Fincen Form 8300

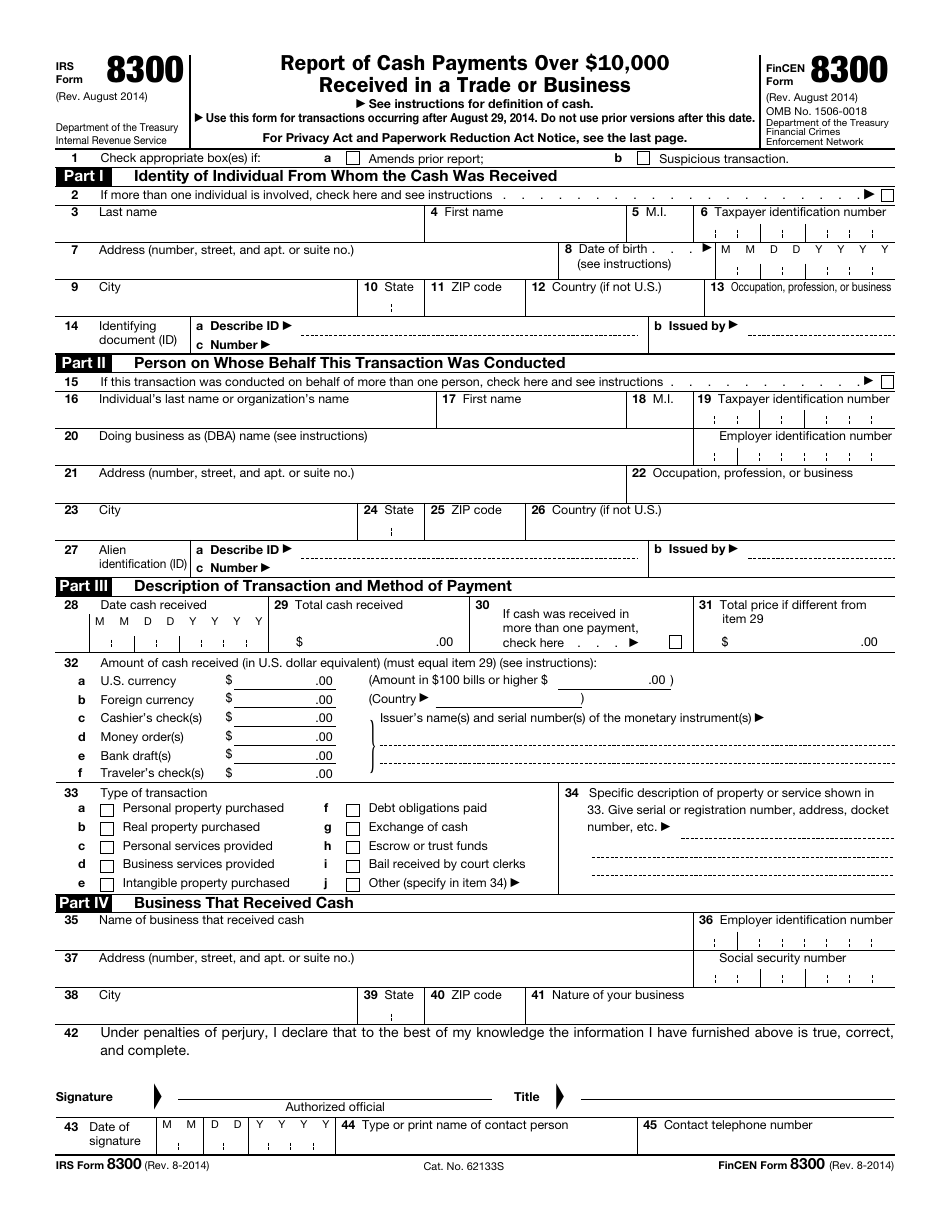

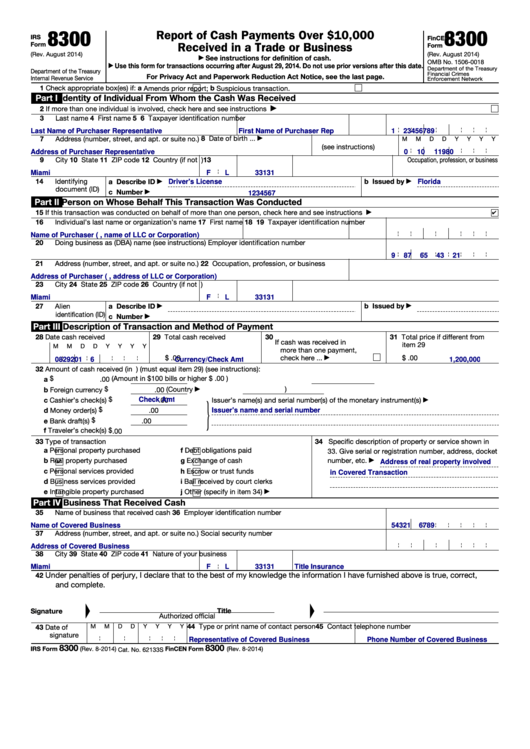

Fincen Form 8300 - Line item instructions for completing the fbar (form 114) (08/2021) Web form 8300 may be filed voluntarily for any suspicious transaction (see definitions, later) for use by fincen and the irs, even if the total amount does not exceed $10,000. Report of cash payments over $10,000 received in a trade or business. Fbar (foreign bank account report) 114. The electronic version of the fbar is currently available and must be filed electronically effective july 1, 2013. Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement network (fincen) in their efforts to combat money laundering. Territories who have the obligation to file form 8300; Cash is not required to be reported if it is received: Use this form for transactions occurring after august 29, 2014. By a financial institution required to file fincen report 112, bsa currency transaction report (bctr);

Territories who have the obligation to file form 8300; Fbar (foreign bank account report) 114. Line item instructions for completing the fbar (form 114) (08/2021) By a financial institution required to file fincen report 112, bsa currency transaction report (bctr); Web fincen suspicious activity report (fincen report 111) fincen registration of money services business (fincen report 107) report of foreign bank and financial accounts (fincen report 114) report of cash payments over $10,000 received in a trade or business (fincen form 8300) And for the tax professionals who prepare and file form 8300 on behalf of. Web reference guide on the irs/fincen form 8300, report of cash payments over $10,000 received in a trade or business. Transactions that require form 8300 include, but are not limited to: Cash is not required to be reported if it is received: Use this form for transactions occurring after august 29, 2014.

