Nc D400 Form 2022

Nc D400 Form 2022 - Sales and use electronic data interchange (edi) step by step instructions for efile; Qualified mortgage interest and real estate property taxes. Individual income tax instructions schedule a: This form allows you to report your income, deductions, credits, and tax liability. Easily fill out pdf blank, edit, and sign them. Printable north carolina state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web click here for help if the form does not appear after you click create form. Electronic filing options and requirements; We will update this page with a new version of the form for 2024 as soon as it is made available by the north carolina government. This form is for income earned in tax year 2022, with tax returns due in april 2023.

Easily fill out pdf blank, edit, and sign them. To determine the amount of n.c. Qualified mortgage interest and real estate property taxes. Sales and use electronic data interchange (edi) step by step instructions for efile; Save or instantly send your ready documents. Web click here for help if the form does not appear after you click create form. Sales and use electronic data interchange (edi) step by step instructions for efile; We will update this page with a new version of the form for 2024 as soon as it is made available by the north carolina government. Single married filing joint married filing separately head of household widow. Individual income tax instructions schedule a:

Easily fill out pdf blank, edit, and sign them. We will update this page with a new version of the form for 2024 as soon as it is made available by the north carolina government. To determine the amount of n.c. Sales and use electronic data interchange (edi) step by step instructions for efile; Save or instantly send your ready documents. You can also find instructions, schedules, and other forms on the ncdor website. Electronic filing options and requirements; Single married filing joint married filing separately head of household widow. This form allows you to report your income, deductions, credits, and tax liability. Electronic filing options and requirements;

2014 Form NC DoR D400TC Fill Online, Printable, Fillable, Blank

To determine the amount of n.c. Individual income tax instructions schedule a: Electronic filing options and requirements; This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the north carolina government.

Nc d400 instructions 2016

You can also find instructions, schedules, and other forms on the ncdor website. Single married filing joint married filing separately head of household widow. Save or instantly send your ready documents. Electronic filing options and requirements; Individual income tax instructions schedule a:

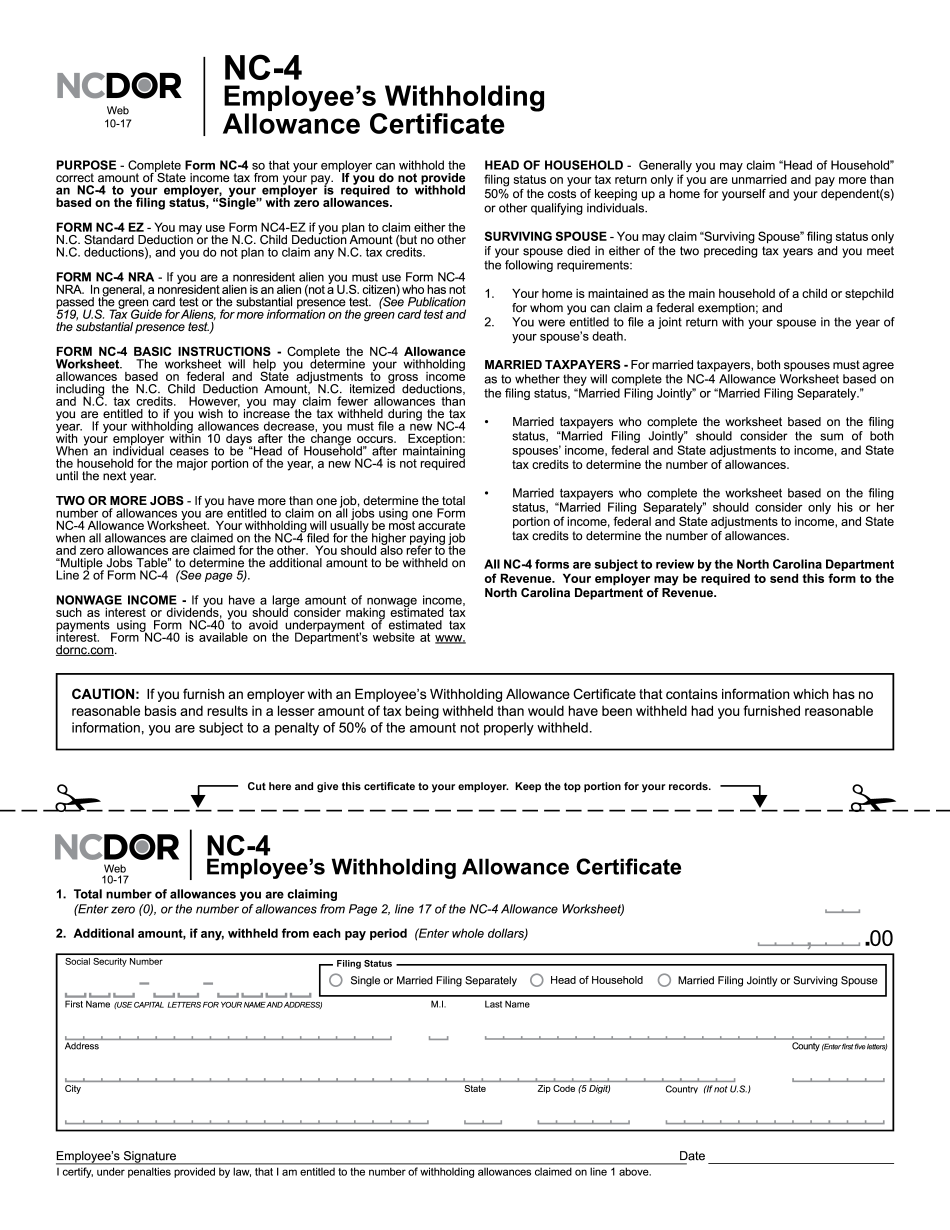

NC4 2022 Printable Form North Carolina Employee's Withholding

You can also find instructions, schedules, and other forms on the ncdor website. Easily fill out pdf blank, edit, and sign them. Web click here for help if the form does not appear after you click create form. Single married filing joint married filing separately head of household widow. Individual income tax instructions schedule a:

Nc d400 instructions 2016

Individual income tax instructions schedule a: Sales and use electronic data interchange (edi) step by step instructions for efile; Qualified mortgage interest and real estate property taxes. Save or instantly send your ready documents. Printable north carolina state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022.

