Michigan Homestead Property Tax Credit Form

Michigan Homestead Property Tax Credit Form - Check here if the taxable value of your homestead includes unoccupied farmland classified as agricultural by your local assessor. You were a resident of michigan for at least six months. Web household income must be less then $82,650. Youaylaim m c a property tax credit if all of the following apply: Signnow allows users to edit, sign, fill and share all type of documents online. Edit, sign and save homestead prop tax credit form. The computed credit is reduced by 10% for every $1,000 (or part of $1,000) that household income exceeds $73,650. Web we last updated the michigan homestead property tax credits for separated or divorced taxpayers in february 2023, so this is the latest version of form 2105, fully updated for. Web who may claim a property tax credit you may claim a property tax credit if all of the following apply: Address where you lived on december 31,.

Web who may claim a property tax credit. Note that this is not the. Web in michigan, the homestead credit is a tax credit that qualifying homeowners and renters can claim on their property taxes. Web are claiming a credit. Misoap and the micafe network are projects of elder law of michigan, inc., a 501(c)(3). Your homestead is in michigan. Web you may qualify for a homestead property tax credit if all of the following apply: Web homestead property tax credit claim when claiming the michigan property tax credit, you need to file form 1040cr along with your income taxes. Edit, sign and save homestead prop tax credit form. Edit, sign and save homestead prop tax credit form.

Web who may claim a property tax credit you may claim a property tax credit if all of the following apply: Your homestead is located in michigan you were a michigan resident. Web by intuit• 943•updated september 13, 2022 common questions about entering form 8958 income for community property allocation in lacerte by intuit• 20•updated 1 month ago. Note that this is not the. Web michigan homestead property tax credit. Check here if the taxable value of your homestead includes unoccupied farmland classified as agricultural by your local assessor. Multiply amount on line 42 by percentage on line 43. Edit, sign and save homestead prop tax credit form. Web household income must be less then $82,650. Web we last updated the michigan homestead property tax credits for separated or divorced taxpayers in february 2023, so this is the latest version of form 2105, fully updated for.

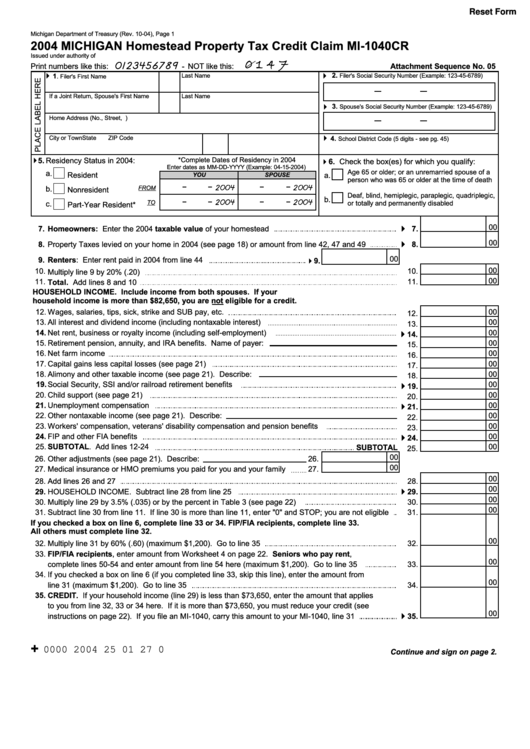

Fillable Form Mi1040cr Homestead Property Tax Credit Claim 2004

Check here if the taxable value of your homestead includes unoccupied farmland classified as agricultural by your local assessor. Web we last updated the michigan homestead property tax credits for separated or divorced taxpayers in february 2023, so this is the latest version of form 2105, fully updated for. Web homestead property tax credit claim when claiming the michigan property.

2015 Michigan Homestead Property Tax Credit Claim MI1040CR. 2015

Signnow allows users to edit, sign, fill and share all type of documents online. Address where you lived on december 31,. Type or print in blue or black ink. Uslegalforms allows users to edit, sign, fill and share all type of documents online. Web michigan homestead property tax credit.

