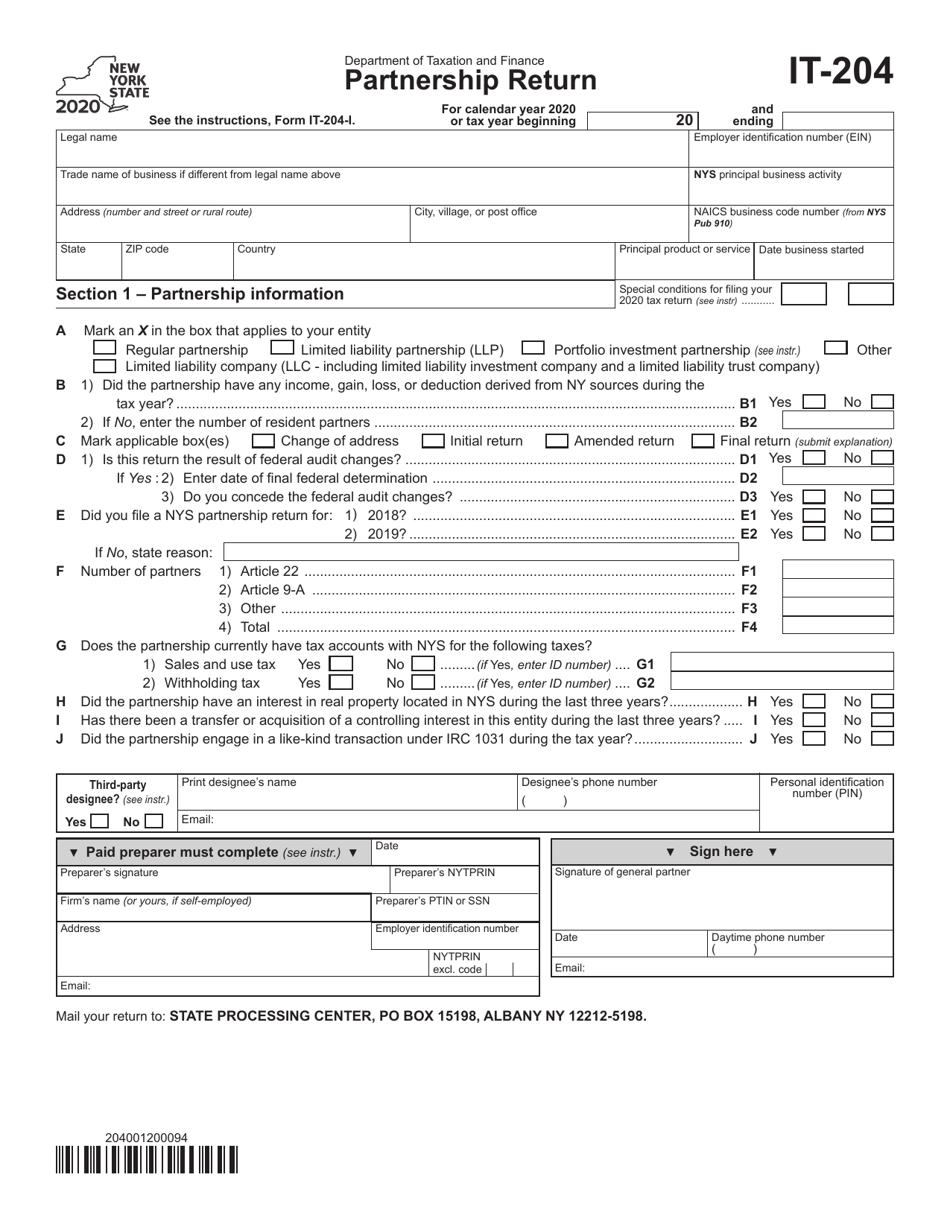

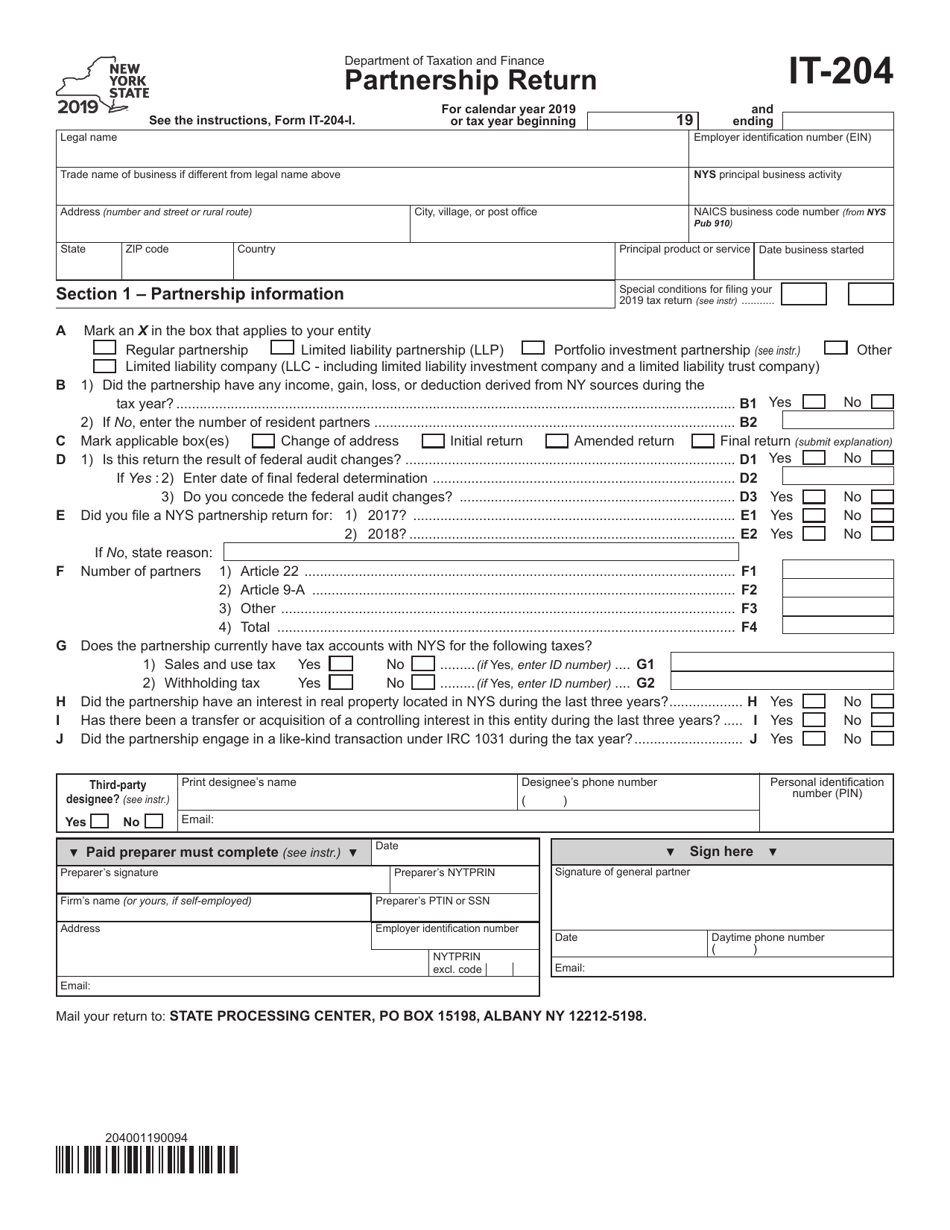

Form It 204 Partnership Return

Form It 204 Partnership Return - We last updated the new york partnership return in march 2023, so this is the latest version of. Otherwise, new york state law does not currently. Otherwise, new york state law does not. Web the instructions are for the partner. Prepare tax documents themselves, without the assistance of a tax. You as a partner are liable for tax on. This page provides an overview of electronic filing and more detailed. For partnerships, including limited liability companies 2021. Use fill to complete blank online new york. Web 19 rows partnership return;

Otherwise, new york state law does not. The ny state website lists it, but i don't see the. You as a partner are liable for tax on. The form is used to report the. For partnerships, including limited liability companies 2021. Use fill to complete blank online new york. This page provides an overview of electronic filing and more detailed. For details on the proper reporting of income. Web the instructions are for the partner. Web regular partnership (those that are not an llc or llp) that is required to file a new york partnership return that has income, gain, loss, or deduction from new york.

