Form 5471 Schedule G-1

Form 5471 Schedule G-1 - E organization or reorganization of foreign corporation stock information (ctrl+e) sch. Line 2g has been modified to update the references to schedule e, due to changes made to that schedule. A taxpayer with only general category income (and no passive Go to www.irs.gov/form5471 for instructions and the latest information. Who must complete schedule g form 5471 and appropriate accompanying schedules must be completed and filed by the following categories of persons: Ein (if any) reference id number (see instructions) important. Persons who are officers, directors or ten percent or greater shareholders in a cfc. New line 5c(iii)(d) was added so that a taxpayer can enter requested information for four sanctioned countries with respect Shareholder of foreign corporation information of u.s. Changes to separate schedule h (form 5471).

E organization or reorganization of foreign corporation stock information (ctrl+e) sch. Line 2g has been modified to update the references to schedule e, due to changes made to that schedule. Persons required schedules for category filers Persons who are officers, directors or ten percent or greater shareholders in a cfc. Web follow these steps to generate and complete form 5471 in the program: Number ofshares held at beginning of annual accounting period number ofshares held at end of annual accounting period form 5471 (rev. This description should match the corresponding description entered in schedule a, column (a). A taxpayer with only general category income (and no passive Shareholder of foreign corporation information of u.s. Report all amounts in u.s.

Who must complete schedule g form 5471 and appropriate accompanying schedules must be completed and filed by the following categories of persons: Web name of person filing form 5471. Shareholder of foreign corporation information of u.s. Report all amounts in u.s. Number ofshares held at beginning of annual accounting period number ofshares held at end of annual accounting period form 5471 (rev. E organization or reorganization of foreign corporation stock information (ctrl+e) sch. Ein (if any) reference id number (see instructions) important. Web description of each class of stock held by shareholder. Web follow these steps to generate and complete form 5471 in the program: Web this article will go line by line through schedule g of form 5471.

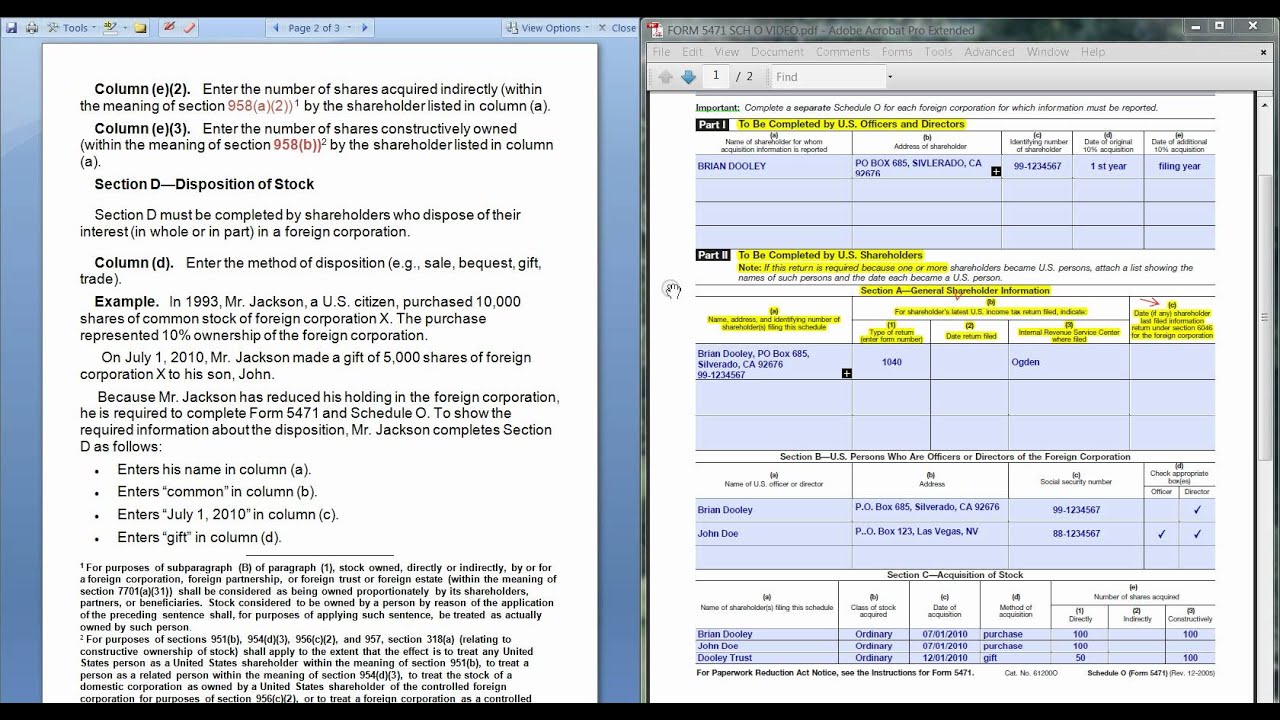

FORM 5471 SCHEDULE O CONTROLLED FOREIGN CORPORATION.avi YouTube

Go to www.irs.gov/form5471 for instructions and the latest information. Persons required schedules for category filers Changes to separate schedule h (form 5471). A taxpayer with only general category income (and no passive Web follow these steps to generate and complete form 5471 in the program:

IRS Issues Updated New Form 5471 What's New?

