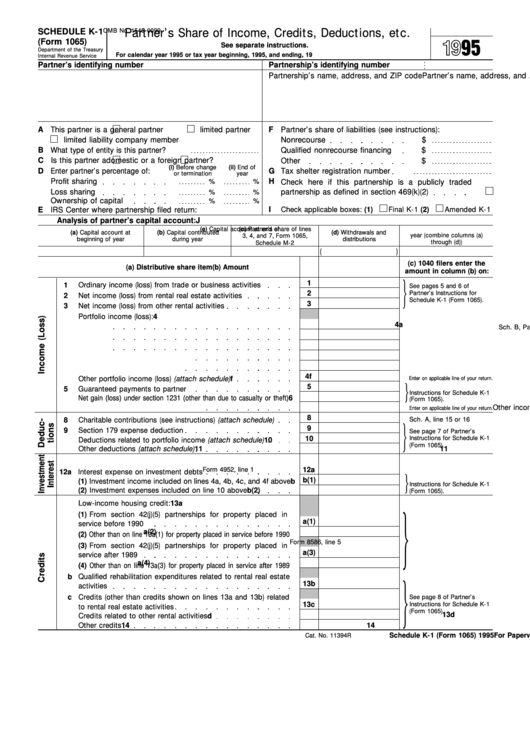

Form 1065 K-1 Codes

Form 1065 K-1 Codes - Page numbers refer to this instruction. Code y is used to report information related to the net investment income tax. Determine whether the income (loss) is passive or nonpassive and enter on your return as follows. Passive loss see page 8 If an election has not already been made, you may elect to include section 951 Former code y (other information) is now code z. For calendar year 2022, or tax year beginning / / 2022. 1 ordinary business income (loss) a, b form 8582 lines 1 or 3 to figure the amount to report on sch e, line 28 columns (f) or (g) ordinary business income (loss) c, d schedule e, line 28, column (h) or (j) 2 net rental real estate. Part i information about the partnership. Department of the treasury internal revenue service.

See back of form and separate instructions. Department of the treasury internal revenue service. Determine whether the income (loss) is passive or nonpassive and enter on your return as follows. Passive loss see page 8 Code y is used to report information related to the net investment income tax. 1 ordinary business income (loss) a, b form 8582 lines 1 or 3 to figure the amount to report on sch e, line 28 columns (f) or (g) ordinary business income (loss) c, d schedule e, line 28, column (h) or (j) 2 net rental real estate. Web recovery startup business, before january 1, 2022). Part i information about the partnership. Former code y (other information) is now code z. Page numbers refer to this instruction.

Passive loss see page 8 1 ordinary business income (loss) a, b form 8582 lines 1 or 3 to figure the amount to report on sch e, line 28 columns (f) or (g) ordinary business income (loss) c, d schedule e, line 28, column (h) or (j) 2 net rental real estate. Former code y (other information) is now code z. Department of the treasury internal revenue service. Ending / / partner’s share of income, deductions, credits, etc. For calendar year 2022, or tax year beginning / / 2022. Determine whether the income (loss) is passive or nonpassive and enter on your return as follows. Part i information about the partnership. Page numbers refer to this instruction. Code y is used to report information related to the net investment income tax.

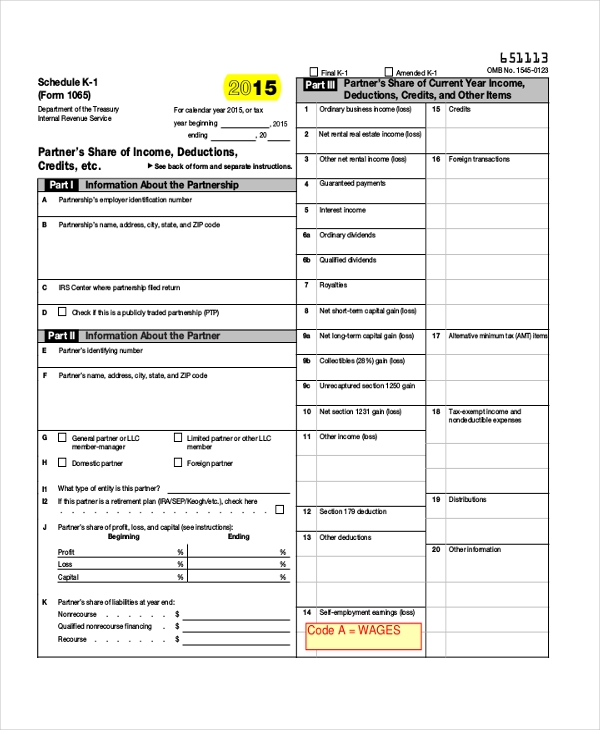

Schedule K1 (Form 1065) Partner'S Share Of Credits

Part i information about the partnership. If an election has not already been made, you may elect to include section 951 For calendar year 2022, or tax year beginning / / 2022. Page numbers refer to this instruction. Ending / / partner’s share of income, deductions, credits, etc.

