Homestead Form Texas

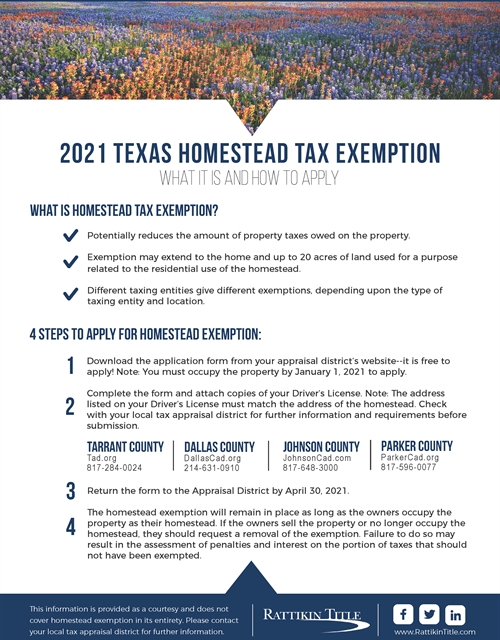

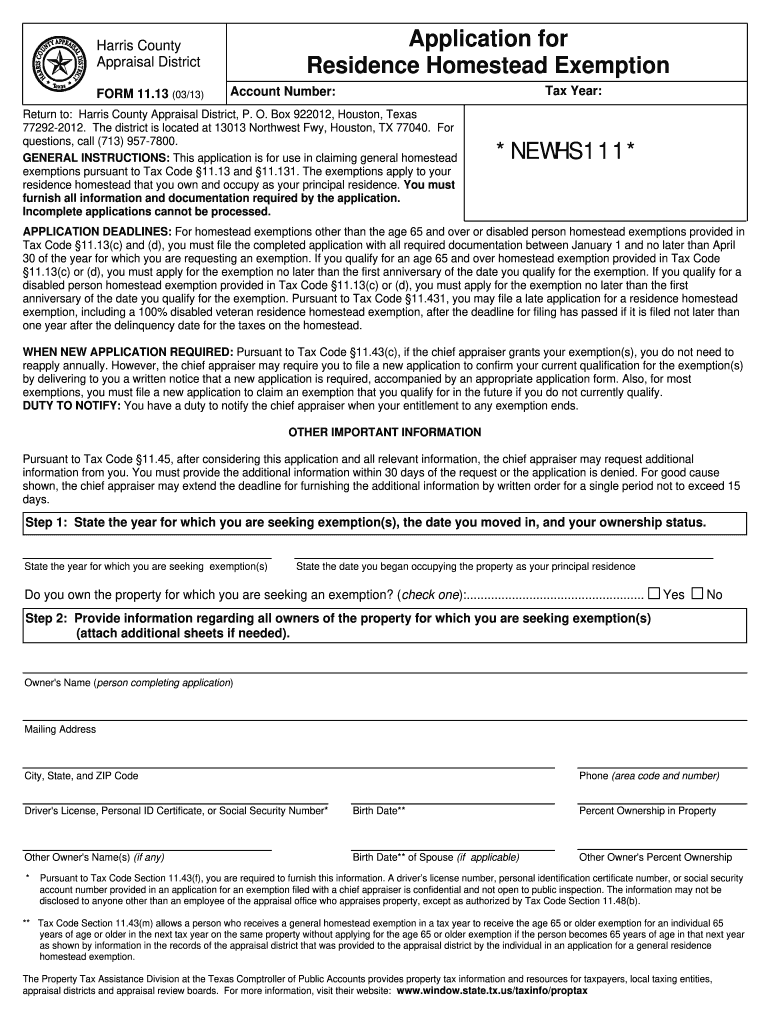

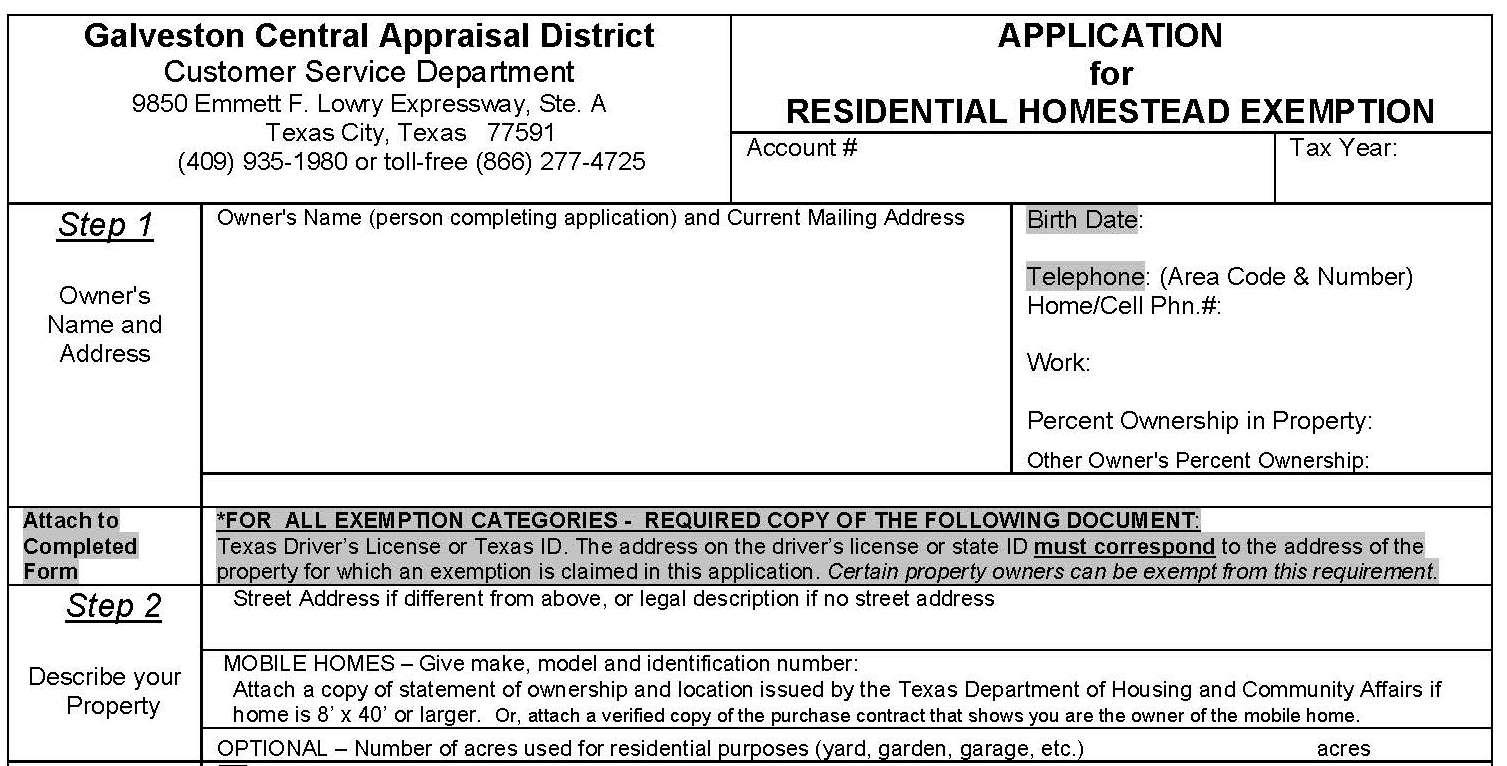

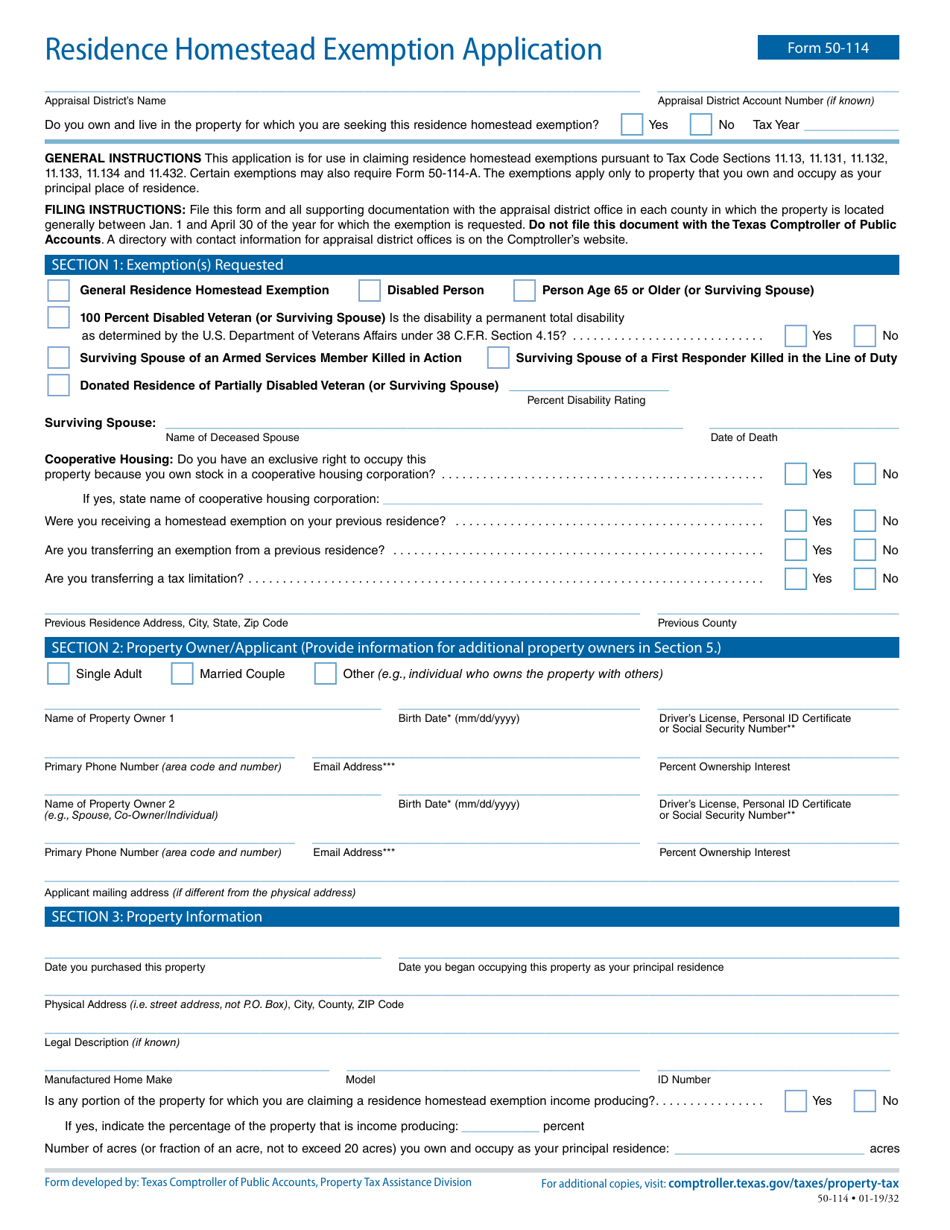

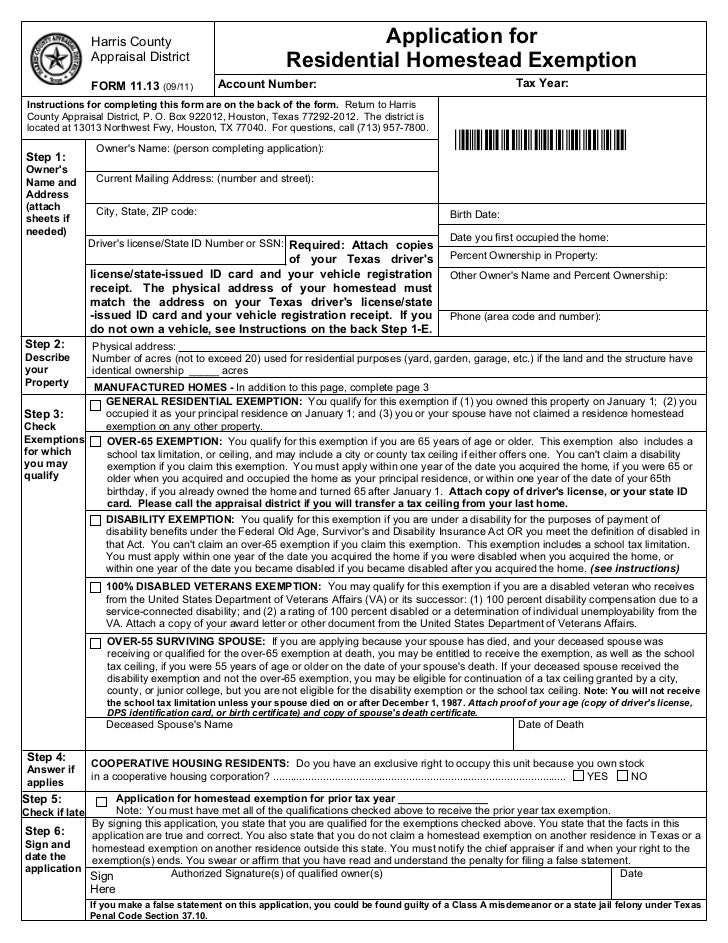

Homestead Form Texas - May be used for creditor protection or property tax purposes. Web 6 hours agotexas voters will have to vote on raising the homestead exemption form $40,000 to $100,000 on the november ballot. Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each. Web applying for a homestead exemption. Texas property owners can download and fill out the application for residence homestead exemption. If you own and occupy your home as of january 1 st of the. Web property tax forms home » taxes » property tax » forms taxes property tax forms the forms listed below are pdf files. All homestead applications must be accompanied by a copy of applicant's drivers license or other information as required by the texas property tax code. Get ready for tax season deadlines by completing any required tax forms today. Web the texas legislature has passed a new law effective january 1, 2022, permitting buyers to file for homestead exemption in the same year they purchase their new home.

