Form 15111 Instructions

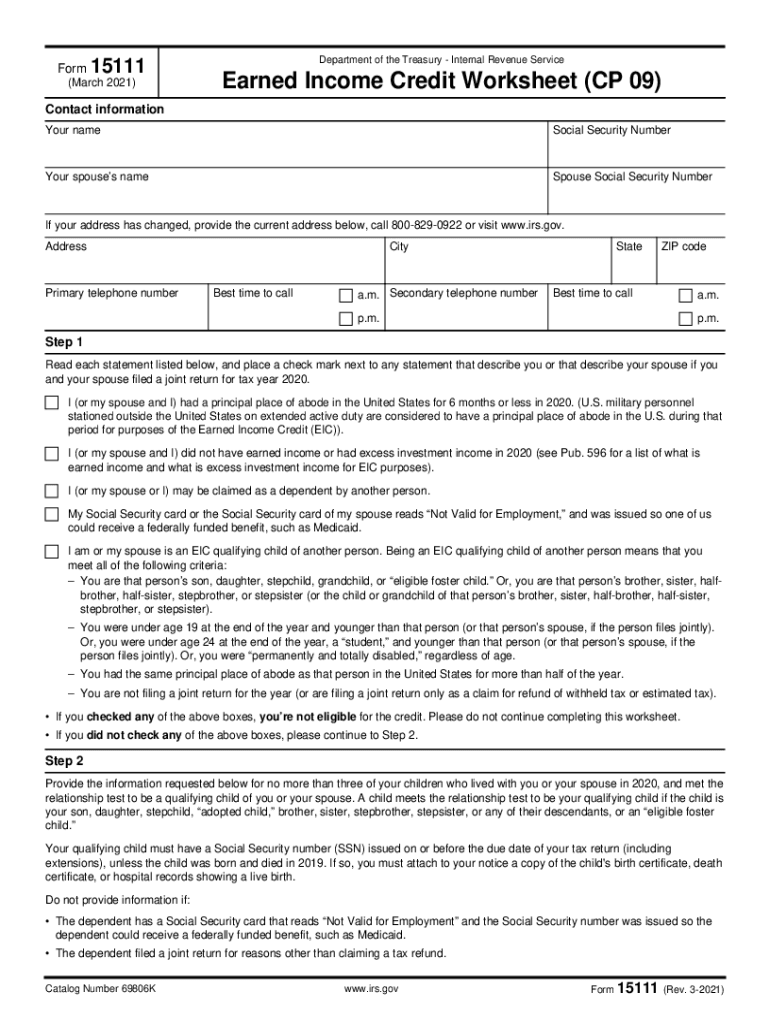

Form 15111 Instructions - Information if we audit or deny your. Complete the eic eligibility form 15112, earned income. Your child must have a social security. Web step 1 read each statement listed below, and place a check mark next to any statement that describes you or that describes your spouse if you and your spouse filed a joint. Web irs form 15111 instructions by forrest baumhover july 6, 2023 reading time: Our service offers you an extensive library. Are you still seeking a fast and efficient tool to complete form 15111 at a reasonable price? Click on “ jump to child tax credit”. Use get form or simply click on the template preview to open it in the editor. Web eligius_ms • 2 yr.

Web step 1 read each statement listed below, and place a check mark next to any statement that describe you or that describe your spouse if you and your spouse filed a joint return. Use get form or simply click on the template preview to open it in the editor. Web edit form 15111 (rev. Start completing the fillable fields and. Web follow the simple instructions below: It will explain the steps needed to determine your qualifications. Web what you need to do read your notice carefully. Current revision publication 596 pdf ( html | ebook epub) recent. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Login to your turbotax account.

Click on the search box on the top and type child tax credit . Information if we audit or deny your. Our service offers you an extensive library. Web follow the simple instructions below: You can view a sample form 15111 worksheet on the irs website. Step by step instructions if you’ve. For tax year 2020, the tax code has a special 'look back' provision for calculating earned income credit. Share your form with others send. Current revision publication 596 pdf ( html | ebook epub) recent. Web fill in the name as it appears on the social security card for each dependent child you claimed on your 2022 tax return.

