How To File Form 2210

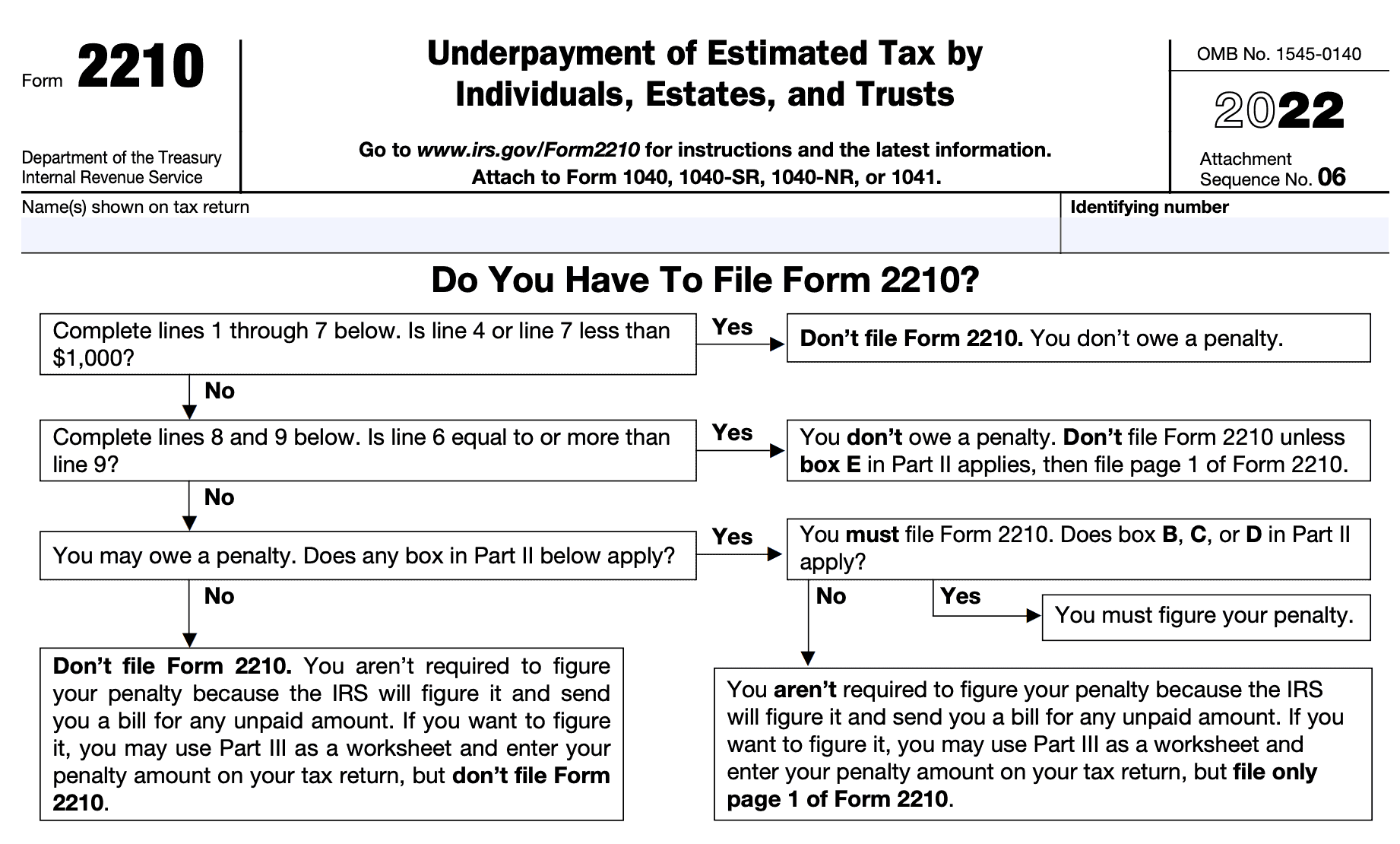

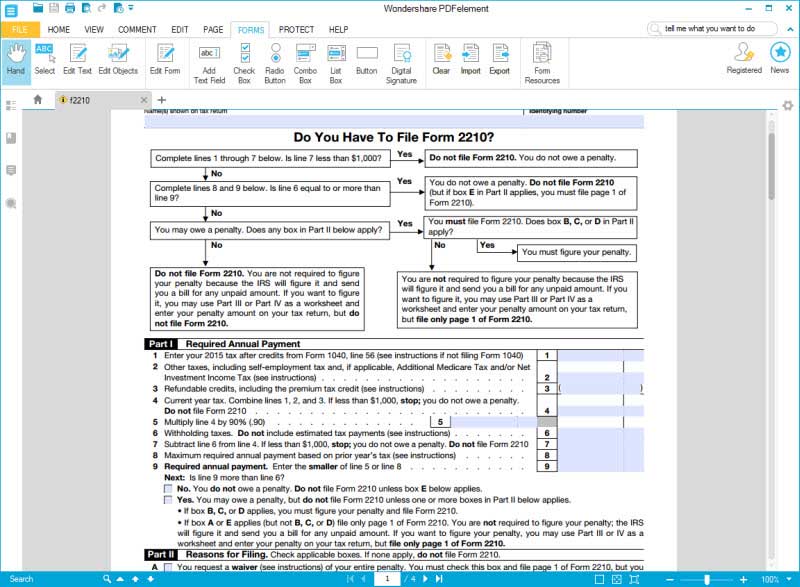

How To File Form 2210 - The irs charges the underpayment penalty when you don’t pay enough in estimated taxes. Web enter the amounts from schedule ai, part i, line 25, columns (a) through (d), in the corresponding columns of form 2210, part iv, line 18. This is done either through withholdings from your. Web form 2210 is typically used by taxpayers when they owe more than $1,000 to the irs on their federal tax return. Web to make things easier, irs form 2210 actually provides a useful flowchart that can help you determine whether or not you need to file it. If the amount on line 10 was paid on or after 04/15/12 enter 0 zero. Web now the big question comes how to fill out irs form 2210. File your 2290 tax now and receive schedule 1 in minutes. The irs states that you do not need to file. The irs will generally figure any penalty due and send the taxpayer a bill.

Dispute a penalty if you don’t qualify for penalty removal or. Web what is the underpayment of estimated tax? How do i complete form 2210 within the program? File your 2290 tax now and receive schedule 1 in minutes. The irs states that you do not need to file. Go to the tax return tab. Web how do i suppress form 2210? Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. The irs charges the underpayment penalty when you don’t pay enough in estimated taxes. The irs will generally figure any penalty due and send the taxpayer a bill.

Web enter the amounts from schedule ai, part i, line 25, columns (a) through (d), in the corresponding columns of form 2210, part iv, line 18. Web now the big question comes how to fill out irs form 2210. Follow these steps to suppress form 2210 for all clients: Web how do i add form 2210? Complete, edit or print tax forms instantly. Web if you are subject to an underpayment penalty and would like to pay it with your tax return, you will need to fill out and file form 2210 with your tax return, reporting. The irs states that you do not need to file. Complete part iv to figure the. Underpayment of estimated tax occurs when you don’t pay enough tax during those quarterly estimated tax payments. Don't miss this 50% discount.

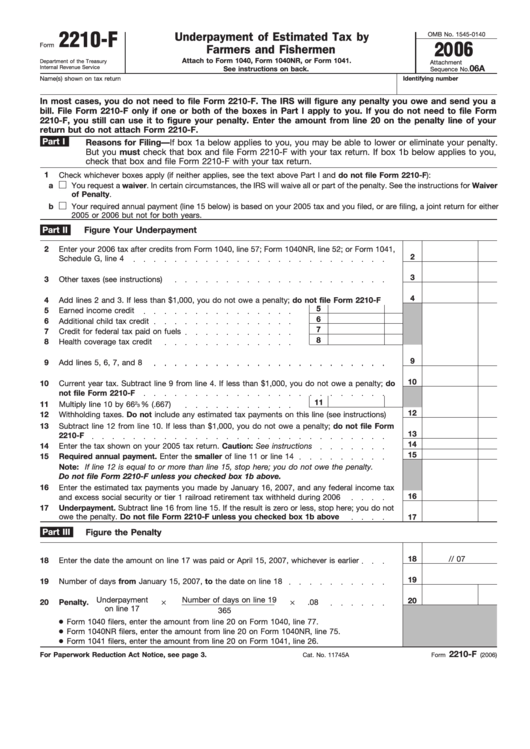

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Go to the tax return tab. Web the form doesn't always have to be completed; This is done either through withholdings from your. From the settings menu, select options. Web enter the amounts from schedule ai, part i, line 25, columns (a) through (d), in the corresponding columns of form 2210, part iv, line 18.

Ssurvivor Irs Form 2210 Instructions 2020

Complete, edit or print tax forms instantly. Examine the form before completing it and use the. Underpayment of estimated tax occurs when you don’t pay enough tax during those quarterly estimated tax payments. Solved • by turbotax • 2456 • updated january 13, 2023 irs form 2210 (underpayment of estimated tax by individuals, estates, and. The irs charges the underpayment.

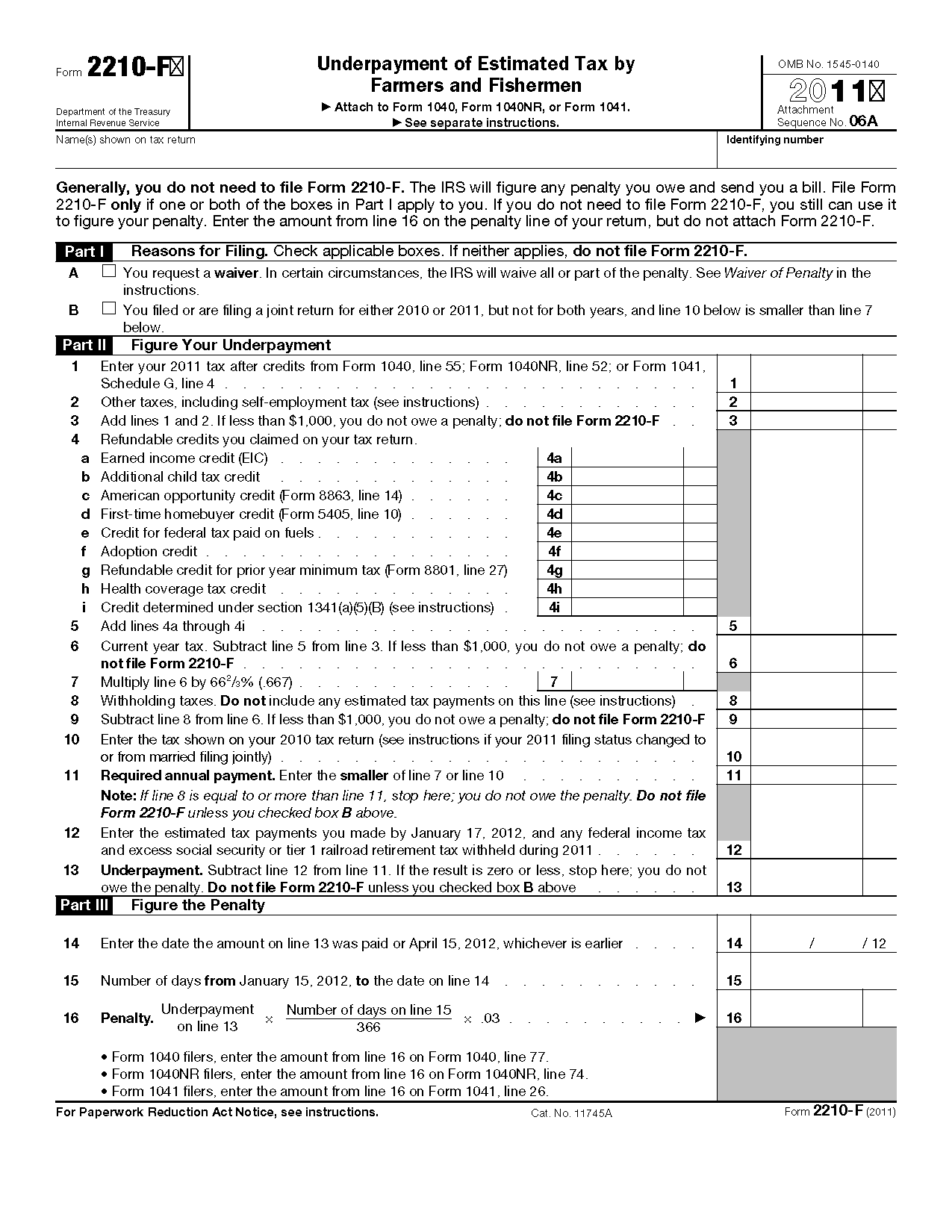

Fillable Form 2210F Underpayment Of Estimated Tax By Farmers And

From the settings menu, select options. Complete, edit or print tax forms instantly. Underpayment of estimated tax occurs when you don’t pay enough tax during those quarterly estimated tax payments. The irs charges the underpayment penalty when you don’t pay enough in estimated taxes. Web the form instructions say not to file form 2210 for the sole purpose of including.

