Form 8995 2018

Form 8995 2018 - The advanced tools of the. To begin the form, utilize the fill & sign online button or tick the preview image of the blank. Web instructions for form 8995 qualified business income deduction simplified computation section references are to the internal revenue code unless otherwise noted. By completing irs tax form 8995, eligible small business owners can claim. Web how you can fill out the irs 8965 2018 on the internet: Table of contents the qualified business. Web great news for small business owners: You have qbi, qualified reit dividends, or qualified ptp income or loss; Web the draft form 8995 is comprised of one section (17 lines) with a fairly straightforward computation of the qualified business income (taking into account any. Web for the 2018 tax year, taxpayers must calculate the deduction amount on a worksheet, filed separately from the taxpayer’s return.

Table of contents the qualified business. You have qbi, qualified reit dividends, or qualified ptp income or loss; Web attach to your tax return. To begin the form, utilize the fill & sign online button or tick the preview image of the blank. Web for the 2018 tax year, taxpayers must calculate the deduction amount on a worksheet, filed separately from the taxpayer’s return. Web instructions for form 8995 qualified business income deduction simplified computation section references are to the internal revenue code unless otherwise noted. The individual has qualified business income. Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022. Web the draft form 8995 is comprised of one section (17 lines) with a fairly straightforward computation of the qualified business income (taking into account any. As with most tax issues, the.

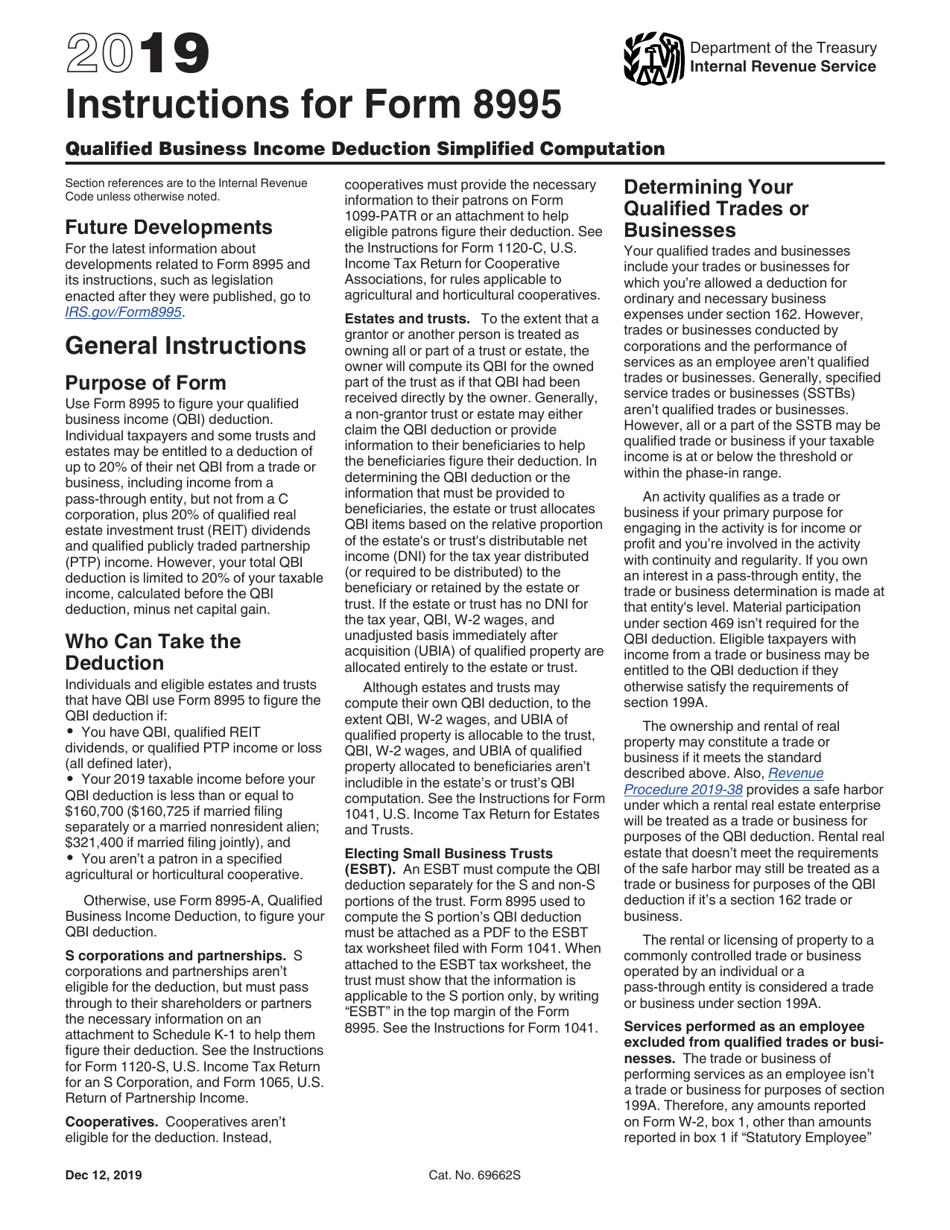

Taxable income thresholds that potentially affect the. The advanced tools of the. Table of contents the qualified business. Web attach to your tax return. Web the draft form 8995 is comprised of one section (17 lines) with a fairly straightforward computation of the qualified business income (taking into account any. Go to www.irs.gov/form8995 for instructions and the latest information. You have qbi, qualified reit dividends, or qualified ptp income or loss; Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022. Form 8995 is the simplified form and is used if all of the following are true:

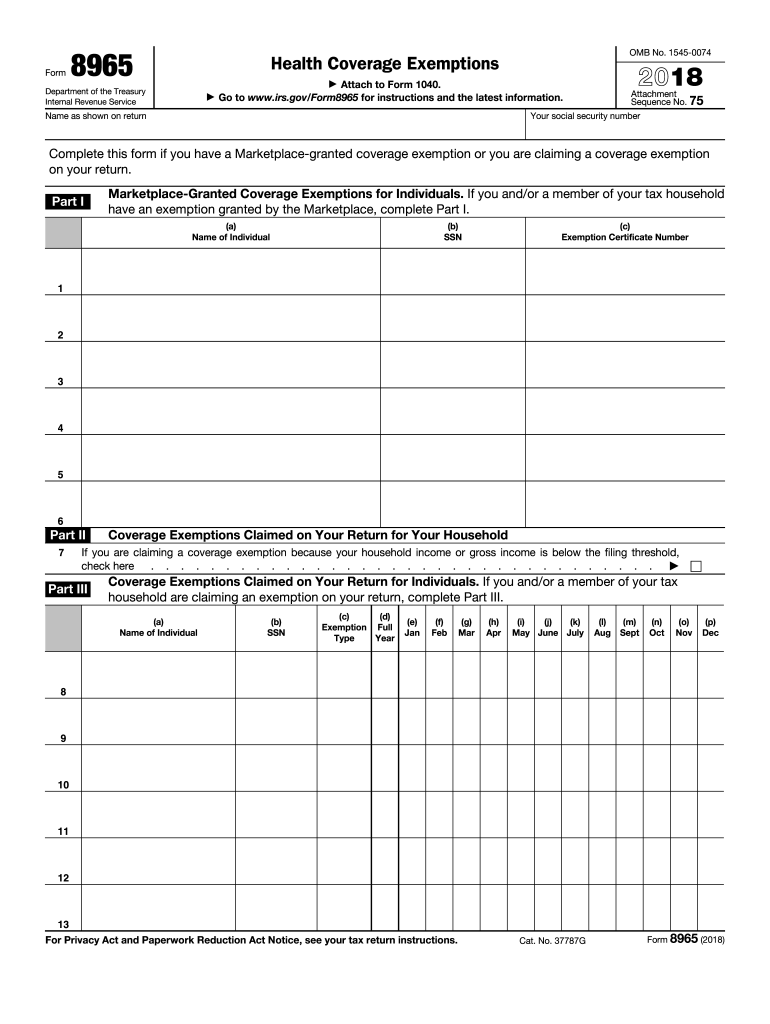

20182023 Form IRS 8965 Fill Online, Printable, Fillable, Blank pdfFiller

The taxpayer isn't a patron in a specified agricultural or. The individual has qualified business income. As with most tax issues, the. Form 8995 is the simplified form and is used if all of the following are true: Web instructions for form 8995 qualified business income deduction simplified computation section references are to the internal revenue code unless otherwise noted.

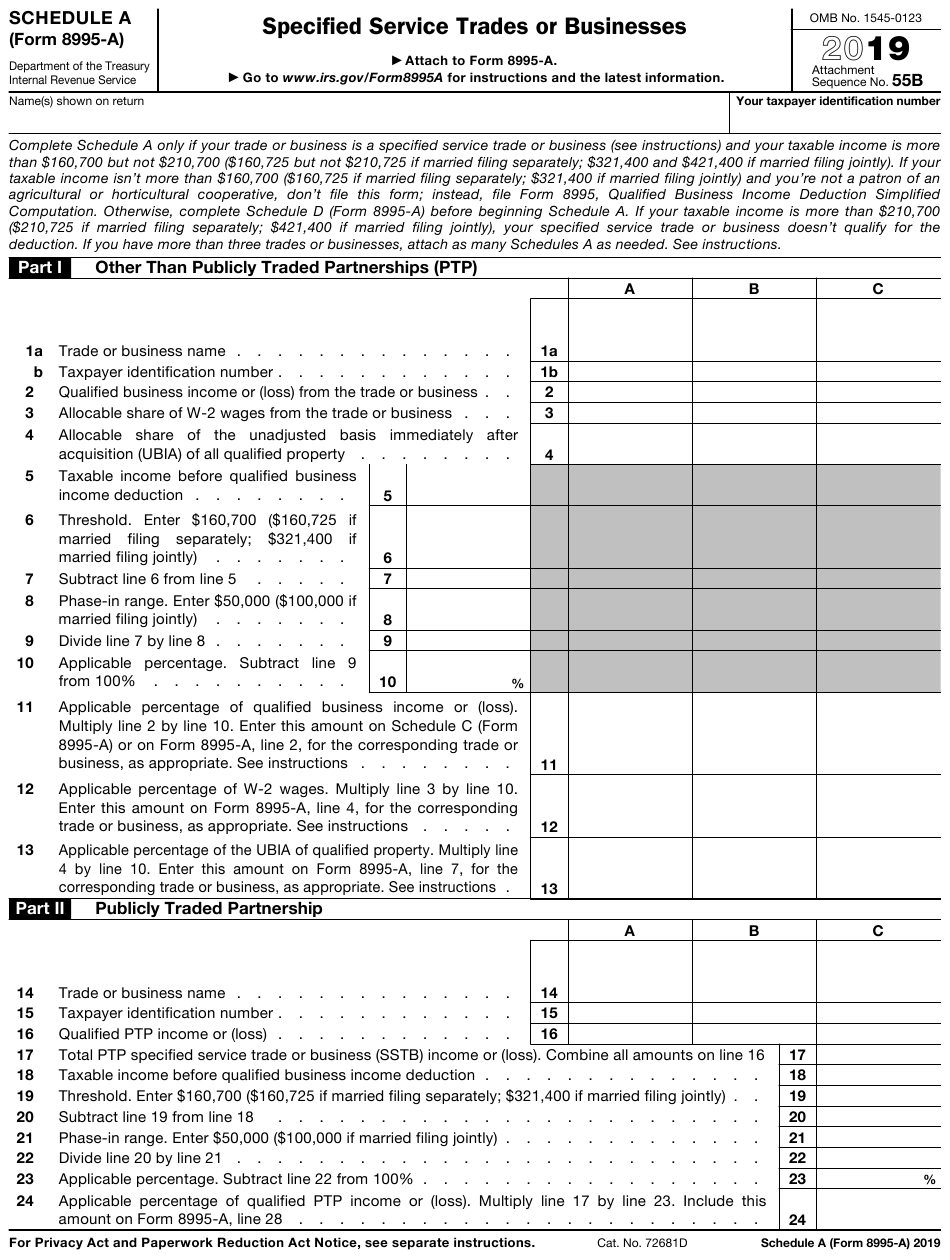

Irs Schedule A Printable Form Printable Form 2021

Table of contents the qualified business. On april 15, 2019, the irs. And your 2019 taxable income. Go to www.irs.gov/form8995 for instructions and the latest information. Web the draft form 8995 is comprised of one section (17 lines) with a fairly straightforward computation of the qualified business income (taking into account any.

Download Instructions for IRS Form 8995 Qualified Business

Your 20% tax savings is just one form away. To begin the form, utilize the fill & sign online button or tick the preview image of the blank. Web how you can fill out the irs 8965 2018 on the internet: On april 15, 2019, the irs. As with most tax issues, the.

Instructions for Form 8995 (2019) Internal Revenue Service Small

Table of contents the qualified business. On april 15, 2019, the irs. Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022. Go to www.irs.gov/form8995 for instructions and the latest information. To begin the form, utilize the fill & sign online button.

