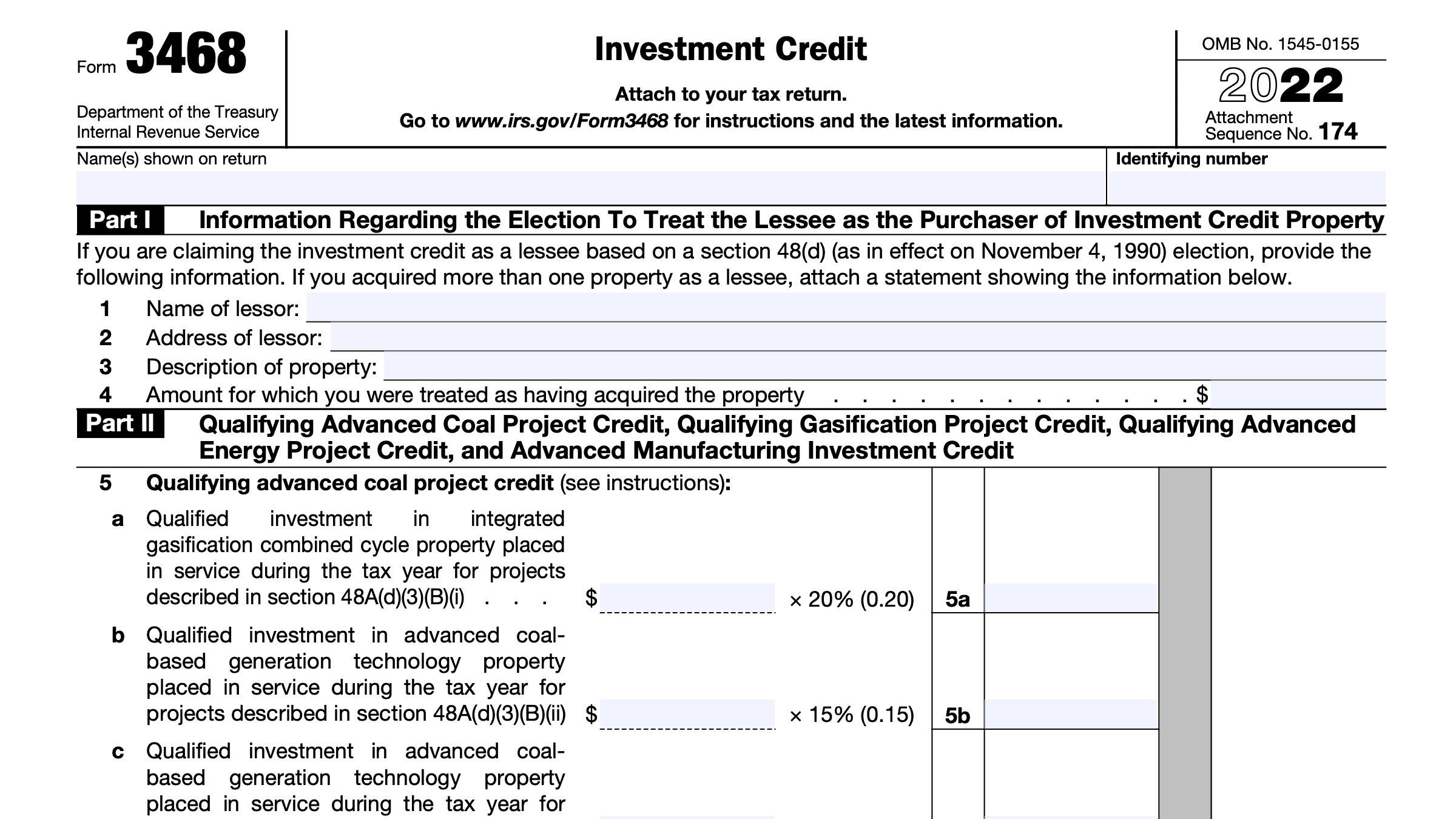

Investment Credit Form 3468

Investment Credit Form 3468 - You must complete part i to claim the credit if you lease the property from someone else and. Web to enter investment credit information: Irs form 3468 is often used in. Web form 3468 has three sections, but most taxpayers do not need to complete all three: Form 3468 will be produced only if there's a certified historic structure, and then only lines 11h and 11i will. The investment tax credit is part of the general business credit. The investment credit consists of the rehabilitation, energy, qualifying advanced coal project, qualifying gasification project,. 7th street kansas city, mo. Web purpose of form use form 3468 to claim the investment credit. From the input return tab, go to schedule k ⮕ credits ⮕ other credits.

