Where To Mail 944 Form

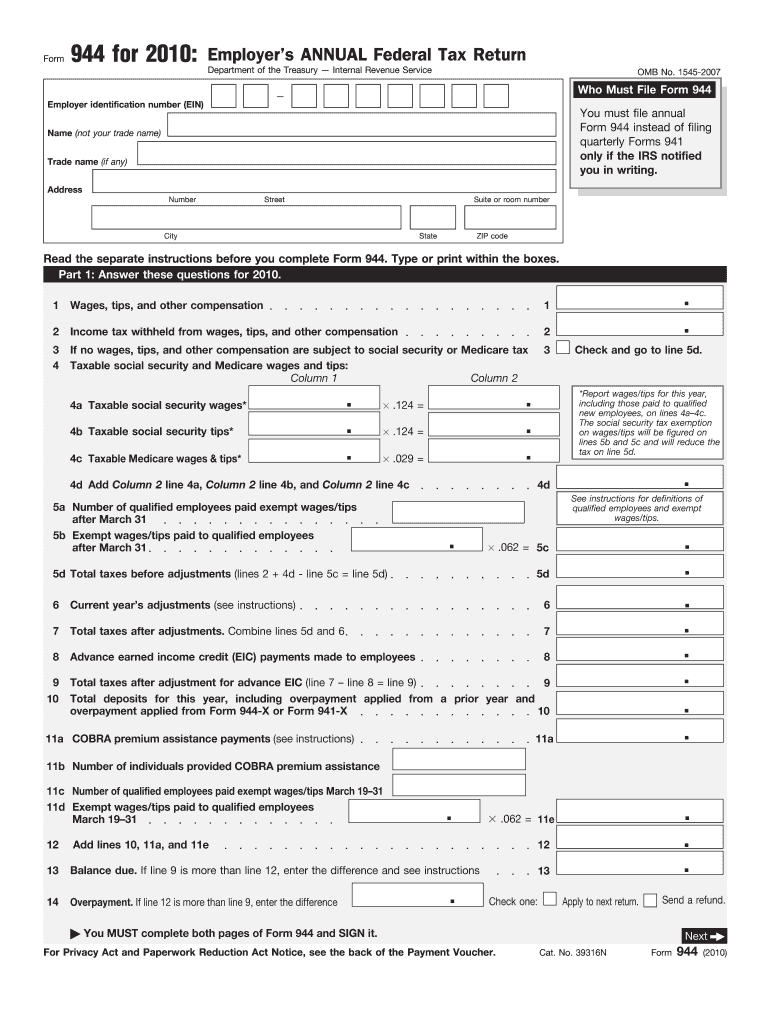

Where To Mail 944 Form - Form 944 is to report the payroll taxes annually. Web for the latest information about developments related to form 944 and its instructions, such as legislation enacted after they were published, go to irs.gov/form944. Employers report these taxes quarterly, using form 941, small businesses whose annual tax liability falls below $1,000, have requested to file form 944. Web 4 rows 3. You can complete it online, download a copy, or you can print out a copy from the website. What is irs form 944 for 2022? Web where to mail form 944. Where to mail form 944 for 2022? Web while the majority of u.s. Exception for exempt organizations, federal, state and local government entities and indian tribal.

Web you can either print form 944, fill it out by hand and mail it, or you can fill it out on your computer, print it and mail it. Form 944 is to report the payroll taxes annually. When filing paper copies, small business employers must mail. Web where to mail form 944. The agency will send a written notice if it changes. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. If you mail in form 944, where you file depends on whether you include a payment with the form and the state in which your business is located. Web 4 rows 3. Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s. What is irs form 944 for 2022?

Web here's everything you need to know about irs form 944 and how to file form 944 with the irs. Web you can either print form 944, fill it out by hand and mail it, or you can fill it out on your computer, print it and mail it. Department of the treasury internal revenue service ogden, ut. Form 944 allows small employers. Web for the latest information about developments related to form 944 and its instructions, such as legislation enacted after they were published, go to irs.gov/form944. Where to mail form 944 for 2022? You can complete it online, download a copy, or you can print out a copy from the website. Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. 1 choose form and tax year 2 enter social security & medicare taxes 3 enter federal income tax withheld 4.