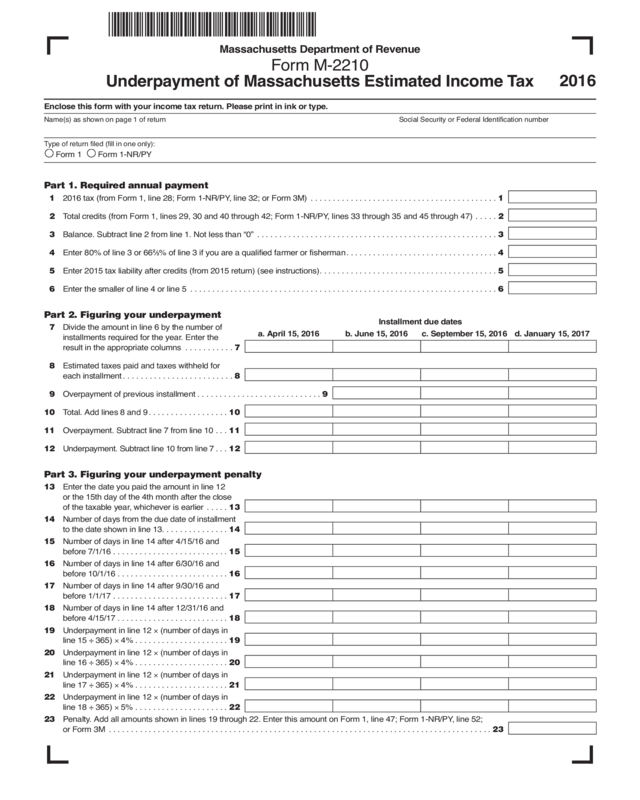

Form M2210 Edit, Fill, Sign Online Handypdf

Follow these steps to suppress form 2210 for all clients: The irs requires that you pay the taxes you owe throughout the year. Web enter the amounts from schedule ai, part i, line 25, columns (a) through (d), in the corresponding columns of form 2210, part iv, line 18. However, the form includes a flowchart on the first page to..

IRS Form 2210 Instructions Underpayment of Estimated Tax

Web form 2210 is typically used by taxpayers when they owe more than $1,000 to the irs on their federal tax return. Web the form instructions say not to file form 2210 for the sole purpose of including and calculating the penalty. Web to request a waiver when you file, complete irs form 2210 and submit it with your tax.

Form 2210 F Underpayment Of Estimated Tax By Farmers And 1040 Form

Don't miss this 50% discount. How do i complete form 2210 within the program? Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. The irs requires that you pay the taxes you owe throughout the year. Web complete.

IRS Form 2210 Fill it with the Best Form Filler

If the amount on line 10 was paid on or after 04/15/12 enter 0 zero. Complete part iv to figure the. However, the form includes a flowchart on the first page to. The irs charges the underpayment penalty when you don’t pay enough in estimated taxes. Go to the tax return tab.

IRS Form 2210Fill it with the Best Form Filler

This is done either through withholdings from your. Go to the tax return tab. Complete, edit or print tax forms instantly. No worries, here we have included a stepwise detailed guide that will walk you through the entire process. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were.

Ssurvivor Irs Form 2210 Ai Instructions

The irs requires that you pay the taxes you owe throughout the year. Web the form doesn't always have to be completed; The irs will generally figure any penalty due and send the taxpayer a bill. With the form, attach an explanation for why you didn’t pay estimated taxes in the. Web to request a waiver when you file, complete.

Ssurvivor Irs Form 2210 For 2017

Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. Web enter the amounts from schedule ai, part i, line 25, columns (a) through (d), in the corresponding columns of form 2210, part iv, line 18. The irs will.

Web Now The Big Question Comes How To Fill Out Irs Form 2210.

Go to the tax return tab. Web what is the irs underpayment penalty? Web enter the amounts from schedule ai, part i, line 25, columns (a) through (d), in the corresponding columns of form 2210, part iv, line 18. The irs states that you do not need to file.

Dispute A Penalty If You Don’t Qualify For Penalty Removal Or.

Complete part iv to figure the. Complete, edit or print tax forms instantly. Web the form doesn't always have to be completed; Web form 2210 is typically used by taxpayers when they owe more than $1,000 to the irs on their federal tax return.

Ad Efile Form 2290 Tax With Ez2290 & Get Schedule 1 In Minutes.

Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Web how do i add form 2210? How do i complete form 2210 within the program? Web to request a waiver when you file, complete irs form 2210 and submit it with your tax return.

Web Complete Form 2210, Schedule Ai, Annualized Income Installment Method Pdf (Found Within The Form).

However, the form includes a flowchart on the first page to. The irs will generally figure any penalty due and send the taxpayer a bill. Follow these steps to suppress form 2210 for all clients: Solved • by turbotax • 2456 • updated january 13, 2023 irs form 2210 (underpayment of estimated tax by individuals, estates, and.