Form 7004 Due Date 2022

Form 7004 Due Date 2022 - The purpose of form 7004: You will get an automatic tax extension time of six months to file your complete reports along with the. Return due date * due date for filing under. Requests for a tax filing. Web application for automatic extension of time to file certain business income tax, information, and other returns 7004 note: Web the entity must file form 7004 by the due date of the return (the 15th day of the 6th month following the close of the tax year) to request an extension. Web the deadline is april 18th, 2022. If you just need the basics, here’s the skinny: Web federal tax extension form 7004 could get you the much needed relief on reporting your business tax returns by march 15, 2022 and gives you the extra time to. Web how and when to file form 7004 and make tax payments;

To file online go to www.floridarevenue.com if you are required to pay tax with this application, failure to. Web the deadline is april 18th, 2022. 2 choose your business tax return that you are required to file. If you just need the basics, here’s the skinny: Web file this application on or before the original due date of the of the tax year. Web all due dates tables. You will get an automatic tax extension time of six months to file your complete reports along with the. Web federal tax extension form 7004 could get you the much needed relief on reporting your business tax returns by march 15, 2022 and gives you the extra time to. Web application for automatic extension of time to file certain business income tax, information, and other returns 7004 note: Application of business income tax extension form 7004 falls in the mid of the fourth month of every year, which falls on april 18th this.

The purpose of form 7004: Web only 1 in 20 babies are born on their actual due date. Web future developments for the latest information about developments related to form 7004 and its instructions, such as legislation enacted after they were published, go to. Web federal tax extension form 7004 could get you the much needed relief on reporting your business tax returns by march 15, 2022 and gives you the extra time to. 2 choose your business tax return that you are required to file. If you just need the basics, here’s the skinny: And for the tax returns such as 1120, 1041 and others. Web the entity must file form 7004 by the due date of the return (the 15th day of the 6th month following the close of the tax year) to request an extension. Web all due dates tables. Web application for automatic extension of time to file certain business income tax, information, and other returns 7004 note:

2011 Form IRS 7004 Fill Online, Printable, Fillable, Blank pdfFiller

Web the table below shows the deadline for filing form 7004 for business tax returns. A normal pregnancy often lasts from 38 to 42 weeks, which keeps the majority of parents guessing right up. Web 1 select your business entity type that the irs elected you. Web the entity must file form 7004 by the due date of the return.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

Web the deadline is april 18th, 2022. Web all due dates tables. Return due date * due date for filing under. And for the tax returns such as 1120, 1041. This determines which income tax return you need to file.

Irs Form 7004 amulette

You will get an automatic tax extension time of six months to file your complete reports along with the. You will get an automatic tax extension time of six months to file your complete reports along with the. Web the entity must file form 7004 by the due date of the return (the 15th day of the 6th month following.

Form 7004 Business Tax Extension Due This March 15

Requests for a tax filing. Web federal tax extension form 7004 could get you the much needed relief on reporting your business tax returns by march 15, 2022 and gives you the extra time to. If you just need the basics, here’s the skinny: Return due date * due date for filing under. Web all due dates tables.

Form 12 Extension Why You Should Not Go To Form 12 Extension AH

If you just need the basics, here’s the skinny: Web the entity must file form 7004 by the due date of the return (the 15th day of the 6th month following the close of the tax year) to request an extension. You will get an automatic tax extension time of six months to file your complete reports along with the..

extension form 7004 for 2022 IRS Authorized

You will get an automatic tax extension time of six months to file your complete reports along with the. To file online go to www.floridarevenue.com if you are required to pay tax with this application, failure to. Requests for a tax filing. Return due date * due date for filing under. You will get an automatic tax extension time of.

Form 7004 Automatically Extend Your 1120 Filing Due date IRSForm7004

2 choose your business tax return that you are required to file. To file online go to www.floridarevenue.com if you are required to pay tax with this application, failure to. Web future developments for the latest information about developments related to form 7004 and its instructions, such as legislation enacted after they were published, go to. A normal pregnancy often.

When is Tax Extension Form 7004 Due? Tax Extension Online

Web application for automatic extension of time to file certain business income tax, information, and other returns 7004 note: Web all due dates tables. 2 choose your business tax return that you are required to file. If you just need the basics, here’s the skinny: You will get an automatic tax extension time of six months to file your complete.

