1099 Electronic Consent Form

1099 Electronic Consent Form - Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). Web you may withdraw your consent to paperless delivery by providing written notice either (1) by mail at the address set forth above; Complete, edit or print tax forms instantly. Web to provide 1099 electronically, you must follow the below instructions: Before you can issue a form 1099 electronically,. Web the below information you choose to have your irs form 1099 delivered electronically, please check the box to indicate your affirmative consent and sign electronically. Explaining how they can withdraw consent, get a paper. Your consent to receive irs forms electronically will be. This notice hereby modifies part h of the 2003. See the instructions for form.

Before you can issue a form 1099 electronically,. Or (2) by email to gw_e1099@gwu.edu. You may also have a filing requirement. Web to provide 1099 electronically, you must follow the below instructions: Web the below information you choose to have your irs form 1099 delivered electronically, please check the box to indicate your affirmative consent and sign electronically. Your consent to receive irs forms electronically will be. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Ad access irs tax forms. Persons with a hearing or speech disability with access to. This notice hereby modifies part h of the 2003.

Persons with a hearing or speech disability with access to. Web downloaded a copy for your records. Ad access irs tax forms. Your consent to receive irs forms electronically will be. Complete, edit or print tax forms instantly. Web when you submit your 1099 forms, emails will be sent out to all recipients asking for their consent to receive their statement electronically. Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). The portal is to be modeled after a social security. For payees who do not provide consent, or who withdraw their. See the instructions for form.

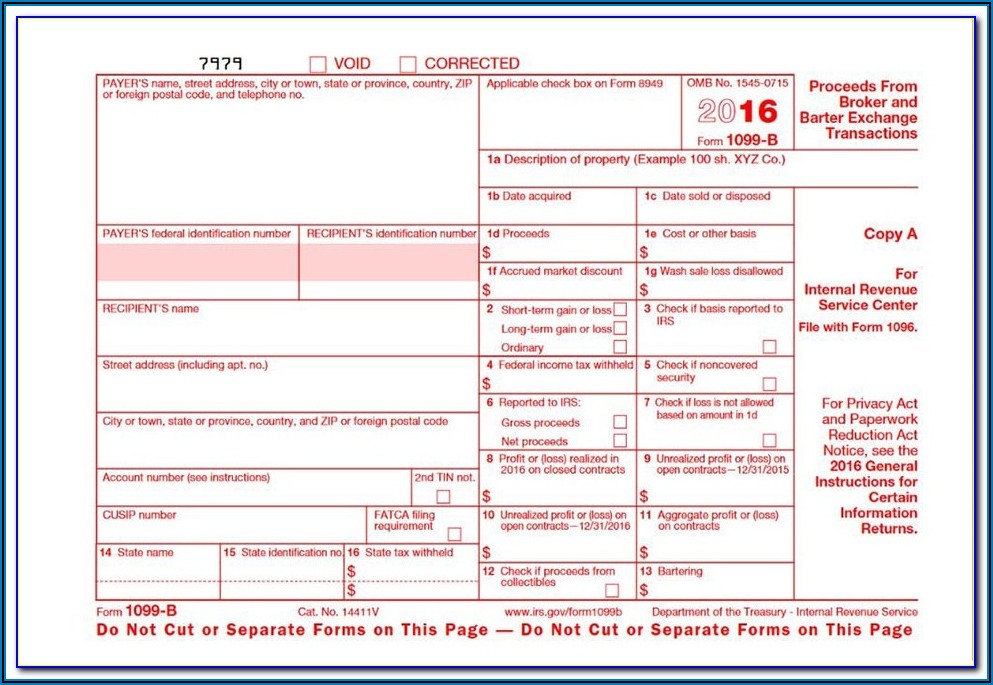

Form 1099 Electronic Filing Requirements Universal Network

Persons with a hearing or speech disability with access to. The portal is to be modeled after a social security. Web when you submit your 1099 forms, emails will be sent out to all recipients asking for their consent to receive their statement electronically. The recipients who give their consent. Web you may withdraw your consent to paperless delivery by.

Electronic IRS Form 1099H 2018 2019 Printable PDF Sample

Web the act requires irs to develop an internet portal by january 1, 2023 that allows taxpayers to electronically file forms 1099. Web informing your contractor that you will provide a paper copy if they do not consent to an electronic form. Before you can issue a form 1099 electronically,. The portal is to be modeled after a social security..