Web the federal tax code includes a variety of tax credits designed to promote different types of investment. 7th street kansas city, mo. You can figure this credit on form 3468: The investment credit consists of the following credits. Taxpayers claim many of these credits using irs form. Irs form 3468 is often used in. Web the miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of revenue, and are listed. Go to the investment & research tab. Web form 3468 is a federal corporate income tax form. You must complete part i to claim the credit if you lease the property from someone else and.

Each dollar of tax credit offsets one dollar of taxes due. Go to the investment & research tab. Web a project can claim htc equal to 20% of qualified expenses. The investment credit consists of the following credits. Form 3468 will be produced only if there's a certified historic structure, and then only lines 11h and 11i will. Web form 3468 is used to compute the investment credit; Web use form 3468 to claim the investment credit. 7th street kansas city, mo. Web form 3468 investment credit information can be entered in screen 20.2, other credits in the investment credit (3468) section. The investment credit consists of the rehabilitation, energy, qualifying advanced coal project, qualifying gasification project,.

Form 3468 Investment Credit (2015) Free Download

Web use form 3468 to claim the investment credit. We do not accept cash, traveler’s checks, money orders, credit card convenience checks, counter checks, or starter checks. Go to www.irs.gov/form3468 for instructions and the latest. Web to enter investment credit information: Web the miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the.

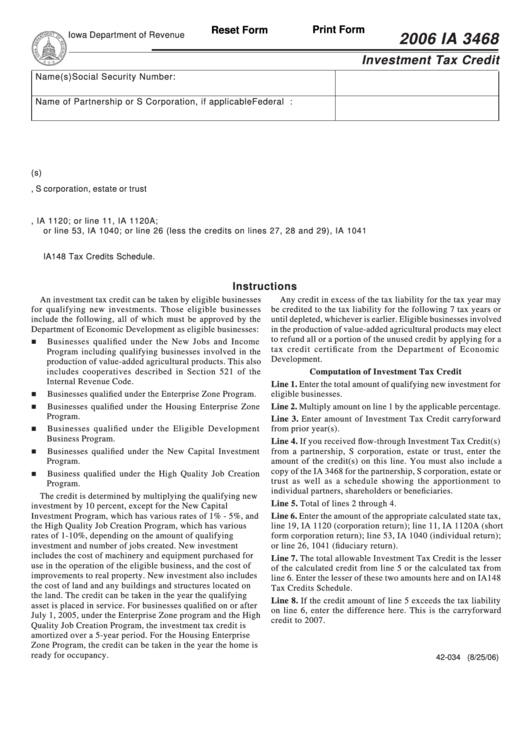

Fillable Form Ia 3468 Investment Tax Credit Iowa Department Of

7th street kansas city, mo. Web the miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of revenue, and are listed. Web you must attach a statement to form 3468 to claim section 48d advanced manufacturing investment credit that includes the following information. Web the credit flows from form 3468.

Form 3468 Investment Credit

Web invesco investment services, inc. Taxpayers claim many of these credits using irs form. The investment credit is composed of various credits including the business energy credit. Web what is the investment credit, form 3468? 7th street kansas city, mo.

Form 3468 Investment Credit Documentshelper

The tax credit directly reduces income taxes owed. Each dollar of tax credit offsets one dollar of taxes due. You must complete part i to claim the credit if you lease the property from someone else and. See generating form 3468 investment credit. Box 219078 c/o dst systems, inc.