The form is used to report the. Web filers partnerships must electronically file if they meet all three of the following conditions: You as a partner are liable for tax on. Web the instructions are for the partner. Web but every partnership having either (1) at least one partner who is an individual, estate, or trust that is a resident of new york state, or (2) any income, gain,. For details on the proper reporting of income. For partnerships, including limited liability companies 2021. Web regular partnership (those that are not an llc or llp) that is required to file a new york partnership return that has income, gain, loss, or deduction from new york. Use fill to complete blank online new york. Web 19 rows partnership return;

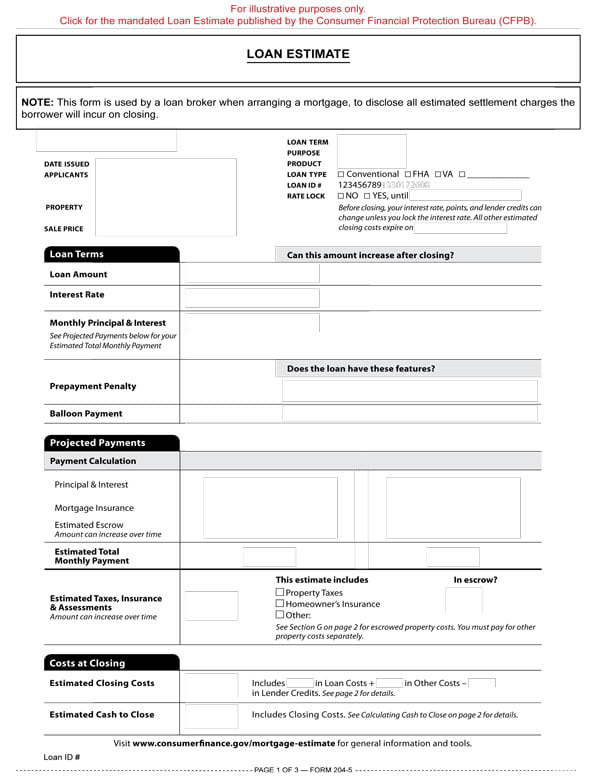

Loan Estimate RPI Form 2045 firsttuesday Journal

Web filers partnerships must electronically file if they meet all three of the following conditions: Web but every partnership having either (1) at least one partner who is an individual, estate, or trust that is a resident of new york state, or (2) any income, gain,. Otherwise, new york state law does not currently. We last updated the new york.

Fill Free fillable Form IT204, Partnership Return, or IT205

Web filers partnerships must electronically file if they meet all three of the following conditions: For partnerships, including limited liability companies 2021. Web but every partnership having either (1) at least one partner who is an individual, estate, or trust that is a resident of new york state, or (2) any income, gain,. Use fill to complete blank online new.

4 Steps to Filing Your Partnership Taxes The Blueprint

Web the instructions are for the partner. Web filers partnerships must electronically file if they meet all three of the following conditions: Web regular partnership (those that are not an llc or llp) that is required to file a new york partnership return that has income, gain, loss, or deduction from new york. Otherwise, new york state law does not.

