W2 Form For Babysitter

W2 Form For Babysitter - Pay them $2,600 or more in 2023 (or paid them $2,400 or more in 2022) or; Web you may be required to report this amount on form 8959, additional medicare tax. Provide this form to your employee by january 31. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. Amounts over $5,000 are also included. See the form 1040 instructions to determine if you are required to complete form 8959. It documents how much they were paid and how much has been withheld in taxes. Ad care.com® homepay can handle all of your household payroll obligations. The january 31 date is the ‘mail by’ date. Upload, modify or create forms.

Web if the caregiver employee is a family member, the employer may not owe employment taxes even though the employer needs to report the caregiver's. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. Provide this form to your employee by january 31. See the form 1040 instructions to determine if you are required to complete form 8959. Can you claim a nanny on your taxes? Web you may be required to report this amount on form 8959, additional medicare tax. Try it for free now! It communicates to the appropriate. The january 31 date is the ‘mail by’ date. It documents how much they were paid and how much has been withheld in taxes.

Upload, modify or create forms. It documents how much they were paid and how much has been withheld in taxes. That rule applies to babysitters with a few key things to know. Web if the caregiver employee is a family member, the employer may not owe employment taxes even though the employer needs to report the caregiver's. You'll likely need to pay state taxes as well. The irs specifically asks that you allow the employer until february 15 before you report it missing. Amounts over $5,000 are also included. The january 31 date is the ‘mail by’ date. Try it for free now! Web you may be required to report this amount on form 8959, additional medicare tax.

