Form 1310 Electronic Filing

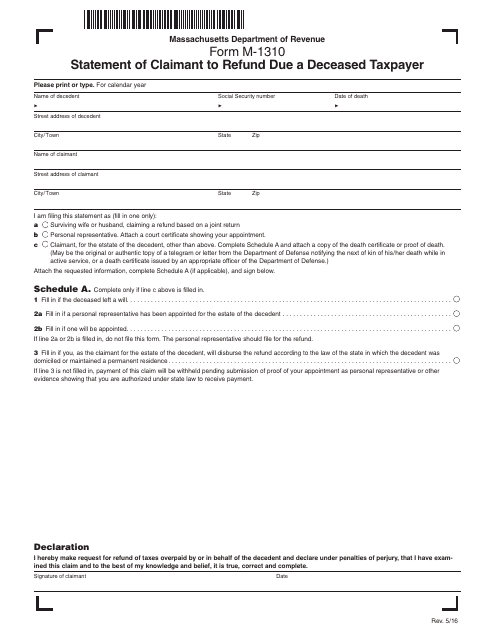

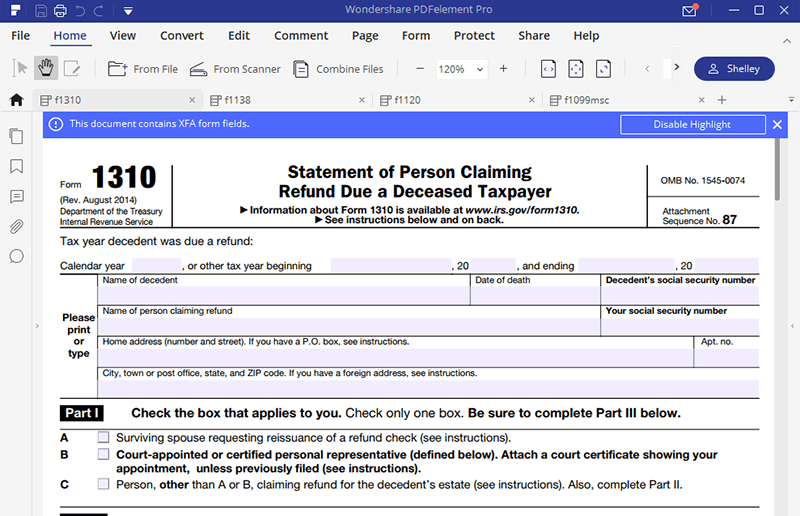

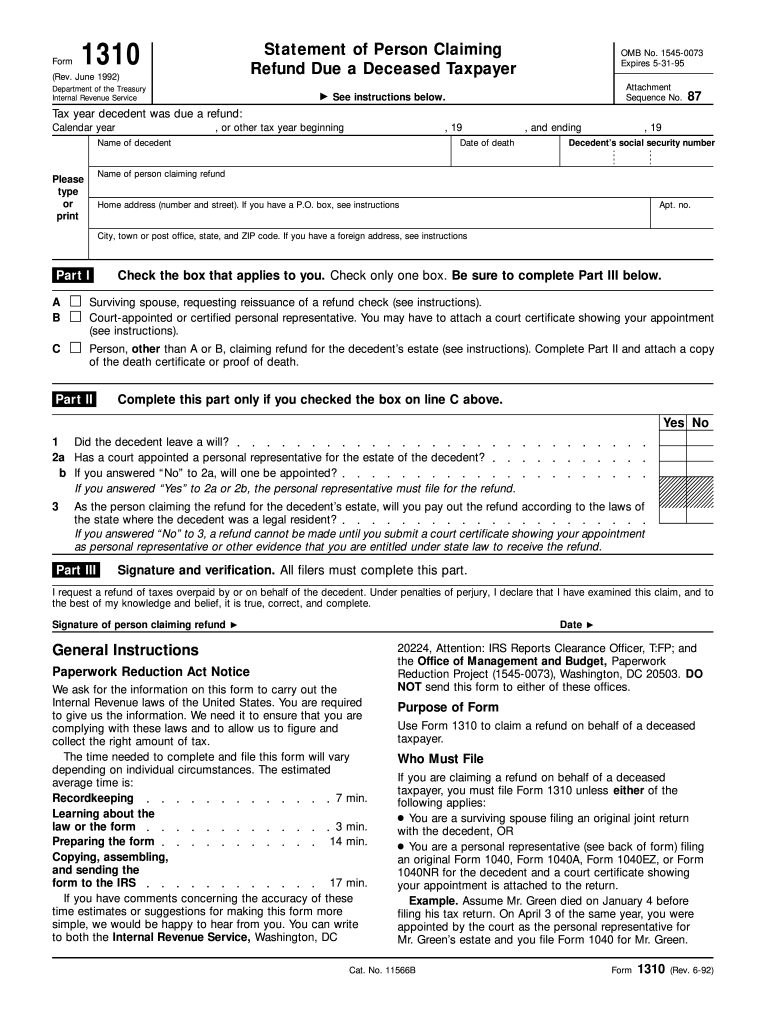

Form 1310 Electronic Filing - Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless. Then you have to provide all other required information in the. Web to access form 1310 in the taxact program: Statement of person claiming refund due a deceased taxpayer should be available on 03/04/21. In care of addresseeelectronic filing information worksheet. Complete, edit or print tax forms instantly. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Edit, sign and save irs 1310 form. Although turbotax fills out the 1310 internally, it does not include it when you print you returns for filing or for.

Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web 9 rows the irs has set specific electronic filing guidelines for form 1310. Complete, edit or print tax forms instantly. Web electronic filing guidelines for form 1310 (1040) the irs has set specific electronic filing guidelines for form 1310. Then you have to provide all other required information in the. Where to file if you checked. Edit, sign and save irs 1310 form. Web if a refund is due to the decedent, it may be necessary to file form 1310, statement of person claiming refund due a deceased taxpayer with the return. Statement of person claiming refund due a deceased taxpayer should be available on 03/04/21. Complete, edit or print tax forms instantly.

Although turbotax fills out the 1310 internally, it does not include it when you print you returns for filing or for. Web to access form 1310 in the taxact program: Edit, sign and save irs 1310 form. Where to file if you checked. At the top of the form, you’ll provide identifying information such as the tax year, the decedent’s social security. Web about publication 559, survivors, executors and administrators. In care of addresseeelectronic filing information worksheet. Publication 559 is designed to help those in charge (personal representatives) of the property. Web fortunately, the form is very simple to complete. If data entry on the 1310 screen does not meet the irs.

1992 Form IRS 1310 Fill Online, Printable, Fillable, Blank pdfFiller

Web this information includes name, address, and the social security number of the person who is filing the tax return. Web about publication 559, survivors, executors and administrators. Web to access form 1310 in the taxact program: Complete, edit or print tax forms instantly. Where to file if you checked.