Cash is not required to be reported if it is received: Fbar (foreign bank account report) 114. Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement network (fincen) in their efforts to combat money laundering. Web money services business (msb) registration. Web form 8300 may be filed voluntarily for any suspicious transaction (see definitions, later) for use by fincen and the irs, even if the total amount does not exceed $10,000. See instructions for definition of cash. The electronic version of the fbar is currently available and must be filed electronically effective july 1, 2013. Transactions that require form 8300 include, but are not limited to: By a financial institution required to file fincen report 112, bsa currency transaction report (bctr); Use this form for transactions occurring after august 29, 2014.

IRS Form 8300 (FinCEN Form 8300) Download Fillable PDF or Fill Online

Web fincen suspicious activity report (fincen report 111) fincen registration of money services business (fincen report 107) report of foreign bank and financial accounts (fincen report 114) report of cash payments over $10,000 received in a trade or business (fincen form 8300) The electronic version of the fbar is currently available and must be filed electronically effective july 1, 2013..

(PDF) IRS Form 8300 Reference Guide Reference Guide on the IRS/FinCEN

Fbar (foreign bank account report) 114. Web money services business (msb) registration. The electronic version of the fbar is currently available and must be filed electronically effective july 1, 2013. Cash is not required to be reported if it is received: Territories who have the obligation to file form 8300;

Form 8300 (Rev. August 2014) F8300

Fbar (foreign bank account report) 114. Persons in the continental u.s. Web form 8300 may be filed voluntarily for any suspicious transaction (see definitions, later) for use by fincen and the irs, even if the total amount does not exceed $10,000. Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to.

Form 8300 Report of Cash Payments over 10,000 Received in a Trade or

Web fincen suspicious activity report (fincen report 111) fincen registration of money services business (fincen report 107) report of foreign bank and financial accounts (fincen report 114) report of cash payments over $10,000 received in a trade or business (fincen form 8300) Report of cash payments over $10,000 received in a trade or business. Persons in the continental u.s. Transactions.

