Form 5498 Schwab

Form 5498 Schwab - File this form for each. Web add checks and debit cards to an existing schwab one trust account. Web form 5498 is an informational return sent by your ira account custodian to the irs (for example, by charles schwab or by fidelity if your retirement accounts are. Web this guide provides some basic information about several of the most common forms you may need to prepare your 2022 taxes, including: It’s issued by your broker or financial institution which oversees. Web form 5498 outlines any transaction in which money transferred into an ira for the previous year. What, if anything, do i need to do now? Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Charles schwab just gave me a 5498 form (roth ira contribution form) for the year 2019. Schwab option, margin & short account trading application.

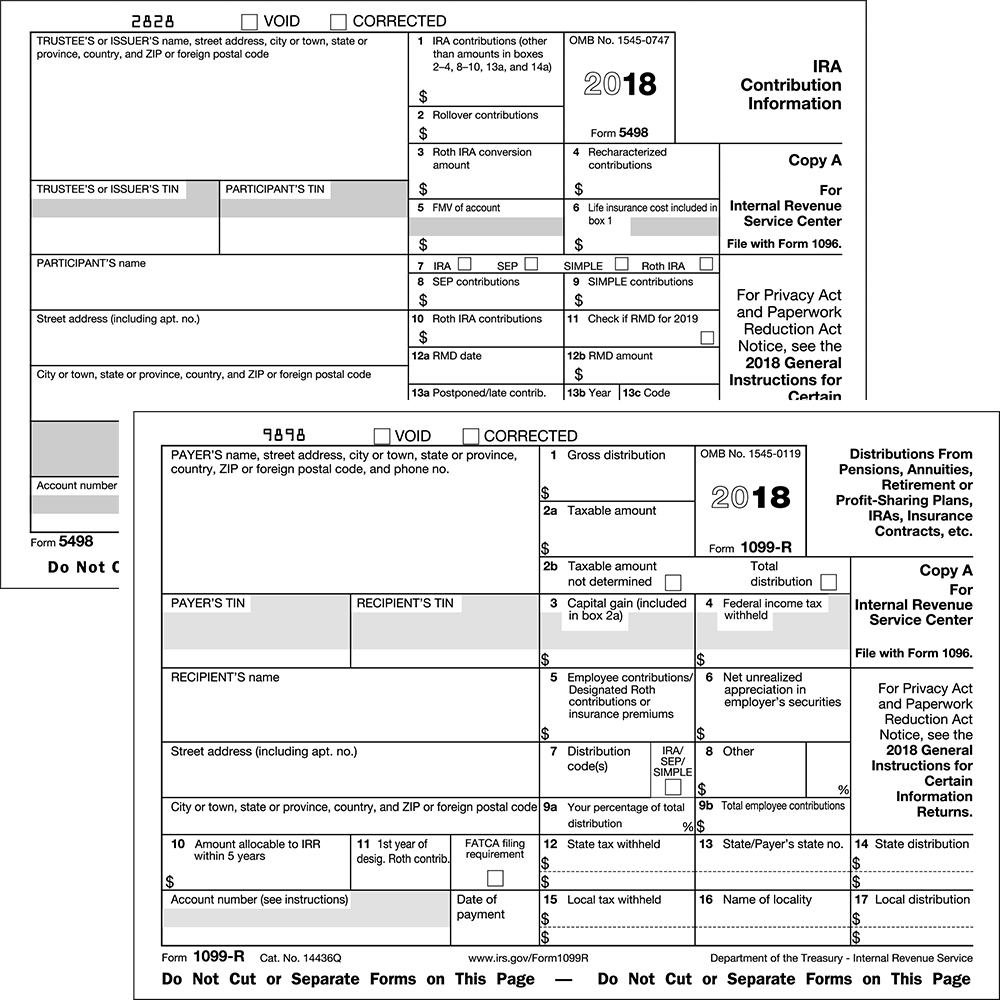

Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Web use the irs’s online tax withholding estimator tool to check your withholdings. Web what is form 5498? Web form 5498 outlines any transaction in which money transferred into an ira for the previous year. Schwab option, margin & short account trading application. What, if anything, do i need to do now? It’s issued by your broker or financial institution which oversees. If applicable, it will include employer contributions and. • form 1099 composite* • retirement. I filed my taxes months ago.