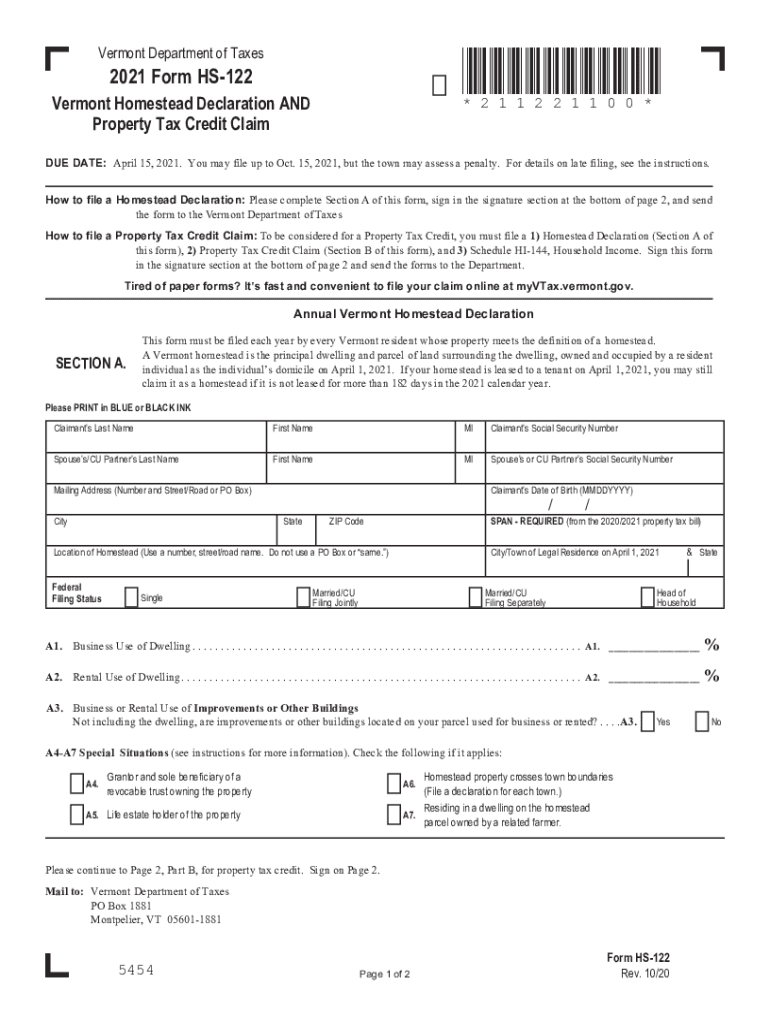

Vermont Homestead Form Fill Out and Sign Printable PDF Template signNow

Web who may claim a property tax credit you may claim a property tax credit if all of the following apply: Your homestead is in michigan. Web we last updated the michigan homestead property tax credits for separated or divorced taxpayers in february 2023, so this is the latest version of form 2105, fully updated for. Address where you lived.