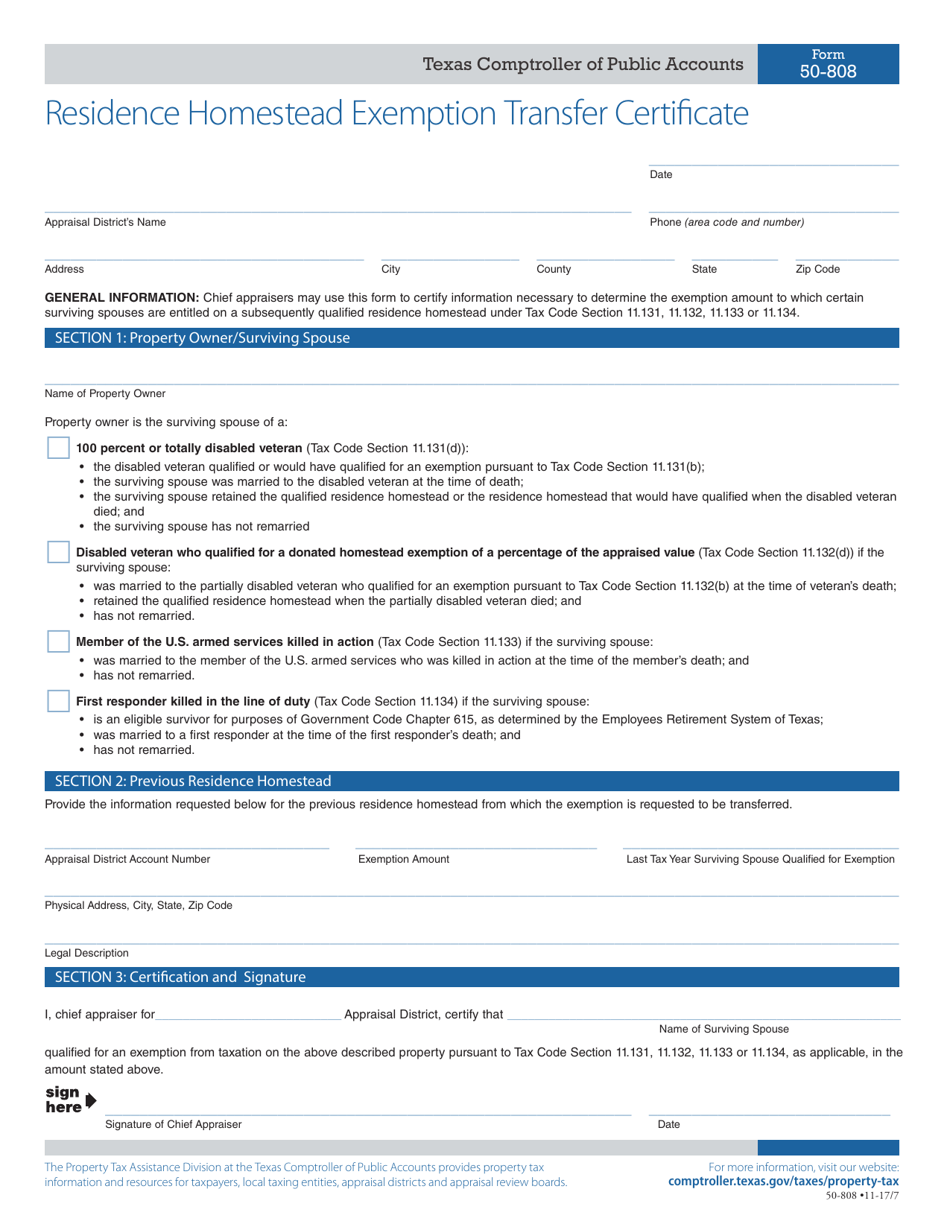

Applying is free and only needs to be filed once. Web chief appraisers may use this form to certify information necessary to determine the exemption amount to which certain surviving spouses are entitled on a subsequently. Get access to the largest online library of legal forms for any state. All homestead applications must be accompanied by a copy of applicant's drivers license or other information as required by the texas property tax code. What residence homestead exemptions are available? Web applying for a homestead exemption. Web how to fill out the homestead exemption form in texas. Tax exemptions, limitations and qualification dates general residence homestead exemptions: Web property tax forms home » taxes » property tax » forms taxes property tax forms the forms listed below are pdf files. A homestead exemption is a legal provision that can help you pay less taxes on your home.

May be used for creditor protection or property tax purposes. Web start by requesting the application form from your county appraisal district, your mortgage company, or by downloading it yourself from texas’s comptroller website. Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each. Web chief appraisers may use this form to certify information necessary to determine the exemption amount to which certain surviving spouses are entitled on a subsequently. Web 6 hours agotexas voters will have to vote on raising the homestead exemption