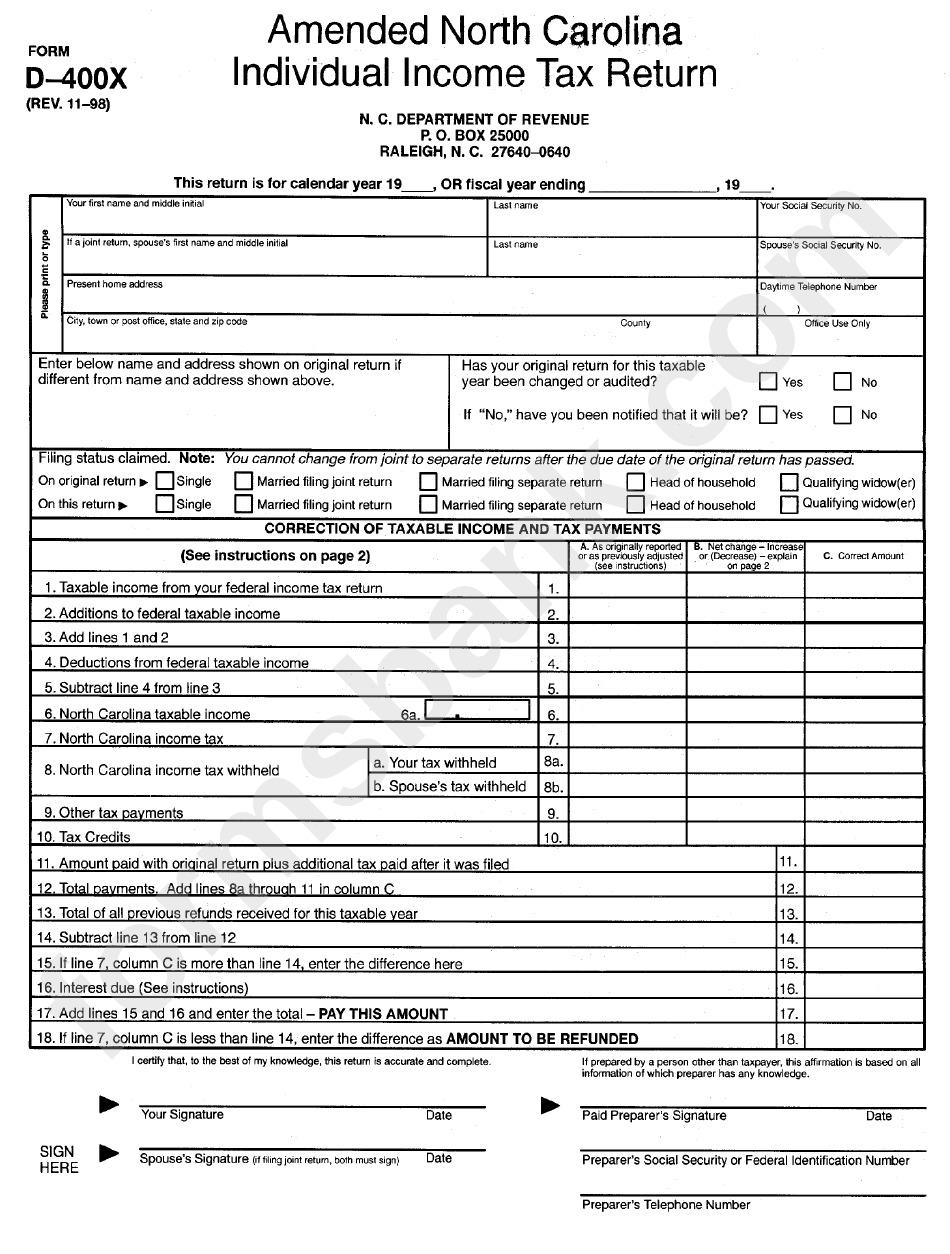

Fillable Form D400x Amended North Carolina Individual Tax

Sales and use electronic data interchange (edi) step by step instructions for efile; Easily fill out pdf blank, edit, and sign them. We will update this page with a new version of the form for 2024 as soon as it is made available by the north carolina government. Electronic filing options and requirements; Save or instantly send your ready documents.

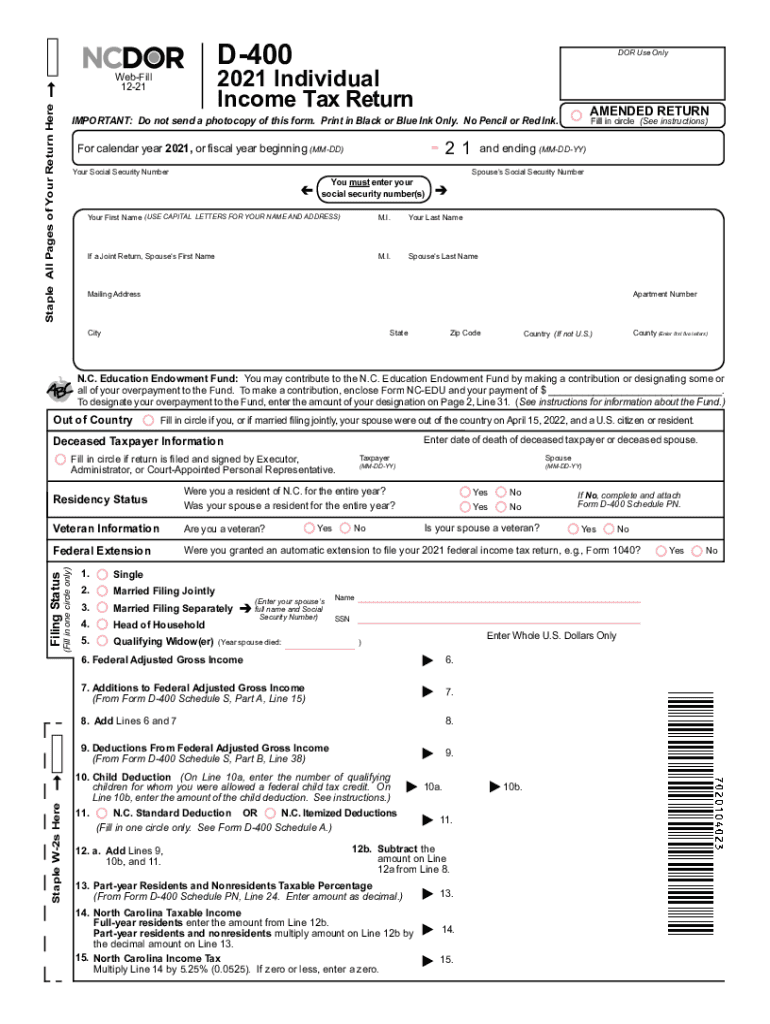

2021 Form NC DoR D400 Fill Online, Printable, Fillable, Blank pdfFiller

We will update this page with a new version of the form for 2024 as soon as it is made available by the north carolina government. Sales and use electronic data interchange (edi) step by step instructions for efile; Sales and use electronic data interchange (edi) step by step instructions for efile; This form allows you to report your income,.

Explore Our Example of Commission Payment Voucher Template Payment

Printable north carolina state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Single married filing joint married filing separately head of household widow. We will update this page with a new version of the form for 2024 as soon as it is made available by the north.

