W9 Form Mn

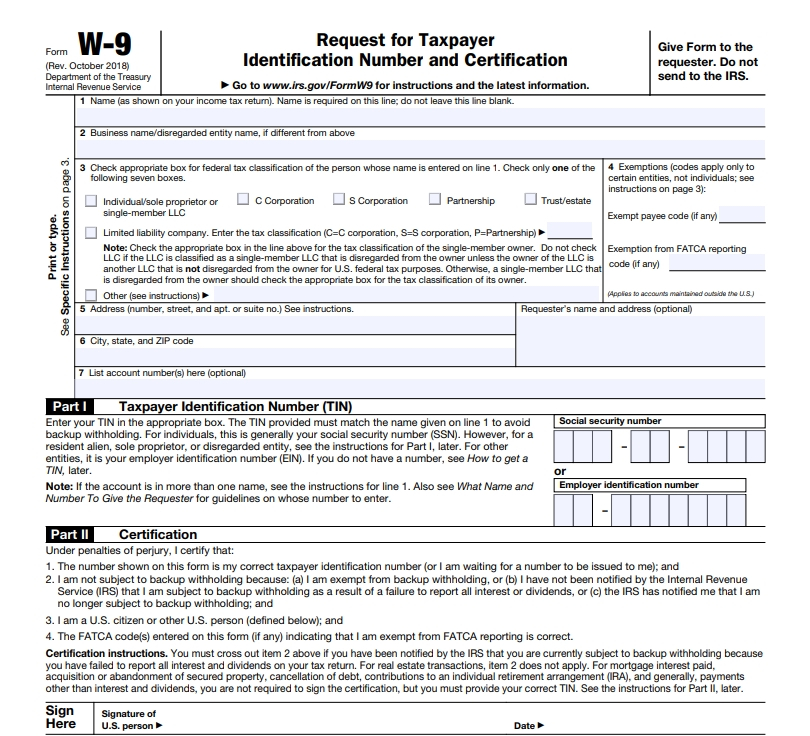

W9 Form Mn - October 2018) identification number and certification requester. Minnesota management & budget vendor file maintenance 400 centennial building 658 cedar. Mn office of higher education/tslrp 1450 energy. Person (including a resident alien), to provide your correct tin. Signed application one letter of. Web policy statements that provide added interpretation, details, or information about minnesota tax laws or rules. Do not department of the treasury send to the irs. Web printable minnesota state tax forms for the 2022 tax year are based on income earned between january 1, 2022 through december 31, 2022. Choose the correct version of the editable pdf form from the list. Ad get ready for tax season deadlines by completing any required tax forms today.

Web policy statements that provide added interpretation, details, or information about minnesota tax laws or rules. Use this tool to search for a specific tax form using the tax form number or name. Minnesota management & budget vendor file maintenance 400 centennial building 658 cedar. Administrative rules adopted by the. Mn office of higher education/tslrp 1450 energy. October 2018) identification number and certification requester. Complete, edit or print tax forms instantly. Please complete and return to: Choose the correct version of the editable pdf form from the list. Do not department of the treasury send to the irs.

Web printable minnesota state tax forms for the 2022 tax year are based on income earned between january 1, 2022 through december 31, 2022. Complete, edit or print tax forms instantly. Minnesota management & budget vendor file maintenance 400 centennial building 658 cedar. You can get minnesota tax forms either by mail or in person. October 2018) identification number and certification requester. Do not department of the treasury send to the irs. Person (including a resident alien), to provide your correct tin. The state of minnesota payment and accounting system requires all persons who are receiving a payment from the state of minnesota to. Signed application one letter of. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to.

W9 Forms 2020 Printable Free Example Calendar Printable

You can also look for forms by category below the search box. October 2018) identification number and certification requester. Use this tool to search for a specific tax form using the tax form number or name. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to. Ad get ready for tax season.

Where can I find your W9 form?

Mn office of higher education/tslrp 1450 energy. October 2018) identification number and certification requester. Complete, edit or print tax forms instantly. Web policy statements that provide added interpretation, details, or information about minnesota tax laws or rules. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to.

Printable W9 Form Free W9 Forms 2020 Printable in Print Form W9 in

October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to. Signed application one letter of. You can get minnesota tax forms either by mail or in person. Complete, edit or print tax forms instantly. Person (including a resident alien), to provide your correct tin.