form $40,000 to $100,000 on the november ballot. What residence homestead exemptions are available? Web applying for a homestead exemption. Web the texas legislature has passed a new law effective january 1, 2022, permitting buyers to file for homestead exemption in the same year they purchase their new home. If you own property in the state of texas, you may be required to legally document the property as. To apply for a homestead exemption, fill out of a copy of the homestead exemption application form and mail it, as well as copies of any.

PRORFETY What Documents Do I Need To File Homestead Exemption In Texas

Web the texas homestead exemption form or tex4141 is a form that determines whether an individual is eligible for the homestead exemption and how it benefits you. Web chief appraisers may use this form to certify information necessary to determine the exemption amount to which certain surviving spouses are entitled on a subsequently. All homestead applications must be accompanied by.

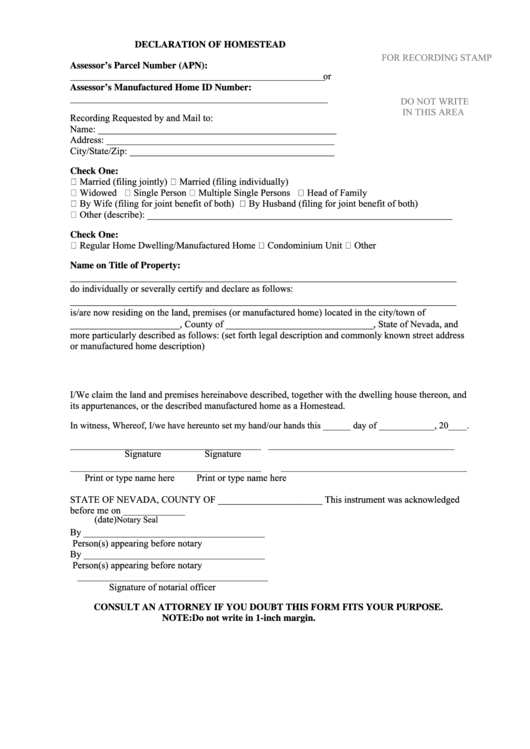

Top 17 Homestead Declaration Form Templates free to download in PDF format

They include graphics, fillable form fields, scripts and. Web property tax forms home » taxes » property tax » forms taxes property tax forms the forms listed below are pdf files. Web the homestead exemption allows homeowners to exempt a portion of the appraised value of their primary residence from taxation, so their tax burden is lower. Web applying for.