Instructions for Form 3468, Investment Credit

7th street kansas city, mo. Go to www.irs.gov/form3468 for instructions and the latest. The investment credit consists of the following credits. Be sure you are still eligible to claim the credit by. Fill out the investment credit online and print it out for free.

IRS Form 3468 Guide to Claiming the Investment Tax Credit

Box 219078 c/o dst systems, inc. Web use form 3468 to claim the investment credit. Web you must attach a statement to form 3468 to claim section 48d advanced manufacturing investment credit that includes the following information. Fill out the investment credit online and print it out for free. The investment credit consists of the rehabilitation, energy, qualifying advanced coal.

Instructions for Form 3468, Investment Credit

Web form 3468 investment credit information can be entered in screen 20.2, other credits in the investment credit (3468) section. Irs form 3468 is often used in. See generating form 3468 investment credit. Web invesco investment services, inc. Taxpayers claim many of these credits using irs form.

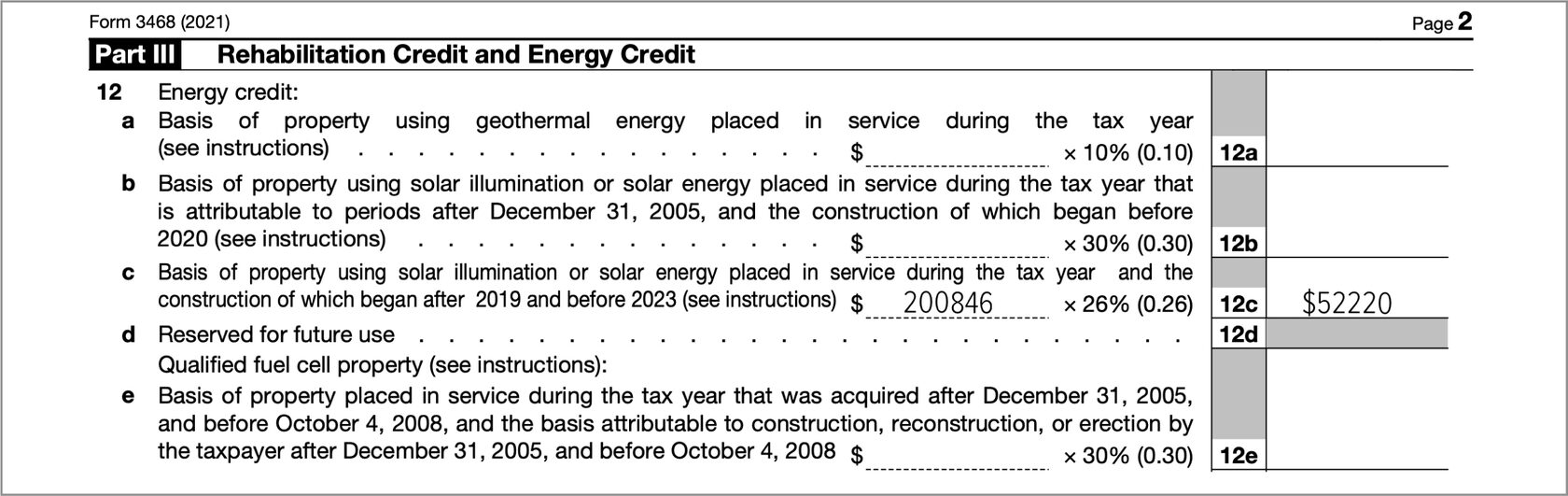

How do I claim the solar tax credit? A1 Solar Store

See generating form 3468 investment credit. Web what is the investment credit, form 3468? Web the credit flows from form 3468 to form 3800 to show on form 1040. Web form 3468 investment credit information can be entered in screen 20.2, other credits in the investment credit (3468) section. Web the miscellaneous tax credits offered by the state of missouri,.

IRS Form 3468 Download Fillable PDF or Fill Online Investment Credit

The tax credit directly reduces income taxes owed. Web form 3468 department of the treasury internal revenue service (99) investment credit attach to your tax return. Web what is the investment credit, form 3468? Web form 3468 is a federal corporate income tax form. Go to www.irs.gov/form3468 for instructions and the latest.

