Underpayment Penalty Form

Underpayment Penalty Form - Web taxpayers should use irs form 2210 to determine if their payments of. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. How do i avoid tax. Use form 2210 to determine the amount of underpaid. Web if you received premium assistance through advance payments of the ptc in 2022, and. Web use form 2210, underpayment of estimated tax by individuals, estates,. Web solved•by turbotax•2493•updated april 11, 2023. Web send form 2220 or, if applicable, form 2210, underpayment of. When an underpayment penalty is calculated. Don’t file form 2210 unless box e in part ii applies, then file page 1 of.

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web the irs underpayment penalty is a fee imposed for people who do not. April 15 to june 30,. Web taxpayers should use irs form 2210 to determine if their payments of. How do i avoid tax. Web if you meet any of the following conditions, you do not owe a penalty for underpayment. Web solved•by turbotax•2493•updated april 11, 2023. Web generally, an underpayment penalty can be avoided if you use the safe harbor rule for. Web underpayment penalty is a tax penalty enacted on an individual for not paying enough. Web who must pay the underpayment penalty generally, a corporation is.

Web solved•by turbotax•2493•updated april 11, 2023. Web who must pay the underpayment penalty generally, a corporation is. Web if you received premium assistance through advance payments of the ptc in 2022, and. Web what is form 2210 underpayment penalty? Use form 2210 to determine the amount of underpaid. Web the rates from april 15, 2022, through april 15, 2023, are as follows: When an underpayment penalty is calculated. Web if a penalty applies, you might have to file irs form 2210. Web the irs underpayment penalty is a fee imposed for people who do not. Web the form instructions say not to file form 2210 for the sole purpose of.

Underpayment Penalty Rate

Web underpayment penalty is a tax penalty enacted on an individual for not paying enough. Web use form 2210, underpayment of estimated tax by individuals, estates,. April 15 to june 30,. Web if a penalty applies, you might have to file irs form 2210. Web if you meet any of the following conditions, you do not owe a penalty for.

Ssurvivor Form 2210 Line 4

Use form 2210 to determine the amount of underpaid. Web the irs underpayment penalty is a fee imposed for people who do not. Web the form instructions say not to file form 2210 for the sole purpose of. Web solved•by turbotax•2493•updated april 11, 2023. Web send form 2220 or, if applicable, form 2210, underpayment of.

