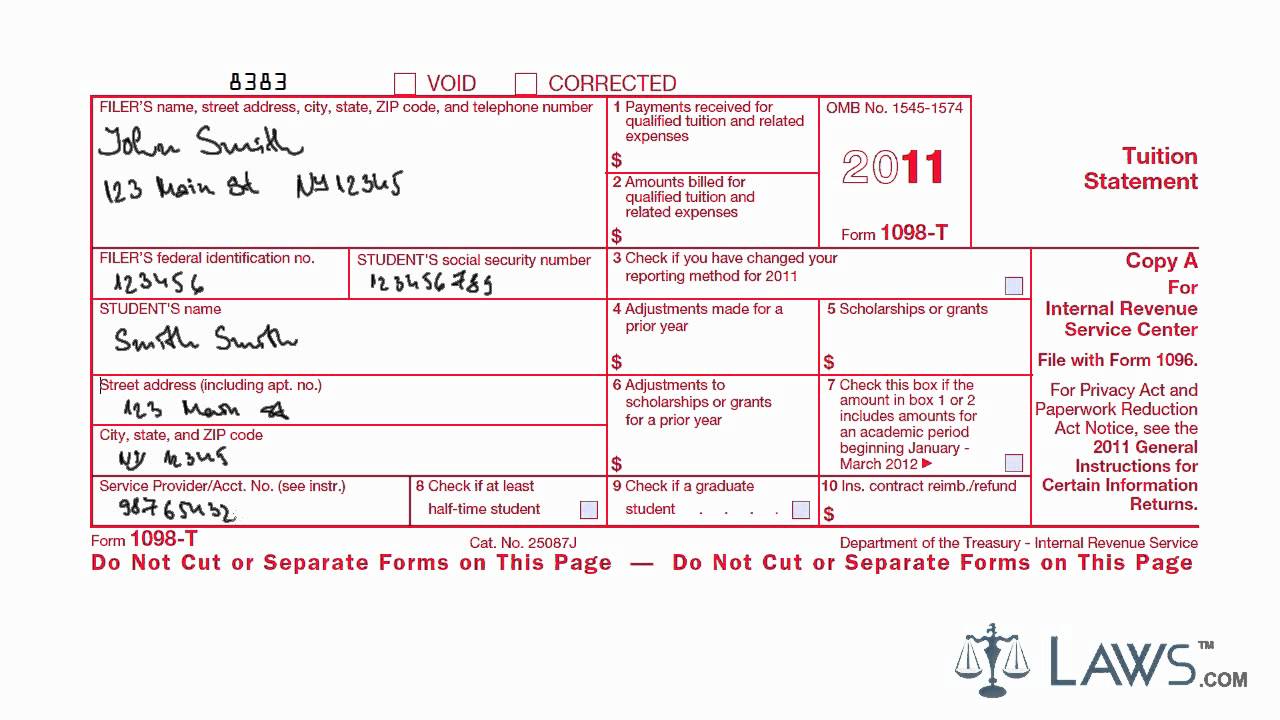

Example 1098 T Form

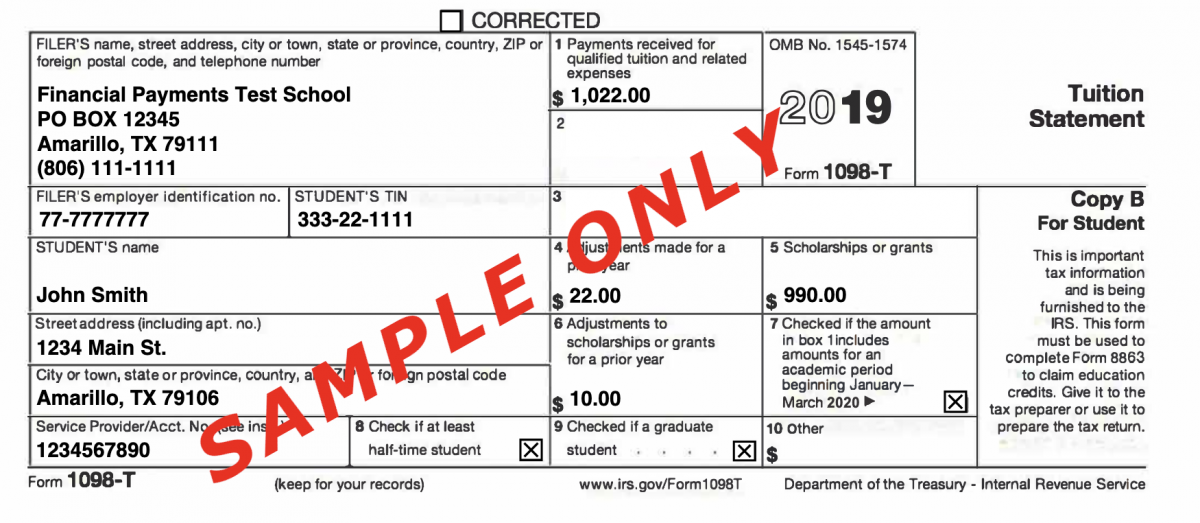

Example 1098 T Form - This box reports the total amount of payments received for qualified tuition and related expenses from all. This form must be used to complete form 8863 to claim education credits. It documents qualified tuition, fees, and other related course materials. Payments received for qualified tuition and related expenses. As of tax year 2018 and due to an irs change to institutional reporting requirements under federal law, tufts reports using the box 1 method which reports the amount of qtre you paid, including loans, during the year rather than amounts billed. The amount reported is the total amount of payments received less any. Payments received for qualified tuition and related expenses. Beginning in tax year 2018, btc will be reporting payments received for qualified tuition and related expenses, and no longer reporting amounts billed for qualified tuition and related expenses. [5] courses for which no academic credit is offered (such as adjunct courses), regardless of enrollment status nonresident alien students students whose tuition are either completely waived or. Contract reimb./refund this is important tax information and is being furnished to the irs.

Web for example, people with a mortgage would likely receive a form 1098 from their lender, reporting how much mortgage interest they paid during a tax year. Consult a tax professional for explanation. It documents qualified tuition, fees, and other related course materials. This box reports the total amount of payments received for qualified tuition and related expenses from all sources during the calendar year. Contract reimb./refund this is important tax information and is being furnished to the irs. Contributions of motor vehicles, boats, or airplanes; This form must be used to complete form 8863 to claim education credits. This box reports the total amount of payments received for qualified tuition and related expenses from all. This post may contain affiliate links. For a payment to be reportable, it must relate to qualified tuition and related expenses billed during the same calendar year.