Web name of person filing form 5471. Report all amounts in u.s. Number ofshares held at beginning of annual accounting period number ofshares held at end of annual accounting period form 5471 (rev. Ein (if any) reference id number (see instructions) important. Shareholder of foreign corporation information of u.s.

Demystifying the Form 5471 Part 9. Schedule G SF Tax Counsel

Web description of each class of stock held by shareholder. Shareholder of foreign corporation information of u.s. December 2023) cost sharing arrangement department of the treasury internal revenue service attach to form 5471. Who must complete schedule g form 5471 and appropriate accompanying schedules must be completed and filed by the following categories of persons: Number ofshares held at beginning.

2012 form 5471 instructions Fill out & sign online DocHub

Web this article will go line by line through schedule g of form 5471. Shareholder of foreign corporation information of u.s. Line 2g has been modified to update the references to schedule e, due to changes made to that schedule. Persons required schedules for category filers New line 5c(iii)(d) was added so that a taxpayer can enter requested information for.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

Report all amounts in u.s. December 2023) cost sharing arrangement department of the treasury internal revenue service attach to form 5471. Ein (if any) reference id number (see instructions) important. A taxpayer with only general category income (and no passive Changes to separate schedule h (form 5471).

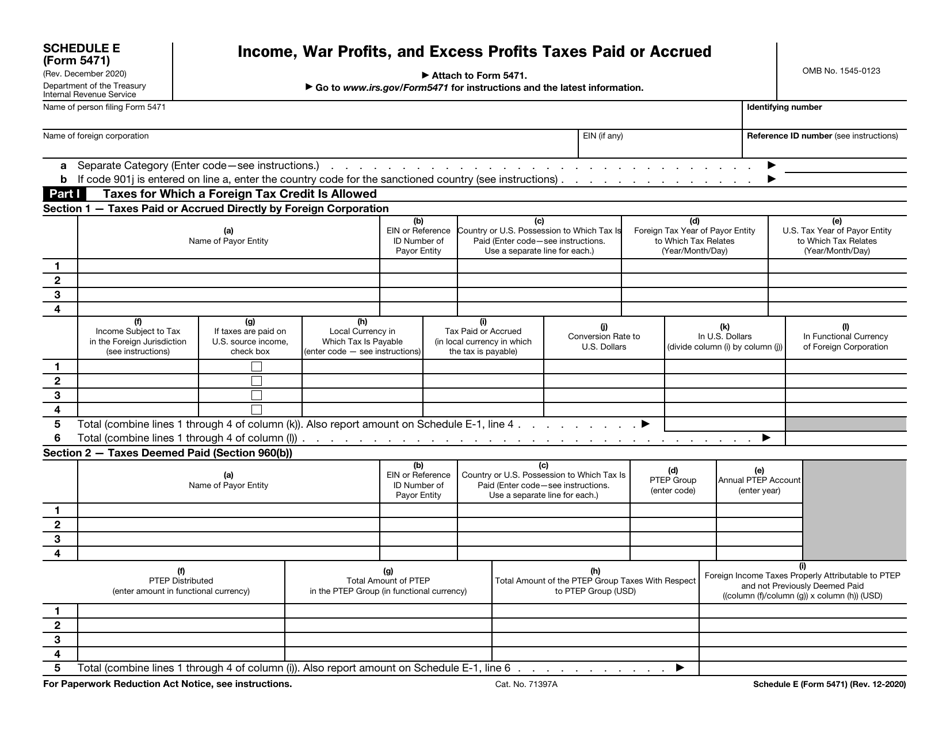

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Shareholder of foreign corporation information of u.s. New line 5c(iii)(d) was added so that a taxpayer can enter requested information for four sanctioned countries with respect Persons required schedules for category filers Who must complete schedule g form 5471 and appropriate accompanying schedules must be completed and filed by the following categories of persons: Web description of each class of.

Form 5471 Information Return of U.S. Persons with Respect to Certain

Web follow these steps to generate and complete form 5471 in the program: Shareholder of foreign corporation information of u.s. Persons required schedules for category filers Web this article will go line by line through schedule g of form 5471. This description should match the corresponding description entered in schedule a, column (a).