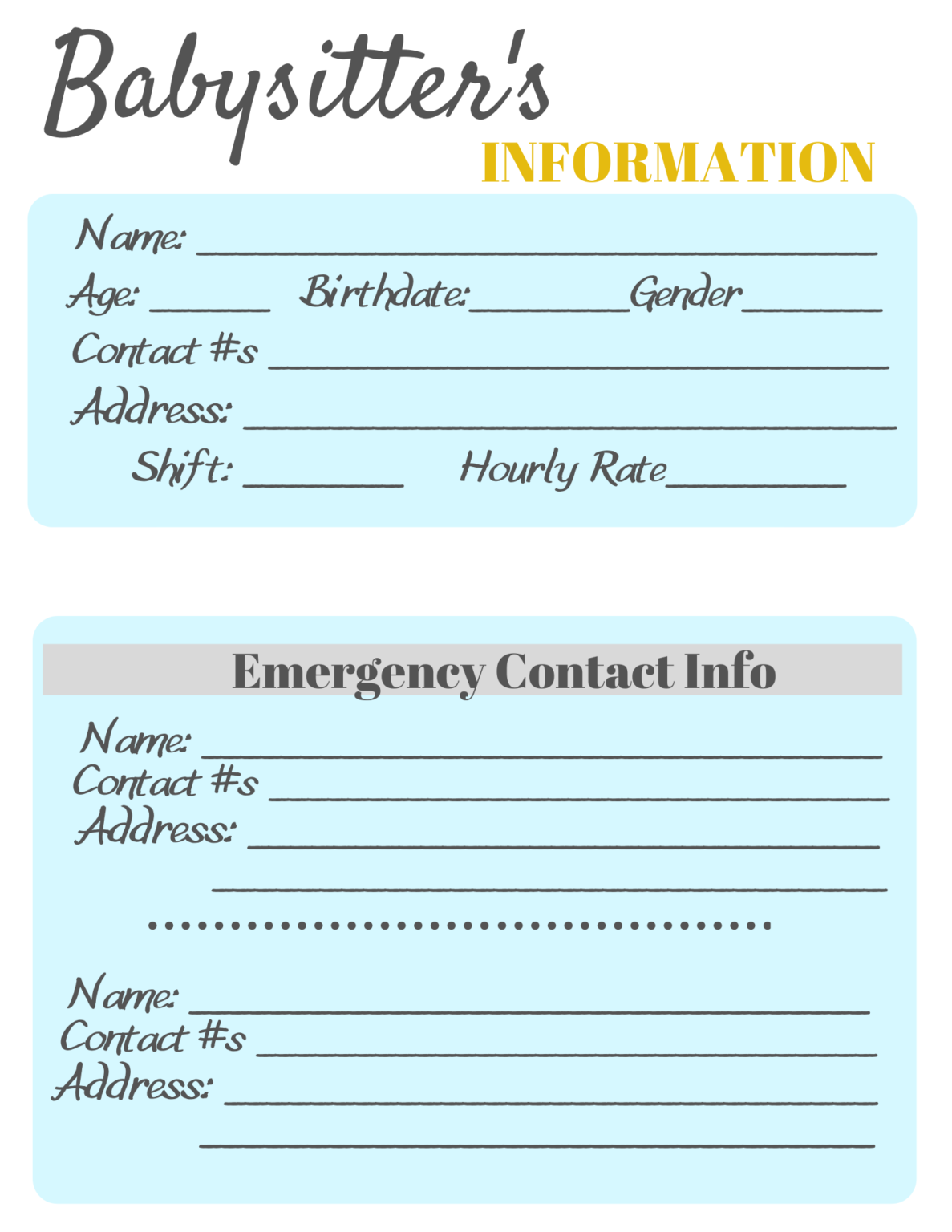

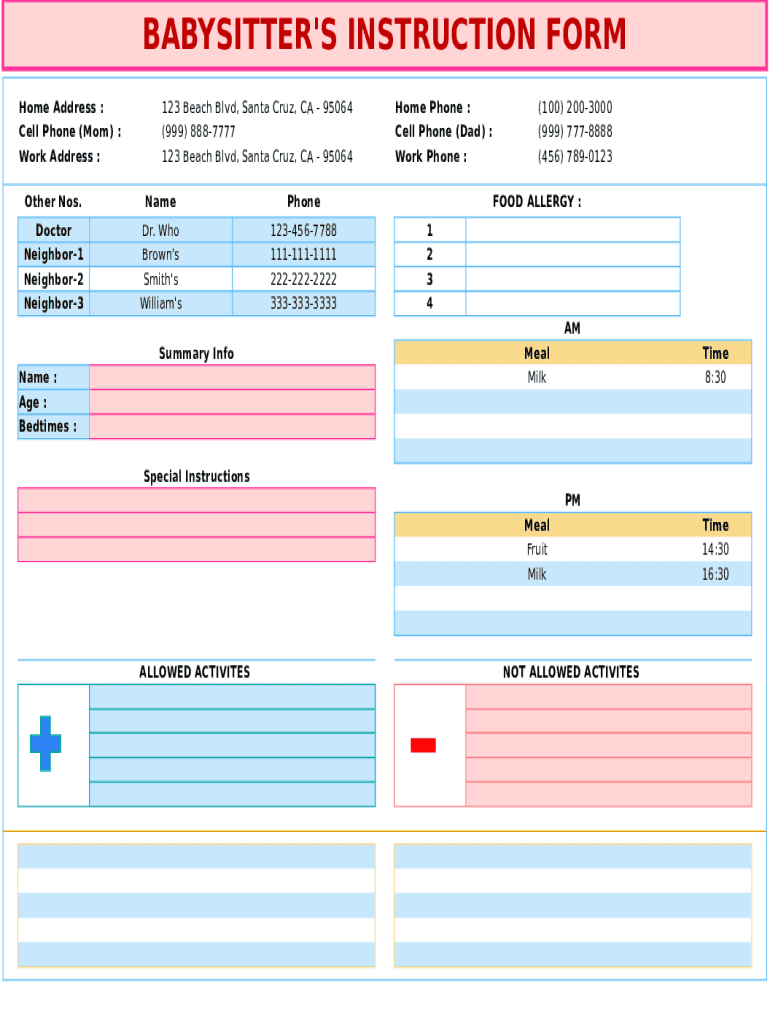

Babysitter Form Babysitter Notes Babysitter Sheet

The irs specifically asks that you allow the employer until february 15 before you report it missing. See the form 1040 instructions to determine if you are required to complete form 8959. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer..

Family Dollar W2 Forms Online New Dollar Wallpaper HD

See the form 1040 instructions to determine if you are required to complete form 8959. You'll likely need to pay state taxes as well. Pay them $2,600 or more in 2023 (or paid them $2,400 or more in 2022) or; Enter this amount on the. Web if the caregiver employee is a family member, the employer may not owe employment.

