South Carolina State Withholding Form

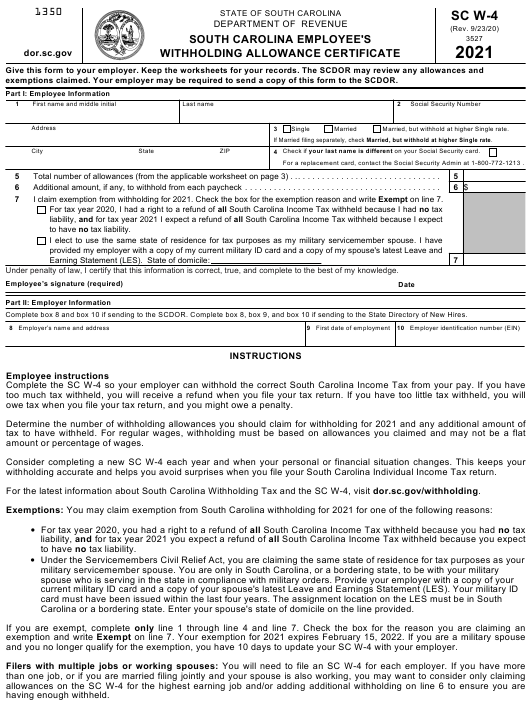

South Carolina State Withholding Form - Web (a)(1) resident withholding agents who deposit and pay withholding to the internal revenue service under the provisions of the internal revenue code as defined in. Complete, edit or print tax forms instantly. Web certify that you are not subject to backup withholding, or 3. Web if a south carolina resident is earning wages in a state that does not have a state income tax, the withholding should be for south carolina. The maximum standard deduction in the case of any. The south carolina employee’s withholding allowance certificate form is separate from the. Web withholding accurate and helps you avoid surprises when you file your south carolina individual income tax return. Web download or print the 2022 south carolina (state or federal withholding allowance) (2022) and other income tax forms from the south carolina department of revenue. For the latest information about south carolina. Find more information on non.

The income tax withholding for the state of south carolina includes the following changes: The maximum standard deduction in the case of any exemptions has. You may claim exemption from south carolina. For the latest information about south carolina. Web if a south carolina resident is earning wages in a state that does not have a state income tax, the withholding should be for south carolina. If more than one job has annual. The income tax withholding for the state of south carolina includes the following changes: Web withholding accurate and helps you avoid surprises when you file your south carolina individual income tax return. The south carolina employee’s withholding allowance certificate form is separate from the. The maximum standard deduction in the case of any.

If you are a foreign person,. You can download or print. Web download or print the 2022 south carolina (state or federal withholding allowance) (2022) and other income tax forms from the south carolina department of revenue. The maximum standard deduction in the case of any. Web (a)(1) resident withholding agents who deposit and pay withholding to the internal revenue service under the provisions of the internal revenue code as defined in. Find more information on non. Web withholding accurate and helps you avoid surprises when you file your south carolina individual income tax return. Web the income tax withholding for the state of south carolina includes the following changes: The income tax withholding for the state of south carolina includes the following changes: The income tax withholding for the state of south carolina includes the following changes:

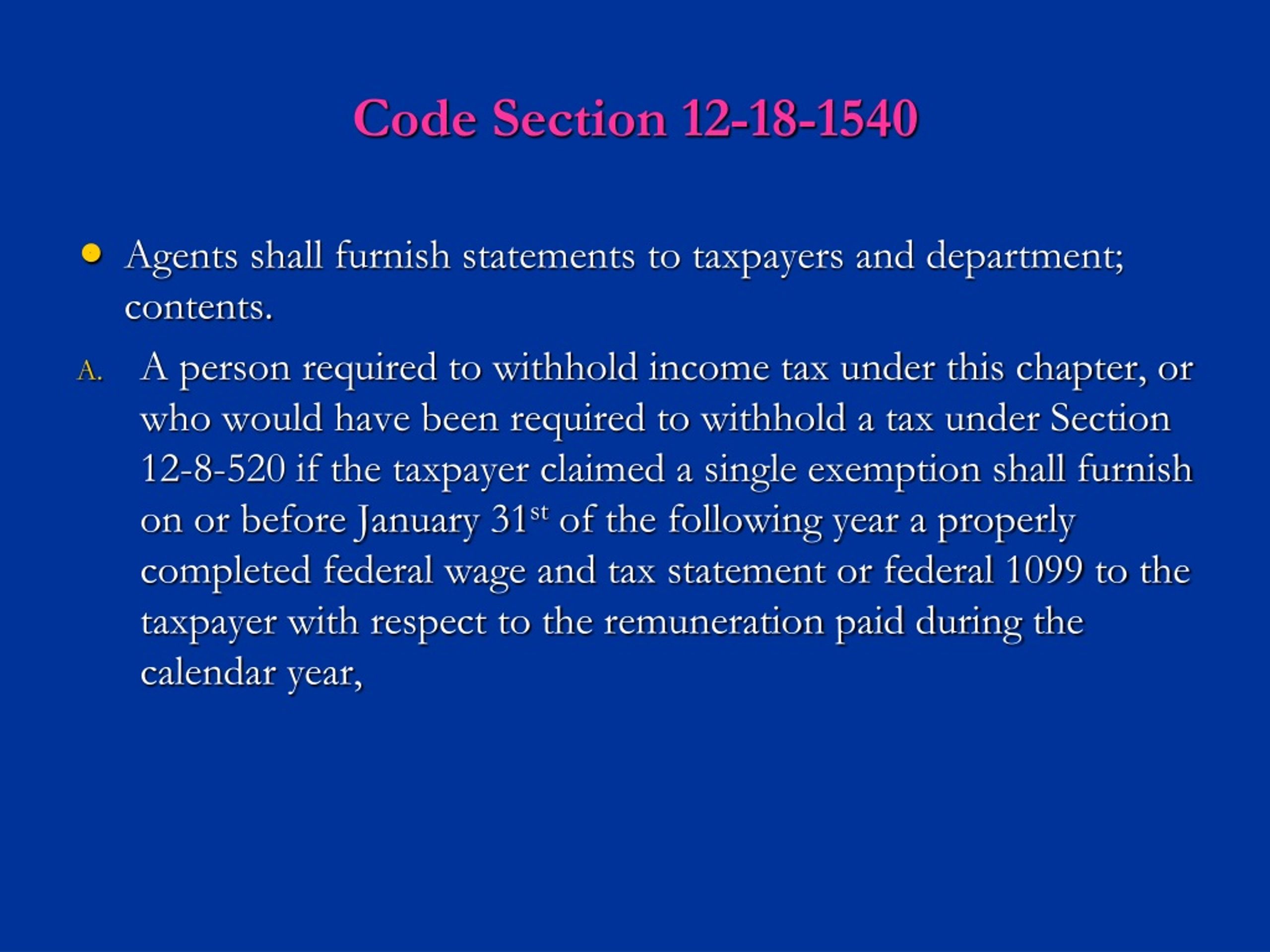

PPT South Carolina Withholding and Forms W2 PowerPoint Presentation

The income tax withholding for the state of south carolina includes the following changes: The maximum standard deduction in the case of any. Web the income tax withholding for the state of south carolina includes the following changes: If more than one job has annual. The income tax withholding for the state of south carolina includes the following changes:

