Form A1 R

Form A1 R - Web december 21, 2017. Date of entry on current tour 6. Web 13 rows withholding transmittal of wage and tax statements. For calendar year 2022, the following federal. Arizona quarterly withholding tax return:. Failure to file electronically may result in filing penalties. The gross compensation paid to employees who work or perform services in kansas city, missouri should be reported. The proponent agency is odcsper. Web satisfied 96 votes handy tips for filling out arizona quarterly withholding tax return online printing and scanning is no longer the best way to manage documents. 44) statement of correction for a general business or nonprofit corporation (corp.

Web 13 rows withholding transmittal of wage and tax statements. Do not submit any liability owed or try to claim refunds with this return. Date of acceptance of ra. Web december 21, 2017. The gross compensation paid to employees who work or perform services in kansas city, missouri should be reported. 7th street, suite 219227 kansas city, mo. Part 1 taxpayer information (refer to the instructions before completing. Date of entry on current tour 6. Arizona quarterly withholding tax return:. To submit additional liability or claim a refund, file amended.

Failure to file electronically may result in filing penalties. Web 13 rows withholding transmittal of wage and tax statements. Web satisfied 96 votes handy tips for filling out arizona quarterly withholding tax return online printing and scanning is no longer the best way to manage documents. Web return completed form(s) to: Part 1 taxpayer information (refer to the instructions before completing. Web december 21, 2017. The proponent agency is odcsper. For calendar year 2022, the following federal. To submit additional liability or claim a refund, file amended. 44) statement of correction for a general business or nonprofit corporation (corp.

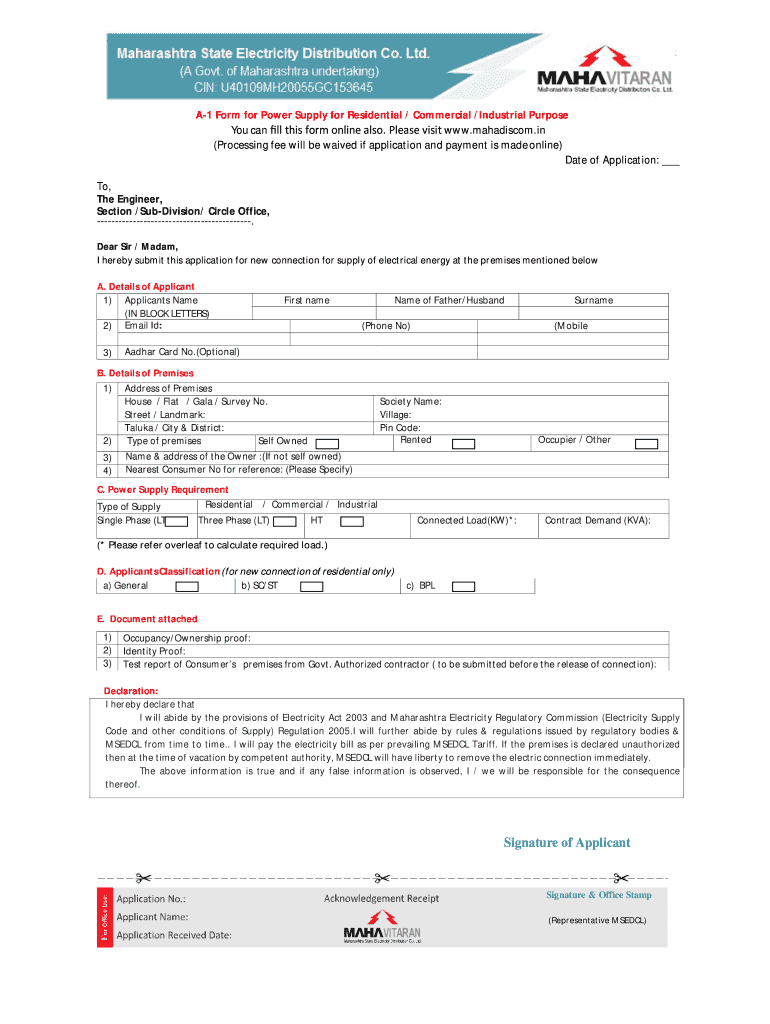

form a1 Scribd india

Part 1 taxpayer information (refer to the instructions before completing. For calendar year 2022, the following federal. 44) statement of correction for a general business or nonprofit corporation (corp. Web return completed form(s) to: Do not submit any liability owed or try to claim refunds with this return.

