California Installment Agreement Form

California Installment Agreement Form - Web california residential purchase agreement and joint escrow instructions (c.a.r. If the tax liability you owe exceeds. The fee amount is subject to change without further notice. Web if you can't pay your tax bill in 90 days and want to get on a payment plan, you can apply for an installment agreement. • the installment period for payment does. It may take up to 60 days to process your request. Select online and follow the instructions on the installment . Web use form ftb 3805e to report income from casual sales of real or personal property other than inventory if you will receive any payments (including installment payments from. Your request should include the following: Web if the total amount you owe isn’t more than $50,000 (including any amounts you owe from prior years), you don’t need to file form 9465;

If the tax liability you owe exceeds. Web pay a $34 installment agreement fee, which we will add to your tax liability. This form is a generic example that may be. Easily customize your payment agreement. Web you must have your social security number and the confirmation number you received when you submitted your request. * social security number 9. Web i certify that i have read and fully understand the conditions and terms of this agreement as stated on the installment plan information sheet. Web use form ftb 3805e to report income from casual sales of real or personal property other than inventory if you will receive any payments (including installment payments from. Enter your social security number and last name. • the installment period for payment does.

Ad answer simple questions to make a payment agreement on any device in minutes. You can request an installment. • the tax liability you owe does not exceed $25,000. If the tax liability you owe exceeds. Web if the total amount you owe isn’t more than $50,000 (including any amounts you owe from prior years), you don’t need to file form 9465; Web use form ftb 3805e to report income from casual sales of real or personal property other than inventory if you will receive any payments (including installment payments from. Common reasons to change or cancel: Edit, sign and save ca de 999d form. • the installment period for payment does. Web you may be eligible for an installment agreement if the following conditions apply:

California Civil Code & Conditional Sales Contracts Dealer 101

The maker is obligated to pay the lender in monthly installments, with interest. • the installment period for payment does. Web california residential purchase agreement and joint escrow instructions (c.a.r. Web instant download buy now free preview description this agreement deals with purchasing exercise equipment from a health spa. Please visit our disaster relief webpage for additional information.