Form 1065 (Schedule K1) Partner's Share of Deductions and

Page numbers refer to this instruction. Ending / / partner’s share of income, deductions, credits, etc. If an election has not already been made, you may elect to include section 951 Determine whether the income (loss) is passive or nonpassive and enter on your return as follows. Part i information about the partnership.

Schedule K1 Form 1065 Self Employment Tax Employment Form

Department of the treasury internal revenue service. If an election has not already been made, you may elect to include section 951 Page numbers refer to this instruction. Former code y (other information) is now code z. See back of form and separate instructions.

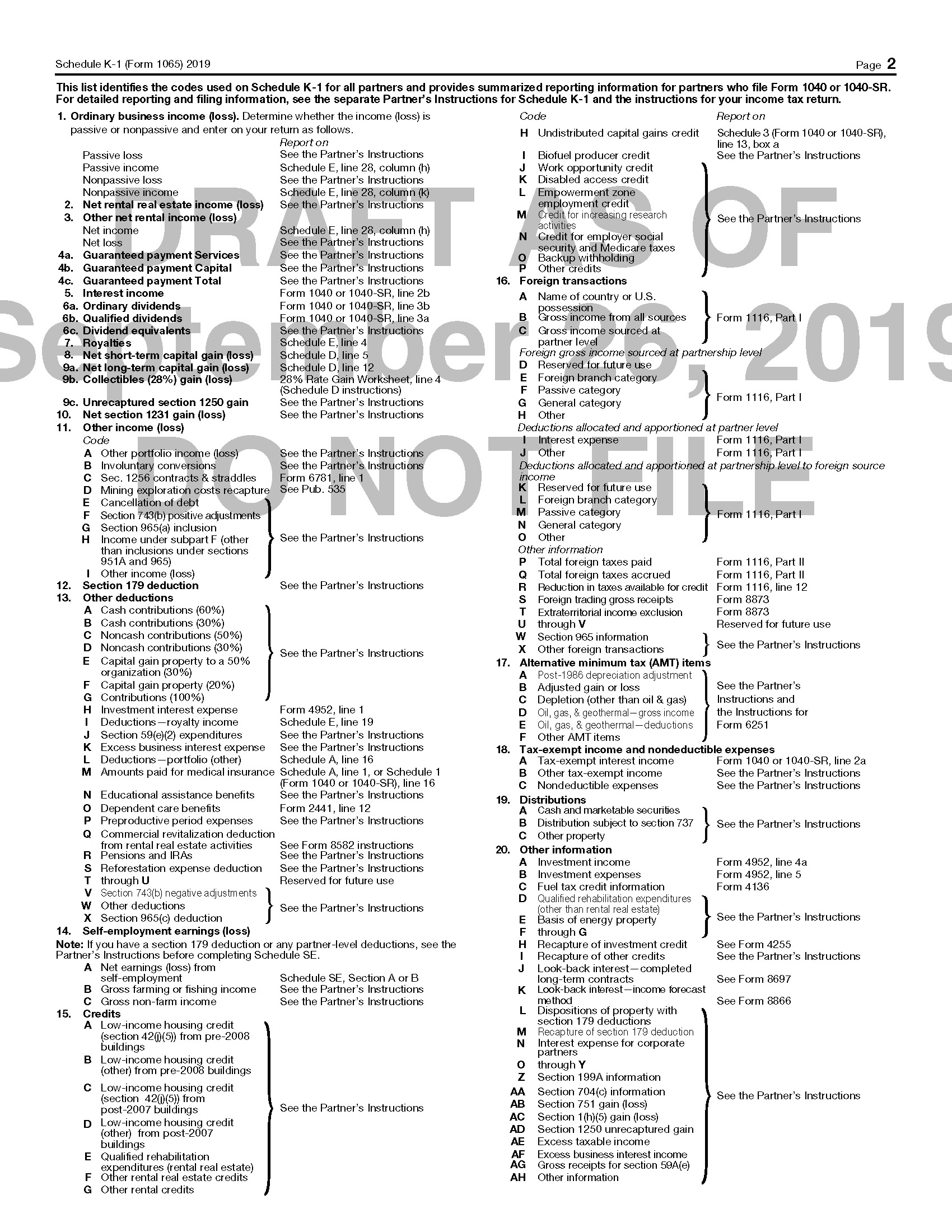

Drafts of 2019 Forms 1065 and 1120S, As Well As K1s, Issued by IRS

See back of form and separate instructions. If an election has not already been made, you may elect to include section 951 Code y is used to report information related to the net investment income tax. For calendar year 2022, or tax year beginning / / 2022. Department of the treasury internal revenue service.