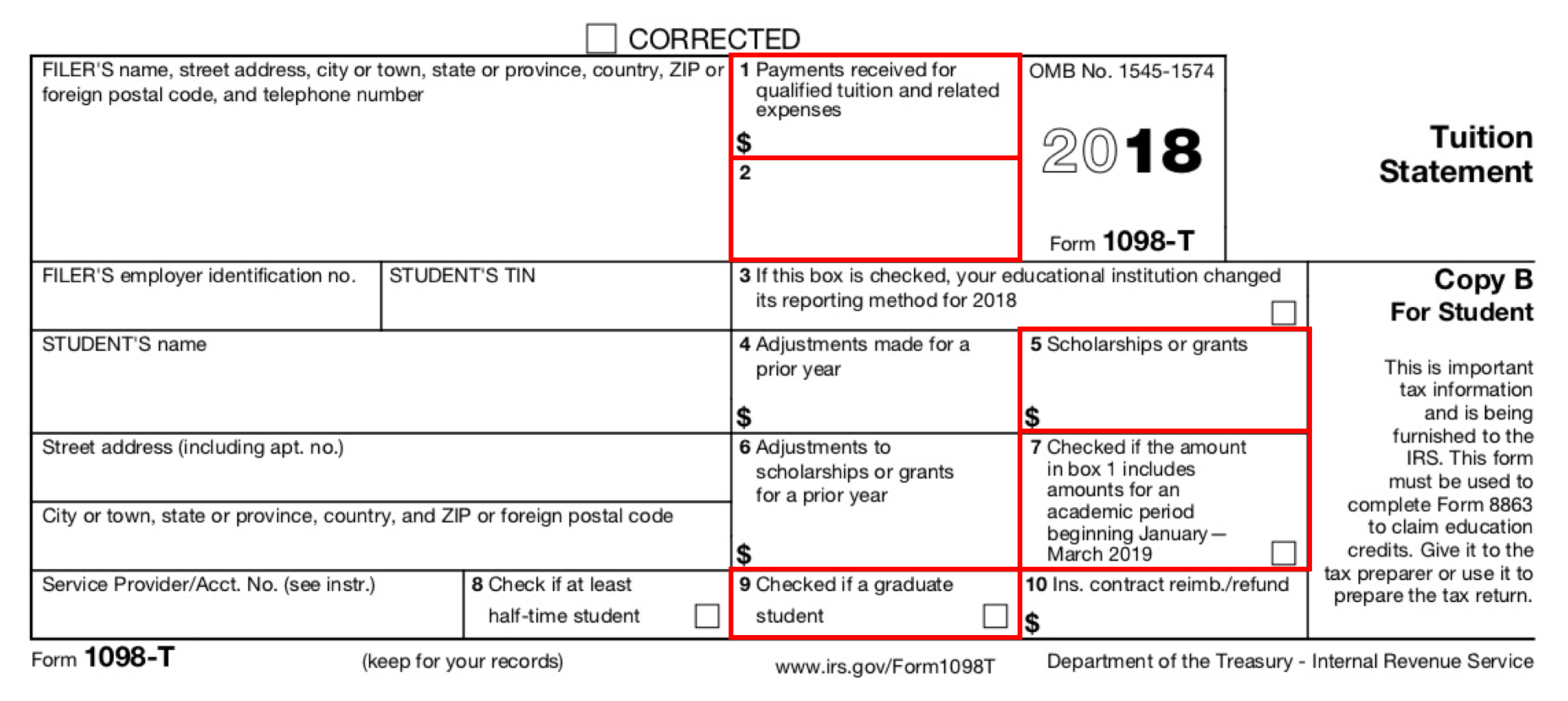

Click on a box number description for more information. Filer's name, street address, city or town, state or province, country, zip or foreign postal code, and telephone number. As of tax year 2018 and due to an irs change to institutional reporting requirements under federal law, tufts reports using the box 1 method which reports the amount of qtre you paid, including loans, during the year rather than amounts billed. This post may contain affiliate links. For a payment to be reportable, it must relate to qualified tuition and related expenses billed during the same calendar year. And tuition and scholarship information. Contract reimb./refund this is important tax information and is being furnished to the irs. Web for example, people with a mortgage would likely receive a form 1098 from their lender, reporting how much mortgage interest they paid during a tax year. For purposes of the tuition and fees deduction, qualified education expenses are tuition and certain related expenses required for enrollment or attendance at an eligible educational institution. 2 amount billed for qualified tuition and related expenses.

