Form 8282 Instructions

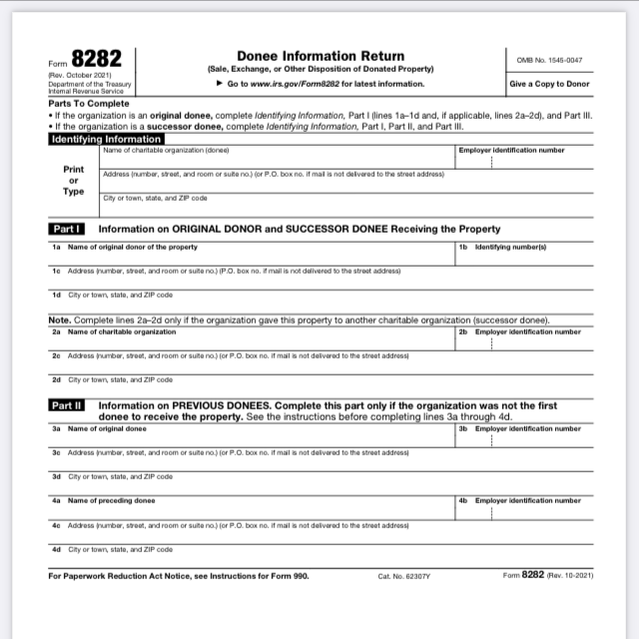

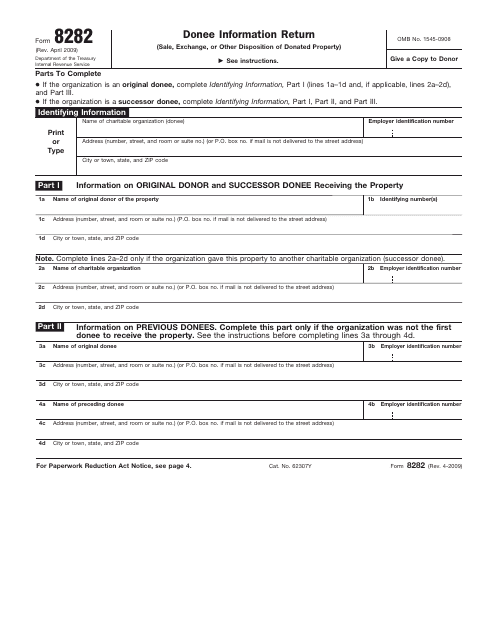

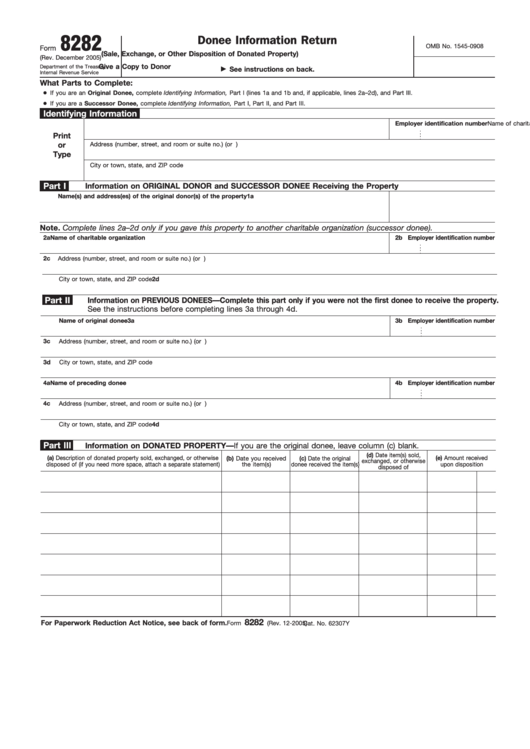

Form 8282 Instructions - Treat these items as cash contributions. The organization must keep a copy of section b of form 8283 in its records. Web how to file form 8282. Charitable organizations are required to complete and file form 8282 with the irs and provide a copy to the donor. Parts to complete • if the organization is an. Donee organizations use this form to report information to the irs and donors about dispositions of certain charitable deduction property made within. Web copy of form 8282 to the original donor of the property. Give a copy to donor. Web all partnerships with tax years beginning after 2017 are subject to the centralized partnership audit regime unless they make a valid election under section 6221(b). See section 6221(b) and the instructions for form 1065 for information on which partnerships are.