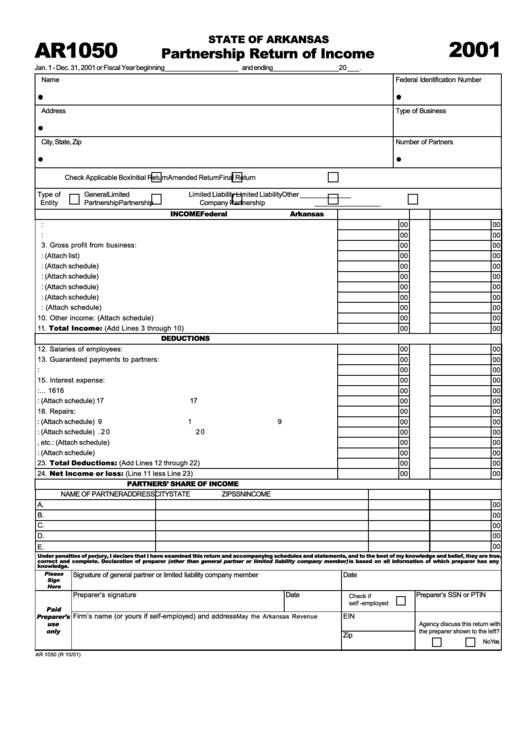

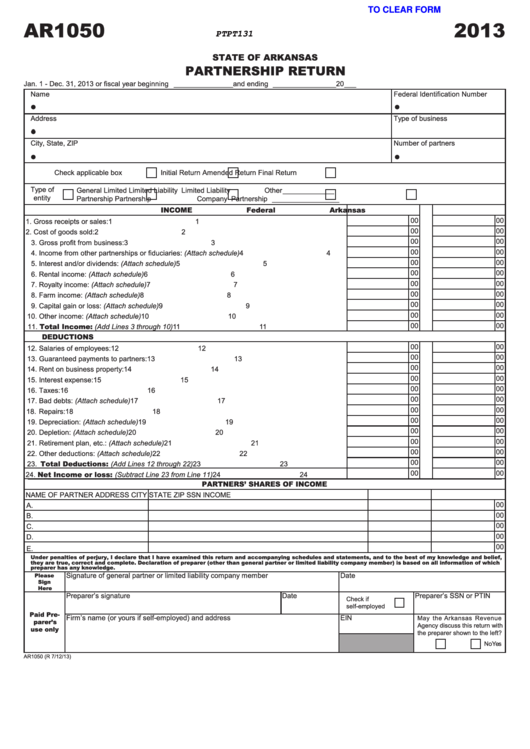

Form Ar1050 Partnership Return Of 2001 printable pdf download

Web regular partnership (those that are not an llc or llp) that is required to file a new york partnership return that has income, gain, loss, or deduction from new york. The ny state website lists it, but i don't see the. Otherwise, new york state law does not. Prepare tax documents themselves, without the assistance of a tax. Web.

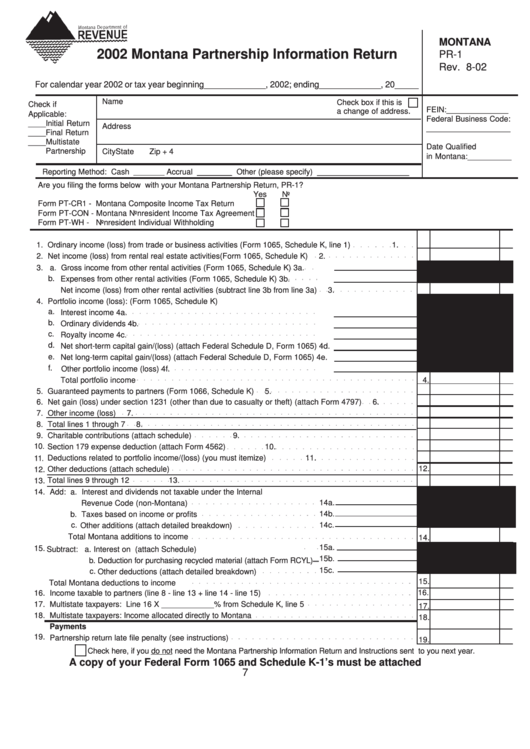

Form Pr1 Montana Partnership Information Return 2003 printable pdf

Web the instructions are for the partner. Web regular partnership (those that are not an llc or llp) that is required to file a new york partnership return that has income, gain, loss, or deduction from new york. Otherwise, new york state law does not currently. You as a partner are liable for tax on. Web 19 rows partnership return;