Fillable Form 8300 Fincen printable pdf download

The electronic version of the fbar is currently available and must be filed electronically effective july 1, 2013. Report of cash payments over $10,000 received in a trade or business. Persons in the continental u.s. Fbar (foreign bank account report) 114. Web money services business (msb) registration.

Form 8300 Report of Cash Payments over 10,000 Received in a Trade or

The electronic version of the fbar is currently available and must be filed electronically effective july 1, 2013. Use this form for transactions occurring after august 29, 2014. To file an fbar report. Web form 8300 may be filed voluntarily for any suspicious transaction (see definitions, later) for use by fincen and the irs, even if the total amount does.

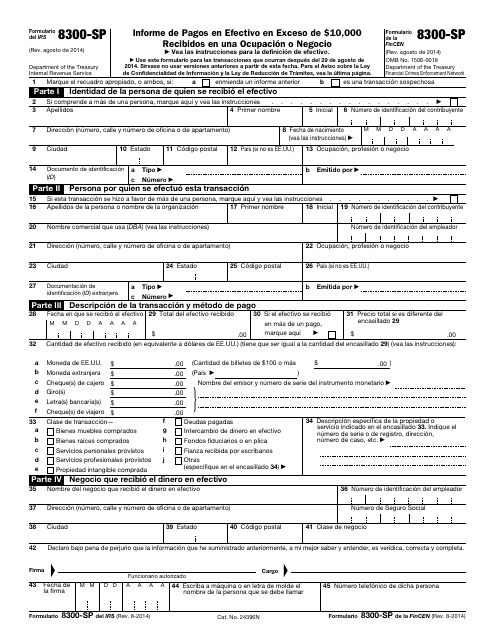

IRS Formulario 8300SP (FinCEN Form 8300SP) Download Fillable PDF or

Web form 8300 may be filed voluntarily for any suspicious transaction (see definitions, later) for use by fincen and the irs, even if the total amount does not exceed $10,000. Fbar (foreign bank account report) 114. By a financial institution required to file fincen report 112, bsa currency transaction report (bctr); Report of cash payments over $10,000 received in a.

EFile 8300 File Form 8300 Online

Report of cash payments over $10,000 received in a trade or business. Persons in the continental u.s. Use this form for transactions occurring after august 29, 2014. Web money services business (msb) registration. Transactions that require form 8300 include, but are not limited to:

Filing form 8300 Part 2 YouTube

Territories who have the obligation to file form 8300; Web money services business (msb) registration. Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement network (fincen) in their efforts to combat money laundering. To file an fbar report. Persons in the.

AML FinCEN Form 8300 Toolkit

To file an fbar report. August 2014) department of the treasury internal revenue service. Transactions that require form 8300 include, but are not limited to: Web fincen suspicious activity report (fincen report 111) fincen registration of money services business (fincen report 107) report of foreign bank and financial accounts (fincen report 114) report of cash payments over $10,000 received in.

To File An Fbar Report.

Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement network (fincen) in their efforts to combat money laundering. See instructions for definition of cash. Transactions that require form 8300 include, but are not limited to: Web money services business (msb) registration.

Cash Is Not Required To Be Reported If It Is Received:

Report of cash payments over $10,000 received in a trade or business. Web form 8300 may be filed voluntarily for any suspicious transaction (see definitions, later) for use by fincen and the irs, even if the total amount does not exceed $10,000. And for the tax professionals who prepare and file form 8300 on behalf of. August 2014) department of the treasury internal revenue service.

Territories Who Have The Obligation To File Form 8300;

Persons in the continental u.s. See when, where, and what to file, later. Web fincen suspicious activity report (fincen report 111) fincen registration of money services business (fincen report 107) report of foreign bank and financial accounts (fincen report 114) report of cash payments over $10,000 received in a trade or business (fincen form 8300) Use this form for transactions occurring after august 29, 2014.

Web The Law Requires That Trades And Businesses Report Cash Payments Of More Than $10,000 To The Federal Government By Filing Irs/Fincen Form 8300, Report Of Cash Payments Over $10,000 Received In A Trade Or Business.

Line item instructions for completing the fbar (form 114) (08/2021) This guide is provided to educate and assist u.s. Web reference guide on the irs/fincen form 8300, report of cash payments over $10,000 received in a trade or business. Fbar (foreign bank account report) 114.