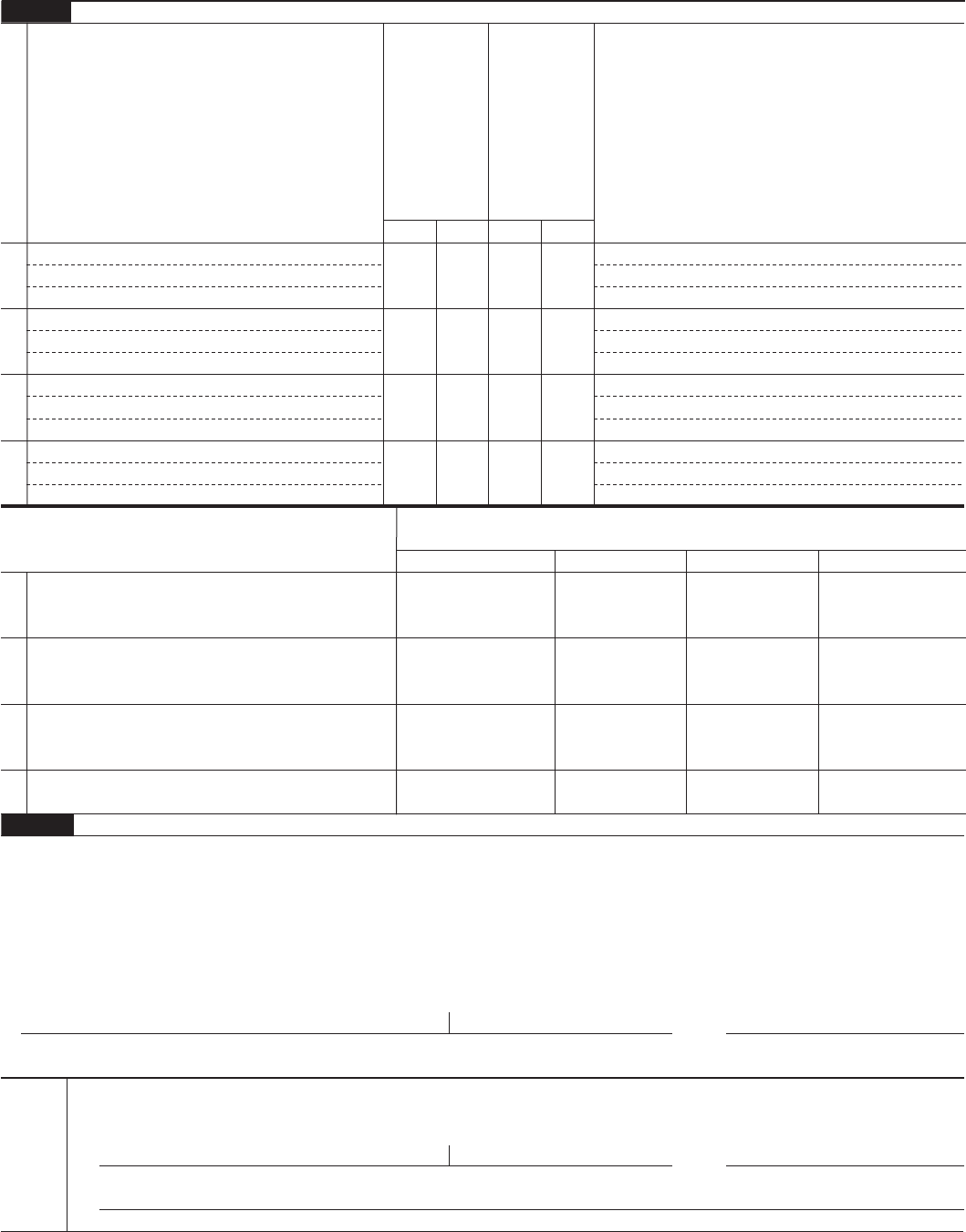

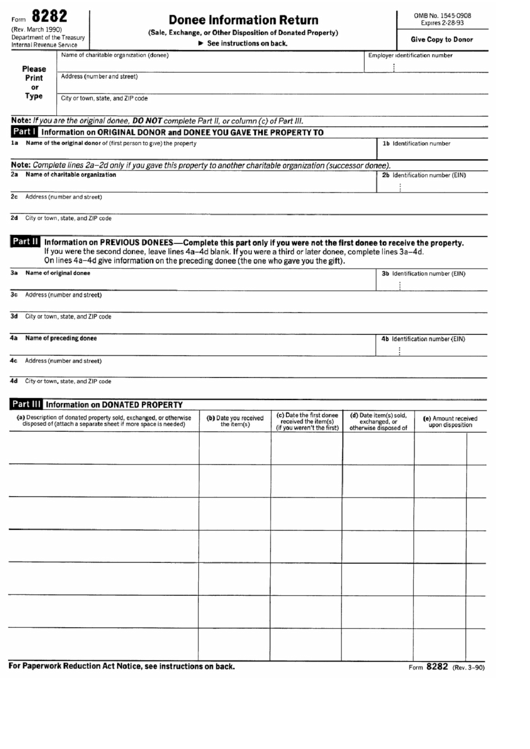

The organization must keep a copy of section b of form 8283 in its records. Parts to complete • if the organization is an. See section 6221(b) and the instructions for form 1065 for information on which partnerships are. Donee information return (sale, exchange, or other disposition of donated property). When a donated item is sold or disposed of within three years of the donation, form 8282 must be filed with the irs within 125 days of the disposition. Failure to file the form, or filing an incomplete form, can subject the organization to a $50 penalty. You must file the form within 125 days of the disposition unless: Department of treasury, internal revenue service center. Web how to file form 8282. Web your organization will generally need to file form 8282, “donee information return,” with the irs if you sell, exchange, or otherwise dispose of a donated item within three years of receiving the donation.

Web your organization will generally need to file form 8282, “donee information return,” with the irs if you sell, exchange, or otherwise dispose of a donated item within three years of receiving the donation. Web copy of form 8282 to the original donor of the property. Charitable organizations are required to complete and file form 8282 with the irs and provide a copy to the donor. Parts to complete • if the organization is an. Web use form 8283 to report information about noncash charitable contributions. You must file the form within 125 days of the disposition unless: Donee information return (sale, exchange, or disposition of donated property) is an irs tax form used by donor organizations to report the sale or disposition of charitable deduction. Two exceptions to reporting exist: Items valued at $500 or less at the time of original donation; If form 8282 is filed by the due date, enter the organization’s name, address, and employer identification number (ein) and complete at least part iii, columns 1, 2, 3, and 4.

IRS Form 8282 Download Fillable PDF or Fill Online Donee Information

Treat these items as cash contributions. The organization must keep a copy of section b of form 8283 in its records. Parts to complete • if the organization is an. If form 8282 is filed by the due date, enter the organization’s name, address, and employer identification number (ein) and complete at least part iii, columns 1, 2, 3, and.

Fillable Form 8282 (Rev. December 2005) Donee Information Return

When a donated item is sold or disposed of within three years of the donation, form 8282 must be filed with the irs within 125 days of the disposition. Web all partnerships with tax years beginning after 2017 are subject to the centralized partnership audit regime unless they make a valid election under section 6221(b). Department of treasury, internal revenue.

Form 8282 Donee Information Return (2009) Free Download

Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the donor contributed the property. Web form 8282 must be filed by the organization within 125 days after the date of disposition of the asset. Donee organizations use this form to report information to the.

