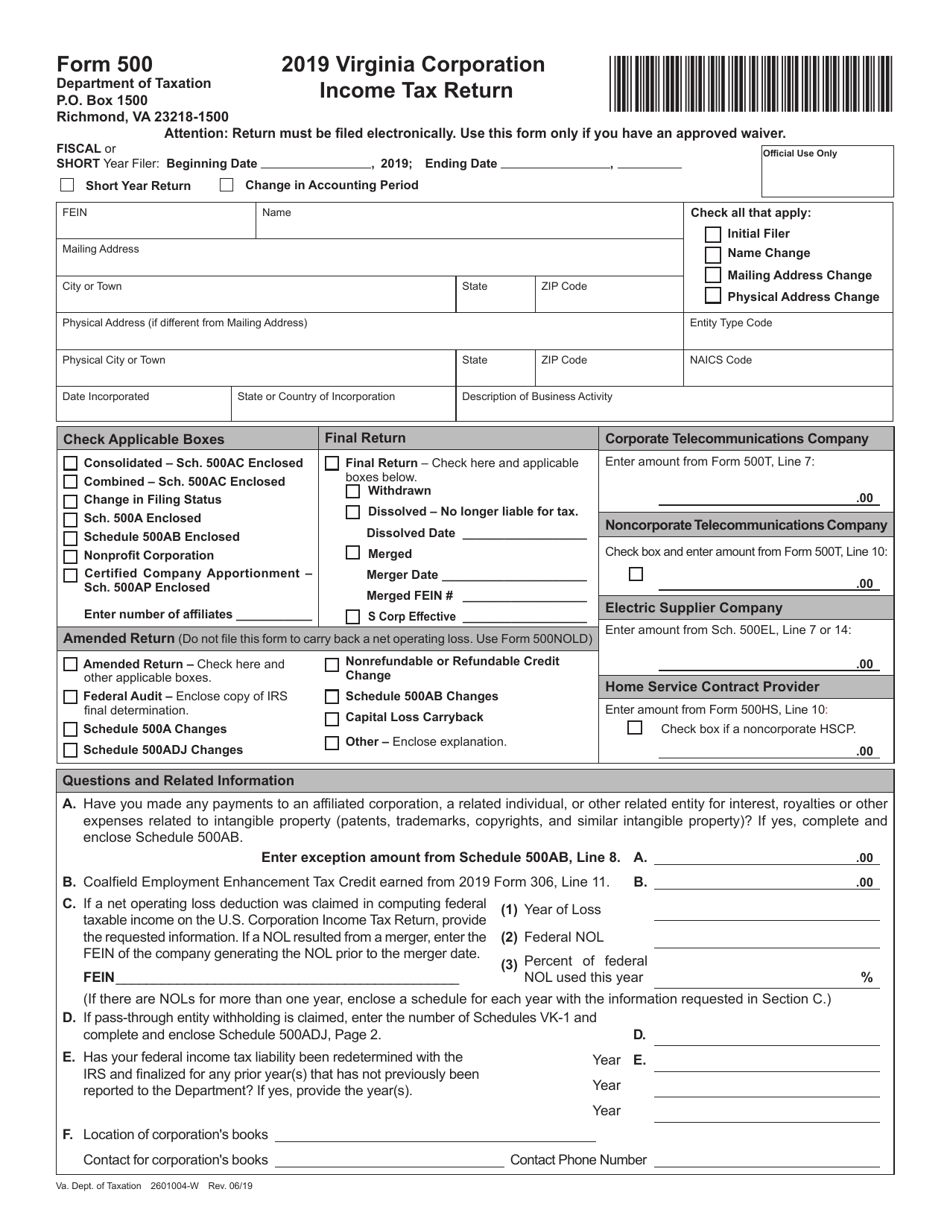

Virginia Form 500 - Web 2020 virginia corporation *vacorp120888* income tax return. Beginning on or after january 1, 2004, electric. Web all corporations can file their annual income tax return (form 500) and pay any tax due using approved software products. Web to federal income tax is also subject to the virginia corporation income tax and should file a virginia corporation return, form 500. Attach an explanation of changes to income and modifications. For each related entity for which the taxpayer claims an exception,. Web service contract providers must submit form 500hs with their form 500. Certain virginia corporations, with 100% of their. Web virginia's date of conformity with the internal revenue code (irc) was advanced from december 31, 2018, to december. You can download or print.