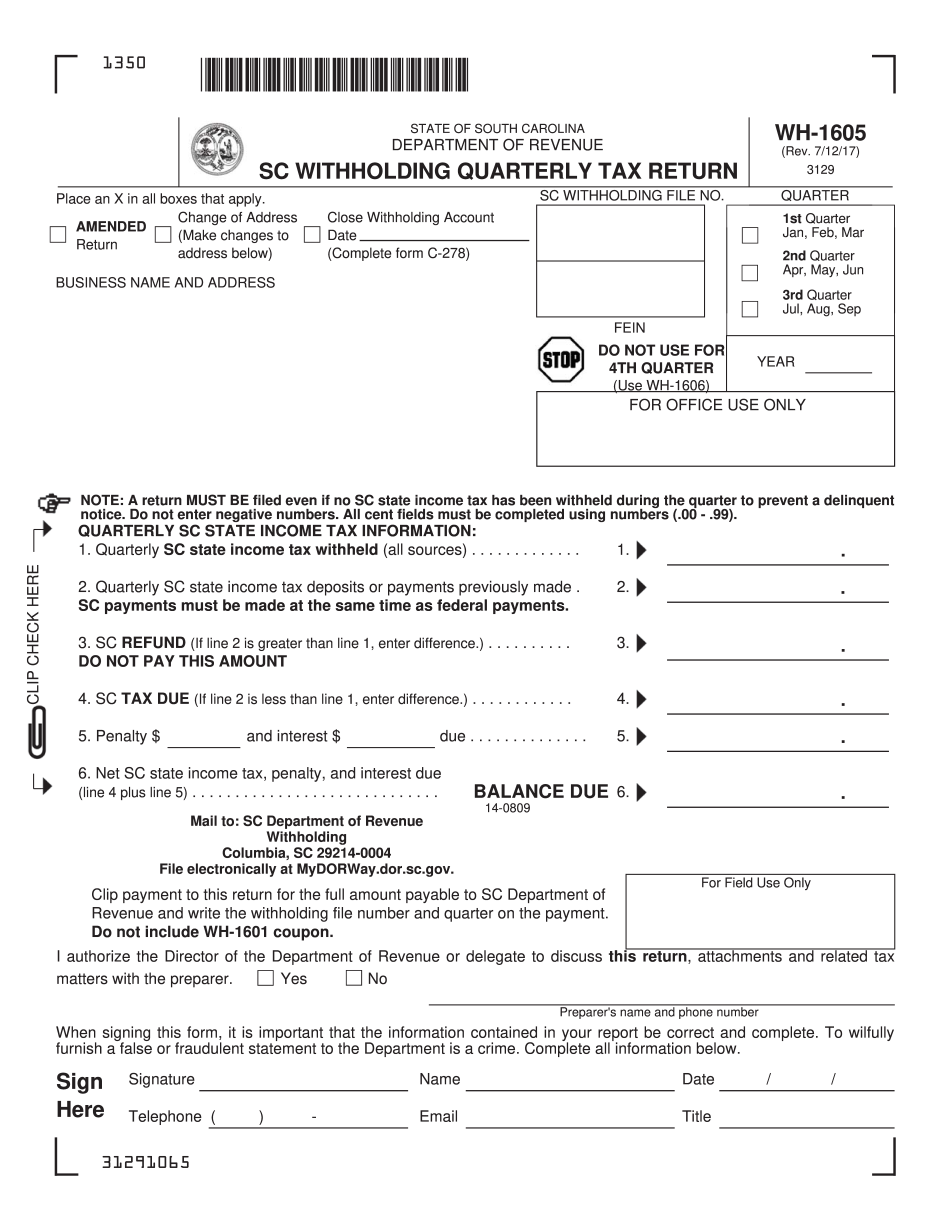

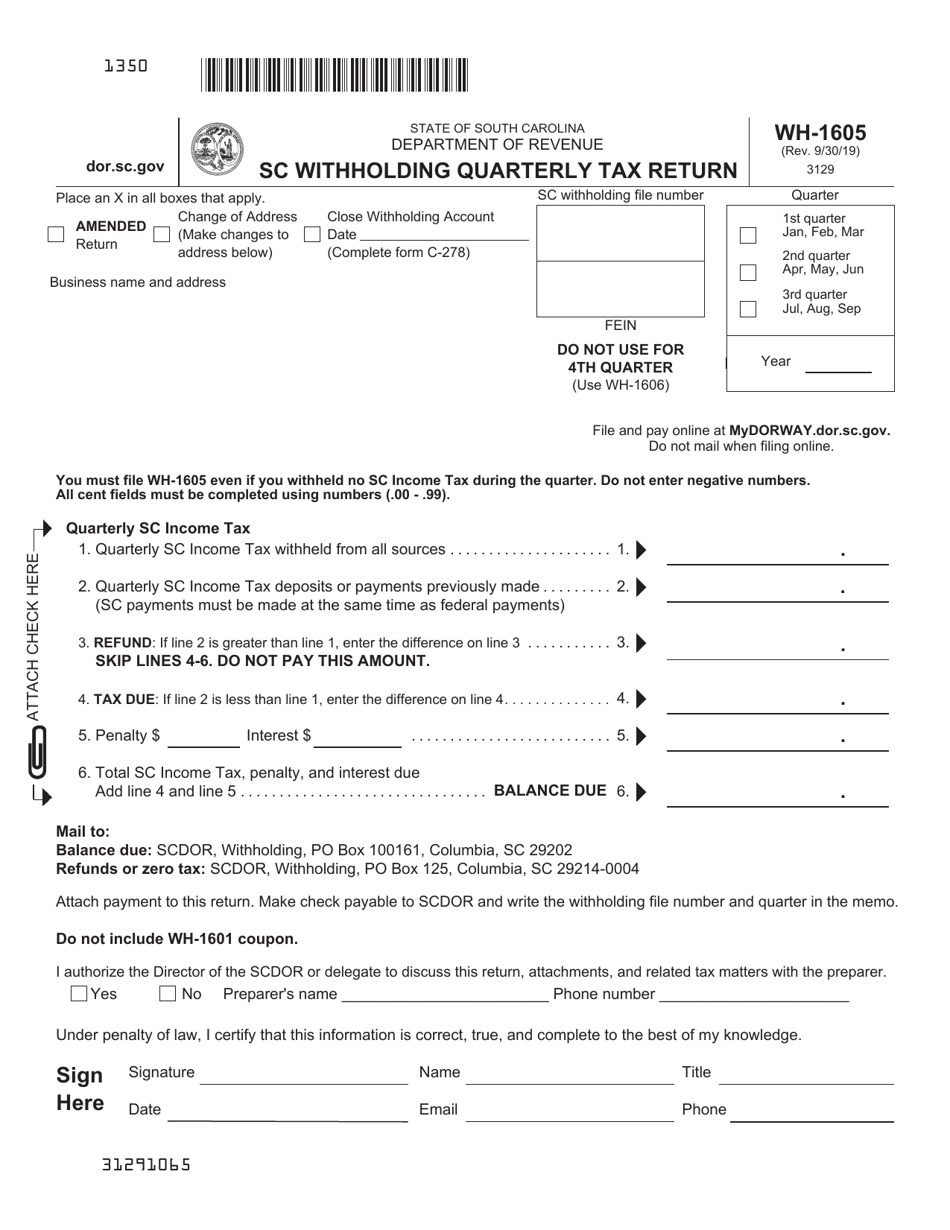

South Carolina Form WH1605 Printable SC Withholding Quarterly Tax Return

Web download or print the 2022 south carolina (state or federal withholding allowance) (2022) and other income tax forms from the south carolina department of revenue. For the latest information about south carolina. Web certify that you are not subject to backup withholding, or 3. The maximum standard deduction in the case of any. For the latest information about south.

North Carolina Tax Withholding Form 2022

Web certify that you are not subject to backup withholding, or 3. Complete, edit or print tax forms instantly. Claim exemption from backup withholding if you are a u.s. Web withholding accurate and help you avoid surprises when you file your south carolina individual income tax return. The south carolina employee’s withholding allowance certificate form is separate from the.

Top 33 South Carolina Withholding Form Templates free to download in

The south carolina employee’s withholding allowance certificate form is separate from the. For the latest information about south carolina. You can download or print. Web download or print the 2022 south carolina (state or federal withholding allowance) (2022) and other income tax forms from the south carolina department of revenue. The income tax withholding for the state of south carolina.