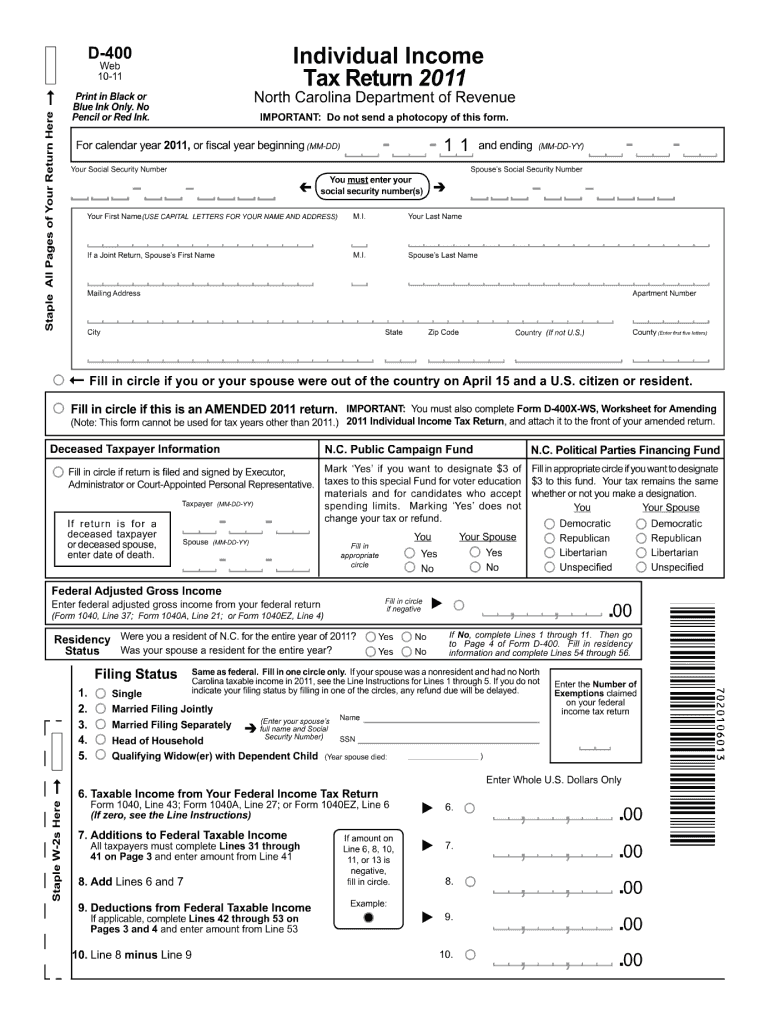

D400 Form Fill Out and Sign Printable PDF Template signNow

To determine the amount of n.c. Individual income tax instructions schedule a: Sales and use electronic data interchange (edi) step by step instructions for efile; Web click here for help if the form does not appear after you click create form. Sales and use electronic data interchange (edi) step by step instructions for efile;

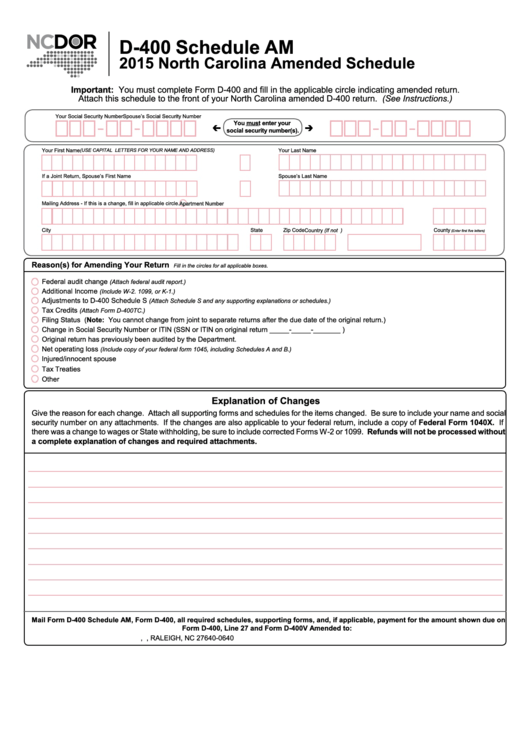

Form D400 Schedule Am North Carolina Amended Schedule 2015

Electronic filing options and requirements; Easily fill out pdf blank, edit, and sign them. To determine the amount of n.c. Web click here for help if the form does not appear after you click create form. Single married filing joint married filing separately head of household widow.

Nc d400 instructions 2016

Sales and use electronic data interchange (edi) step by step instructions for efile; We will update this page with a new version of the form for 2024 as soon as it is made available by the north carolina government. Individual income tax instructions schedule a: Single married filing joint married filing separately head of household widow. Qualified mortgage interest and.

Individual Income Tax Instructions Schedule A:

You can also find instructions, schedules, and other forms on the ncdor website. Electronic filing options and requirements; Save or instantly send your ready documents. Qualified mortgage interest and real estate property taxes.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

This form allows you to report your income, deductions, credits, and tax liability. Web click here for help if the form does not appear after you click create form. Single married filing joint married filing separately head of household widow. Printable north carolina state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022.

Electronic Filing Options And Requirements;

Sales and use electronic data interchange (edi) step by step instructions for efile; To determine the amount of n.c. Easily fill out pdf blank, edit, and sign them. We will update this page with a new version of the form for 2024 as soon as it is made available by the north carolina government.