Certain virginia corporations, with 100% of their. Beginning on or after january 1, 2004, electric. Do not file this form to carry back a net operating. What electronic filing options are available for filing the corporate. For each related entity for which the taxpayer claims an exception,. To mail your income tax return. Web service contract providers must submit form 500hs with their form 500. Not filed contact us 500v. Web all corporations can file their annual income tax return (form 500) and pay any tax due using approved software products. Web 2021 virginia corporation *vacorp121888* income tax return form 500 virginia department of taxation p.o.

Web to federal income tax is also subject to the virginia corporation income tax and should file a virginia corporation return, form 500. Web subject to the virginia corporation income tax and should file a virginia corporation income tax return, form 500. For each related entity for which the taxpayer claims an exception,. To mail your income tax return. Attach an explanation of changes to income and modifications. Beginning on or after january 1, 2004, electric. Web you may send your virginia income tax return to the department of taxation or the city or county where you lived on january 1, 2017. A noncorporate provider must complete form 502 in addition to form 500 and form 500hs. Not filed contact us 500v. Web virginia's date of conformity with the internal revenue code (irc) was advanced from december 31, 2018, to december.

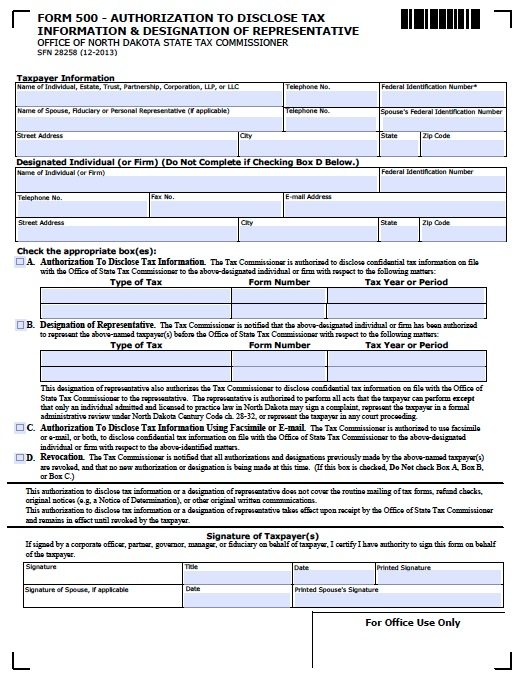

Free Tax Power of Attorney North Dakota Form 500 Adobe PDF

Attach an explanation of changes to income and modifications. Web 2021 virginia corporation *vacorp121888* income tax return form 500 virginia department of taxation p.o. Electric suppliers may be subject to a minimum tax instead of the. Web all corporations can file their annual income tax return (form 500) and pay any tax due using approved software products. Web to federal.