I don't know my PIN or AGI from 2018 because I was married. I am

Start completing the fillable fields and. 8 minutes watch video get the form! Information if we audit or deny your. Current revision publication 596 pdf ( html | ebook epub) recent. Our service offers you an extensive library.

Tax Forms Teach Me! Personal Finance

Click on the search box on the top and type child tax credit . Web the earned income credit (eic) is a tax credit for certain people who work and have earned income. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web after reading this.

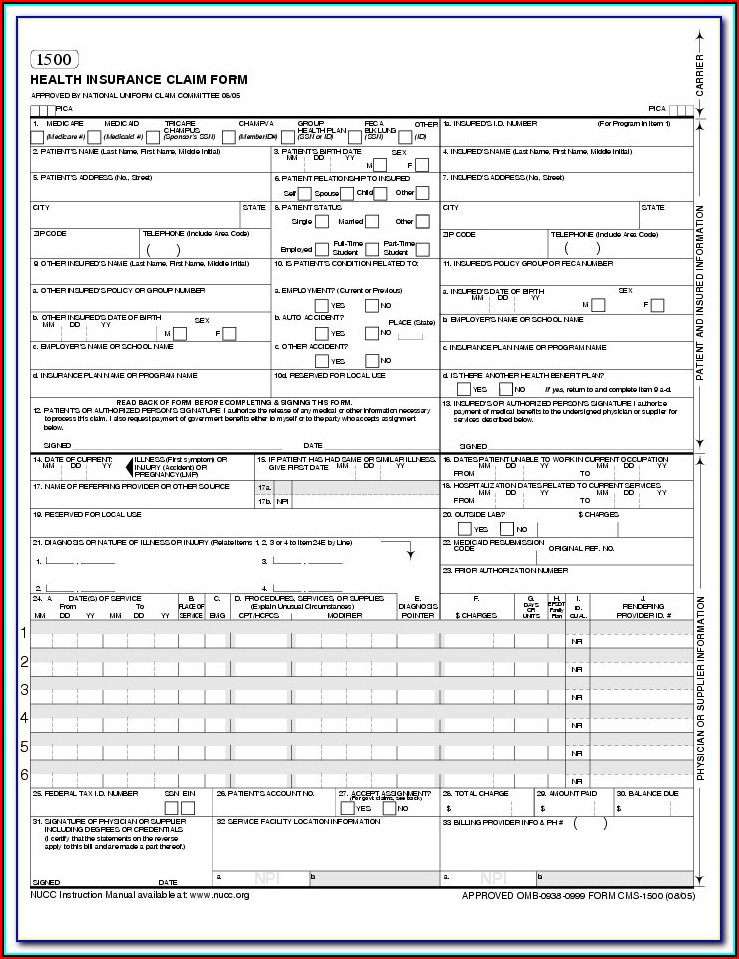

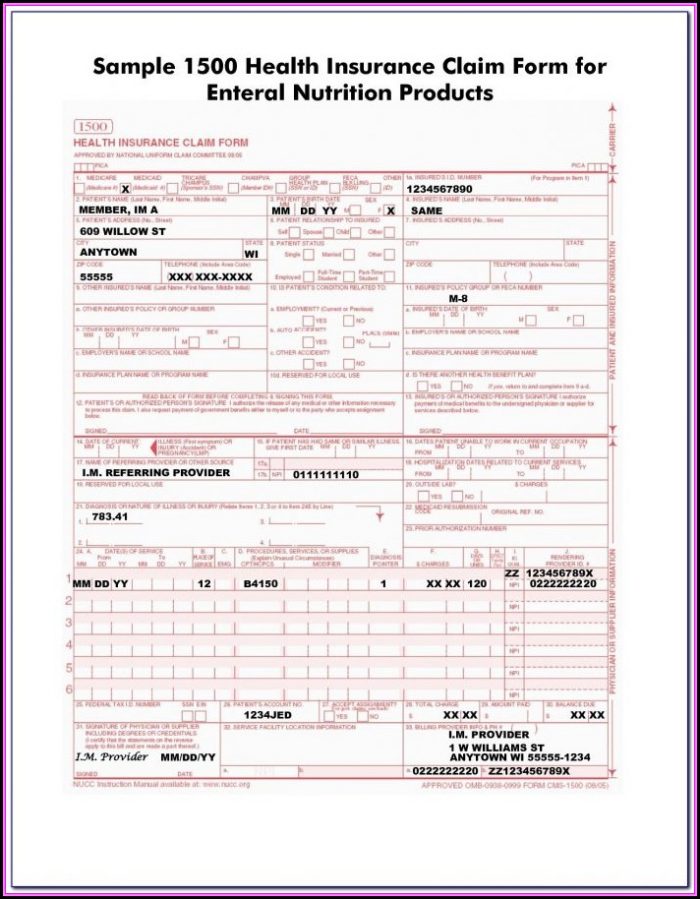

Form Cms 1500 Instructions Form Resume Examples Wk9y1XX93D

Web irs form 15111 instructions by forrest baumhover july 6, 2023 reading time: Web follow the simple instructions below: Web get instructions on how to claim the eitc for past tax years. Web the irs provide tax assistance to taxpayers and pursue and resolve fraudulent tax filings. For tax year 2020, the tax code has a special 'look back' provision.

Every Which Way But Loose

Are you still seeking a fast and efficient tool to complete form 15111 at a reasonable price? Current revision publication 596 pdf ( html | ebook epub) recent. Web what you need to do read your notice carefully. Our service offers you an extensive library. It will explain the steps needed to determine your qualifications.

2021 Form IRS 15111 Fill Online, Printable, Fillable, Blank pdfFiller

Web what is form 15111. Current revision publication 596 pdf ( html | ebook epub) recent. Web what you need to do read your notice carefully. Login to your turbotax account. For tax year 2020, the tax code has a special 'look back' provision for calculating earned income credit.

Form 15111? r/IRS

Web after reading this notice carefully, recipient taxpayers should fill out the earned income tax credit worksheet on form 15111 that accompanies the notice. Web follow the simple instructions below: Web the earned income credit (eic) is a tax credit for certain people who work and have earned income. Web irs form 15111 instructions by forrest baumhover july 6, 2023.

Irs 2290 Form Instructions Form Resume Examples a6YnOeWVBg

Web follow the simple instructions below: Step by step instructions if you’ve. Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. Information if we audit or deny your. Web the earned income credit (eic) is a tax credit for certain people who work and have earned income.

