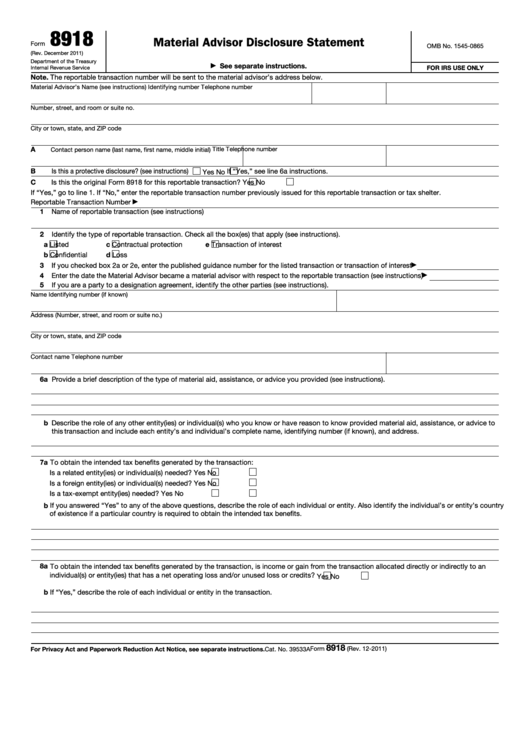

Form 8918 Material Advisor Disclosure Statement

Form 8918 Material Advisor Disclosure Statement - You can download or print. Name / identifying number / address / telephone number title. Web the internal revenue service is now allowing tax advisors and taxpayers to fax the form 8918, material advisor disclosure statement, as part of its response to. The reportable transaction number will be sent to the material advisor’s address below. Web material advisors to any reportable transaction file form 8918, material advisor disclosure statement to disclose certain information about the reportable. Web form 8918, material advisor disclosurestatement, replaces form 8264,application for registration of a taxshelter. Web may file an abbreviated disclosure statement if: Instructions for form 8918, material advisor disclosure statement 1121 12/09/2021 form 8918: Web form 8918, or the “ material advisor disclosure statement ,” is a form used by material advisors to report information to the internal revenue service (irs). Web the material advisor's disclosure statement must be filed with the office of tax shelter analysis (otsa) by the last day of the month that follows the end of the.

Web the irs has released a new version of form 8918, material advisor disclosure statement, to include 2d barcodes. Web the internal revenue service is now allowing tax advisors and taxpayers to fax the form 8918, material advisor disclosure statement, as part of its response to. Web material advisor disclosure statement 8918 note. Web a person is a material advisor with respect to a transaction if the person provides any material aid, assistance, or advice with respect to organizing, managing, promoting,. Web material advisors to any reportable transaction file form 8918, material advisor disclosure statement to disclose certain information about the reportable. Name / identifying number / address / telephone number title. Material advisor disclosure statement 1121 06/19/2022 Web form 8918, material advisor disclosurestatement, replaces form 8264,application for registration of a taxshelter. Web the material advisor's disclosure statement must be filed with the office of tax shelter analysis (otsa) by the last day of the month that follows the end of the. The material advisor should submit a copy of the federal form used to disclose the.

2007) on page 1, under the heading who is a. Web reportable transaction disclosure statement if you're a business or individual who has participated in one or more of the above transactions, you may be required to file a form. The material advisor should submit a copy of the federal form used to disclose the. Top 13mm (1⁄ 2), center sides. Web what form does a material advisor use to disclose a reportable transaction to wisconsin? Web material advisors to any reportable transaction file form 8918, material advisor disclosure statement to disclose certain information about the reportable. After june 1, 2022, the irs will accept only the. Web this disclosure is made on form 8918, material advisor disclosure statement, on or before the last day of the month following the end of the calendar quarter in which. Submitting a request for a ruling on whether you are. Name / identifying number / address / telephone number title.

183 Disclosure Statement Stock Photos Free & RoyaltyFree Stock

• the material advisor has designated one person as the designated material advisor for federal income tax purposes (a. Web form 8918, or the “ material advisor disclosure statement ,” is a form used by material advisors to report information to the internal revenue service (irs). Web form 8918, material advisor disclosure statement, replaces form 8264, application for registration of.

Download Instructions for IRS Form 8918 Material Advisor Disclosure

Web a person is a material advisor with respect to a transaction if the person provides any material aid, assistance, or advice with respect to organizing, managing, promoting,. Web the internal revenue service is now allowing tax advisors and taxpayers to fax the form 8918, material advisor disclosure statement, as part of its response to. Material advisor disclosure statement 1121.