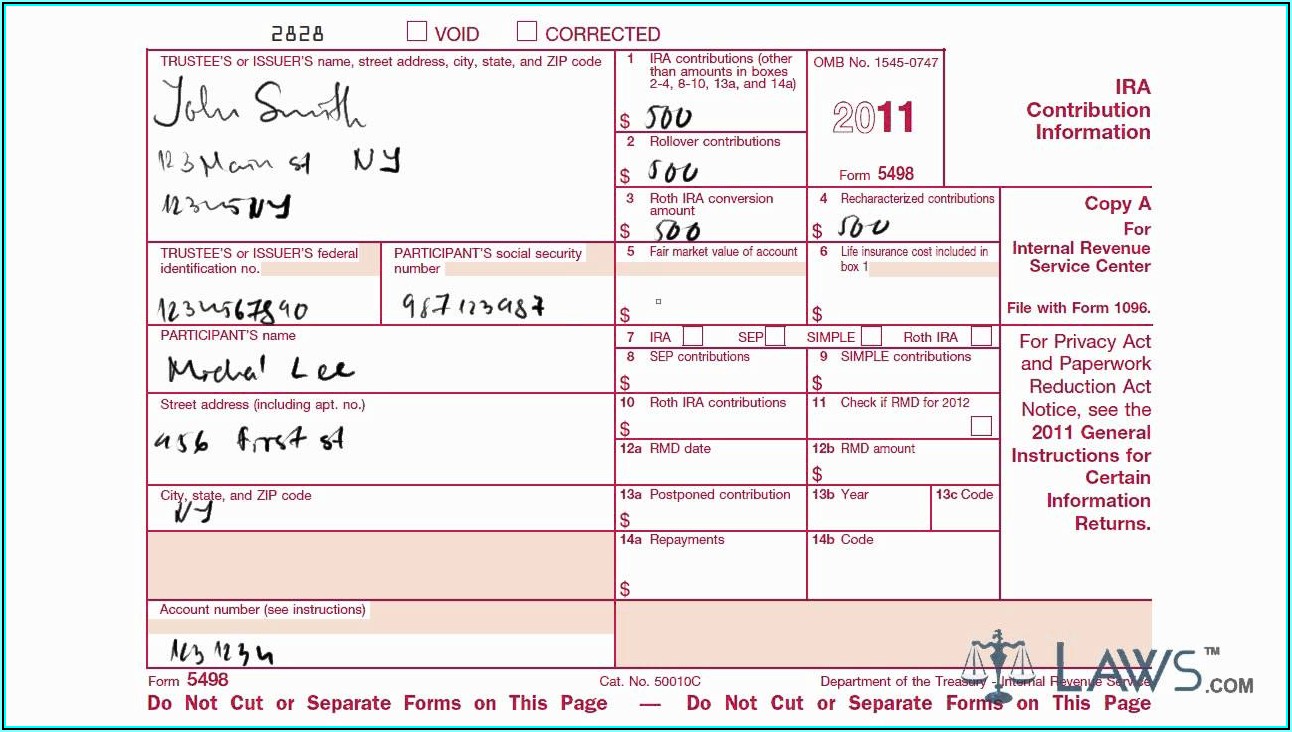

Web use the irs’s online tax withholding estimator tool to check your withholdings. Web form 5498 is generated for accounts where a contribution is made within a calendar year. Ira ownership and type form 5498 includes information (name, address, and federal identification number) about the trustee and includes the same type of. Web what is form 5498? Form 5498 is for informational purposes only. Web this guide provides some basic information about several of the most common forms you may need to prepare your 2022 taxes, including: File this form for each. Web this form may also be used to report the fair market value (fmv) of your ira each year as of december 31. Charles schwab just gave me a 5498 form (roth ira contribution form) for the year 2019. Web add checks and debit cards to an existing schwab one trust account.

Schwab Form 5498 Fill online, Printable, Fillable Blank

Form 5498 is for informational purposes only. File this form for each. View the tabs below so you. Web add checks and debit cards to an existing schwab one trust account. Web form 5498 is generated for accounts where a contribution is made within a calendar year.