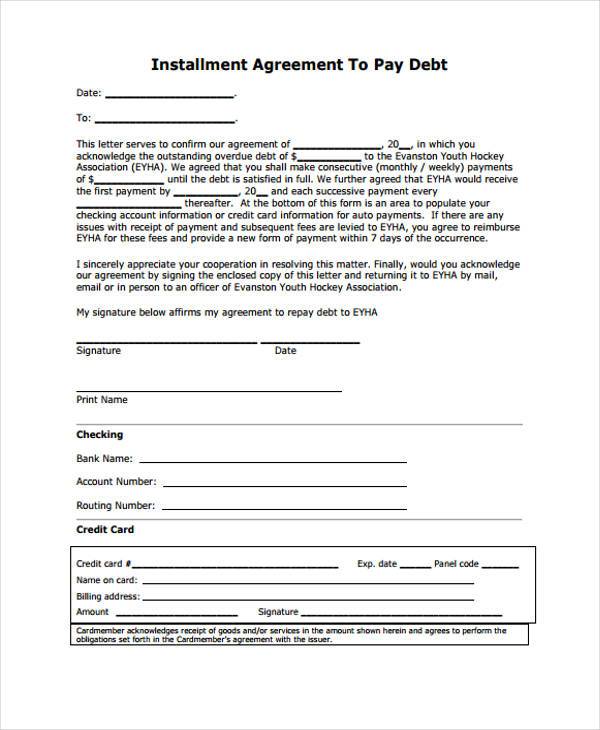

FREE 9+ Installment Agreement Sample Forms in PDF MS Word

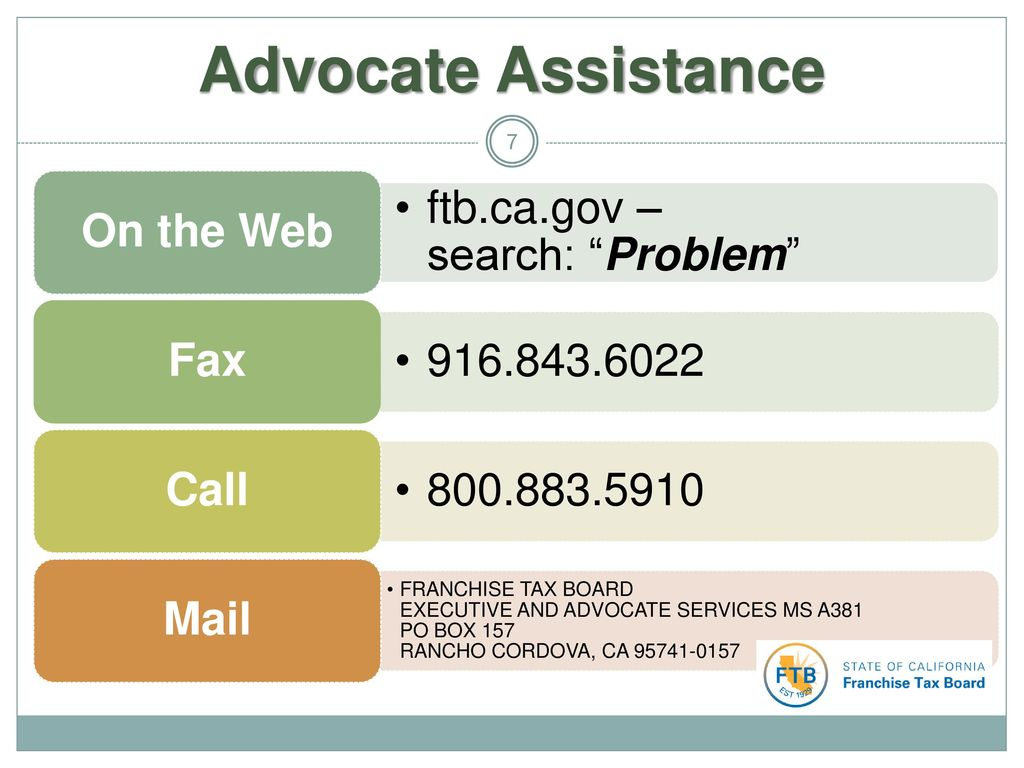

Web by completing form ftb 3567 and sending it to the state of california, franchise tax board, p.o. The fee amount is subject to change without further notice. Web installment agreement request on behalf of the business identified below, as an individual owner, partner or representative of the corporation, i request that the employment. • the tax liability you owe.

6+ Sample Installment Agreements Sample Templates

You can request an installment. Web property owners impacted by the recent winter storms may be eligible for property tax relief. Download or email ca form de 999d & more fillable forms, register and subscribe now! The combination must match our records in order to access this application. Your request should include the following:

FREE 8+ Installment Agreement Form Samples in PDF MS Word

Edit, sign and save ca de 999d form. Web california residential purchase agreement and joint escrow instructions (c.a.r. Download or email ca form de 999d & more fillable forms, register and subscribe now! Web pay a $34 installment agreement fee, which we will add to your tax liability. Web instant download buy now free preview description this agreement deals with.

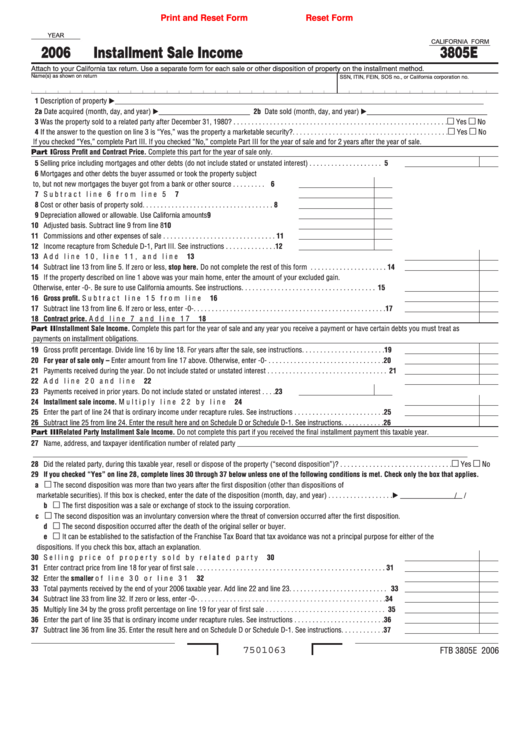

Fillable California Form 3805e Installment Sale 2006

The combination must match our records in order to access this application. The fee amount is subject to change without further notice. • the installment period for payment does. Enter your social security number and last name. Web if you can't pay your tax bill in 90 days and want to get on a payment plan, you can apply for.

32+ Exclusive Image of Ftb Ca Gov Installment Agreement letterify.info

Web use form ftb 3805e to report income from casual sales of real or personal property other than inventory if you will receive any payments (including installment payments from. Select online and follow the instructions on the installment . Web california residential purchase agreement and joint escrow instructions (c.a.r. Web you must have your social security number and the confirmation.