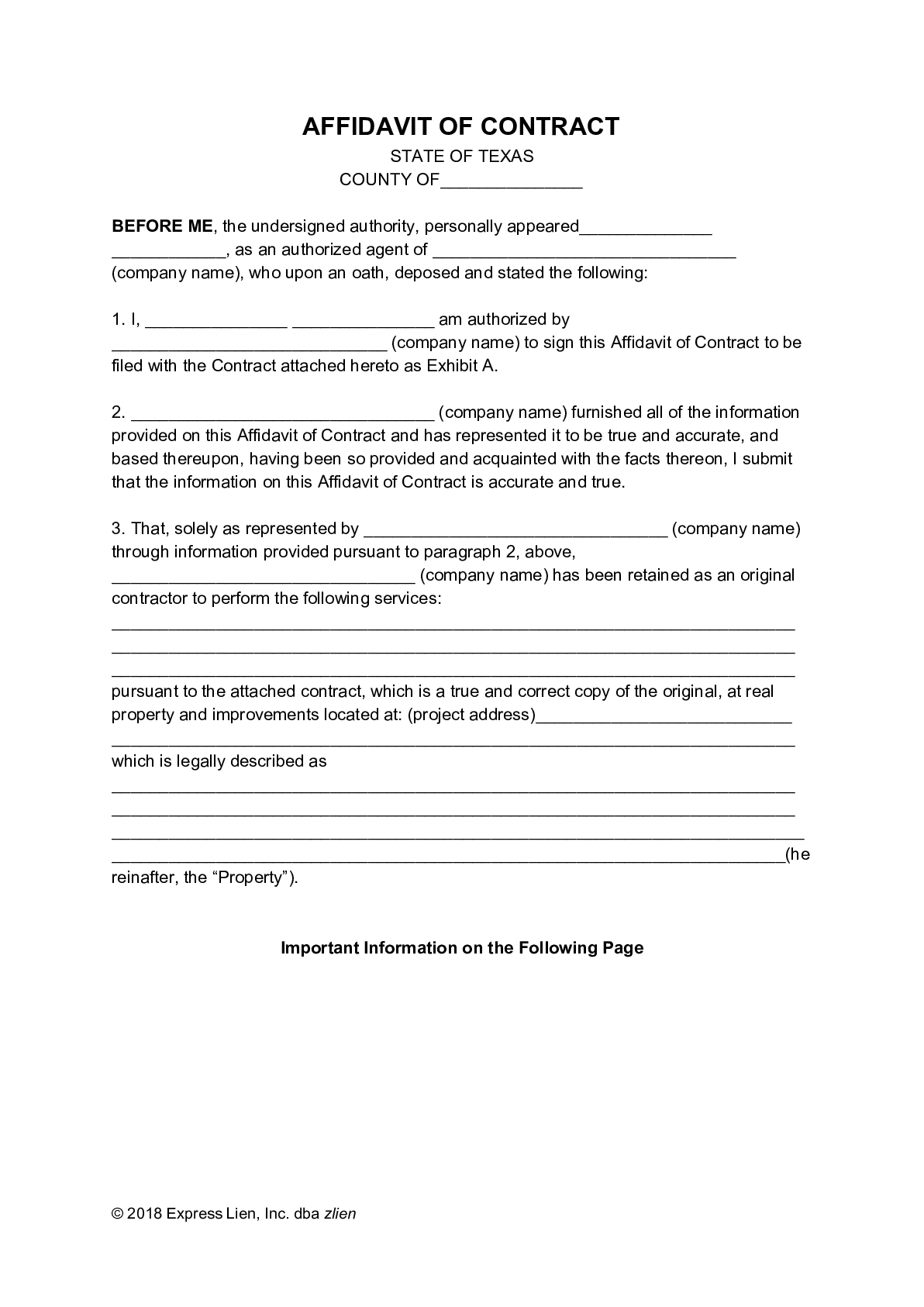

Texas Affidavit of Contract Homestead Form Free Template

To apply for a homestead exemption, fill out of a copy of the homestead exemption application form and mail it, as well as copies of any. Web according to the texas comptroller’s website, a homestead can be a separate structure, condominium or a manufactured home located on owned or leased land. Web 6 hours agotexas voters will have to vote.