Fill Free fillable Form 15111 Earned Credit Worksheet (CP 09

Web eligius_ms • 2 yr. Web what you need to do read your notice carefully. Click on the search box on the top and type child tax credit . 8 minutes watch video get the form! Find information on how to avoid common errors.

Why Most U.S. Citizens Residing Overseas Haven’t a Clue about the

Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. Step by step instructions if you’ve. Web what you need to do read your notice carefully. Web step 1 read each statement.

Blog Teach Me! Personal Finance

Current revision publication 596 pdf ( html | ebook epub) recent. Web fill in the name as it appears on the social security card for each dependent child you claimed on your 2022 tax return. Your child must have a social security. Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. Click on the.

Web Follow The Simple Instructions Below:

Complete the eic eligibility form 15112, earned income. Find information on how to avoid common errors. Click on the search box on the top and type child tax credit . Looks like they are sending out the.

Web Step 1 Read Each Statement Listed Below, And Place A Check Mark Next To Any Statement That Describe You Or That Describe Your Spouse If You And Your Spouse Filed A Joint Return.

Your child must have a social security. Web the earned income credit (eic) is a tax credit for certain people who work and have earned income. For tax year 2020, the tax code has a special 'look back' provision for calculating earned income credit. Click on “ jump to child tax credit”.

Additional Child Tax Credit Worksheet 0423 02/10/2023 Form 15110 (Sp) Additional Child Tax Credit Worksheet (Spanish Version) 0123 12/27/2022 Form 1040.

Browse irs forms related forms form 4: Login to your turbotax account. Start completing the fillable fields and. Web after reading this notice carefully, recipient taxpayers should fill out the earned income tax credit worksheet on form 15111 that accompanies the notice.

Web What You Need To Do Read Your Notice Carefully.

It will explain the steps needed to determine your qualifications. Step by step instructions if you’ve. Our service offers you an extensive library. Web step 1 read each statement listed below, and place a check mark next to any statement that describes you or that describes your spouse if you and your spouse filed a joint.