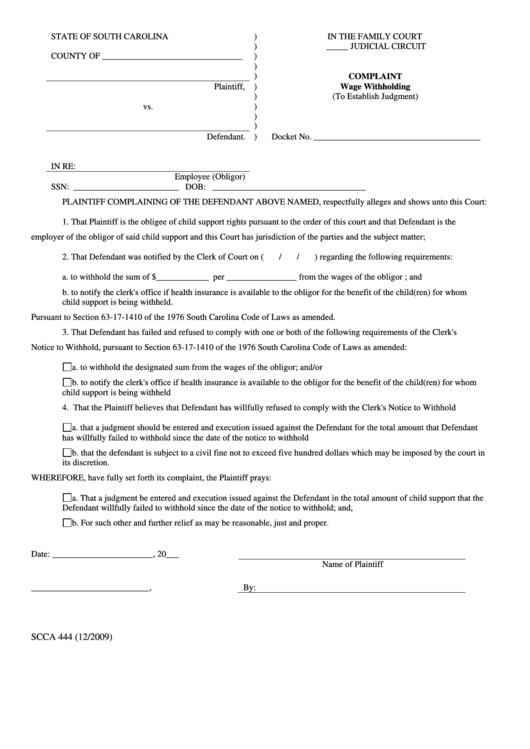

Complaint Wage Withholding Form South Carolina Secretary Of State

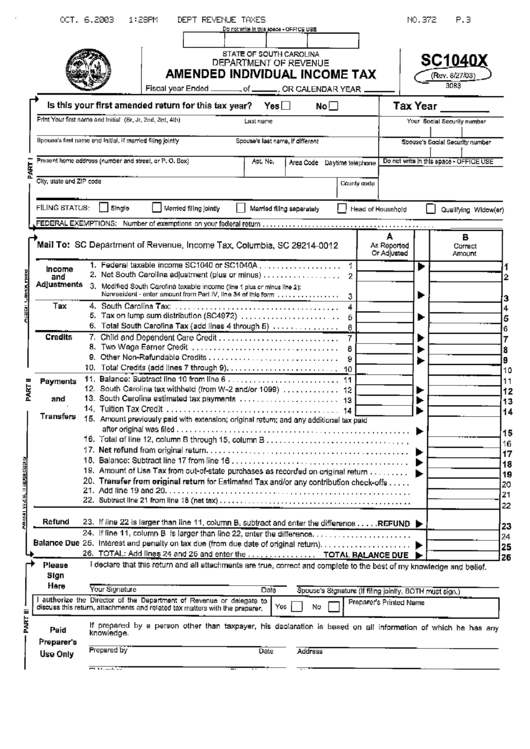

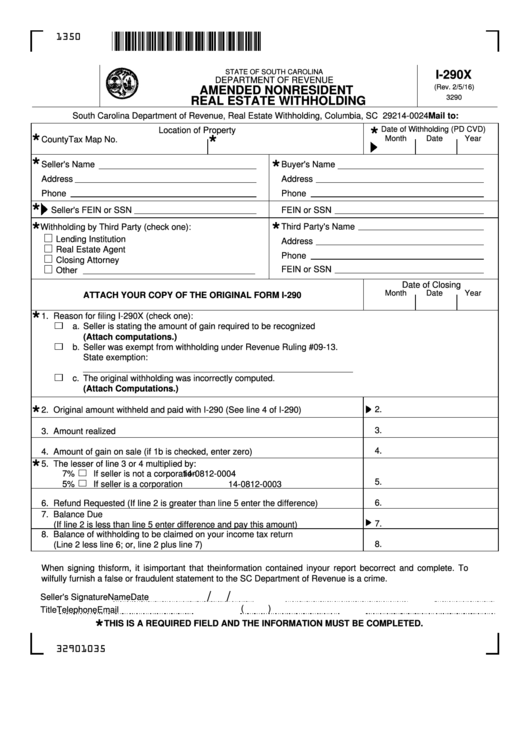

Web the income tax withholding for the state of south carolina includes the following changes: If you are a foreign person,. You may claim exemption from south carolina. Web south carolina department of revenue The maximum standard deduction in the case of any.

PPT South Carolina Withholding and Forms W2 PowerPoint Presentation

The south carolina employee’s withholding allowance certificate form is separate from the. The maximum standard deduction in the case of any. Web download or print the 2022 south carolina (state or federal withholding allowance) (2022) and other income tax forms from the south carolina department of revenue. If more than one job has annual. Find more information on non.

2014 Form SC DoR WH1605 Fill Online, Printable, Fillable, Blank

Web the income tax withholding for the state of south carolina includes the following changes: The income tax withholding for the state of south carolina includes the following changes: Web your tax withholding will remain in effect until you change or revoke it. Web certify that you are not subject to backup withholding, or 3. The maximum standard deduction in.

Form WH1605 Download Printable PDF or Fill Online Sc Withholding

Web if a south carolina resident is earning wages in a state that does not have a state income tax, the withholding should be for south carolina. You may claim exemption from south carolina. Web download or print the 2022 south carolina (state or federal withholding allowance) (2022) and other income tax forms from the south carolina department of revenue..