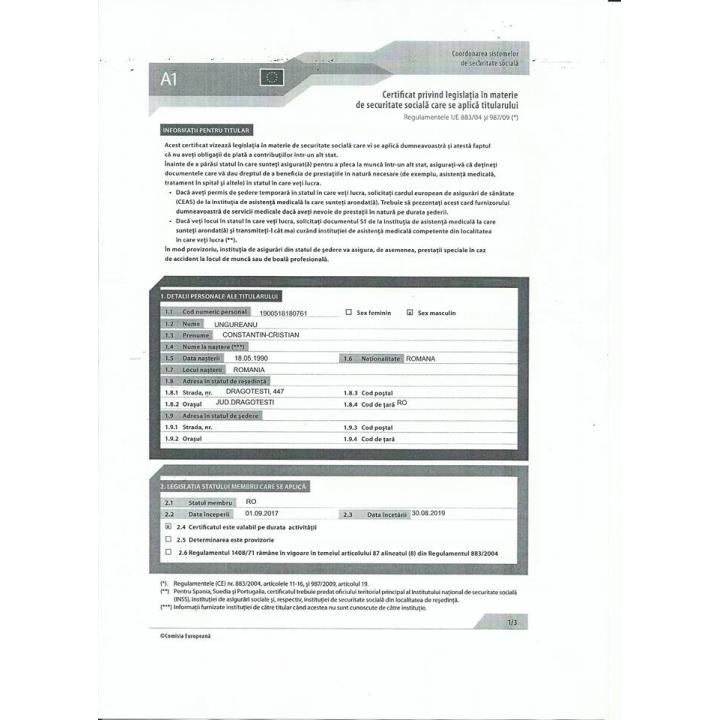

How To Obtain The A1 Form

For calendar year 2022, the following federal. Do not submit any liability owed or try to claim refunds with this return. Date of entry on current tour 6. Arizona quarterly withholding tax return:. Part 1 taxpayer information (refer to the instructions before completing.