Form 7 Box 7 Codes 7 Precautions You Must Take Before Attending Form 7

If an election has not already been made, you may elect to include section 951 Passive loss see page 8 Determine whether the income (loss) is passive or nonpassive and enter on your return as follows. Page numbers refer to this instruction. Department of the treasury internal revenue service.

IRS changes Form 1065 and the Form 1065 K1 for 2019 December 17, 2019

1 ordinary business income (loss) a, b form 8582 lines 1 or 3 to figure the amount to report on sch e, line 28 columns (f) or (g) ordinary business income (loss) c, d schedule e, line 28, column (h) or (j) 2 net rental real estate. Page numbers refer to this instruction. Part i information about the partnership. Department.

Form 1065 (Schedule K1) Partner's Share of Deductions and

Page numbers refer to this instruction. Part i information about the partnership. Ending / / partner’s share of income, deductions, credits, etc. Code y is used to report information related to the net investment income tax. Web recovery startup business, before january 1, 2022).

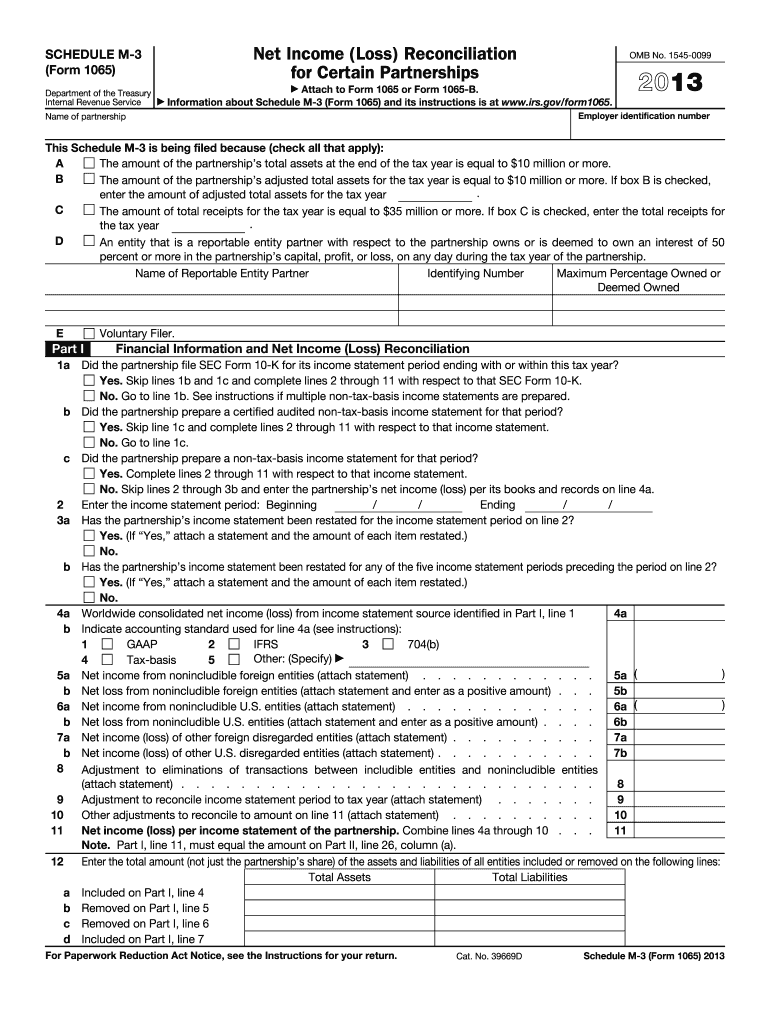

2013 Form IRS 1065 Schedule M3 Fill Online, Printable, Fillable

Department of the treasury internal revenue service. Passive loss see page 8 For calendar year 2022, or tax year beginning / / 2022. If an election has not already been made, you may elect to include section 951 Determine whether the income (loss) is passive or nonpassive and enter on your return as follows.

5 Changes to Note on New Draft of 2019 Form 1065 K1 October 11, 2019

Former code y (other information) is now code z. Part i information about the partnership. Department of the treasury internal revenue service. Passive loss see page 8 See back of form and separate instructions.

Code Y Is Used To Report Information Related To The Net Investment Income Tax.

Former code y (other information) is now code z. Department of the treasury internal revenue service. Passive loss see page 8 For calendar year 2022, or tax year beginning / / 2022.

Web Recovery Startup Business, Before January 1, 2022).

See back of form and separate instructions. Determine whether the income (loss) is passive or nonpassive and enter on your return as follows. Ending / / partner’s share of income, deductions, credits, etc. Page numbers refer to this instruction.

Part I Information About The Partnership.

If an election has not already been made, you may elect to include section 951 1 ordinary business income (loss) a, b form 8582 lines 1 or 3 to figure the amount to report on sch e, line 28 columns (f) or (g) ordinary business income (loss) c, d schedule e, line 28, column (h) or (j) 2 net rental real estate.