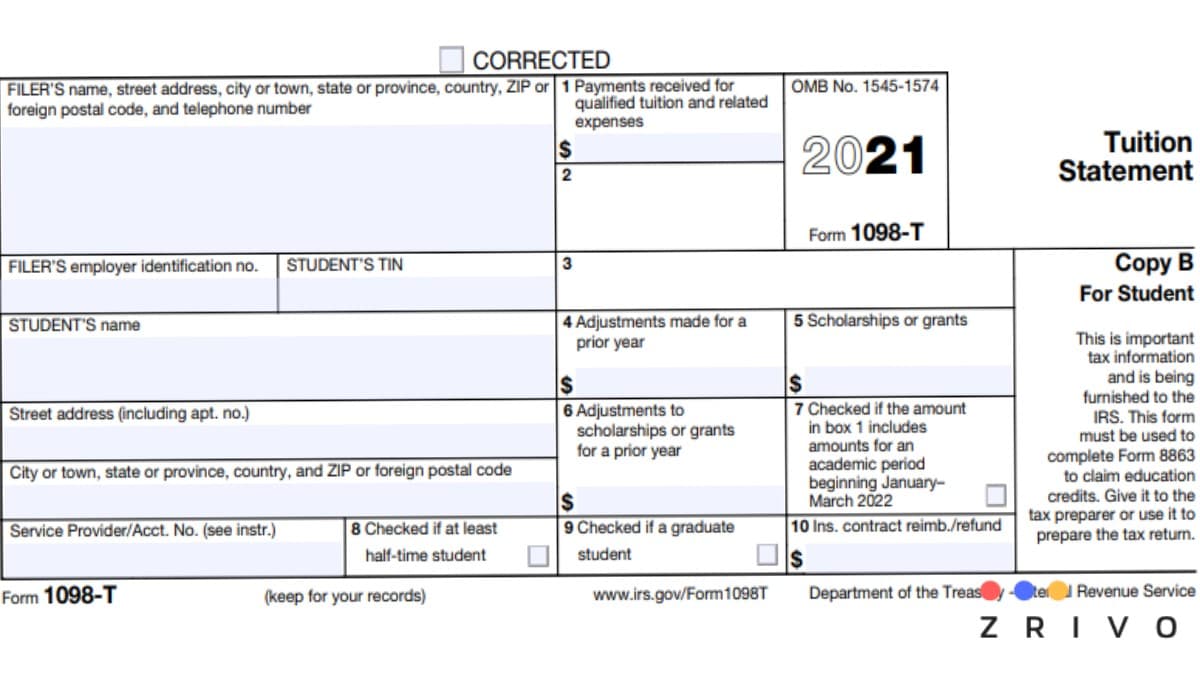

1098 T Form 2021

Payments received for qualified tuition and related expenses. The amount reported is the total amount of payments received less any. This box reports the total amount of payments received for qualified tuition and related expenses from all sources during the calendar year. Payments received for qualified tuition and related expenses. Consult a tax professional for explanation.

Irs Form 1098 T Box 4 Universal Network

Filer's name, street address, city or town, state or province, country, zip or foreign postal code, and telephone number. As of tax year 2018 and due to an irs change to institutional reporting requirements under federal law, tufts reports using the box 1 method which reports the amount of qtre you paid, including loans, during the year rather than amounts.

1098T Student Business Services CSUF

Payments received for qualified tuition and related expenses. This form must be used to complete form 8863 to claim education credits. Payments received for qualified tuition and related expenses. For purposes of the tuition and fees deduction, qualified education expenses are tuition and certain related expenses required for enrollment or attendance at an eligible educational institution. 1 payments received for.

1098T IRS Tax Form Instructions 1098T Forms

Determine your enrollment for each period under your own rules or use one of the following dates. As of tax year 2018 and due to an irs change to institutional reporting requirements under federal law, tufts reports using the box 1 method which reports the amount of qtre you paid, including loans, during the year rather than amounts billed. Payments.