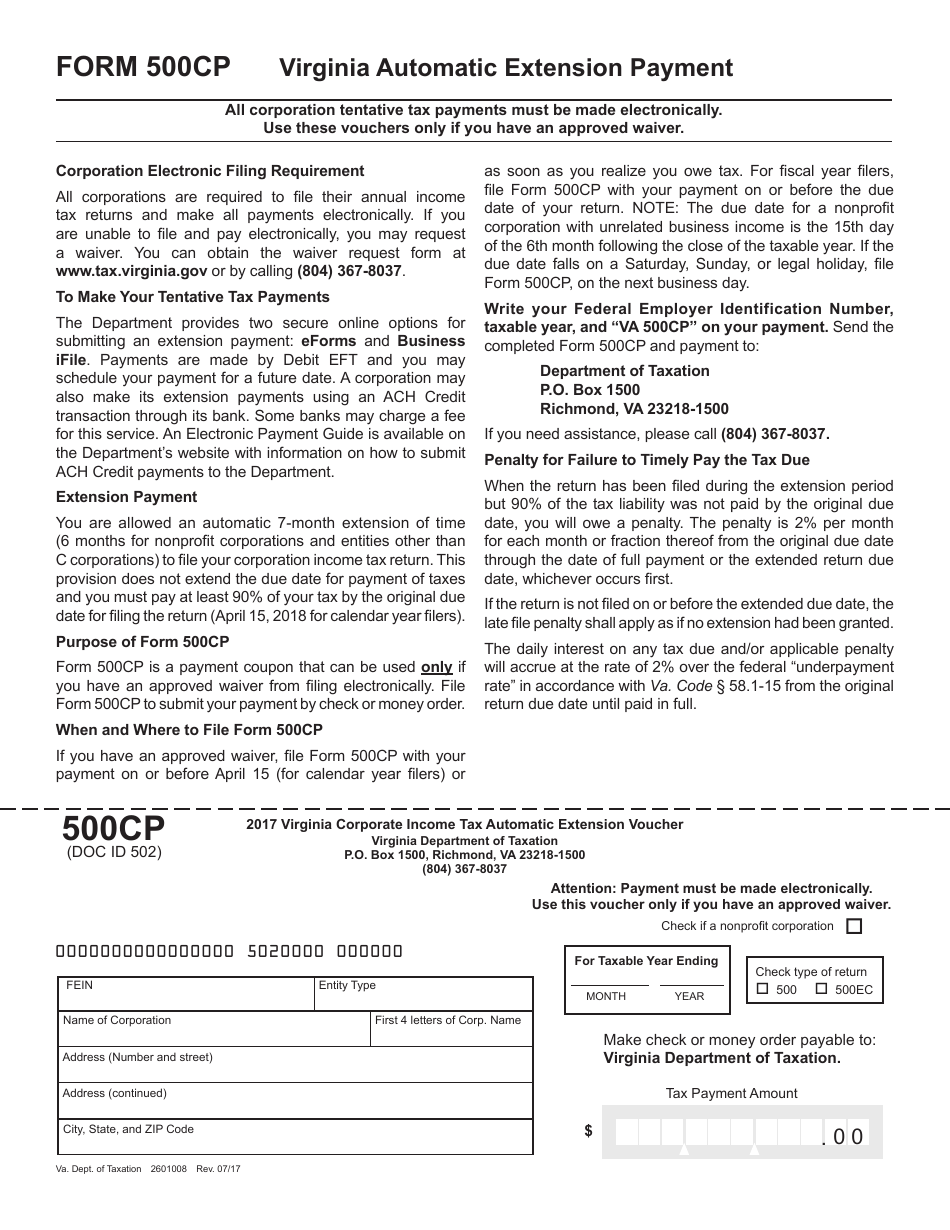

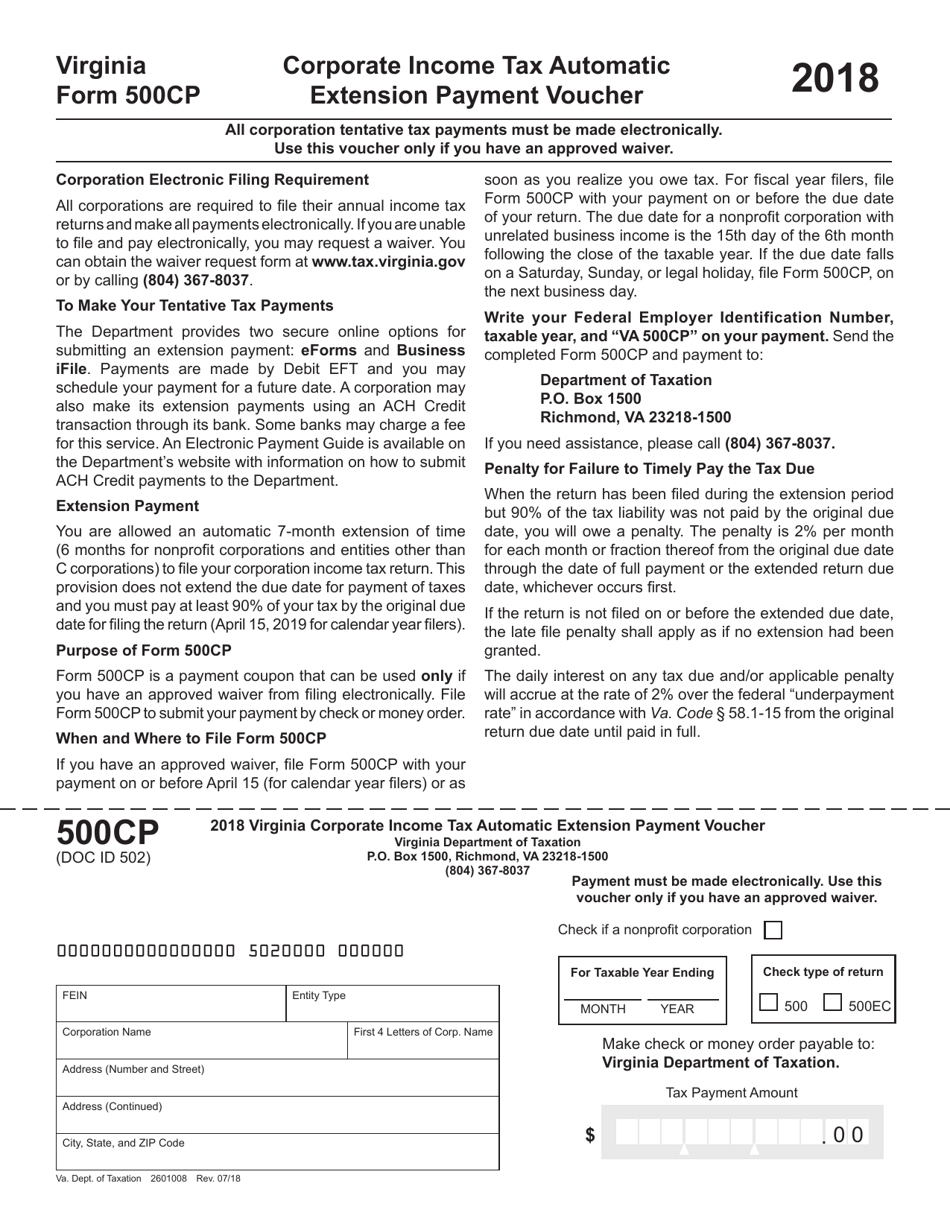

Form 500CP Download Fillable PDF or Fill Online Virginia Corporate

You can download or print. For each related entity for which the taxpayer claims an exception,. Web enclose schedule 500ab with your virginia corporation return, form 500. Not filed contact us 500v. Web you may send your virginia income tax return to the department of taxation or the city or county where you lived on january 1, 2017.