Grayson Cad Fill Out and Sign Printable PDF Template signNow

A homestead exemption is a legal provision that can help you pay less taxes on your home. Web how to fill out the homestead exemption form in texas. May be used for creditor protection or property tax purposes. Get access to the largest online library of legal forms for any state. How do i get a general $40,000 residence homestead.

2019 Homestead Exemption

Web how to fill out the homestead exemption form in texas. Web if your property is located in fort bend county, you can download the fort bend county homestead exemption application, and mail back to: Web the homestead exemption allows homeowners to exempt a portion of the appraised value of their primary residence from taxation, so their tax burden is.

Claim Homestead Fill Online, Printable, Fillable, Blank pdfFiller

To apply for a homestead exemption, fill out of a copy of the homestead exemption application form and mail it, as well as copies of any. Web according to the texas comptroller’s website, a homestead can be a separate structure, condominium or a manufactured home located on owned or leased land. Web if your property is located in fort bend.

Designation Of Homestead Request Form Texas

Get ready for tax season deadlines by completing any required tax forms today. Texas property owners can download and fill out the application for residence homestead exemption. Web property tax forms home » taxes » property tax » forms taxes property tax forms the forms listed below are pdf files. Web how to fill out the homestead exemption form in.

Form 50114 Download Fillable PDF or Fill Online Residence Homestead

Web property tax forms home » taxes » property tax » forms taxes property tax forms the forms listed below are pdf files. A homestead exemption is a legal provision that can help you pay less taxes on your home. Web start by requesting the application form from your county appraisal district, your mortgage company, or by downloading it yourself.

Homestead exemption form

Web according to the texas comptroller’s website, a homestead can be a separate structure, condominium or a manufactured home located on owned or leased land. May be used for creditor protection or property tax purposes. Get ready for tax season deadlines by completing any required tax forms today. Texas property owners can download and fill out the application for residence.

Form 50808 Download Fillable PDF or Fill Online Residence Homestead

All homestead applications must be accompanied by a copy of applicant's drivers license or other information as required by the texas property tax code. Web 6 hours agotexas voters will have to vote on raising the homestead exemption form $40,000 to $100,000 on the november ballot. Applying is free and only needs to be filed once. A homestead exemption is.

What Residence Homestead Exemptions Are Available?

If you own property in the state of texas, you may be required to legally document the property as. Web the texas legislature has passed a new law effective january 1, 2022, permitting buyers to file for homestead exemption in the same year they purchase their new home. Web how to fill out the homestead exemption form in texas. Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each.

Web What Is A Residence Homestead?

Web the homestead exemption allows homeowners to exempt a portion of the appraised value of their primary residence from taxation, so their tax burden is lower. Applying is free and only needs to be filed once. May be used for creditor protection or property tax purposes. Web 6 hours agotexas voters will have to vote on raising the homestead exemption form $40,000 to $100,000 on the november ballot.

Web The Texas Homestead Exemption Form Or Tex4141 Is A Form That Determines Whether An Individual Is Eligible For The Homestead Exemption And How It Benefits You.

They include graphics, fillable form fields, scripts and. To apply for a homestead exemption, fill out of a copy of the homestead exemption application form and mail it, as well as copies of any. Web the application for residence homestead exemption is required to apply for a homestead exemption. Tax exemptions, limitations and qualification dates general residence homestead exemptions:

Web Start By Requesting The Application Form From Your County Appraisal District, Your Mortgage Company, Or By Downloading It Yourself From Texas’s Comptroller Website.

Web property tax forms home » taxes » property tax » forms taxes property tax forms the forms listed below are pdf files. All homestead applications must be accompanied by a copy of applicant's drivers license or other information as required by the texas property tax code. Texas property owners can download and fill out the application for residence homestead exemption. You can webfile or use the downloadable pdf reports from the website.