Form 1098T Information Student Portal

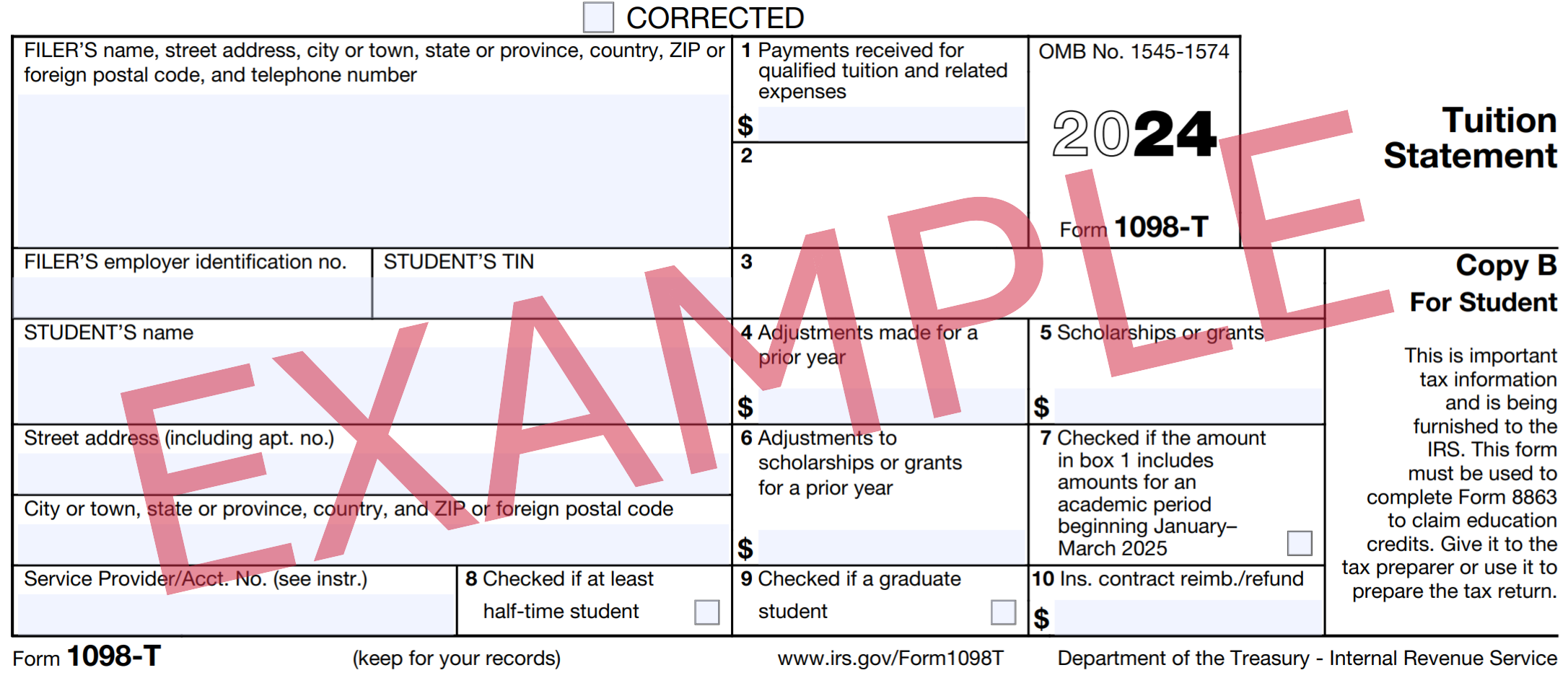

This form must be used to complete form 8863 to claim education credits. Payments received for qualified tuition and related expenses. For purposes of the tuition and fees deduction, qualified education expenses are tuition and certain related expenses required for enrollment or attendance at an eligible educational institution. For a payment to be reportable, it must relate to qualified tuition.

Form 1098T Still Causing Trouble for Funded Graduate Students

1 payments received for qualified tuition and related expenses. This form must be used to complete form 8863 to claim education credits. In particular, they cover mortgage interest payments; 2 amount billed for qualified tuition and related expenses. As of tax year 2018 and due to an irs change to institutional reporting requirements under federal law, tufts reports using the.

1098T Information Bursar's Office Office of Finance UTHSC

Click on a box number description for more information. This box reports the total amount of payments received for qualified tuition and related expenses from all sources during the calendar year. You must file for each student you enroll and for whom a reportable transaction is made. This form must be used to complete form 8863 to claim education credits..

Claim your Educational Tax Refund with IRS Form 1098T

This form must be used to complete form 8863 to claim education credits. And tuition and scholarship information. Payments received for qualified tuition and related expenses. Payments received for qualified tuition and related expenses. Contract reimb./refund this is important tax information and is being furnished to the irs.

Understanding your IRS Form 1098T Student Billing

Contributions of motor vehicles, boats, or airplanes; Contract reimb./refund this is important tax information and is being furnished to the irs. Payments received for qualified tuition and related expenses. This box reports the total amount of payments received for qualified tuition and related expenses from all sources during the calendar year. 2 amount billed for qualified tuition and related expenses.

Learn How to Fill the Form 1098T Tuition Statement YouTube