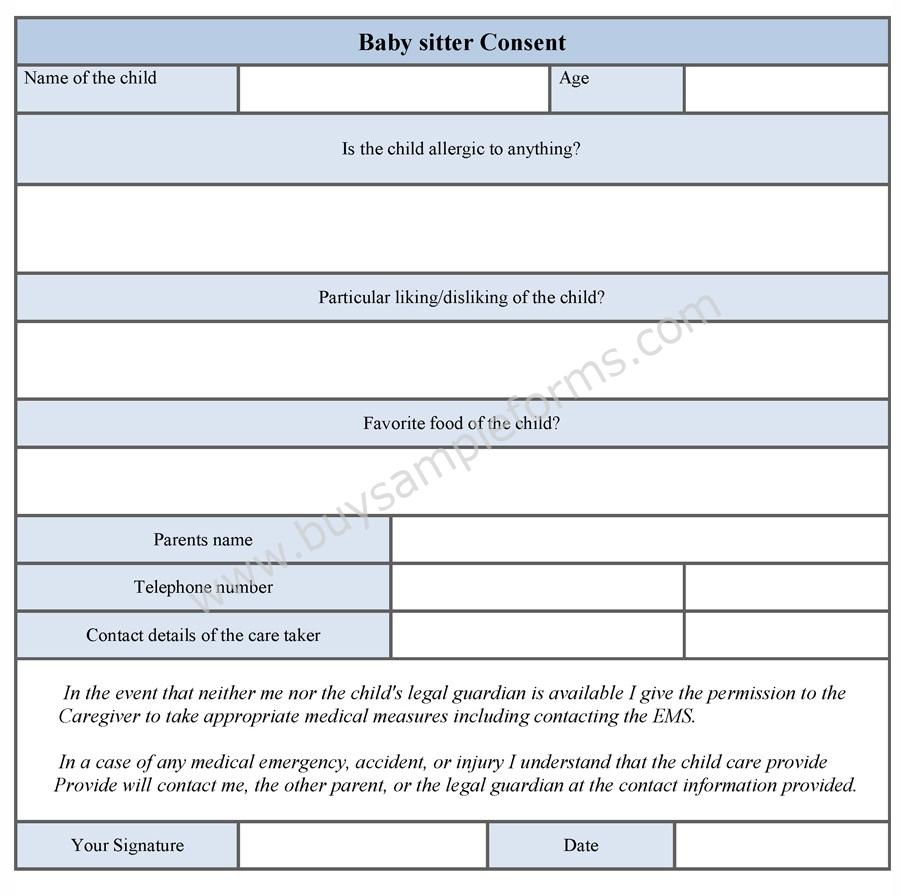

Medical Release form for Babysitter Best Of Would Your Child S

Upload, modify or create forms. Web if the caregiver employee is a family member, the employer may not owe employment taxes even though the employer needs to report the caregiver's. The irs specifically asks that you allow the employer until february 15 before you report it missing. Provide this form to your employee by january 31. Enter this amount on.

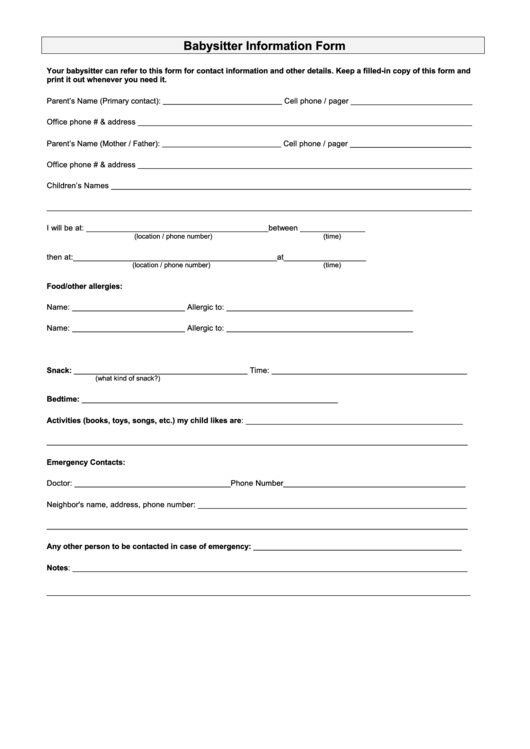

Printable Babysitter Information Sheets Long Wait For Isabella

It documents how much they were paid and how much has been withheld in taxes. Can you claim a nanny on your taxes? Try it for free now! Pay them $2,600 or more in 2023 (or paid them $2,400 or more in 2022) or; Enter this amount on the.