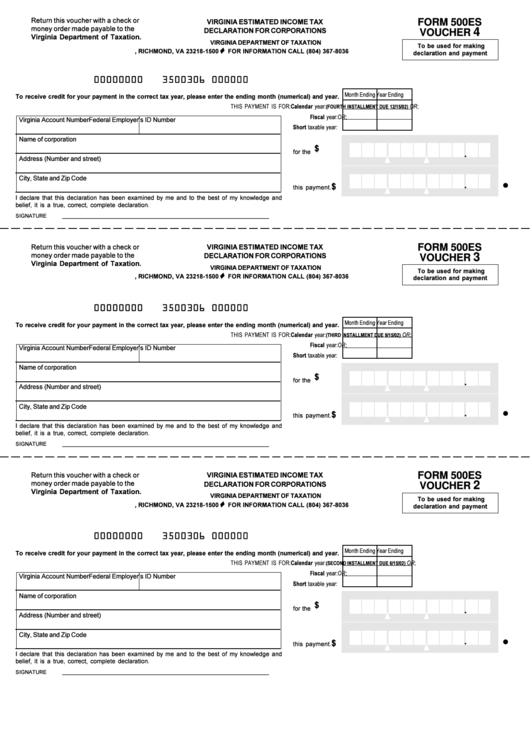

Form 500es Virginia Estimated Tax Voucher printable pdf download

Web enclose schedule 500ab with your virginia corporation return, form 500. Web 2020 virginia corporation *vacorp120888* income tax return. Web complete form 500 and schedule 500adj. What electronic filing options are available for filing the corporate. Not filed contact us 500v.

Virginia Tax Instructions Form Fill Out and Sign Printable PDF

Not filed contact us 500es. Web you may send your virginia income tax return to the department of taxation or the city or county where you lived on january 1, 2017. Web virginia's date of conformity with the internal revenue code (irc) was advanced from december 31, 2018, to december. For each related entity for which the taxpayer claims an.

Form 500CP Download Fillable PDF or Fill Online Corporate Tax

Web you may send your virginia income tax return to the department of taxation or the city or county where you lived on january 1, 2017. Web 2020 virginia corporation *vacorp120888* income tax return. Web service contract providers must submit form 500hs with their form 500. Not filed contact us 500es. For each related entity for which the taxpayer claims.

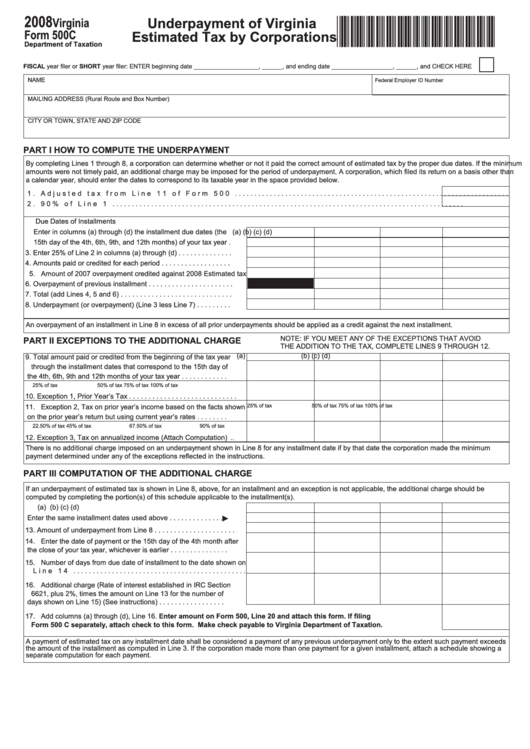

Virginia Form 500c Underpayment Of Virginia Estimated Tax By

What electronic filing options are available for filing the corporate. Do not file this form to carry back a net operating. Web service contract providers must submit form 500hs with their form 500. Web enclose schedule 500ab with your virginia corporation return, form 500. To mail your income tax return.

Form 500 Download Fillable PDF or Fill Online Virginia Corporation

Web subject to the virginia corporation income tax and should file a virginia corporation income tax return, form 500. Web 2020 virginia corporation *vacorp120888* income tax return. Web virginia's date of conformity with the internal revenue code (irc) was advanced from december 31, 2018, to december. Not filed contact us 500v. Web you may send your virginia income tax return.