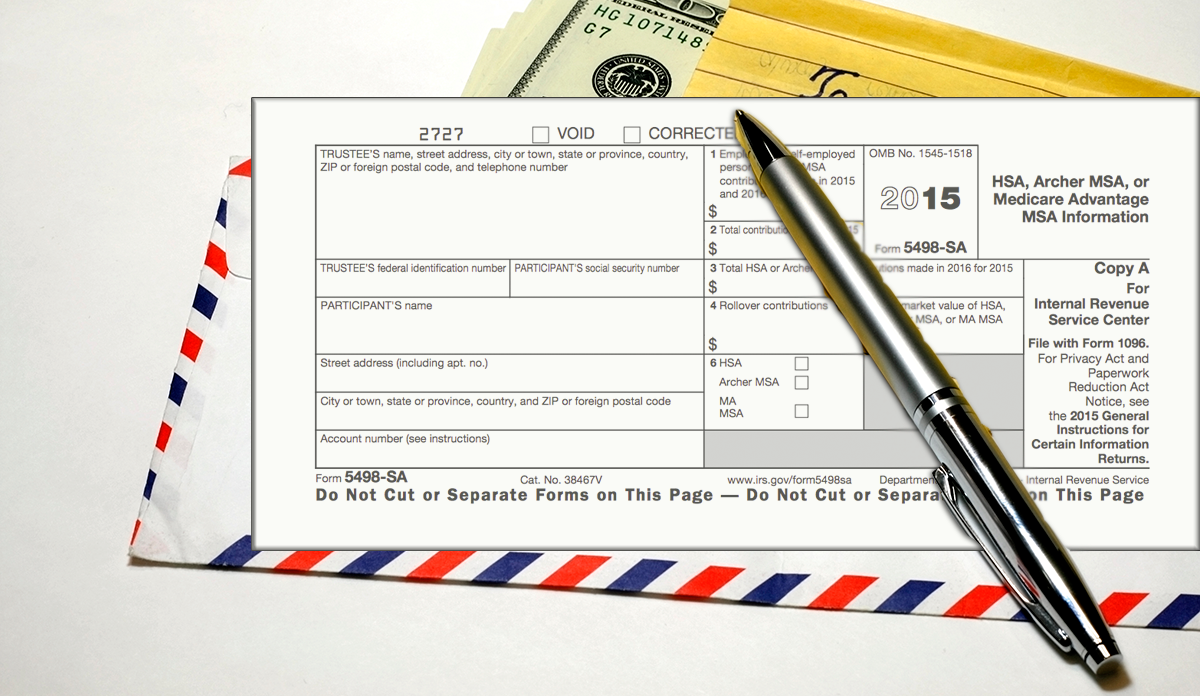

What is IRS Form 5498SA? BRI Benefit Resource

Ira ownership and type form 5498 includes information (name, address, and federal identification number) about the trustee and includes the same type of. Schwab option, margin & short account trading application. This video explains irs form 5498. Any state or its agency or. Form 5498 is for informational purposes only.

401k Rollover Form 5498 Form Resume Examples Kw9kbZZ2JN

Web this form may also be used to report the fair market value (fmv) of your ira each year as of december 31. Ira ownership and type form 5498 includes information (name, address, and federal identification number) about the trustee and includes the same type of. View the tabs below so you. Web form 5498 is generated for accounts where.

Ira Rollover Tax Form 5498 Universal Network

Web form 5498 is generated for accounts where a contribution is made within a calendar year. Be aware of tax rules and changes that might. I filed my taxes months ago. Ira ownership and type form 5498 includes information (name, address, and federal identification number) about the trustee and includes the same type of. Form 5498 is for informational purposes.

5498 Form 2021

Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Web this guide provides some basic information about several of the most common forms you may need to prepare your 2022 taxes, including: Be aware of tax rules and changes that might..

All About IRS Tax Form 5498 for 2020 IRA for individuals

Web incorrect information on form 5498, ira contribution information, may cause taxpayers to make ira reporting errors on their tax returns. Form 5498 is for informational purposes only. Web this guide provides some basic information about several of the most common forms you may need to prepare your 2022 taxes, including: Any state or its agency or. • form 1099.

5498 Software to Create, Print & EFile IRS Form 5498

File this form for each. Be aware of tax rules and changes that might. Schwab option, margin & short account trading application. View the tabs below so you. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file.

Ira Rollover Form 5498 Universal Network

Web incorrect information on form 5498, ira contribution information, may cause taxpayers to make ira reporting errors on their tax returns. Web form 5498 is generated for accounts where a contribution is made within a calendar year. Web use the irs’s online tax withholding estimator tool to check your withholdings. Web this form may also be used to report the.

Formulario de objetivo del IRS 5498 Traders Studio

View the tabs below so you. What, if anything, do i need to do now? Any state or its agency or. Form 5498 is for informational purposes only. It’s issued by your broker or financial institution which oversees.

1099r Form Box 7 Codes Leah Beachum's Template

Form 5498 is for informational purposes only. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. If applicable, it will include employer contributions and. Web form 5498 outlines any transaction in which money transferred into an ira for the previous year. Be aware of tax rules and changes that might.

Form 5498 Is For Informational Purposes Only.

Complete, edit or print tax forms instantly. Web this form may also be used to report the fair market value (fmv) of your ira each year as of december 31. Web use the irs’s online tax withholding estimator tool to check your withholdings. Web incorrect information on form 5498, ira contribution information, may cause taxpayers to make ira reporting errors on their tax returns.

When You Save For Retirement With An Individual Retirement Arrangement (Ira), You Probably Receive A Form 5498 Each Year.

Web add checks and debit cards to an existing schwab one trust account. Any state or its agency or. Web this guide provides some basic information about several of the most common forms you may need to prepare your 2022 taxes, including: Ira ownership and type form 5498 includes information (name, address, and federal identification number) about the trustee and includes the same type of.

Web This Form May Also Be Used To Report The Fair Market Value (Fmv) Of Your Ira Each Year As Of December 31.

What, if anything, do i need to do now? This video explains irs form 5498. I filed my taxes months ago. • form 1099 composite* • retirement.

Schwab Option, Margin & Short Account Trading Application.

File this form for each. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Web form 5498 is generated for accounts where a contribution is made within a calendar year. View the tabs below so you.