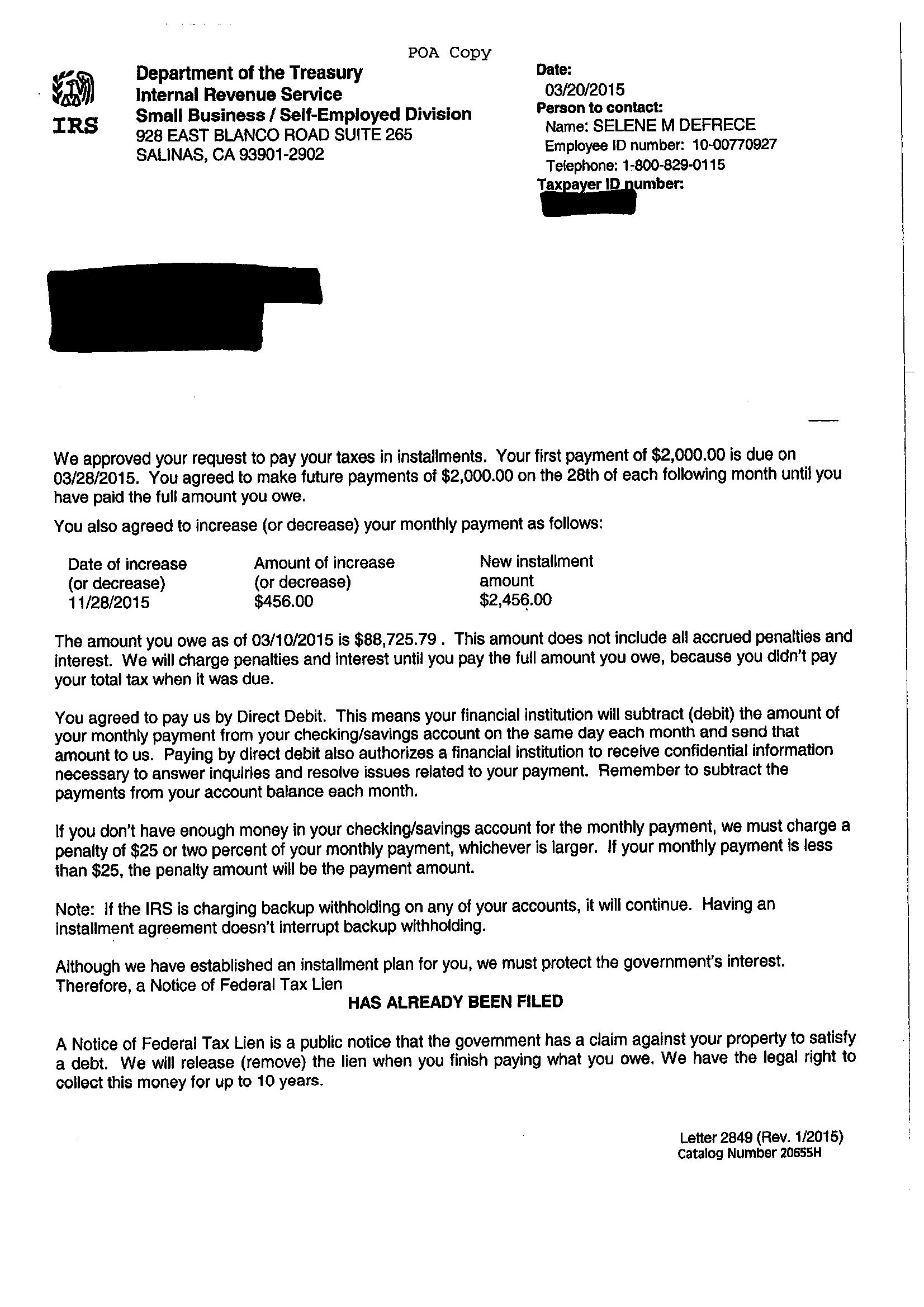

Success Stories Tabb Financial Services

Common reasons to change or cancel: • the tax liability you owe does not exceed $25,000. Web instant download buy now free preview description this agreement deals with purchasing exercise equipment from a health spa. * social security number 9. Web change or cancel a payment plan.