Digital Consent Form Fill Online, Printable, Fillable, Blank pdfFiller

Or (2) by email to gw_e1099@gwu.edu. Get ready for tax season deadlines by completing any required tax forms today. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. This notice hereby modifies part h of the 2003. Explaining how they can withdraw consent, get a paper.

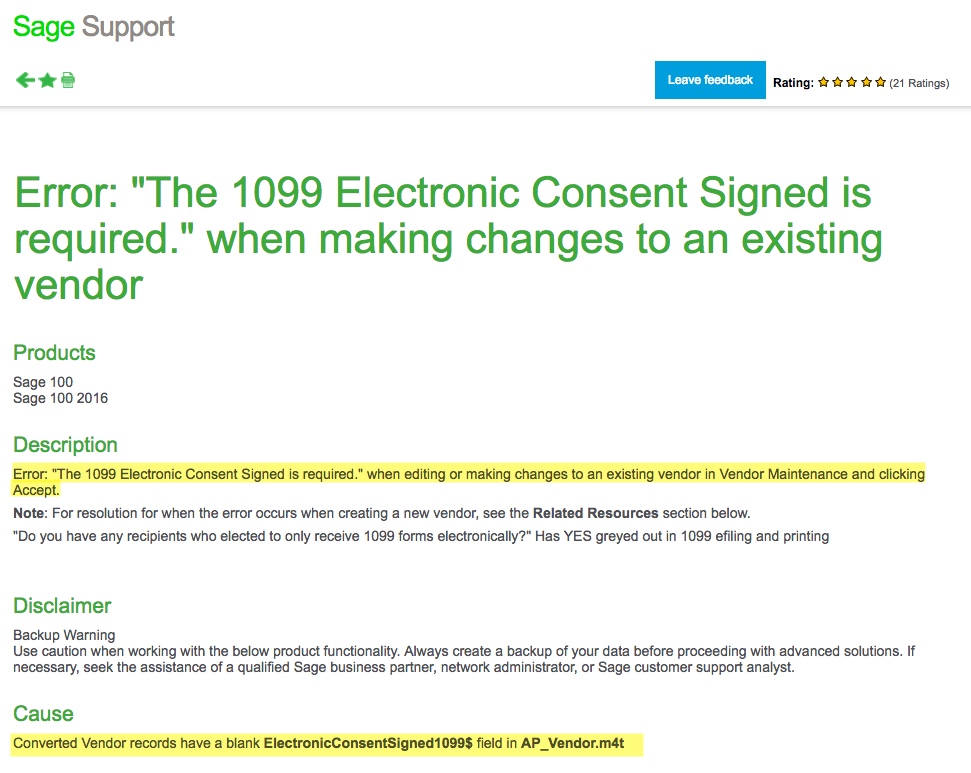

Fixed Sage 100 Upgrade Bug The 1099 Electronic Consent Signed is

Web when you submit your 1099 forms, emails will be sent out to all recipients asking for their consent to receive their statement electronically. Web you may withdraw your consent to paperless delivery by providing written notice either (1) by mail at the address set forth above; If a furnisher does not obtain affirmative consent, they. Web to provide 1099.

Efile 2022 Form 1099R Report the Distributions from Pensions

Persons with a hearing or speech disability with access to. Or (2) by email to gw_e1099@gwu.edu. Explaining how they can withdraw consent, get a paper. The recipients who give their consent. Web downloaded a copy for your records.

Form 1099 Electronic Filing Requirements Form Resume Template

Ad access irs tax forms. The portal is to be modeled after a social security. For payees who do not provide consent, or who withdraw their. See the instructions for form. Web downloaded a copy for your records.

Electronic Filing W2 Consent Form (Example)

Get ready for tax season deadlines by completing any required tax forms today. Web informing your contractor that you will provide a paper copy if they do not consent to an electronic form. Web downloaded a copy for your records. Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). See.

