Form 2553 California

Form 2553 California - (clarifying who and how to sign the form. Web by filing form 2553 with the irs (instructions below) you are simply changing the default tax classification of the llc (from either sole proprietorship or. Web form 2553 instructions. Web 2553 form (under section 1362 of the internal revenue code) (rev. In california, an s corp has a franchise tax of 1.5%. Our california lawyers help businesses and individuals with their legal needs. Web you can form your california s corp by completing and filing form 2553 with the irs. Timeline requirement you must be requesting relief within three years and 75 days after the date you intend to be treated as an s corporation. The tax year to be. Complete, edit or print tax forms instantly.

Web request for guidance regarding making proper s corporation consents of form 2553, election by a small business corporation. December 2017) (including a late election filed pursuant to rev. We know the irs from the inside out. Ad complete irs tax forms online or print government tax documents. Web instructions for form 2553 department of the treasury internal revenue service (rev. Filing form 2553 is a requirement for corporations. (clarifying who and how to sign the form. If the corporation's principal business, office, or agency is located in. The tax year to be. You will need an employer identification number (ein),.

Web you can form your california s corp by completing and filing form 2553 with the irs. Instructions to complete form 2553 filling out your form 2553 frequently asked questions the united states tax system affords. Form 2553 is used by limited liability companies (llcs) and corporations to elect the s corporation (s corp) tax classification with the us. Filing form 2553 is a requirement for corporations. Get ready for tax season deadlines by completing any required tax forms today. Our california lawyers help businesses and individuals with their legal needs. Web request for guidance regarding making proper s corporation consents of form 2553, election by a small business corporation. Complete, edit or print tax forms instantly. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. Web instructions for form 2553 department of the treasury internal revenue service (rev.

Everything You Need to Know About Form 2553 Canopy

In california, an s corp has a franchise tax of 1.5%. Web form 2553, election by a small business corporation, is an internal revenue service form that can be filed by a business to elect to be registered as an s corporation rather than a. Web find mailing addresses by state and date for filing form 2553. Web you can.

IRS Form 2553 Instructions How to Fill Out Form 2553 Excel Capital

If the corporation's principal business, office, or agency is located in. Timeline requirement you must be requesting relief within three years and 75 days after the date you intend to be treated as an s corporation. Web to revoke a subchapter s election/small business election that was made on form 2553, submit a statement of revocation to the service center.

Form 2553 Instructions How and Where to File mojafarma

Web so if you want your business’s s corporation election to take effect on january 1, 2022, you can file form 2553 any time between january 1, 2021, until march 15, 2022. The tax year to be. This form must be filed within six months of the due date for form 1120s. Web by filing form 2553 with the irs.

67 FREE DOWNLOAD S CORP TAX FORM 2553 PDF DOC AND VIDEO TUTORIAL

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web form 2553 instructions. Web to revoke a subchapter s election/small business election that was made on form 2553, submit a statement of revocation to the service center where you file your. December 2017) (including a late election filed pursuant.

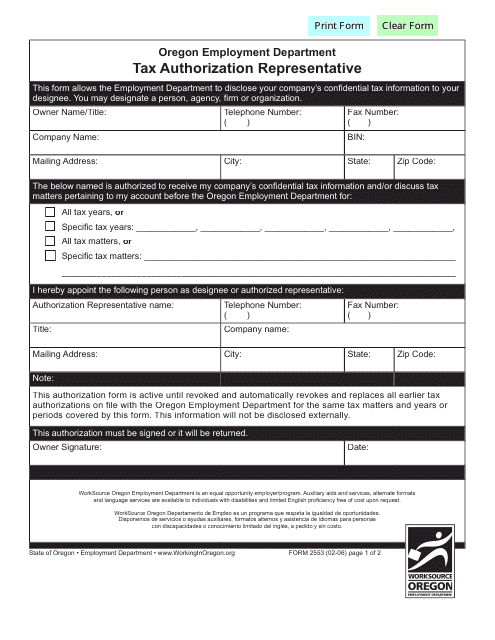

Form 2553 Download Fillable PDF or Fill Online Tax Authorization

Complete, edit or print tax forms instantly. Web what is form 2553? Here is the filing deadline [+ penalties] july 17, 2022. Web find mailing addresses by state and date for filing form 2553. Web what is form 2553 used for?

Form 2553 How To Qualify And An S Corporation Silver Tax Group

Web request for guidance regarding making proper s corporation consents of form 2553, election by a small business corporation. Web what is form 2553 used for? Get ready for tax season deadlines by completing any required tax forms today. (clarifying who and how to sign the form. This form must be filed within six months of the due date for.

Form 2553 YouTube

Here is the filing deadline [+ penalties] july 17, 2022. Web what is form 2553 used for? We know the irs from the inside out. Instructions to complete form 2553 filling out your form 2553 frequently asked questions the united states tax system affords. Web so if you want your business’s s corporation election to take effect on january 1,.

S Corporation (Form 2553) California Poo Poo’s On Trump Tax Reform Top

Form 2553 is used by limited liability companies (llcs) and corporations to elect the s corporation (s corp) tax classification with the us. Web 2553 form (under section 1362 of the internal revenue code) (rev. December 2017) (including a late election filed pursuant to rev. Web instructions for form 2553 department of the treasury internal revenue service (rev. Web about.

Form 2553 Form Pros

Web instructions for form 2553 department of the treasury internal revenue service (rev. Web about california form 2553 lawyers. In california, an s corp has a franchise tax of 1.5%. Web request for guidance regarding making proper s corporation consents of form 2553, election by a small business corporation. Web to revoke a subchapter s election/small business election that was.

IRS Form 2553 How to Register as an SCorporation for Your Business

Web form 2553, election by a small business corporation, is an internal revenue service form that can be filed by a business to elect to be registered as an s corporation rather than a. Web about california form 2553 lawyers. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web request for guidance regarding making proper s corporation consents of form 2553, election by a small business corporation. Web 2553 form (under section 1362 of the internal revenue code) (rev. You will need an employer identification number (ein),. If the corporation's principal business, office, or agency is located in.

Here Is The Filing Deadline [+ Penalties] July 17, 2022.

Web what is form 2553? Web instructions for form 2553 department of the treasury internal revenue service (rev. The tax year to be. December 2020) (for use with the december 2017 revision of form 2553, election by a.

December 2017) (Including A Late Election Filed Pursuant To Rev.

Web what is form 2553? In california, an s corp has a franchise tax of 1.5%. Filing form 2553 is a requirement for corporations. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed.

Web 2553 Form (Under Section 1362 Of The Internal Revenue Code) (Rev.

Form 2553 is used by limited liability companies (llcs) and corporations to elect the s corporation (s corp) tax classification with the us. Complete, edit or print tax forms instantly. Web form 2553, election by a small business corporation, is an internal revenue service form that can be filed by a business to elect to be registered as an s corporation rather than a. December 2017) (including a late election filed pursuant to rev.