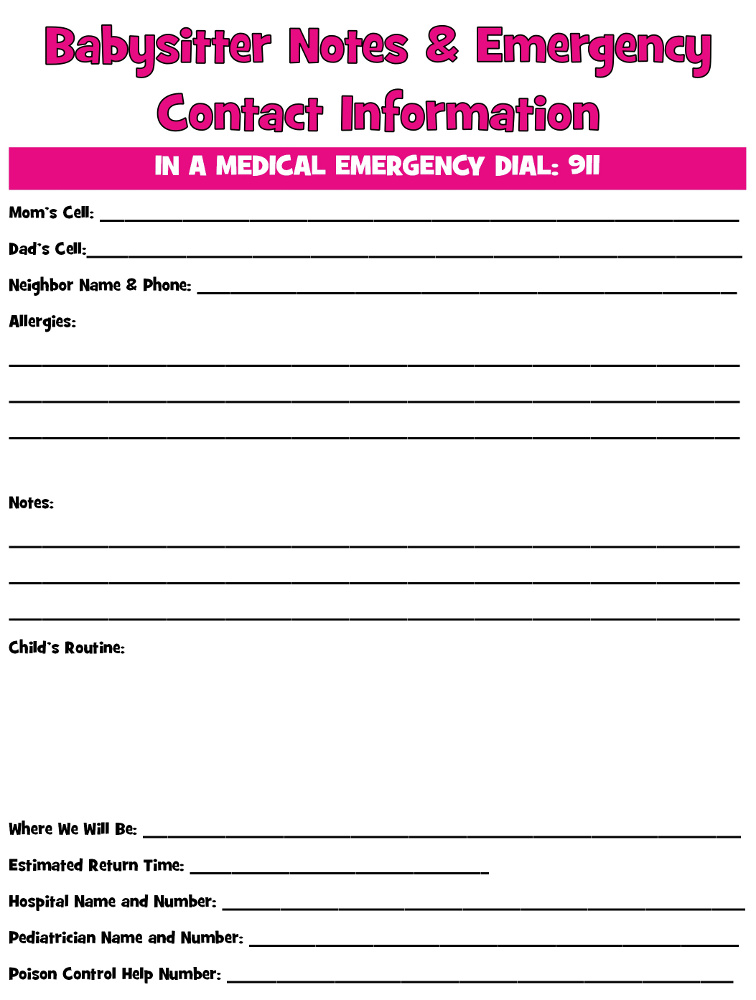

Cutting Down the Cost of Babysitting » Thrifty Little Mom

Web if the caregiver employee is a family member, the employer may not owe employment taxes even though the employer needs to report the caregiver's. You'll likely need to pay state taxes as well. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to.

Babysitter Form Etsy

Try it for free now! The irs specifically asks that you allow the employer until february 15 before you report it missing. It communicates to the appropriate. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. That rule applies to babysitters.

Babysitter Consent Form Sample Forms

The january 31 date is the ‘mail by’ date. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. It communicates to the appropriate. Try it for free now! See the form 1040 instructions to determine if you are required to complete.

Cutting Down the Cost of Babysitting » Thrifty Little Mom

Amounts over $5,000 are also included. Web if the caregiver employee is a family member, the employer may not owe employment taxes even though the employer needs to report the caregiver's. It communicates to the appropriate. That rule applies to babysitters with a few key things to know. Upload, modify or create forms.

Babysitter Instruction Form Fill and Sign Printable Template Online

Enter this amount on the. Upload, modify or create forms. That rule applies to babysitters with a few key things to know. Provide this form to your employee by january 31. It documents how much they were paid and how much has been withheld in taxes.

Top 6 Babysitter Information Sheets free to download in PDF format

Ad care.com® homepay can handle all of your household payroll obligations. Can you claim a nanny on your taxes? It communicates to the appropriate. Pay them $2,600 or more in 2023 (or paid them $2,400 or more in 2022) or; Web you may be required to report this amount on form 8959, additional medicare tax.

It Communicates To The Appropriate.

Try it for free now! It documents how much they were paid and how much has been withheld in taxes. Web if the caregiver employee is a family member, the employer may not owe employment taxes even though the employer needs to report the caregiver's. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer.

Enter This Amount On The.

See the form 1040 instructions to determine if you are required to complete form 8959. The irs specifically asks that you allow the employer until february 15 before you report it missing. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. Enter this amount on the.

The January 31 Date Is The ‘Mail By’ Date.

Amounts over $5,000 are also included. Upload, modify or create forms. That rule applies to babysitters with a few key things to know. You'll likely need to pay state taxes as well.

Pay Them $2,600 Or More In 2023 (Or Paid Them $2,400 Or More In 2022) Or;

Provide this form to your employee by january 31. Ad care.com® homepay can handle all of your household payroll obligations. Web you may be required to report this amount on form 8959, additional medicare tax. Can you claim a nanny on your taxes?

:max_bytes(150000):strip_icc()/w2-9ca13523f4d74e958b821aab63af2e60.png)