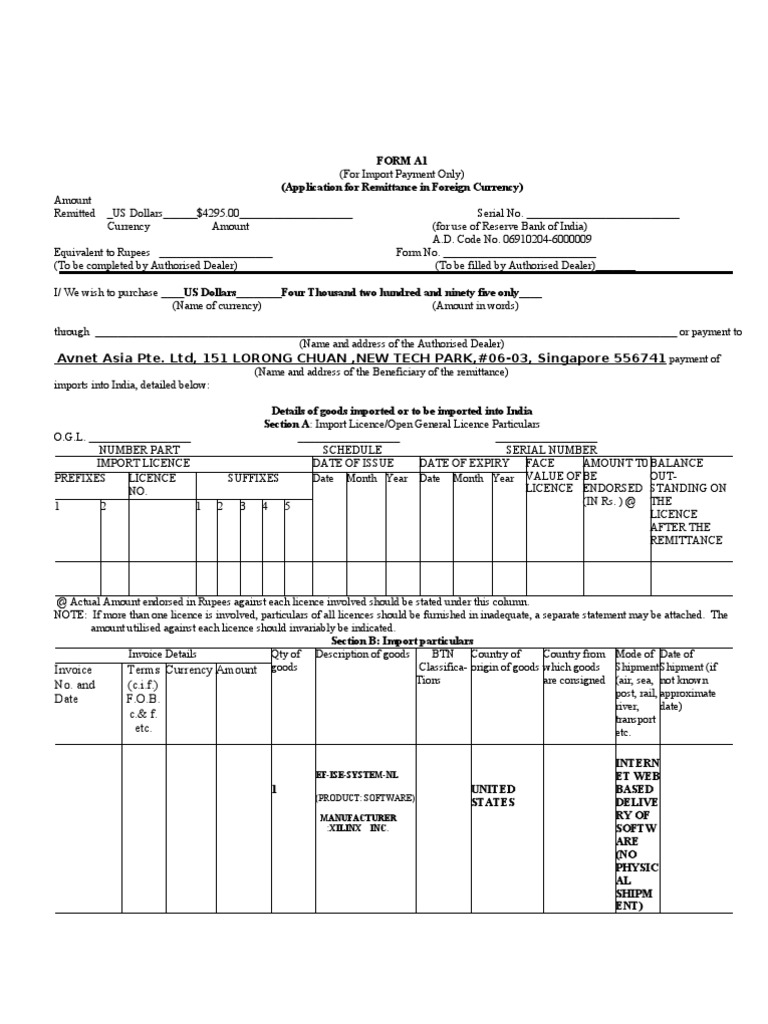

FORM A1 (for Import Payment Only) (Application for Remittance In

44) statement of correction for a general business or nonprofit corporation (corp. Web 13 rows withholding transmittal of wage and tax statements. Web december 21, 2017. Do not submit any liability owed or try to claim refunds with this return. Web amendment of articles of incorporation for a general business or close corporation (corp.

form a1 Scribd india

Date of entry on current tour 6. Web december 21, 2017. Date of acceptance of ra. Part 1 taxpayer information (refer to the instructions before completing. Failure to file electronically may result in filing penalties.

ElectronTest Form A1 Ramsay Corporation

To submit additional liability or claim a refund, file amended. The gross compensation paid to employees who work or perform services in kansas city, missouri should be reported. Date of entry on current tour 6. Date of acceptance of ra. Failure to file electronically may result in filing penalties.

Company Registration Form A1 Leah Beachum's Template

For calendar year 2022, the following federal. Failure to file electronically may result in filing penalties. Do not submit any liability owed or try to claim refunds with this return. Date of entry on current tour 6. Web 13 rows withholding transmittal of wage and tax statements.

Arizona Form A1R

Arizona quarterly withholding tax return:. Web december 21, 2017. Web amendment of articles of incorporation for a general business or close corporation (corp. Failure to file electronically may result in filing penalties. Date of acceptance of ra.