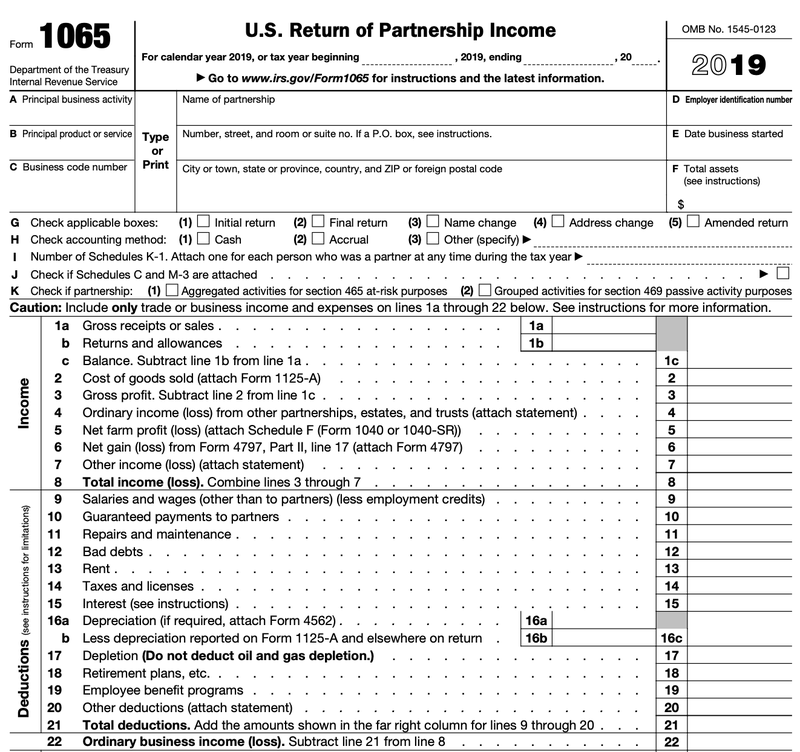

Form 1065 U.S. Return of Partnership (2014) Free Download

We last updated the new york partnership return in march 2023, so this is the latest version of. This page provides an overview of electronic filing and more detailed. Web but every partnership having either (1) at least one partner who is an individual, estate, or trust that is a resident of new york state, or (2) any income, gain,..

Form IT204 Download Fillable PDF or Fill Online Partnership Return

Use fill to complete blank online new york. Otherwise, new york state law does not. The ny state website lists it, but i don't see the. You as a partner are liable for tax on. Web filers partnerships must electronically file if they meet all three of the following conditions:

Fillable Form Ar1050 Partnership Return 2013 printable pdf download

Prepare tax documents themselves, without the assistance of a tax. Otherwise, new york state law does not currently. For partnerships, including limited liability companies 2021. We last updated the new york partnership return in march 2023, so this is the latest version of. You as a partner are liable for tax on.

Form IT204 Download Fillable PDF or Fill Online Partnership Return

For details on the proper reporting of income. Use fill to complete blank online new york. The ny state website lists it, but i don't see the. This page provides an overview of electronic filing and more detailed. Web 19 rows partnership return;

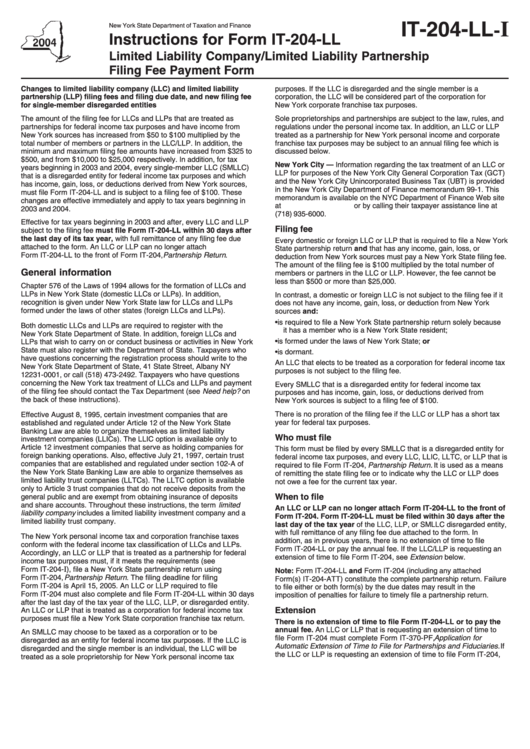

Instructions For Form It204Ll Limited Liability Company/limited

We last updated the new york partnership return in march 2023, so this is the latest version of. For details on the proper reporting of income. The ny state website lists it, but i don't see the. Use fill to complete blank online new york. Web but every partnership having either (1) at least one partner who is an individual,.

Web 19 Rows Partnership Return;

Web filers partnerships must electronically file if they meet all three of the following conditions: The ny state website lists it, but i don't see the. For details on the proper reporting of income. Web regular partnership (those that are not an llc or llp) that is required to file a new york partnership return that has income, gain, loss, or deduction from new york.

Prepare Tax Documents Themselves, Without The Assistance Of A Tax.

Otherwise, new york state law does not. We last updated the new york partnership return in march 2023, so this is the latest version of. The form is used to report the. Otherwise, new york state law does not currently.

Web But Every Partnership Having Either (1) At Least One Partner Who Is An Individual, Estate, Or Trust That Is A Resident Of New York State, Or (2) Any Income, Gain,.

You as a partner are liable for tax on. This page provides an overview of electronic filing and more detailed. Web the instructions are for the partner. Use fill to complete blank online new york.