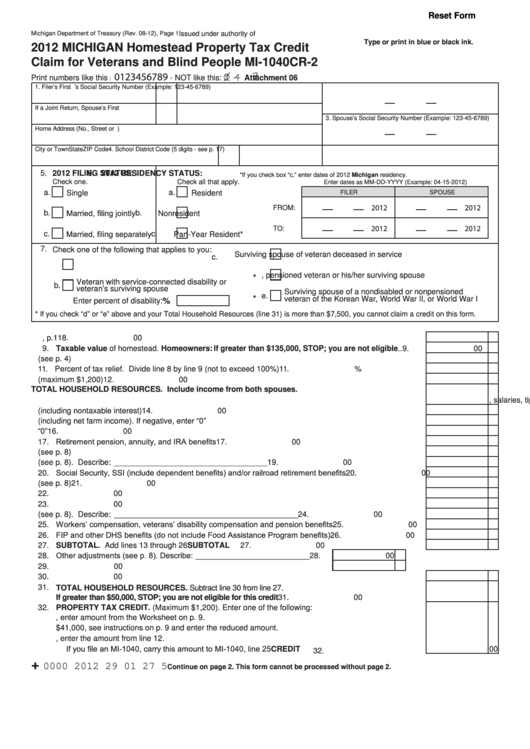

Fillable Form Mi1040cr2 Michigan Homestead Property Tax Credit

Check here if the taxable value of your homestead includes unoccupied farmland classified as agricultural by your local assessor. Web we last updated the michigan homestead property tax credits for separated or divorced taxpayers in february 2023, so this is the latest version of form 2105, fully updated for. Web who may claim a property tax credit you may claim.

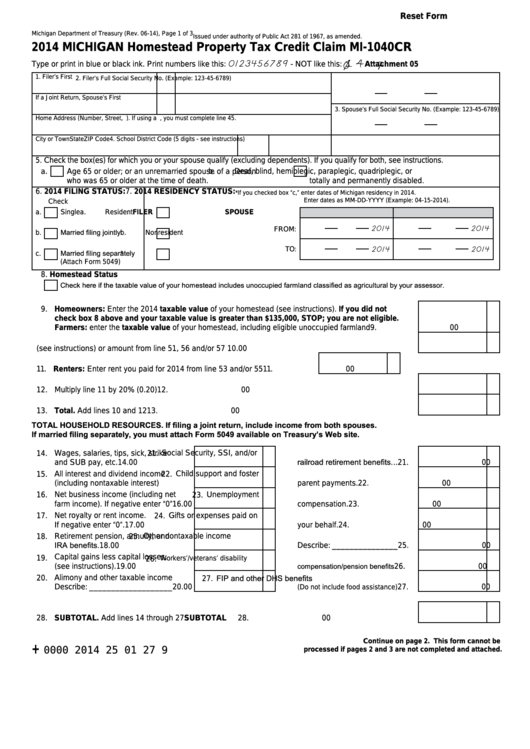

Fillable Form Mi1040cr Michigan Homestead Property Tax Credit Claim

You were a resident of michigan for at least six months. Web who may claim a property tax credit you may claim a property tax credit if all of the following apply: Web in michigan, the homestead credit is a tax credit that qualifying homeowners and renters can claim on their property taxes. Address where you lived on december 31,..

Michigan Homestead Property Tax Credit Form 2018 Property Walls

Web are claiming a credit. Web by intuit• 943•updated september 13, 2022 common questions about entering form 8958 income for community property allocation in lacerte by intuit• 20•updated 1 month ago. The computed credit is reduced by 10% for every $1,000 (or part of $1,000) that household income exceeds $73,650. Uslegalforms allows users to edit, sign, fill and share all.

N.J. Homestead property tax relief not coming this year, treasury says

Web are claiming a credit. Web michigan homestead property tax credit. You were a resident of michigan for at least six months. This booklet contains information for your 2023 michigan property taxes and 2022 individual income taxes, homestead property tax credits, farmland and open. Web you may qualify for a homestead property tax credit if all of the following apply:

Homestead Property Tax Credit Claim for Veterans and Blind People Ins…

Misoap and the micafe network are projects of elder law of michigan, inc., a 501(c)(3). Homesteads with a taxable value greater than $135,000 are not eligible for this credit. Uslegalforms allows users to edit, sign, fill and share all type of documents online. Web michigan homestead property tax credit. Note that this is not the.