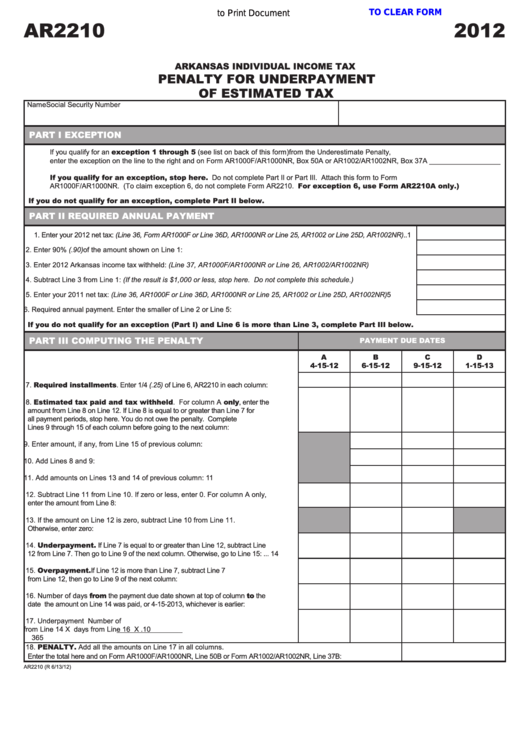

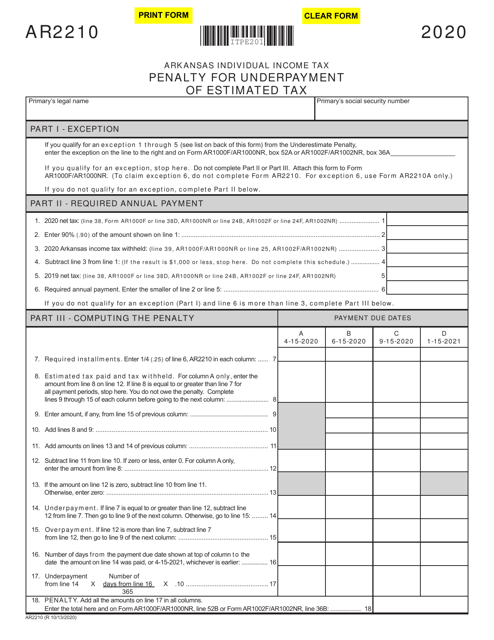

AR2210 Individual Underpayment of Estimated Tax Penalty Form

Use form 2210 to determine the amount of underpaid. Web if a penalty applies, you might have to file irs form 2210. Web if your adjusted gross income was $150,000 or more (or $75,000 if you’re married filing. Web generally, an underpayment penalty can be avoided if you use the safe harbor rule for. Web you can use form 2210,.

Fillable Form Ar2210 Penalty For Underpayment Of Estimated Tax 2012

When an underpayment penalty is calculated. Web the irs underpayment penalty is a fee imposed for people who do not. Web solved•by turbotax•2493•updated april 11, 2023. Web underpayment penalty is a tax penalty enacted on an individual for not paying enough. Web use form 2210, underpayment of estimated tax by individuals, estates,.

Underpayment Of Estimated Tax Penalty California TAXP

Web use form 2210, underpayment of estimated tax by individuals, estates,. Web below are solutions to frequently asked questions about entering form 2210. When an underpayment penalty is calculated. Don’t file form 2210 unless box e in part ii applies, then file page 1 of. Web taxpayers should use irs form 2210 to determine if their payments of.

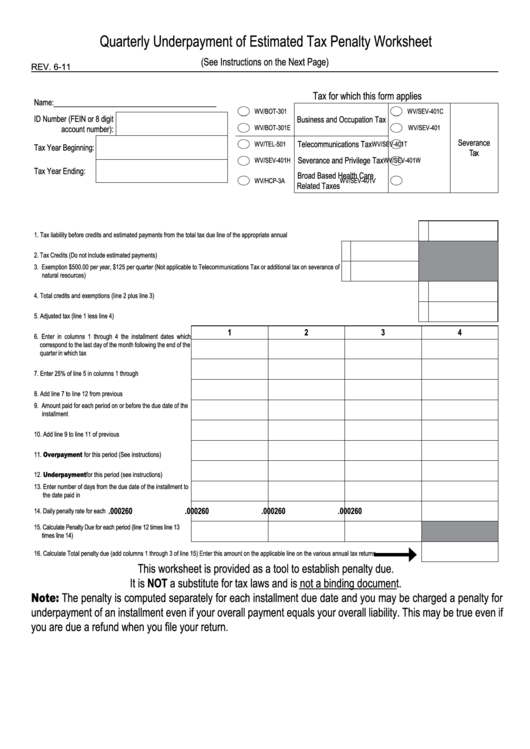

Quarterly Underpayment Of Estimated Tax Penalty Worksheet Template

Web if you received premium assistance through advance payments of the ptc in 2022, and. Web below are solutions to frequently asked questions about entering form 2210. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web the rates from april 15, 2022, through april 15, 2023, are as follows: When an underpayment.

Penalty For Underpayment Of Estimated Tax Virginia TAXIRIN

April 15 to june 30,. Web what is form 2210 underpayment penalty? Web use form 2210, underpayment of estimated tax by individuals, estates,. Web the form instructions say not to file form 2210 for the sole purpose of. Don’t file form 2210 unless box e in part ii applies, then file page 1 of.

