338 H 10 Election Form

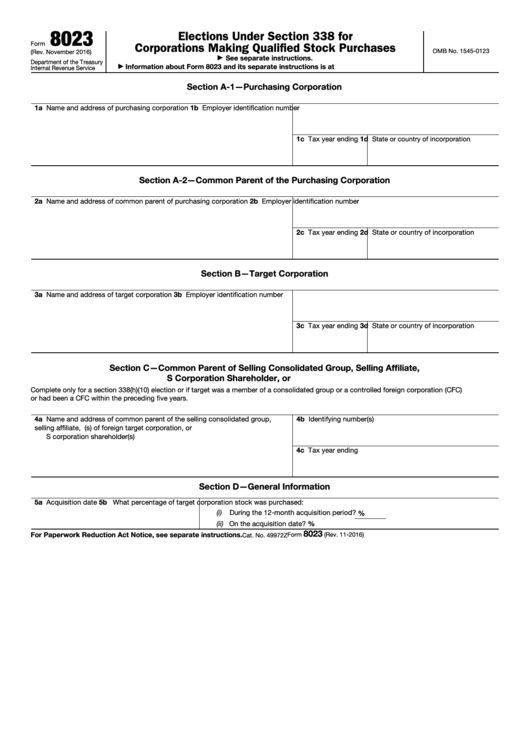

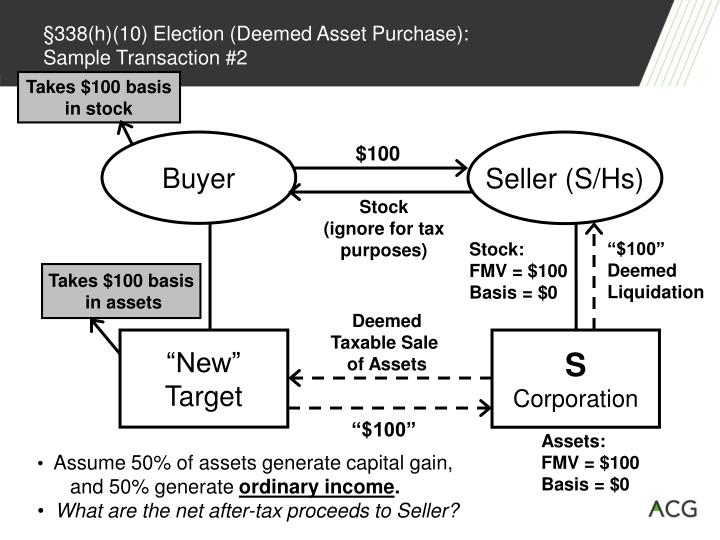

338 H 10 Election Form - This deemed sale occurs while old target is still a member of seller's consolidated group. About form 8023, elections under section 338 for corporations making qualified stock purchases | internal revenue service Web purchasing corporations use this form to make elections under section 338 for the target corporation if they made a qualified stock purchase (qsp) of the target corporation. Form 8883 is used to report information about transactions involving the deemed sale of. Web a section 338(h)(10) election is made jointly by purchaser and seller on form 8023. Old target is treated as transferring all of its assets to an unrelated person in exchange for consideration that includes the discharge of its liabilities. Web section 338 (h) (10) election scenario 1 you’ve found a great company whose acquisition you believe would advance your objectives. Its stock is valued at $1.5 million. You’re faced with a new dilemma. But then upon discussion with the target company, and you discover that the company’s tax basis in its assets is only $500,000.

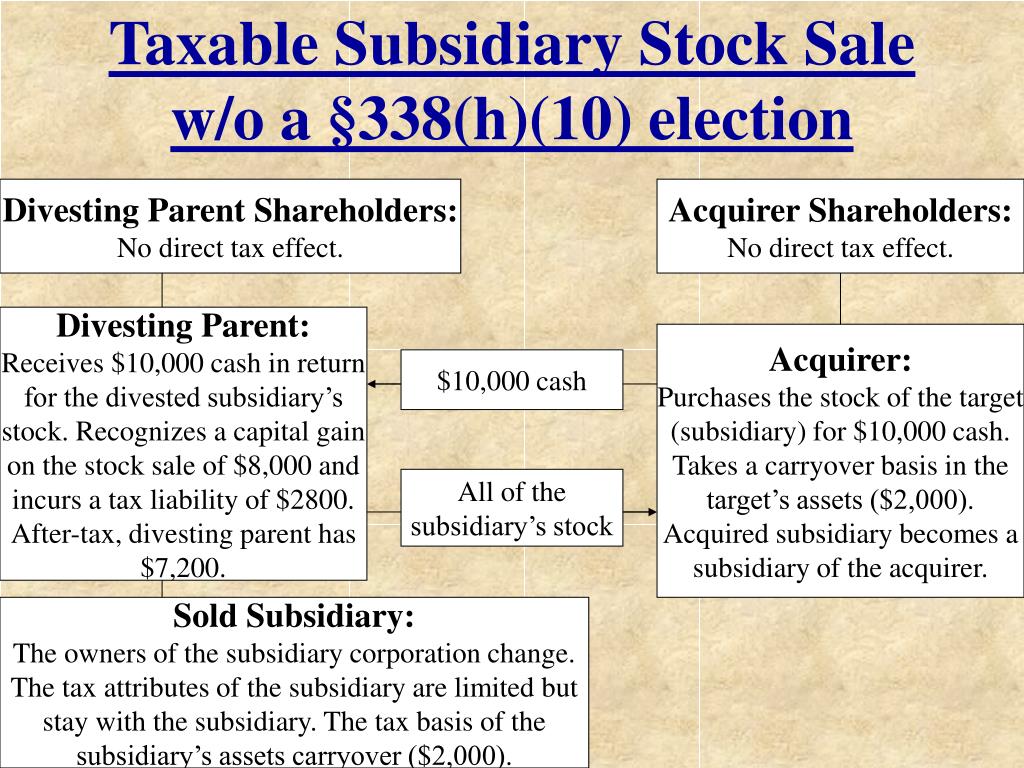

Web a 338 (h) (10) election allows a buyer of stock of an s corporation or a corporation within a consolidated group to treat the transaction as an acquisition of 100% of the assets of the. You’re faced with a new dilemma. Web section 338 (h) (10) elections are available only for targets who are s corporations or members of an affiliated group of corporations (whether or not they file a consolidated federal income tax return). When and how to file generally, attach form 8883 to the return on which the effects of the section 338 deemed sale and purchase of the target's assets are required to be reported. Form 8883 is used to report information about transactions involving the deemed sale of. Web if the target is an s corporation, a section 338(h)(10) election must be made by all of the shareholders of the target, including shareholders who do not sell target stock in the qsp. When and where to file file form 8023 by the 15th day of the 9th month after the acquisition date to make a section 338 election for the target corporation. Web for elections under sections 338(g) and 338(h)(10) both the old target and the new target must file form 8883. Web information about form 8883, asset allocation statement under section 338, including recent updates, related forms and instructions on how to file. Web purchasing corporations use this form to make elections under section 338 for the target corporation if they made a qualified stock purchase (qsp) of the target corporation.

Web a 338 (h) (10) election allows a buyer of stock of an s corporation or a corporation within a consolidated group to treat the transaction as an acquisition of 100% of the assets of the. When and where to file file form 8023 by the 15th day of the 9th month after the acquisition date to make a section 338 election for the target corporation. Web if the target is an s corporation, a section 338(h)(10) election must be made by all of the shareholders of the target, including shareholders who do not sell target stock in the qsp. About form 8023, elections under section 338 for corporations making qualified stock purchases | internal revenue service When and how to file generally, attach form 8883 to the return on which the effects of the section 338 deemed sale and purchase of the target's assets are required to be reported. This deemed sale occurs while old target is still a member of seller's consolidated group. Web consolidated selling group or selling affiliate signature (section 338(h)(10) election) under penalties of perjury, i state and declare that i am authorized to make the section 338(h)(10) election on line 6 on behalf of the common parent of the selling consolidated group or on behalf of the selling affiliate. Its stock is valued at $1.5 million. Web purchasing corporations use this form to make elections under section 338 for the target corporation if they made a qualified stock purchase (qsp) of the target corporation. Web for elections under sections 338(g) and 338(h)(10) both the old target and the new target must file form 8883.

Understanding the Section 338(h)(10) Election YouTube

Web for elections under sections 338(g) and 338(h)(10) both the old target and the new target must file form 8883. Web consolidated selling group or selling affiliate signature (section 338(h)(10) election) under penalties of perjury, i state and declare that i am authorized to make the section 338(h)(10) election on line 6 on behalf of the common parent of the.

What Is A 338(H)(10) Election And Why It Is Important To Me?

Web section 338 (h) (10) election scenario 1 you’ve found a great company whose acquisition you believe would advance your objectives. Its stock is valued at $1.5 million. Form 8883 is used to report information about transactions involving the deemed sale of. But then upon discussion with the target company, and you discover that the company’s tax basis in its.

Section 338(h)(10) election Archives Calder Capital, LLC

Web purchasing corporations use this form to make elections under section 338 for the target corporation if they made a qualified stock purchase (qsp) of the target corporation. When and how to file generally, attach form 8883 to the return on which the effects of the section 338 deemed sale and purchase of the target's assets are required to be.