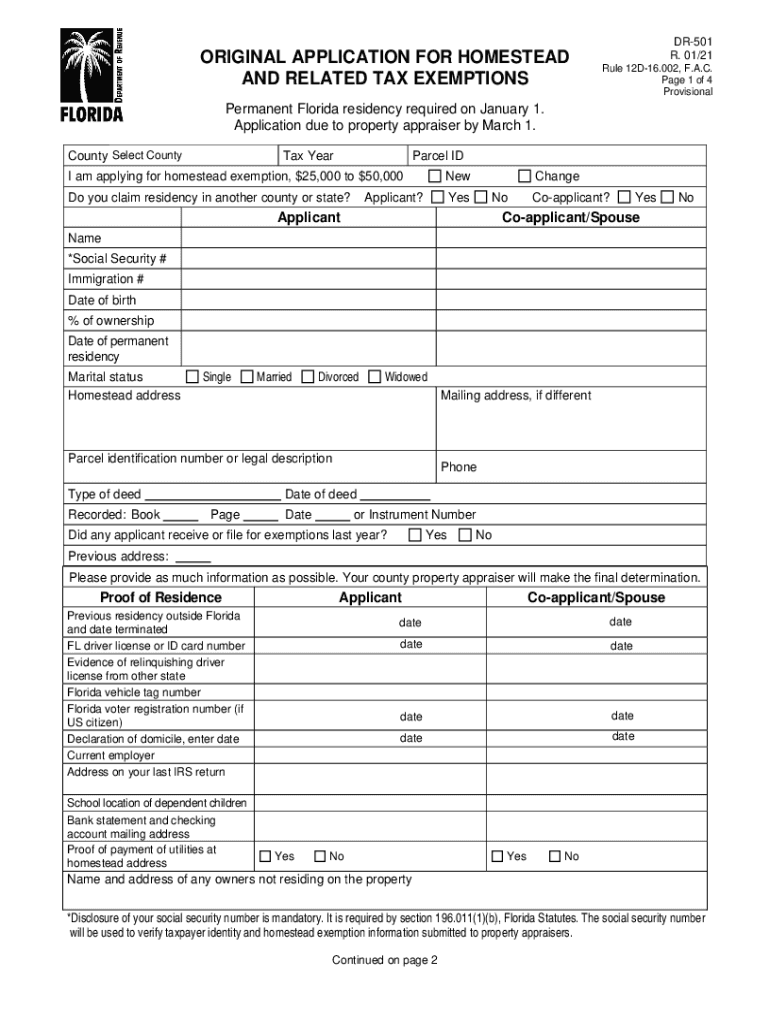

Dr 501 Fill Fill Out and Sign Printable PDF Template signNow

Web tax form search search results forms *mto information show rows: Multiply amount on line 42 by percentage on line 43. Web you may qualify for a homestead property tax credit if all of the following apply: Web household income must be less then $82,650. • your homestead is located in michigan • you were a michigan.

Ingham County Property Homestead Exemption Form

Web who may claim a property tax credit you may claim a property tax credit if all of the following apply: Web we last updated the michigan homestead property tax credits for separated or divorced taxpayers in february 2023, so this is the latest version of form 2105, fully updated for. Edit, sign and save homestead prop tax credit form..

You Were A Resident Of Michigan For At Least Six Months.

Type or print in blue or black ink. Web who may claim a property tax credit you may claim a property tax credit if all of the following apply: Web household income must be less then $82,650. Your homestead is in michigan.

Note That This Is Not The.

Signnow allows users to edit, sign, fill and share all type of documents online. Web michigan homestead property tax credit. Address where you lived on december 31,. Web are claiming a credit.

Web We Last Updated The Michigan Homestead Property Tax Credits For Separated Or Divorced Taxpayers In February 2023, So This Is The Latest Version Of Form 2105, Fully Updated For.

This booklet contains information for your 2023 michigan property taxes and 2022 individual income taxes, homestead property tax credits, farmland and open. Edit, sign and save homestead prop tax credit form. Homesteads with a taxable value greater than $135,000 are not eligible for this credit. Check here if the taxable value of your homestead includes unoccupied farmland classified as agricultural by your local assessor.

Edit, Sign And Save Homestead Prop Tax Credit Form.

Uslegalforms allows users to edit, sign, fill and share all type of documents online. Web tax form search search results forms *mto information show rows: • your homestead is located in michigan • you were a michigan. Web you may qualify for a homestead property tax credit if all of the following apply: