Form 1065 Federal

Form 1065 Federal - Web a 1065 form is the annual us tax return filed by partnerships. Most popular online tax filing services like h&r block, turbotax, and. And the total assets at the end of the tax year. This section of the program contains information for part iii of the schedule k. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from the operation of a partnership. Generally, a domestic partnership must file form 1065 u.s. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web 2 quickfinder® handbooks | form 1065 principal business activity codes—2022 returns copyrit 2023 omson reuters quick nder® form 1065 principal business activity. Ad get ready for tax season deadlines by completing any required tax forms today. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each.

Web form 1065, u.s. Web a 1065 form is the annual us tax return filed by partnerships. Web this form is used to calculate what your partnership owes by assigned its income, losses, dividends, and capital gains directly to the partners. Form 1065 isn't used to calculate. If the partnership's principal business, office, or agency is located in: Most of the information necessary to. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. Most popular online tax filing services like h&r block, turbotax, and. This section of the program contains information for part iii of the schedule k. Return of partnership income by the 15th day of the third month following the date its tax.

Return of partnership income, including recent updates, related forms and instructions on how to file. Form 1065 is used to report the income of. Ad get ready for tax season deadlines by completing any required tax forms today. This section of the program contains information for part iii of the schedule k. Get ready for tax season deadlines by completing any required tax forms today. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. Web the irs requires businesses to report the income, gains, losses, deductions, credits, etc., of a domestic business or other entity for any tax year. Most of the information necessary to.

Llc Tax Form 1065 Universal Network

Web the easiest way to file a 1065 is to use an online filing service that supports form 1065. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. Return of partnership income by the 15th day of the third month following the date its tax..

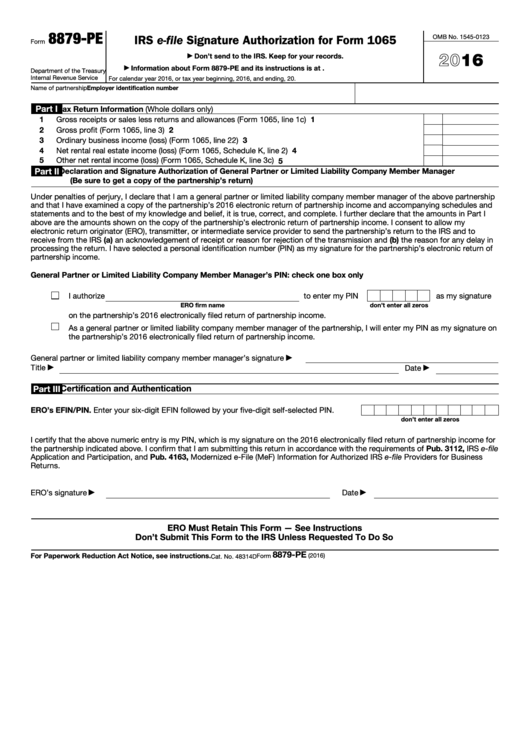

Fillable Form 8879Pe Irs EFile Signature Authorization For Form

Complete, edit or print tax forms instantly. Ad access irs tax forms. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from the operation of a partnership. Form.

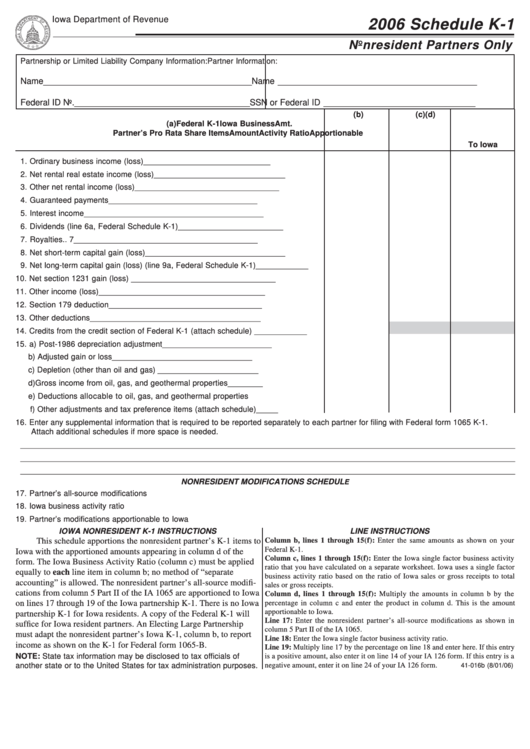

Form Ia 1065 Schedule K1 Nonresident Partners Only 2006

Web form 1065, u.s. Web this form is used to calculate what your partnership owes by assigned its income, losses, dividends, and capital gains directly to the partners. Return of partnership income by the 15th day of the third month following the date its tax. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. If.

IRS releases drafts of the new Form 1065, Schedule K1 Accounting Today

Return of partnership income by the 15th day of the third month following the date its tax. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. Get ready for tax season deadlines by completing.