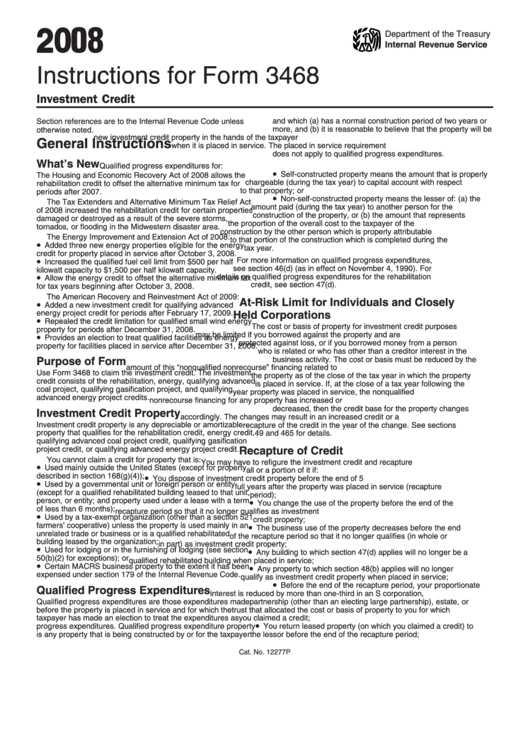

Instructions For Form 3468 Investment Credit 2008 printable pdf

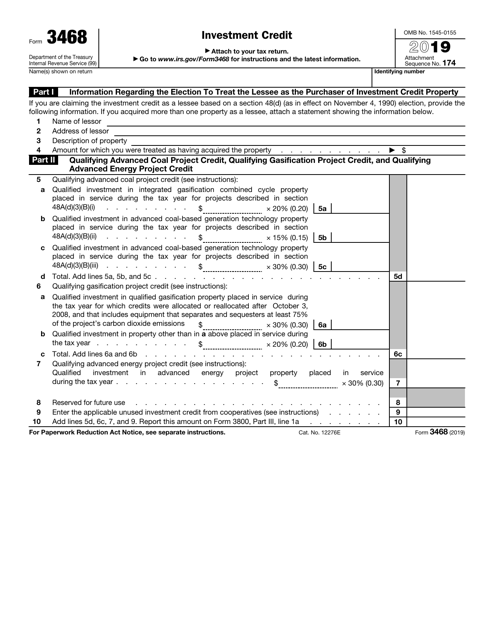

Beginning in tax year 2018, changes have been made to the investment credit. Each dollar of tax credit offsets one dollar of taxes due. Box 219078 c/o dst systems, inc. Web form 3468 is used to compute the investment credit; The credit amounts on form 3468 do not calculate in the.

Web June 14, 2017.

You must complete part i to claim the credit if you lease the property from someone else and. Web the miscellaneous tax credits offered by the state of missouri, are administered by several government agencies including the missouri department of revenue, and are listed. Web the federal tax code includes a variety of tax credits designed to promote different types of investment. Web form 3468 has three sections, but most taxpayers do not need to complete all three:

Web You Must Attach A Statement To Form 3468 To Claim Section 48D Advanced Manufacturing Investment Credit That Includes The Following Information.

The investment credit consists of the following credits. Web a project can claim htc equal to 20% of qualified expenses. Web form 3468 investment credit information can be entered in screen 20.2, other credits in the investment credit (3468) section. Go to the investment & research tab.

Web Form 3468 Department Of The Treasury Internal Revenue Service (99) Investment Credit Attach To Your Tax Return.

Beginning in tax year 2018, changes have been made to the investment credit. Web form 3468 is a federal corporate income tax form. The investment tax credit is part of the general business credit. Form 3468 will be produced only if there's a certified historic structure, and then only lines 11h and 11i will.

From The Input Return Tab, Go To Schedule K ⮕ Credits ⮕ Other Credits.

Each dollar of tax credit offsets one dollar of taxes due. You can figure this credit on form 3468: 7th street kansas city, mo. The investment credit is composed of various credits including the business energy credit.