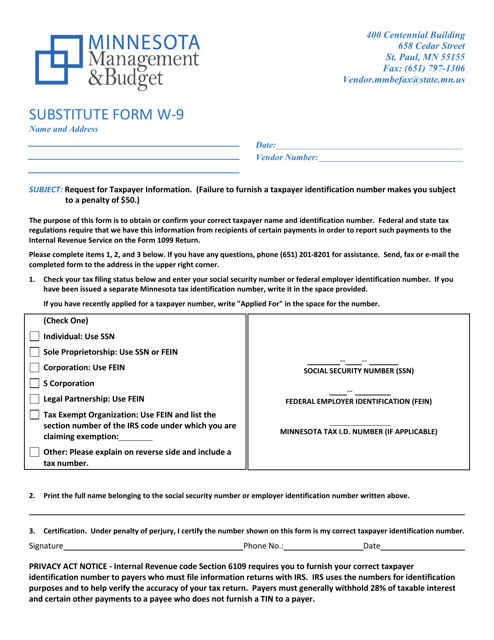

Form W9 Download Fillable PDF or Fill Online Substitute Form Minnesota

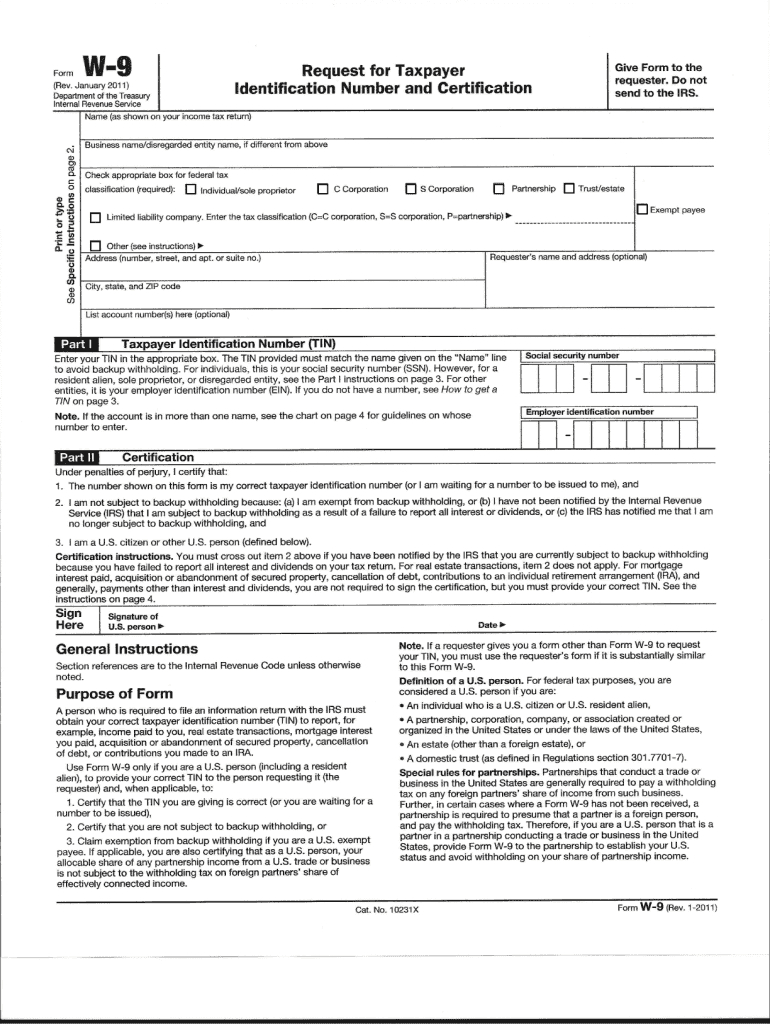

Person (including a resident alien), to provide your correct tin. Ad get ready for tax season deadlines by completing any required tax forms today. Web find and fill out the correct mn w 9 2011 form. Web policy statements that provide added interpretation, details, or information about minnesota tax laws or rules. You can also look for forms by category.

W9 Forms 2021 Printable Free Calendar Printable Free

Choose the correct version of the editable pdf form from the list. Minnesota management & budget vendor file maintenance 400 centennial building 658 cedar. Please complete and return to: Mn office of higher education/tslrp 1450 energy. Web find and fill out the correct mn w 9 2011 form.

Downloadable W9 Tax Form How To Fill Out A W9 Form Line W within Irs

Complete, edit or print tax forms instantly. Minnesota management & budget vendor file maintenance 400 centennial building 658 cedar. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to. Mn office of higher education/tslrp 1450 energy. Person (including a resident alien), to provide your correct tin.

Blank W 9 Form 2021 Printable Irs Calendar Printable Free

October 2018) identification number and certification requester. Choose the correct version of the editable pdf form from the list. Complete, edit or print tax forms instantly. Person (including a resident alien), to give your correcttin to the person requesting it (the requester)and, when applicable, to: Please complete and return to:

Free Printable W9 2021 Calendar Template Printable

You can get minnesota tax forms either by mail or in person. Choose the correct version of the editable pdf form from the list. Minnesota management & budget vendor file maintenance 400 centennial building 658 cedar. Administrative rules adopted by the. Please complete and return to:

Irs W9 Form 2021 Printable Pdf Calendar Printable Free

Web policy statements that provide added interpretation, details, or information about minnesota tax laws or rules. Administrative rules adopted by the. Minnesota management and budget (a state of. Signed application one letter of. Web find and fill out the correct mn w 9 2011 form.

Blank W9 Form Fill Online, Printable, Fillable, Blank with regard to

October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to. October 2018) identification number and certification requester. Please complete and return to: Mn office of higher education/tslrp 1450 energy. Web find and fill out the correct mn w 9 2011 form.

Choose The Correct Version Of The Editable Pdf Form From The List.

Web printable minnesota state tax forms for the 2022 tax year are based on income earned between january 1, 2022 through december 31, 2022. Minnesota management & budget vendor file maintenance 400 centennial building 658 cedar. You can also look for forms by category below the search box. Complete, edit or print tax forms instantly.

Please Complete And Return To:

Mn office of higher education/tslrp 1450 energy. You can get minnesota tax forms either by mail or in person. Signed application one letter of. Ad get ready for tax season deadlines by completing any required tax forms today.

Person (Including A Resident Alien), To Provide Your Correct Tin.

October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to. Web find and fill out the correct mn w 9 2011 form. Do not department of the treasury send to the irs. The state of minnesota payment and accounting system requires all persons who are receiving a payment from the state of minnesota to.

Administrative Rules Adopted By The.

Web policy statements that provide added interpretation, details, or information about minnesota tax laws or rules. Use this tool to search for a specific tax form using the tax form number or name. Person (including a resident alien), to give your correcttin to the person requesting it (the requester)and, when applicable, to: Person (including a resident alien), to.