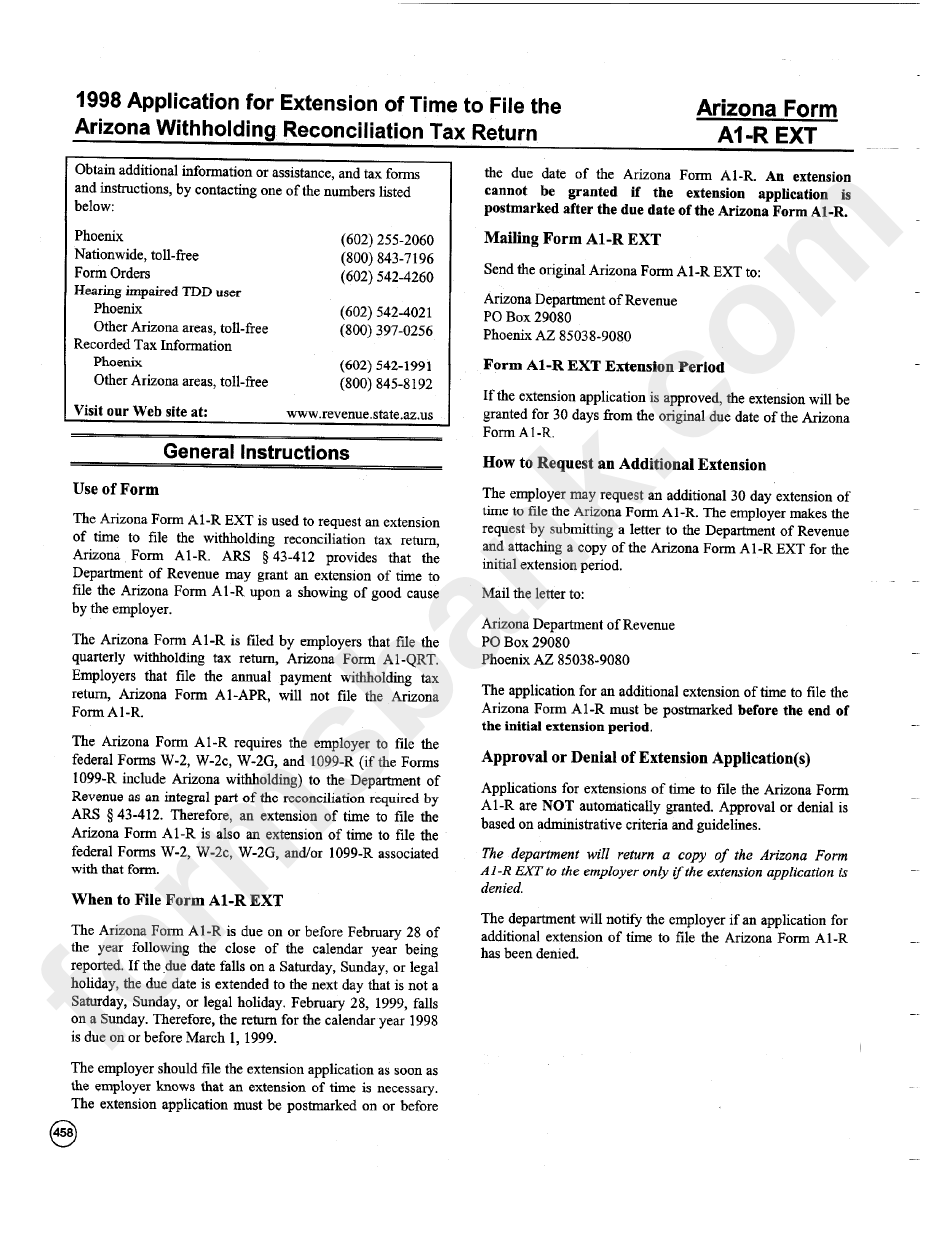

Form A1R Ext 1998 Application For Extension Of Time To File The

Web 13 rows withholding transmittal of wage and tax statements. Failure to file electronically may result in filing penalties. Arizona quarterly withholding tax return:. Web return completed form(s) to: Do not submit any liability owed or try to claim refunds with this return.

FormA1 Register Ofbirth

Date of entry on current tour 6. Web satisfied 96 votes handy tips for filling out arizona quarterly withholding tax return online printing and scanning is no longer the best way to manage documents. Web return completed form(s) to: Do not submit any liability owed or try to claim refunds with this return. The proponent agency is odcsper.

FORM A1 Invoice Business Law

Date of entry on current tour 6. Do not submit any liability owed or try to claim refunds with this return. Date of acceptance of ra. Web amendment of articles of incorporation for a general business or close corporation (corp. For calendar year 2022, the following federal.

For Calendar Year 2022, The Following Federal.

Part 1 taxpayer information (refer to the instructions before completing. Failure to file electronically may result in filing penalties. Web satisfied 96 votes handy tips for filling out arizona quarterly withholding tax return online printing and scanning is no longer the best way to manage documents. Date of acceptance of ra.

To Submit Additional Liability Or Claim A Refund, File Amended.

The proponent agency is odcsper. 7th street, suite 219227 kansas city, mo. Web return completed form(s) to: Web december 21, 2017.

Arizona Quarterly Withholding Tax Return:.

Web amendment of articles of incorporation for a general business or close corporation (corp. The gross compensation paid to employees who work or perform services in kansas city, missouri should be reported. Web 13 rows withholding transmittal of wage and tax statements. Date of entry on current tour 6.

Do Not Submit Any Liability Owed Or Try To Claim Refunds With This Return.

44) statement of correction for a general business or nonprofit corporation (corp.