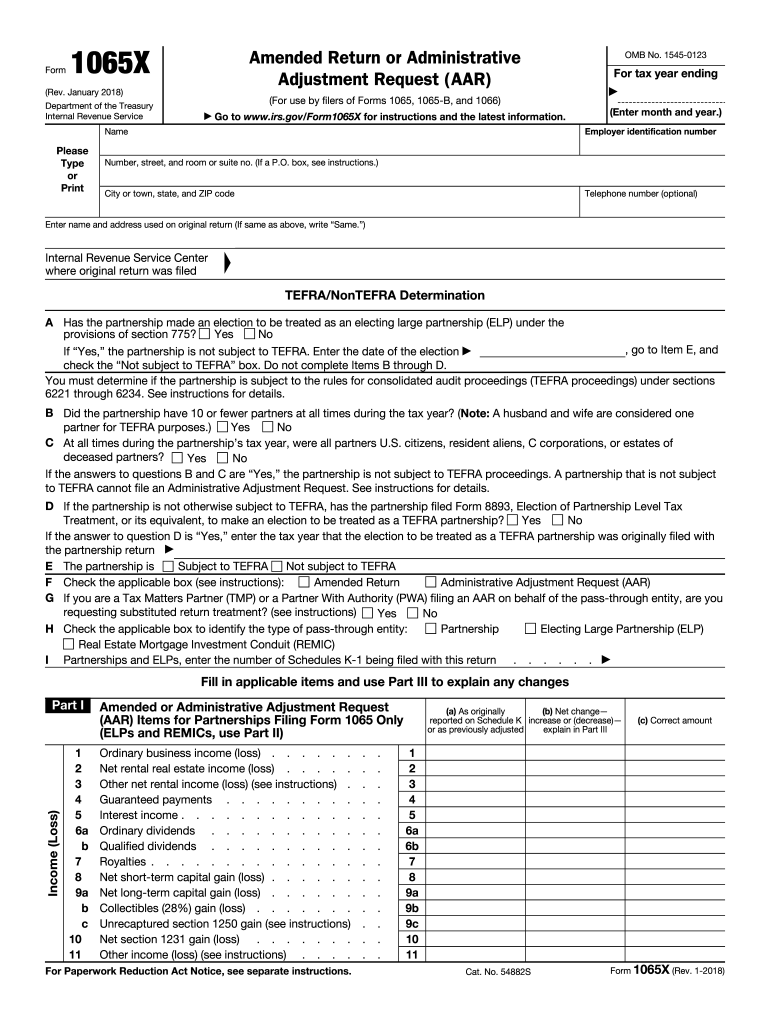

20182020 Form IRS 1065X Fill Online, Printable, Fillable, Blank

Web the irs requires businesses to report the income, gains, losses, deductions, credits, etc., of a domestic business or other entity for any tax year. Web copyrit 2021 omson reuters quickfinder® handbooks | form 1065 principal business activity codes—2020 returns 1 quick nder® table continued on the next page form. Web form 1065, u.s. Web where to file your taxes.

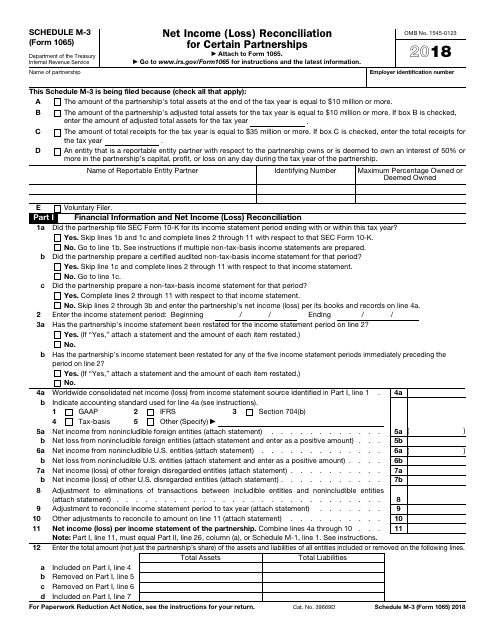

IRS Form 1065 Schedule M3 Download Fillable PDF or Fill Online Net

Web copyrit 2021 omson reuters quickfinder® handbooks | form 1065 principal business activity codes—2020 returns 1 quick nder® table continued on the next page form. Complete, edit or print tax forms instantly. Generally, a domestic partnership must file form 1065 u.s. Web form 1065, u.s. Web where to file your taxes for form 1065.