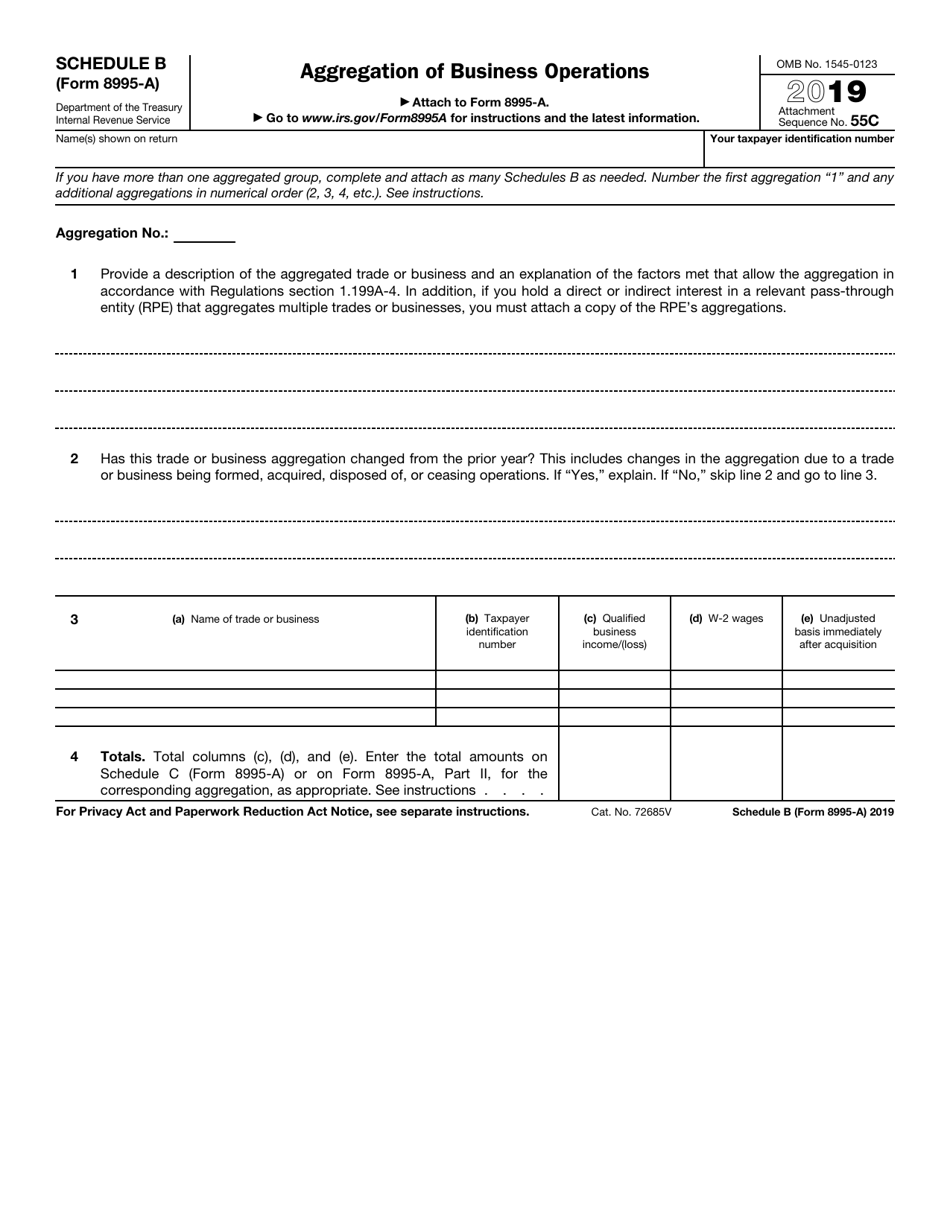

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

And your 2019 taxable income. Your 20% tax savings is just one form away. The advanced tools of the. The taxpayer isn't a patron in a specified agricultural or. The individual has qualified business income.

2013 Form IRS Publication 517 Fill Online, Printable, Fillable, Blank

By completing irs tax form 8995, eligible small business owners can claim. Taxable income thresholds that potentially affect the. You have qbi, qualified reit dividends, or qualified ptp income or loss; Web how you can fill out the irs 8965 2018 on the internet: The taxpayer isn't a patron in a specified agricultural or.

QBI Deduction Frequently Asked Questions (K1, QBI, ScheduleC

The individual has qualified business income. And your 2019 taxable income. Web instructions for form 8995 qualified business income deduction simplified computation section references are to the internal revenue code unless otherwise noted. Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year.

Mason + Rich Blog NH’s CPA Blog

As with most tax issues, the. The taxpayer isn't a patron in a specified agricultural or. And your 2019 taxable income. On april 15, 2019, the irs. Web great news for small business owners:

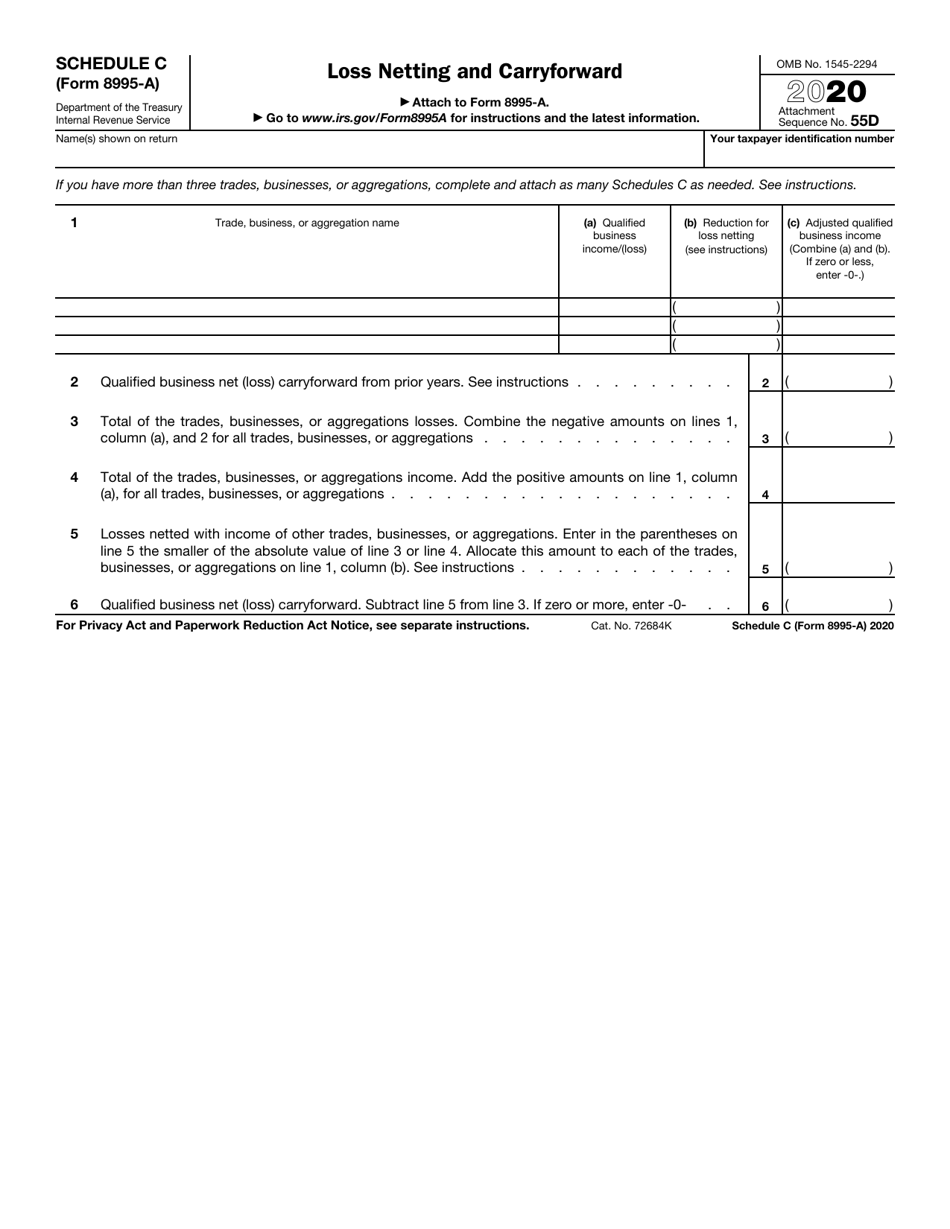

IRS Form 8995A Schedule C Download Fillable PDF or Fill Online Loss

By completing irs tax form 8995, eligible small business owners can claim. Table of contents the qualified business. Go to www.irs.gov/form8995 for instructions and the latest information. Web great news for small business owners: As with most tax issues, the.

8995 Instructions 2022 2023 IRS Forms Zrivo

Web a taxpayer with qualified business income (qbi) can use the simplified form 8995 if both of the following are true: By completing irs tax form 8995, eligible small business owners can claim. The taxpayer isn't a patron in a specified agricultural or. Web we last updated the qualified business income deduction simplified computation in january 2023, so this is.

Web We Last Updated The Qualified Business Income Deduction Simplified Computation In January 2023, So This Is The Latest Version Of 8995, Fully Updated For Tax Year 2022.

To begin the form, utilize the fill & sign online button or tick the preview image of the blank. Your 20% tax savings is just one form away. Web attach to your tax return. And your 2019 taxable income.

You Have Qbi, Qualified Reit Dividends, Or Qualified Ptp Income Or Loss;

Web the draft form 8995 is comprised of one section (17 lines) with a fairly straightforward computation of the qualified business income (taking into account any. On april 15, 2019, the irs. Taxable income thresholds that potentially affect the. Form 8995 is the simplified form and is used if all of the following are true:

The Individual Has Qualified Business Income.

As with most tax issues, the. Web instructions for form 8995 qualified business income deduction simplified computation section references are to the internal revenue code unless otherwise noted. The advanced tools of the. Go to www.irs.gov/form8995 for instructions and the latest information.

Web Great News For Small Business Owners:

By completing irs tax form 8995, eligible small business owners can claim. Web how you can fill out the irs 8965 2018 on the internet: Table of contents the qualified business. The taxpayer isn't a patron in a specified agricultural or.