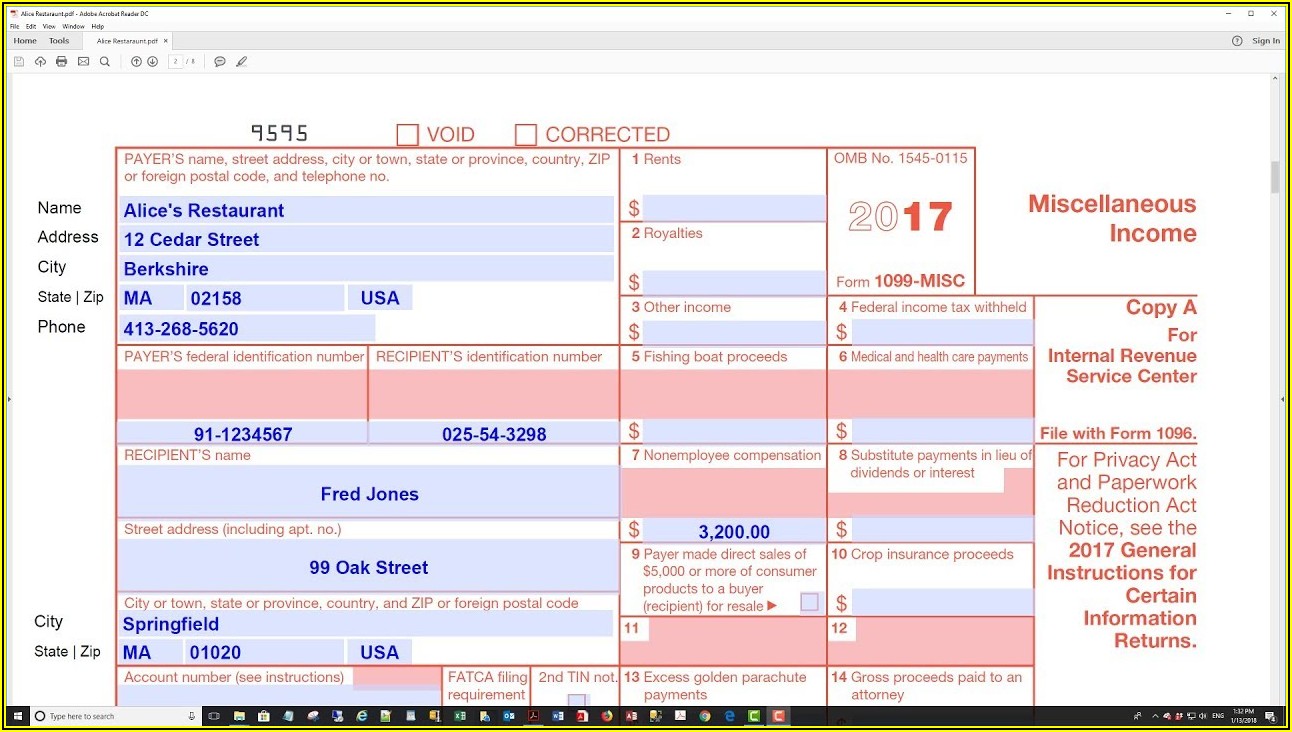

Irs Form 1099 Misc Form Resume Examples dP9l7NZW2R

Web the act requires irs to develop an internet portal by january 1, 2023 that allows taxpayers to electronically file forms 1099. Web downloaded a copy for your records. Web electronic delivery of forms 1099 suggest edits abound® facilitates an electronic delivery of irs forms 1099. Web when you submit your 1099 forms, emails will be sent out to all.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Before you can issue a form 1099 electronically,. Before furnishing the statements electronically, the business. This notice hereby modifies part h of the 2003. Get ready for tax season deadlines by completing any required tax forms today. Persons with a hearing or speech disability with access to.

Electronic W2 Consent Form

Explaining how they can withdraw consent, get a paper. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Persons with a hearing or speech disability with access to. Web informing your contractor that you will provide a paper copy if they do not consent to an electronic form. See the.

You May Also Have A Filing Requirement.

Web the act requires irs to develop an internet portal by january 1, 2023 that allows taxpayers to electronically file forms 1099. Explaining how they can withdraw consent, get a paper. Or (2) by email to gw_e1099@gwu.edu. Before you can issue a form 1099 electronically,.

See The Instructions For Form.

Web when you submit your 1099 forms, emails will be sent out to all recipients asking for their consent to receive their statement electronically. Ad access irs tax forms. The recipients who give their consent. Before furnishing the statements electronically, the business.

The Portal Is To Be Modeled After A Social Security.

Web downloaded a copy for your records. Your consent to receive irs forms electronically will be. If a furnisher does not obtain affirmative consent, they. Web electronic delivery of forms 1099 suggest edits abound® facilitates an electronic delivery of irs forms 1099.

Web To Provide 1099 Electronically, You Must Follow The Below Instructions:

Web informing your contractor that you will provide a paper copy if they do not consent to an electronic form. This notice hereby modifies part h of the 2003. Web the below information you choose to have your irs form 1099 delivered electronically, please check the box to indicate your affirmative consent and sign electronically. Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris).

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)