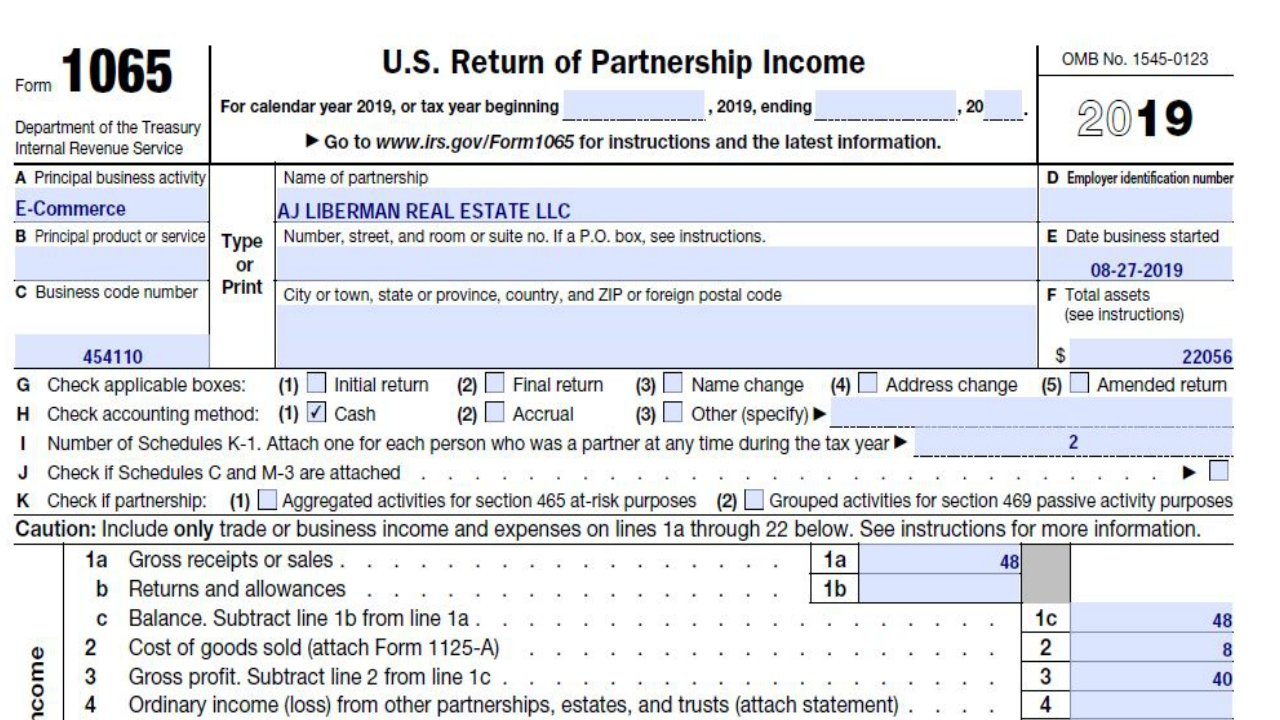

How to Fill Out Form 1065 for a Trade or Business Carrying Inventory

Web copyrit 2021 omson reuters quickfinder® handbooks | form 1065 principal business activity codes—2020 returns 1 quick nder® table continued on the next page form. Complete, edit or print tax forms instantly. Return of partnership income by the 15th day of the third month following the date its tax. This section of the program contains information for part iii of.

Form 1065 Instructions & Information for Partnership Tax Returns

Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. And the total assets at the end of the tax year. Complete, edit or print tax forms instantly. Web information about form 1065, u.s. Most of the information necessary to.

Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

This section of the program contains information for part iii of the schedule k. For a fiscal year or a short tax year, fill in the tax year. Web this form is used to calculate what your partnership owes by assigned its income, losses, dividends, and capital gains directly to the partners. Complete, edit or print tax forms instantly. Get.

Form 1065 U.S. Return of Partnership (2014) Free Download

If the partnership's principal business, office, or agency is located in: Web information about form 1065, u.s. Web form 1065, u.s. Web irs form 1065 is an information return. This section of the program contains information for part iii of the schedule k.

And The Total Assets At The End Of The Tax Year.

Web this form is used to calculate what your partnership owes by assigned its income, losses, dividends, and capital gains directly to the partners. Web information about form 1065, u.s. Get ready for tax season deadlines by completing any required tax forms today. Web the easiest way to file a 1065 is to use an online filing service that supports form 1065.

Return Of Partnership Income By The 15Th Day Of The Third Month Following The Date Its Tax.

Return of partnership income, including recent updates, related forms and instructions on how to file. Web where to file your taxes for form 1065. Web the irs requires businesses to report the income, gains, losses, deductions, credits, etc., of a domestic business or other entity for any tax year. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from the operation of a partnership.

Complete, Edit Or Print Tax Forms Instantly.

Most of the information necessary to. Complete, edit or print tax forms instantly. Web form 1065 is the internal revenue service (irs) federal tax return for all types of business partnerships, including general partnerships, limited partnerships, and. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023.

Ad File Partnership And Llc Form 1065 Fed And State Taxes With Taxact® Business.

Ad get ready for tax season deadlines by completing any required tax forms today. Form 1065 isn't used to calculate. This section of the program contains information for part iii of the schedule k. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each.