This box reports the total amount of payments received for qualified tuition and related expenses from all. The amount reported is the total amount of payments received less any. For purposes of the tuition and fees deduction, qualified education expenses are tuition and certain related expenses required for enrollment or attendance at an eligible educational institution. Consult a tax professional.

Filer's Name, Street Address, City Or Town, State Or Province, Country, Zip Or Foreign Postal Code, And Telephone Number.

You must file for each student you enroll and for whom a reportable transaction is made. 1 payments received for qualified tuition and related expenses. Determine your enrollment for each period under your own rules or use one of the following dates. Contributions of motor vehicles, boats, or airplanes;

Click On A Box Number Description For More Information.

[5] courses for which no academic credit is offered (such as adjunct courses), regardless of enrollment status nonresident alien students students whose tuition are either completely waived or. The amount reported is the total amount of payments received less any. As of tax year 2018 and due to an irs change to institutional reporting requirements under federal law, tufts reports using the box 1 method which reports the amount of qtre you paid, including loans, during the year rather than amounts billed. This form must be used to complete form 8863 to claim education credits.

Consult A Tax Professional For Explanation.

Web for example, tuition for the spring semester is typically billed in october/november so a student may have paid tuition for the spring semester in 2021 even though classes didn’t start until 2022. And tuition and scholarship information. For purposes of the tuition and fees deduction, qualified education expenses are tuition and certain related expenses required for enrollment or attendance at an eligible educational institution. This box reports the total amount of payments received for qualified tuition and related expenses from all sources during the calendar year.

This Post May Contain Affiliate Links.

Payments received for qualified tuition and related expenses. In particular, they cover mortgage interest payments; Sometimes this is referred to as qualifed education expenses, although the two are not always interchangeable. Payments received from any source for qualified tuition and related expenses less any related reimbursements or refunds (reported in tax year 2018 and forward)