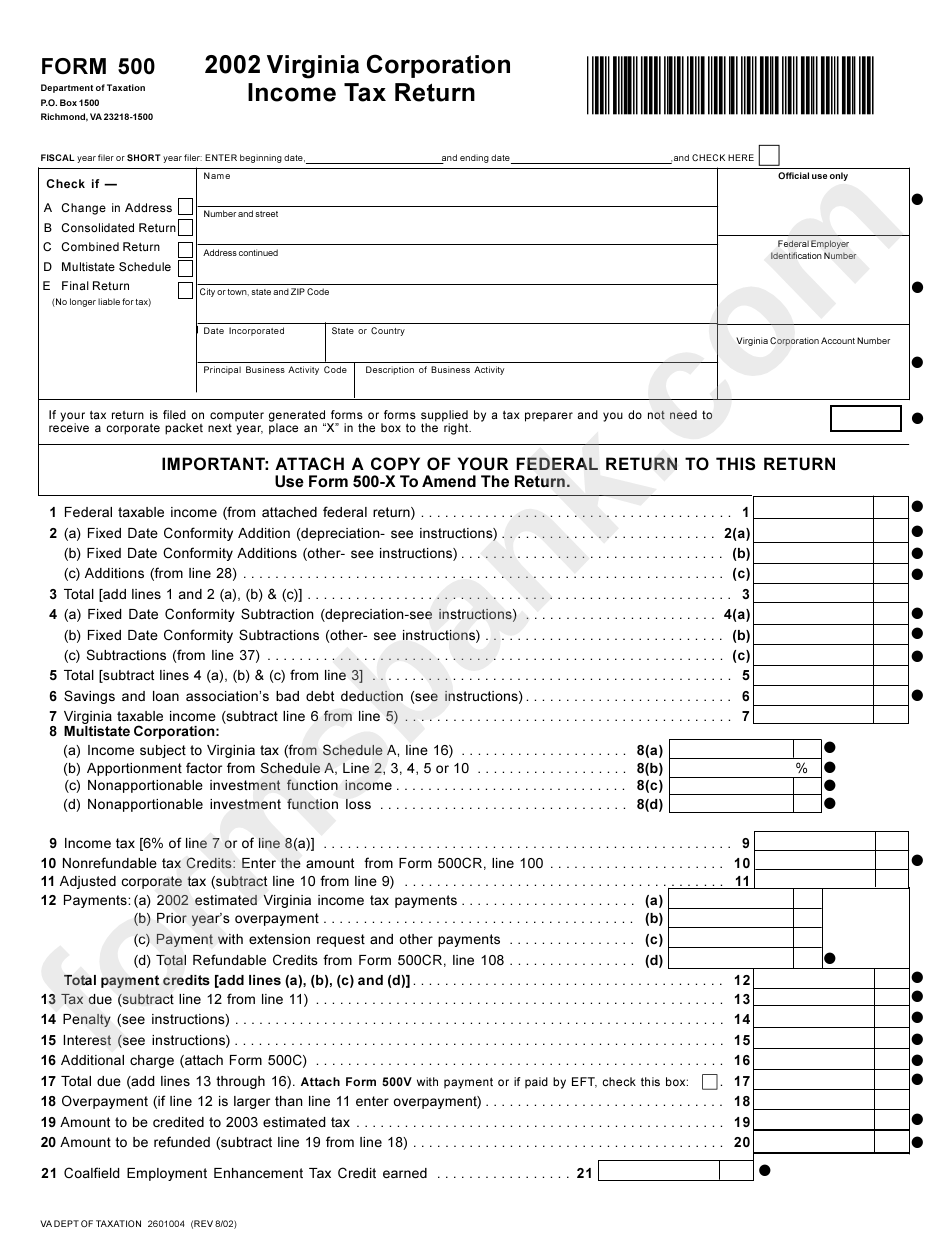

Form 500 Virginia Corporation Tax Return 2002 printable pdf

Electric suppliers may be subject to a minimum tax instead of the. Not filed contact us 500es. Certain virginia corporations, with 100% of their. Web you may send your virginia income tax return to the department of taxation or the city or county where you lived on january 1, 2017. Attach an explanation of changes to income and modifications.