Form 7004 2016 Fill out & sign online DocHub

Web application for automatic extension of time to file certain business income tax, information, and other returns 7004 note: This determines which income tax return you need to file. You will get an automatic tax extension time of six months to file your complete reports along with the. Web the table below shows the deadline for filing form 7004 for.

Form 7004 Where To Sign Fill Out and Sign Printable PDF Template

Return due date * due date for filing under. Web if the 15th falls on a federal holiday or weekend, the return due date is the next business day. You will get an automatic tax extension time of six months to file your complete reports along with the. Web how and when to file form 7004 and make tax payments;.

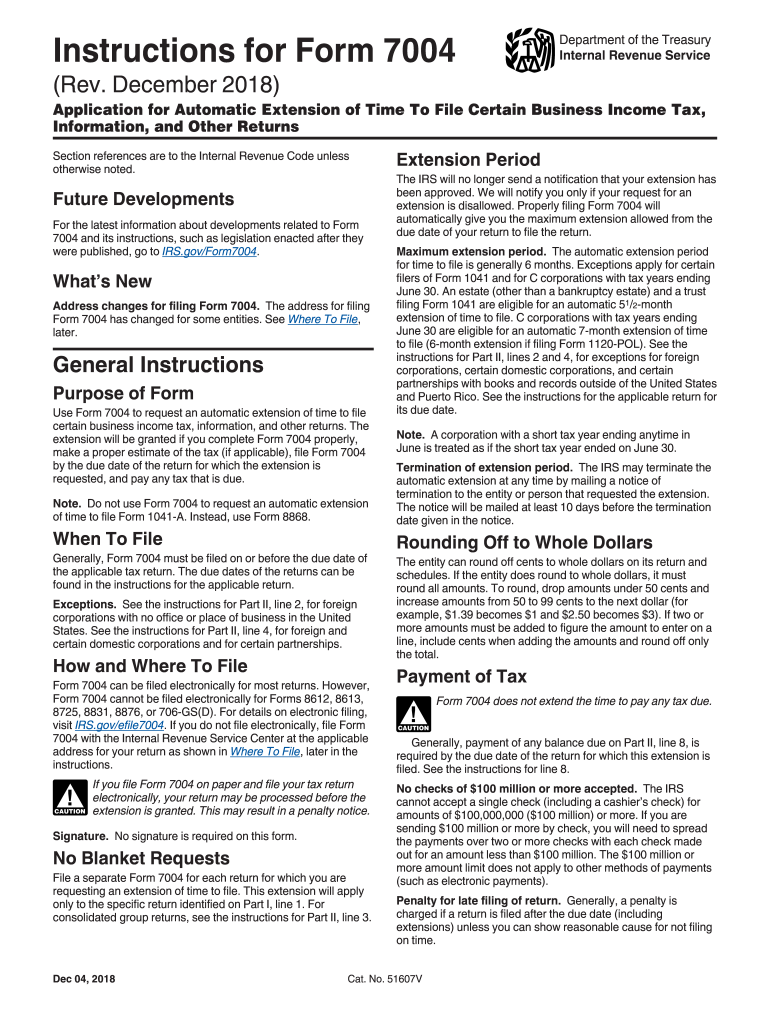

Web Future Developments For The Latest Information About Developments Related To Form 7004 And Its Instructions, Such As Legislation Enacted After They Were Published, Go To.

This determines which income tax return you need to file. 2 choose your business tax return that you are required to file. Return due date * due date for filing under. Web application for automatic extension of time to file certain business income tax, information, and other returns 7004 note:

You Will Get An Automatic Tax Extension Time Of Six Months To File Your Complete Reports Along With The.

Web 1 select your business entity type that the irs elected you. Web how and when to file form 7004 and make tax payments; You will get an automatic tax extension time of six months to file your complete reports along with the. Application of business income tax extension form 7004 falls in the mid of the fourth month of every year, which falls on april 18th this.

File Request For Extension By The Due Date Of.

And for the tax returns such as 1120, 1041 and others. Web federal tax extension form 7004 could get you the much needed relief on reporting your business tax returns by march 15, 2022 and gives you the extra time to. Web the deadline is april 18th, 2022. If you just need the basics, here’s the skinny:

Web File This Application On Or Before The Original Due Date Of The Of The Tax Year.

To file online go to www.floridarevenue.com if you are required to pay tax with this application, failure to. Web the entity must file form 7004 by the due date of the return (the 15th day of the 6th month following the close of the tax year) to request an extension. The purpose of form 7004: Web only 1 in 20 babies are born on their actual due date.