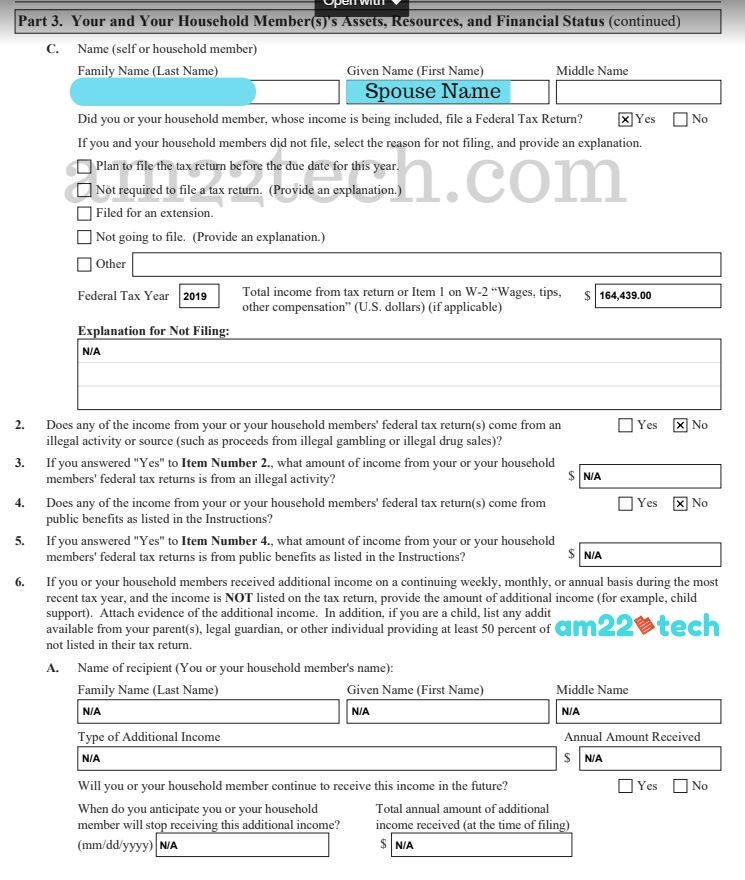

The Sweet Beginning in USA Form I944 Declaration of SelfSufficiency

Web form 944 is available on the irs website. 1 choose form and tax year 2 enter social security & medicare taxes 3 enter federal income tax withheld 4. Form 944 is to report the payroll taxes annually. Where to mail form 944 for 2022? Web here's everything you need to know about irs form 944 and how to file.

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

What is irs form 944 for 2022? 1 choose form and tax year 2 enter social security & medicare taxes 3 enter federal income tax withheld 4. Web 4 rows 3. Form 944 is to report the payroll taxes annually. Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the.

Form 944 Fill Out and Sign Printable PDF Template signNow

If you mail in form 944, where you file depends on whether you include a payment with the form and the state in which your business is located. Department of the treasury internal revenue service ogden, ut. The irs form 944 instructions specify to what. Employers report these taxes quarterly, using form 941, small businesses whose annual tax liability falls.

Form i944 Self Sufficiency US Green Card (Documents Required) USA

Web for the latest information about developments related to form 944 and its instructions, such as legislation enacted after they were published, go to irs.gov/form944. Web 4 rows 3. Form 944 is to report the payroll taxes annually. Web you can either print form 944, fill it out by hand and mail it, or you can fill it out on.

How to Fill out Form I944 ( Declaration of SelfSufficiency ) for AOS

Exception for exempt organizations, federal, state and local government entities and indian tribal. When filing paper copies, small business employers must mail. Web for the latest information about developments related to form 944 and its instructions, such as legislation enacted after they were published, go to irs.gov/form944. Web where to mail form 944. If you mail in form 944, where.

Form 944 vs. Form 941 Should You File the Annual or Quarterly Form?

Web here's everything you need to know about irs form 944 and how to file form 944 with the irs. The agency will send a written notice if it changes. Department of the treasury internal revenue service ogden, ut. You can complete it online, download a copy, or you can print out a copy from the website. Form 944 is.

Who is Required to File Form I944 for a Green Card? CitizenPath

If you mail in form 944, where you file depends on whether you include a payment with the form and the state in which your business is located. Web where to mail form 944. When filing paper copies, small business employers must mail. Form 944 is to report the payroll taxes annually. The agency will send a written notice if.

944 Instruction Fill out and Edit Online PDF Template

The irs form 944 instructions specify to what. Web form 944 is available on the irs website. When filing paper copies, small business employers must mail. Web here's everything you need to know about irs form 944 and how to file form 944 with the irs. You can complete it online, download a copy, or you can print out a.

944 Form 2021 2022 IRS Forms Zrivo

Web irs form 944: How to fill out form 944 Employers report these taxes quarterly, using form 941, small businesses whose annual tax liability falls below $1,000, have requested to file form 944. Where to mail form 944 for 2022? Exception for exempt organizations, federal, state and local government entities and indian tribal.

IRS Form 944 Instructions and Who Needs to File It NerdWallet

Form 944 is to report the payroll taxes annually. The irs form 944 instructions specify to what. Web where to mail form 944. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. How to fill out form 944

The Agency Will Send A Written Notice If It Changes.

You can complete it online, download a copy, or you can print out a copy from the website. Web where to mail form 944. Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s. Web here's everything you need to know about irs form 944 and how to file form 944 with the irs.

Form 944 Is To Report The Payroll Taxes Annually.

Employers report these taxes quarterly, using form 941, small businesses whose annual tax liability falls below $1,000, have requested to file form 944. Exception for exempt organizations, federal, state and local government entities and indian tribal. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. The irs form 944 instructions specify to what.

If You Mail In Form 944, Where You File Depends On Whether You Include A Payment With The Form And The State In Which Your Business Is Located.

Form 944 allows small employers. Web for the latest information about developments related to form 944 and its instructions, such as legislation enacted after they were published, go to irs.gov/form944. What is irs form 944 for 2022? Web you can either print form 944, fill it out by hand and mail it, or you can fill it out on your computer, print it and mail it.

Where To Mail Form 944 For 2022?

Web 4 rows 3. 1 choose form and tax year 2 enter social security & medicare taxes 3 enter federal income tax withheld 4. How to fill out form 944 When filing paper copies, small business employers must mail.