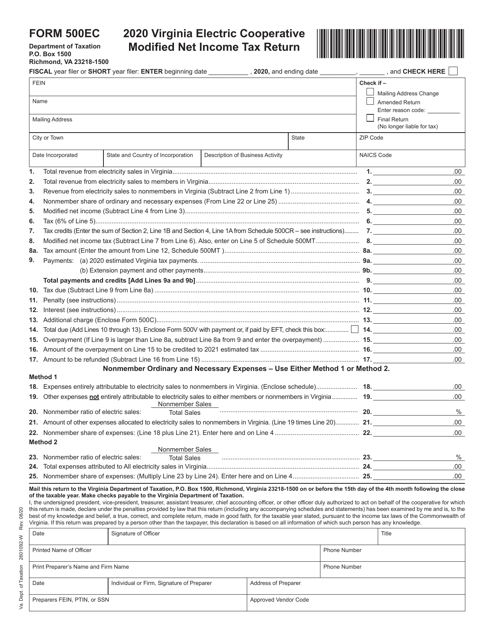

Form 500EC Download Fillable PDF or Fill Online Virginia Electric

Web 2021 virginia corporation *vacorp121888* income tax return form 500 virginia department of taxation p.o. For each related entity for which the taxpayer claims an exception,. To mail your income tax return. Beginning on or after january 1, 2004, electric. Certain virginia corporations, with 100% of their.

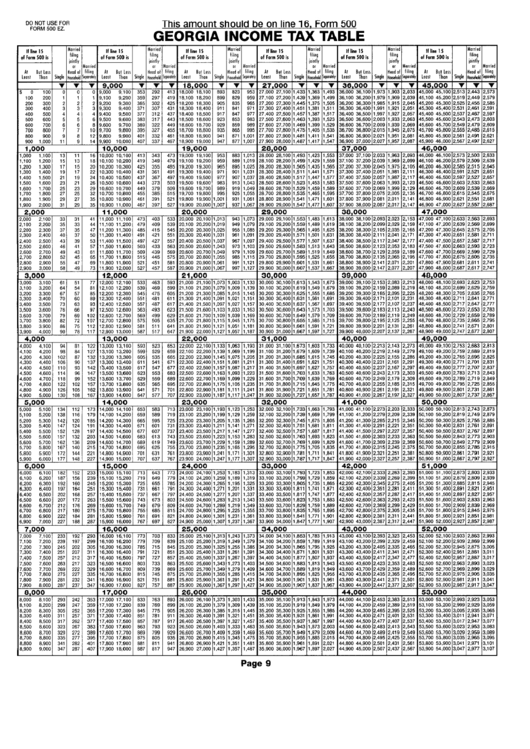

Form 500 Tax Table printable pdf download

Web enclose schedule 500ab with your virginia corporation return, form 500. Web all corporations can file their annual income tax return (form 500) and pay any tax due using approved software products. Attach an explanation of changes to income and modifications. You can download or print. Web complete form 500 and schedule 500adj.

To Mail Your Income Tax Return.

Web service contract providers must submit form 500hs with their form 500. For each related entity for which the taxpayer claims an exception,. Web 2021 virginia corporation *vacorp121888* income tax return form 500 virginia department of taxation p.o. You can download or print.

Electric Suppliers May Be Subject To A Minimum Tax Instead Of The.

Web to federal income tax is also subject to the virginia corporation income tax and should file a virginia corporation return, form 500. Not filed contact us 500es. Web you may send your virginia income tax return to the department of taxation or the city or county where you lived on january 1, 2017. Web virginia's date of conformity with the internal revenue code (irc) was advanced from december 31, 2018, to december.

Certain Virginia Corporations, With 100% Of Their.

Do not file this form to carry back a net operating. Web complete form 500 and schedule 500adj. Web subject to the virginia corporation income tax and should file a virginia corporation income tax return, form 500. Beginning on or after january 1, 2004, electric.

Not Filed Contact Us 500V.

Web all corporations can file their annual income tax return (form 500) and pay any tax due using approved software products. What electronic filing options are available for filing the corporate. A noncorporate provider must complete form 502 in addition to form 500 and form 500hs. Attach an explanation of changes to income and modifications.