Form 5471 and Corresponding Schedules SDG Accountant

Ein (if any) reference id number (see instructions) important. Line 2g has been modified to update the references to schedule e, due to changes made to that schedule. Changes to separate schedule h (form 5471). Who must complete schedule g form 5471 and appropriate accompanying schedules must be completed and filed by the following categories of persons: Go to www.irs.gov/form5471.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Web description of each class of stock held by shareholder. Web name of person filing form 5471. A taxpayer with only general category income (and no passive December 2023) cost sharing arrangement department of the treasury internal revenue service attach to form 5471. Who must complete schedule g form 5471 and appropriate accompanying schedules must be completed and filed by.

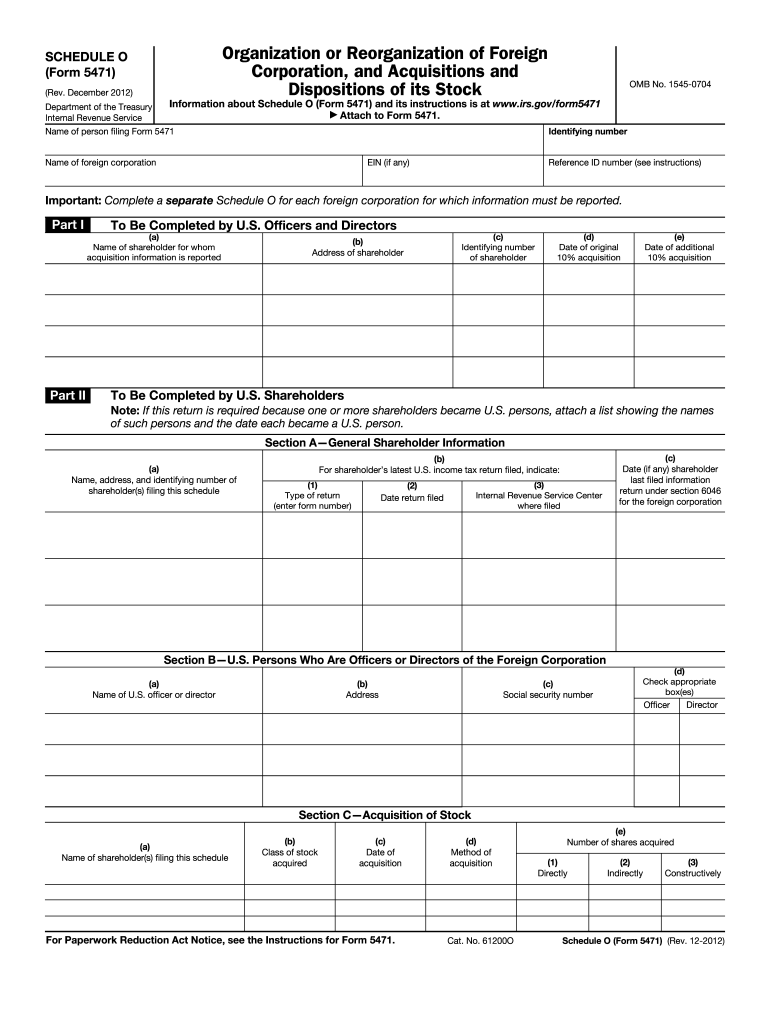

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

This description should match the corresponding description entered in schedule a, column (a). Go to www.irs.gov/form5471 for instructions and the latest information. E organization or reorganization of foreign corporation stock information (ctrl+e) sch. Ein (if any) reference id number (see instructions) important. Web description of each class of stock held by shareholder.

A Taxpayer With Only General Category Income (And No Passive

Report all amounts in u.s. Web this article will go line by line through schedule g of form 5471. Persons who are officers, directors or ten percent or greater shareholders in a cfc. Shareholder of foreign corporation information of u.s.

This Description Should Match The Corresponding Description Entered In Schedule A, Column (A).

December 2023) cost sharing arrangement department of the treasury internal revenue service attach to form 5471. Persons required schedules for category filers Go to www.irs.gov/form5471 for instructions and the latest information. Web description of each class of stock held by shareholder.

Web Follow These Steps To Generate And Complete Form 5471 In The Program:

Web name of person filing form 5471. Line 2g has been modified to update the references to schedule e, due to changes made to that schedule. Who must complete schedule g form 5471 and appropriate accompanying schedules must be completed and filed by the following categories of persons: Changes to separate schedule h (form 5471).

Ein (If Any) Reference Id Number (See Instructions) Important.

E organization or reorganization of foreign corporation stock information (ctrl+e) sch. New line 5c(iii)(d) was added so that a taxpayer can enter requested information for four sanctioned countries with respect Number ofshares held at beginning of annual accounting period number ofshares held at end of annual accounting period form 5471 (rev.