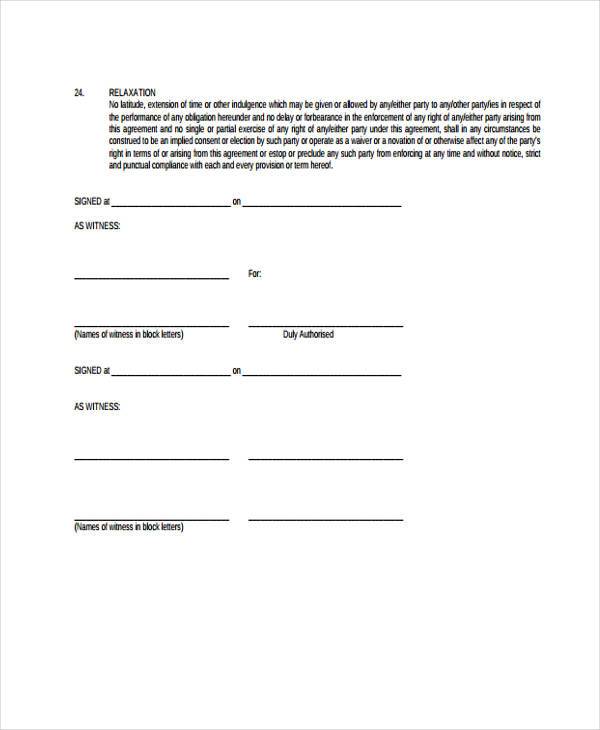

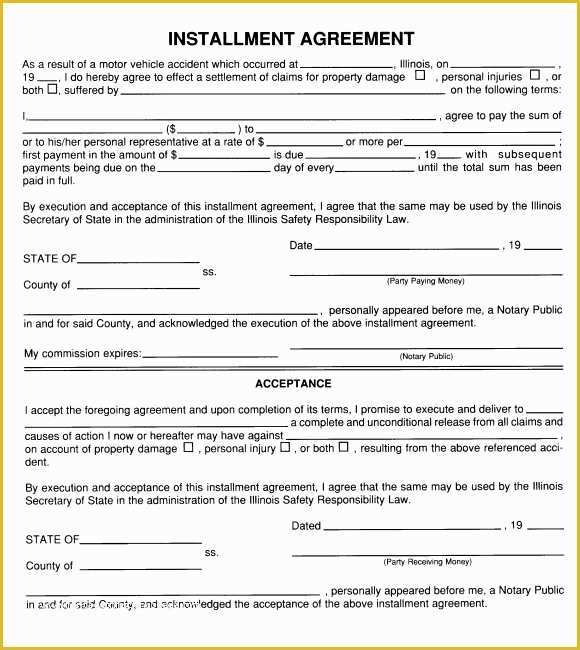

Installment Agreement Template Free Of Template Paid In Full Template

Web use form ftb 3805e to report income from casual sales of real or personal property other than inventory if you will receive any payments (including installment payments from. Please visit our disaster relief webpage for additional information. Download or email ca form de 999d & more fillable forms, register and subscribe now! The combination must match our records in.

32+ Exclusive Image of Ftb Ca Gov Installment Agreement letterify.info

Edit, sign and save ca de 999d form. • the installment period for payment does. Your request should include the following: Web you must have your social security number and the confirmation number you received when you submitted your request. * social security number 9.

California Installment Purchase and Security Agreement With Limited

The maker is obligated to pay the lender in monthly installments, with interest. Web you may be eligible for an installment agreement if the following conditions apply: Select online and follow the instructions on the installment . If the tax liability you owe exceeds. Web if the total amount you owe isn’t more than $50,000 (including any amounts you owe.

Please Visit Our Disaster Relief Webpage For Additional Information.

Common reasons to change or cancel: The maker is obligated to pay the lender in monthly installments, with interest. Select online and follow the instructions on the installment . You can request an installment.

Web Use Form Ftb 3805E To Report Income From Casual Sales Of Real Or Personal Property Other Than Inventory If You Will Receive Any Payments (Including Installment Payments From.

The fee amount is subject to change without further notice. * social security number 9. Your request should include the following: Web if you can't pay your tax bill in 90 days and want to get on a payment plan, you can apply for an installment agreement.

Go To Ftb.ca.gov And Search For Installment Agreement, .

Edit, sign and save ca de 999d form. Web you may be eligible for an installment agreement if the following conditions apply: The combination must match our records in order to access this application. Ad answer simple questions to make a payment agreement on any device in minutes.

Web If The Total Amount You Owe Isn’t More Than $50,000 (Including Any Amounts You Owe From Prior Years), You Don’t Need To File Form 9465;

Web installment agreement request on behalf of the business identified below, as an individual owner, partner or representative of the corporation, i request that the employment. If the tax liability you owe exceeds. • the installment period for payment does. Web instant download buy now free preview description this agreement deals with purchasing exercise equipment from a health spa.