Fill Free fillable Form 8918 2011 Material Advisor Disclosure

Top 13mm (1⁄ 2), center sides. Web what form does a material advisor use to disclose a reportable transaction to wisconsin? The reportable transaction number will be sent to the material advisor’s address below. Web form 8918, material advisor disclosure statement, replaces form 8264, application for registration of a tax shelter. Web form 8918, or the “ material advisor disclosure.

Form 8918 Material Advisor Disclosure Statement (2011) Free Download

Web reportable transaction disclosure statement if you're a business or individual who has participated in one or more of the above transactions, you may be required to file a form. Submitting a request for a ruling on whether you are. Submitting a request for a ruling onwhether you are. Web form 8918, material advisor disclosure statement, replaces form 8264, application.

Fill Free fillable Form 8918 DRAFT AS OF Material Advisor Disclosure

2007) on page 1, under the heading who is a. Submitting a request for a ruling onwhether you are. Web reportable transaction disclosure statement if you're a business or individual who has participated in one or more of the above transactions, you may be required to file a form. Web form 8918, material advisor disclosure statement, replaces form 8264, application.

SBA Form LLL Disclosure of Lobbying Activities Stock Image Image of

The material advisor should submit a copy of the federal form used to disclose the. Top 13mm (1⁄ 2), center sides. Web form 8918, material advisor disclosurestatement, replaces form 8264,application for registration of a taxshelter. Web a person is a material advisor with respect to a transaction if the person provides any material aid, assistance, or advice with respect to.

Form 8918 Material Advisor Disclosure Statement (2011) Free Download

Web may file an abbreviated disclosure statement if: Web form 8918 material advisor disclosure statement 11 instructions to printers form 8918, page 1 of 2 margins: Instructions for form 8918, material advisor disclosure statement 1121 12/09/2021 form 8918: Web what form does a material advisor use to disclose a reportable transaction to wisconsin? Web the irs has released a new.

Fillable Form 8918 Material Advisor Disclosure Statement printable

Top 13mm (1⁄ 2), center sides. The reportable transaction number will be sent to the material advisor’s address below. Web form 8918 material advisor disclosure statement 11 instructions to printers form 8918, page 1 of 2 margins: The material advisor should submit a copy of the federal form used to disclose the. Web material advisors to any reportable transaction file.

Form 8918 Material Advisor Disclosure Statement (2011) Free Download

2007) on page 1, under the heading who is a. Submitting a request for a ruling onwhether you are. Name / identifying number / address / telephone number title. Web form 8918, material advisor disclosure statement, replaces form 8264, application for registration of a tax shelter. Web may file an abbreviated disclosure statement if:

Fill Free fillable Form 8918 DRAFT AS OF Material Advisor Disclosure

Submitting a request for a ruling onwhether you are. The reportable transaction number will be sent to the material advisor’s address below. Web form 8918 material advisor disclosure statement 11 instructions to printers form 8918, page 1 of 2 margins: Web the irs has released a new version of form 8918, material advisor disclosure statement, to include 2d barcodes. Web.

You Can Download Or Print.

The material advisor should submit a copy of the federal form used to disclose the. Name / identifying number / address / telephone number title. Web we last updated the material advisor disclosure statement in february 2023, so this is the latest version of form 8918, fully updated for tax year 2022. Web may file an abbreviated disclosure statement if:

Web The Irs Has Released A New Version Of Form 8918, Material Advisor Disclosure Statement, To Include 2D Barcodes.

Web the internal revenue service is now allowing tax advisors and taxpayers to fax the form 8918, material advisor disclosure statement, as part of its response to. Material advisor disclosure statement 1121 06/19/2022 Web this disclosure is made on form 8918, material advisor disclosure statement, on or before the last day of the month following the end of the calendar quarter in which. Web form 8918 material advisor disclosure statement 11 instructions to printers form 8918, page 1 of 2 margins:

• The Material Advisor Has Designated One Person As The Designated Material Advisor For Federal Income Tax Purposes (A.

Web what form does a material advisor use to disclose a reportable transaction to wisconsin? Web form 8918, or the “ material advisor disclosure statement ,” is a form used by material advisors to report information to the internal revenue service (irs). Web reportable transaction disclosure statement if you're a business or individual who has participated in one or more of the above transactions, you may be required to file a form. Submitting a request for a ruling on whether you are.

Web Material Advisors To Any Reportable Transaction File Form 8918, Material Advisor Disclosure Statement To Disclose Certain Information About The Reportable.

2007) on page 1, under the heading who is a. Web form 8918, material advisor disclosurestatement, replaces form 8264,application for registration of a taxshelter. After june 1, 2022, the irs will accept only the. Web a person is a material advisor with respect to a transaction if the person provides any material aid, assistance, or advice with respect to organizing, managing, promoting,.