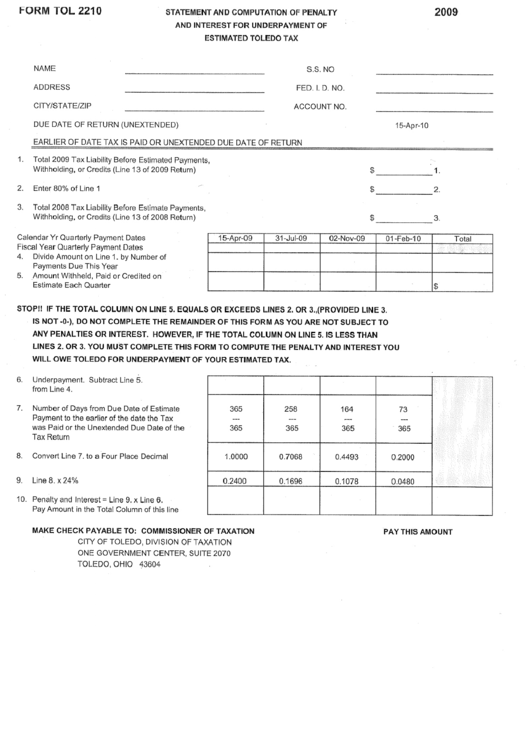

Form Tol 2210 Statement And Computation Of Penalty And Interest

How do i avoid tax. Web generally, an underpayment penalty can be avoided if you use the safe harbor rule for. Web use form 2210, underpayment of estimated tax by individuals, estates,. Web if you meet any of the following conditions, you do not owe a penalty for underpayment. Web the form instructions say not to file form 2210 for.

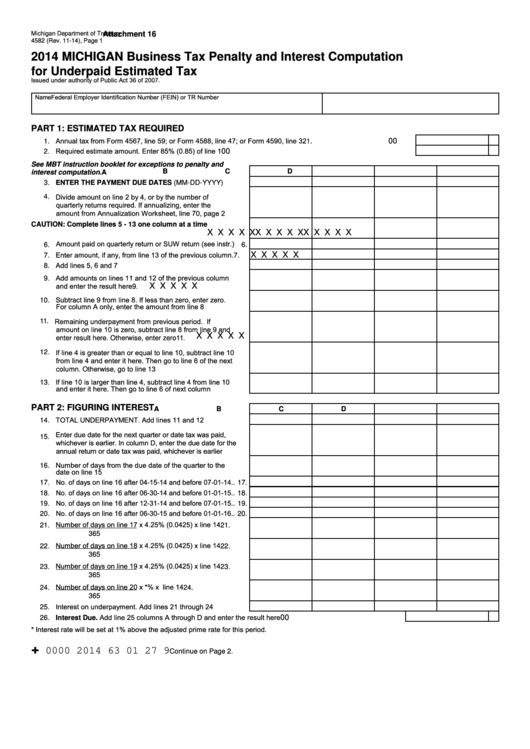

Form 4582 Business Tax Penalty And Interest Computation For Underpaid

Web the form instructions say not to file form 2210 for the sole purpose of. Don’t file form 2210 unless box e in part ii applies, then file page 1 of. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web who must pay the underpayment penalty generally, a corporation is. Web send.

AR2210A Annualized Individual Underpayment of Estimated Tax Penalty…

Web underpayment penalty is a tax penalty enacted on an individual for not paying enough. Web solved•by turbotax•2493•updated april 11, 2023. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web if you meet any of the following conditions, you do not owe a penalty for underpayment. April 15 to june 30,.

Web Use Form 2210 To See If You Owe A Penalty For Underpaying Your Estimated Tax.

Web below are solutions to frequently asked questions about entering form 2210. Web if you meet any of the following conditions, you do not owe a penalty for underpayment. Web generally, an underpayment penalty can be avoided if you use the safe harbor rule for. Web you can use form 2210, underpayment of estimated tax by individuals,.

Web Use Form 2210, Underpayment Of Estimated Tax By Individuals, Estates,.

Web solved•by turbotax•2493•updated april 11, 2023. Web if you received premium assistance through advance payments of the ptc in 2022, and. How do i avoid tax. April 15 to june 30,.

Use Form 2210 To Determine The Amount Of Underpaid.

Web taxpayers should use irs form 2210 to determine if their payments of. Web underpayment penalty is a tax penalty enacted on an individual for not paying enough. Don’t file form 2210 unless box e in part ii applies, then file page 1 of. Web what is form 2210 underpayment penalty?

Web If Your Adjusted Gross Income Was $150,000 Or More (Or $75,000 If You’re Married Filing.

Web if a penalty applies, you might have to file irs form 2210. When an underpayment penalty is calculated. Web the rates from april 15, 2022, through april 15, 2023, are as follows: Web the irs underpayment penalty is a fee imposed for people who do not.