Form 8282 Edit, Fill, Sign Online Handypdf

Web all partnerships with tax years beginning after 2017 are subject to the centralized partnership audit regime unless they make a valid election under section 6221(b). See section 6221(b) and the instructions for form 1065 for information on which partnerships are. Failure to file the form, or filing an incomplete form, can subject the organization to a $50 penalty. When.

Form 8282 What Nonprofits Need to Know The Giving Block

Treat these items as cash contributions. See section 6221(b) and the instructions for form 1065 for information on which partnerships are. Department of treasury, internal revenue service center. Donee information return (sale, exchange, or other disposition of donated property). Web all partnerships with tax years beginning after 2017 are subject to the centralized partnership audit regime unless they make a.

LEGO instructions Technic 8282 Quad Bike (Model 1) YouTube

Parts to complete • if the organization is an. Also, do not use form 8283 to figure your charitable contribution deduction. Web your organization will generally need to file form 8282, “donee information return,” with the irs if you sell, exchange, or otherwise dispose of a donated item within three years of receiving the donation. See section 6221(b) and the.

Form 8282 Donee Information Return Department Of Treasury printable

See section 6221(b) and the instructions for form 1065 for information on which partnerships are. Donee information return (sale, exchange, or disposition of donated property) is an irs tax form used by donor organizations to report the sale or disposition of charitable deduction. A completed irs form 8282 should be sent in a timely manner to: Donee organizations use this.

Form 8282 Donee Information Return Definition

When a donated item is sold or disposed of within three years of the donation, form 8282 must be filed with the irs within 125 days of the disposition. Donee information return (sale, exchange, or other disposition of donated property). Web use form 8283 to report information about noncash charitable contributions. See section 6221(b) and the instructions for form 1065.

Formulario 8282 Investor's wiki

Donee information return (sale, exchange, or disposition of donated property) is an irs tax form used by donor organizations to report the sale or disposition of charitable deduction. Give a copy to donor. Web copy of form 8282 to the original donor of the property. Web form 8282 must be filed by the organization within 125 days after the date.

Blog Cryptocurrency Tax Information

If form 8282 is filed by the due date, enter the organization’s name, address, and employer identification number (ein) and complete at least part iii, columns 1, 2, 3, and 4. Donee information return (sale, exchange, or other disposition of donated property). Treat these items as cash contributions. Failure to file the form, or filing an incomplete form, can subject.

When A Donated Item Is Sold Or Disposed Of Within Three Years Of The Donation, Form 8282 Must Be Filed With The Irs Within 125 Days Of The Disposition.

Treat these items as cash contributions. Donee organizations use this form to report information to the irs and donors about dispositions of certain charitable deduction property made within. Failure to file the form, or filing an incomplete form, can subject the organization to a $50 penalty. Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the donor contributed the property.

Donee Information Return (Sale, Exchange, Or Other Disposition Of Donated Property).

Give a copy to donor. Web your organization will generally need to file form 8282, “donee information return,” with the irs if you sell, exchange, or otherwise dispose of a donated item within three years of receiving the donation. Web copy of form 8282 to the original donor of the property. Items valued at $500 or less at the time of original donation;

Donee Information Return (Sale, Exchange, Or Disposition Of Donated Property) Is An Irs Tax Form Used By Donor Organizations To Report The Sale Or Disposition Of Charitable Deduction.

Web use form 8283 to report information about noncash charitable contributions. Web form 8282 must be filed by the organization within 125 days after the date of disposition of the asset. Web all partnerships with tax years beginning after 2017 are subject to the centralized partnership audit regime unless they make a valid election under section 6221(b). October 2021) department of the treasury internal revenue service.

See Section 6221(B) And The Instructions For Form 1065 For Information On Which Partnerships Are.

Also, do not use form 8283 to figure your charitable contribution deduction. Parts to complete • if the organization is an. You must file the form within 125 days of the disposition unless: The organization must keep a copy of section b of form 8283 in its records.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at10.46.08PM-0a2043614bde4ebea3f7117a3d7e4049.png)