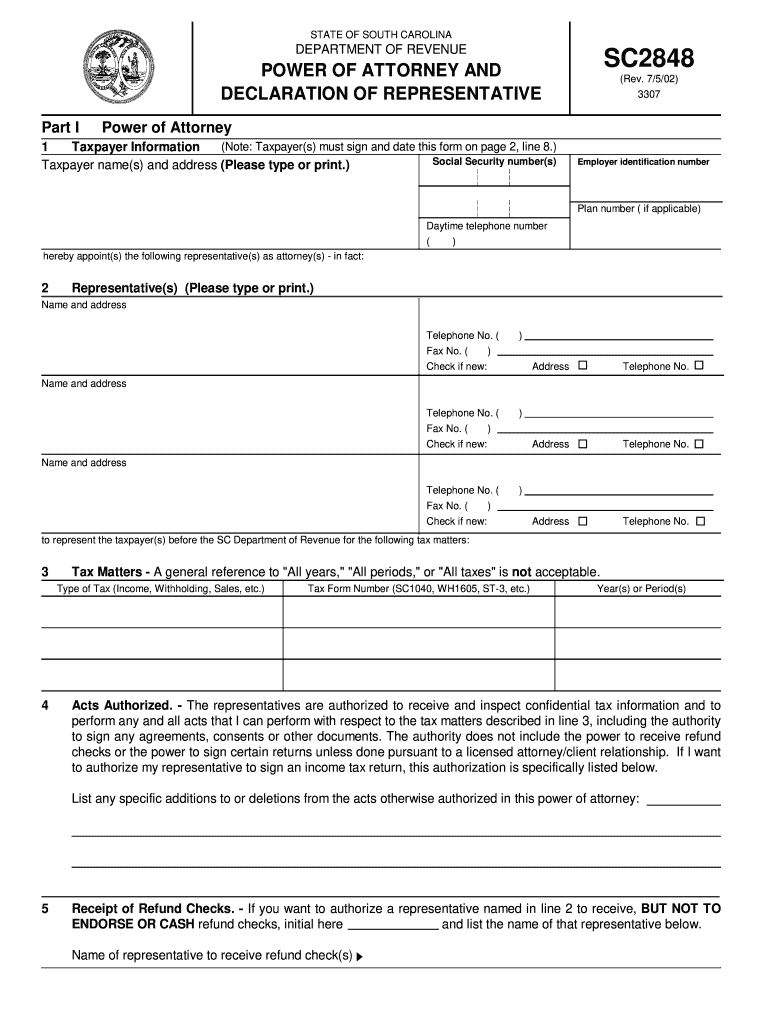

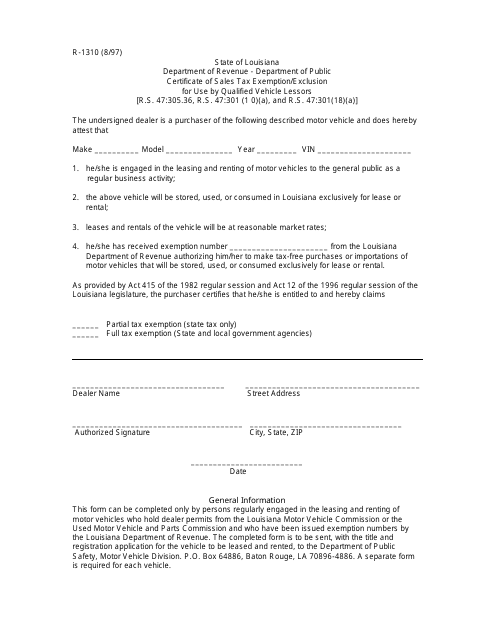

Form R1310 Download Fillable PDF or Fill Online Certificate of Sales

Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. For form 1310 to be generated, the date of death field on screen 1 must. Web if a refund is due to the decedent, it may be necessary to file form 1310, statement of person claiming refund due a deceased taxpayer with.

Form 1310 Definition

Web fortunately, the form is very simple to complete. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web 9 rows the irs has set specific electronic filing guidelines for form 1310. Get ready for tax season deadlines by completing any required tax forms today. At the top of the form, you’ll provide identifying information.

Form 1310 Major Errors Intuit Accountants Community

Web about publication 559, survivors, executors and administrators. Edit, sign and save irs 1310 form. Web up to $40 cash back the penalty for the late filing of irs form 1310 is 5% of the amount due for each month or part of a month that the form is late, up to a maximum of 25%. For form 1310 to.

Fill Free fillable Form 1310 Claiming Refund Due a Deceased Taxpayer

Although turbotax fills out the 1310 internally, it does not include it when you print you returns for filing or for. Where to file if you checked. Edit, sign and save irs 1310 form. Ad access irs tax forms. Then you have to provide all other required information in the.

Irs Form 1310 Printable Master of Documents

Complete, edit or print tax forms instantly. Publication 559 is designed to help those in charge (personal representatives) of the property. Web the final return of a deceased taxpayer may be eligible for electronic filing in the following situations: From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of.

1999 Form MI MI1310 Fill Online, Printable, Fillable, Blank pdfFiller

Where to file if you checked. Web electronic filing guidelines for form 1310 (1040) the irs has set specific electronic filing guidelines for form 1310. Edit, sign and save irs 1310 form. Publication 559 is designed to help those in charge (personal representatives) of the property. In care of addresseeelectronic filing information worksheet.

SRRoberts > Forms > Tax Forms

Web this information includes name, address, and the social security number of the person who is filing the tax return. Web fortunately, the form is very simple to complete. You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to. Web about publication 559, survivors, executors.

Irs Form W4V Printable Fillable W 4v Form Fill Online, Printable

Web this information includes name, address, and the social security number of the person who is filing the tax return. Ad access irs tax forms. Web electronic filing guidelines for form 1310 (1040) the irs has set specific electronic filing guidelines for form 1310. If data entry on the 1310 screen does not meet the irs. Web the final return.

SC DoR SC2848 2002 Fill out Tax Template Online US Legal Forms

Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless. Statement of person claiming refund due a deceased taxpayer should be available on 03/04/21. Web if a refund is due to the decedent, it may be necessary to file form 1310, statement of person claiming refund due a deceased.

For Form 1310 To Be Generated, The Date Of Death Field On Screen 1 Must.

Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless. Web this information includes name, address, and the social security number of the person who is filing the tax return. Although turbotax fills out the 1310 internally, it does not include it when you print you returns for filing or for. Then you have to provide all other required information in the.

Web About Publication 559, Survivors, Executors And Administrators.

Web the final return of a deceased taxpayer may be eligible for electronic filing in the following situations: Web if a refund is due to the decedent, it may be necessary to file form 1310, statement of person claiming refund due a deceased taxpayer with the return. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen,. Edit, sign and save irs 1310 form.

Where To File If You Checked.

You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to. Web 9 rows the irs has set specific electronic filing guidelines for form 1310. Complete, edit or print tax forms instantly. Statement of person claiming refund due a deceased taxpayer should be available on 03/04/21.

In Care Of Addresseeelectronic Filing Information Worksheet.

Ad access irs tax forms. If data entry on the 1310 screen does not meet the irs. Web to access form 1310 in the taxact program: Publication 559 is designed to help those in charge (personal representatives) of the property.

:max_bytes(150000):strip_icc()/1310-RefundClaimDuetoDeceasedTaxpayer-1-292bd14843c94bf4abf09ea5d6eb9a4b.png)