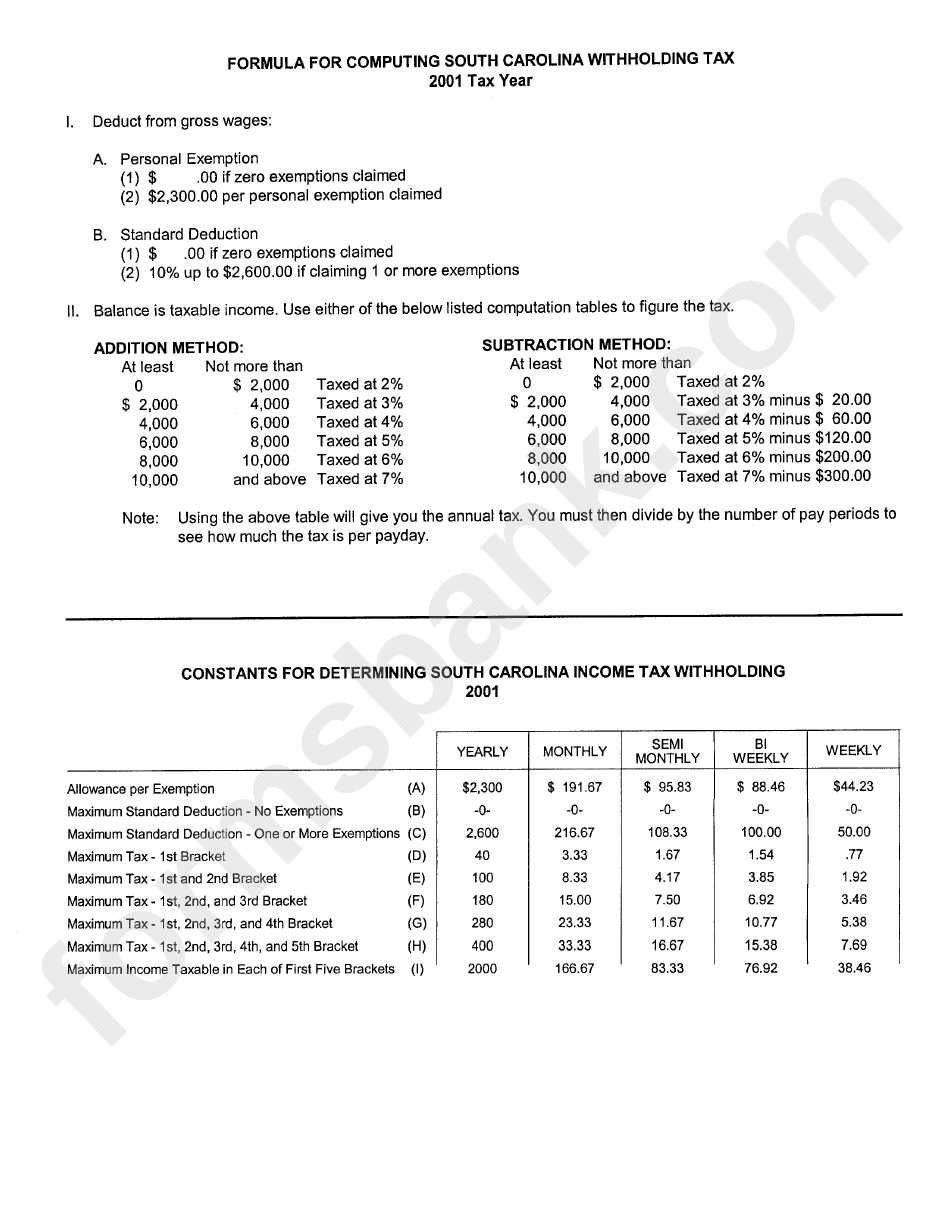

Instructions For South Carolina Tax Withholding Form 2001

The income tax withholding for the state of south carolina includes the following changes: Web south carolina department of revenue The maximum standard deduction in the case of any. The south carolina employee’s withholding allowance certificate form is separate from the. You can download or print.

South Carolina Employee Withholding Form 2022

The maximum standard deduction in the case of any exemptions has. The income tax withholding for the state of south carolina includes the following changes: You may claim exemption from south carolina. You can download or print. The south carolina employee’s withholding allowance certificate form is separate from the.

You May Claim Exemption From South Carolina.

Web the income tax withholding for the state of south carolina includes the following changes: The income tax withholding for the state of south carolina includes the following changes: You can download or print. Web your tax withholding will remain in effect until you change or revoke it.

If You Are A Foreign Person,.

You may claim exemption from south carolina. If more than one job has annual. For the latest information about south carolina. Web download or print the 2022 south carolina (state or federal withholding allowance) (2022) and other income tax forms from the south carolina department of revenue.

For The Latest Information About South Carolina.

Web withholding accurate and helps you avoid surprises when you file your south carolina individual income tax return. Web south carolina department of revenue Web if a south carolina resident is earning wages in a state that does not have a state income tax, the withholding should be for south carolina. Find more information on non.

Claim Exemption From Backup Withholding If You Are A U.s.

Upload, modify or create forms. The maximum standard deduction in the case of any. The maximum standard deduction in the case of any. Web withholding accurate and help you avoid surprises when you file your south carolina individual income tax return.