GT’s Quick Guide to Section 338(h)(10) Elections Insights Greenberg

Web information about form 8883, asset allocation statement under section 338, including recent updates, related forms and instructions on how to file. Web a section 338(h)(10) election is made jointly by purchaser and seller on form 8023. Web for elections under sections 338(g) and 338(h)(10) both the old target and the new target must file form 8883. But then upon.

Fillable Form 8023 Elections Under Section 338 For Corporations

Its stock is valued at $1.5 million. Web a section 338(h)(10) election is made jointly by purchaser and seller on form 8023. When and where to file file form 8023 by the 15th day of the 9th month after the acquisition date to make a section 338 election for the target corporation. This deemed sale occurs while old target is.

PPT TAX ISSUES TO CONSIDER IN COMMON ACQUISITION SCENARIOS PowerPoint

Web section 338 (h) (10) elections are available only for targets who are s corporations or members of an affiliated group of corporations (whether or not they file a consolidated federal income tax return). You’re faced with a new dilemma. Web information about form 8883, asset allocation statement under section 338, including recent updates, related forms and instructions on how.

Section 338 H 10 Election designditliv

But then upon discussion with the target company, and you discover that the company’s tax basis in its assets is only $500,000. You’re faced with a new dilemma. Old target is treated as transferring all of its assets to an unrelated person in exchange for consideration that includes the discharge of its liabilities. Web information about form 8883, asset allocation.

Ulfberht! Alexander Arms' .338 Lapua Magnum 10 shot folding stock

Web a section 338(h)(10) election is made jointly by purchaser and seller on form 8023. Web a 338 (h) (10) election allows a buyer of stock of an s corporation or a corporation within a consolidated group to treat the transaction as an acquisition of 100% of the assets of the. Web information about form 8883, asset allocation statement under.

Tax and Corporate Law on Sales and Purchases of Businesses

Old target is treated as transferring all of its assets to an unrelated person in exchange for consideration that includes the discharge of its liabilities. When and how to file generally, attach form 8883 to the return on which the effects of the section 338 deemed sale and purchase of the target's assets are required to be reported. This deemed.

or 338(h)(10) Election? Choose the LessRestrictive Option

Web a 338 (h) (10) election allows a buyer of stock of an s corporation or a corporation within a consolidated group to treat the transaction as an acquisition of 100% of the assets of the. Web purchasing corporations use this form to make elections under section 338 for the target corporation if they made a qualified stock purchase (qsp).

Web A Section 338(H)(10) Election Is Made Jointly By Purchaser And Seller On Form 8023.

Web section 338 (h) (10) elections are available only for targets who are s corporations or members of an affiliated group of corporations (whether or not they file a consolidated federal income tax return). Old target is treated as transferring all of its assets to an unrelated person in exchange for consideration that includes the discharge of its liabilities. Web section 338 (h) (10) election scenario 1 you’ve found a great company whose acquisition you believe would advance your objectives. Form 8883 is used to report information about transactions involving the deemed sale of.

When And How To File Generally, Attach Form 8883 To The Return On Which The Effects Of The Section 338 Deemed Sale And Purchase Of The Target's Assets Are Required To Be Reported.

When and where to file file form 8023 by the 15th day of the 9th month after the acquisition date to make a section 338 election for the target corporation. Web for elections under sections 338(g) and 338(h)(10) both the old target and the new target must file form 8883. Web a 338 (h) (10) election allows a buyer of stock of an s corporation or a corporation within a consolidated group to treat the transaction as an acquisition of 100% of the assets of the. But then upon discussion with the target company, and you discover that the company’s tax basis in its assets is only $500,000.

Its Stock Is Valued At $1.5 Million.

This deemed sale occurs while old target is still a member of seller's consolidated group. Web information about form 8883, asset allocation statement under section 338, including recent updates, related forms and instructions on how to file. You’re faced with a new dilemma. Web purchasing corporations use this form to make elections under section 338 for the target corporation if they made a qualified stock purchase (qsp) of the target corporation.

Web If The Target Is An S Corporation, A Section 338(H)(10) Election Must Be Made By All Of The Shareholders Of The Target, Including Shareholders Who Do Not Sell Target Stock In The Qsp.

About form 8023, elections under section 338 for corporations making qualified stock purchases | internal revenue service Web consolidated selling group or selling affiliate signature (section 338(h)(10) election) under penalties of perjury, i state and declare that i am authorized to make the section 338(h)(10) election on line 6 on behalf of the common parent of the selling consolidated group or on behalf of the selling affiliate.