1099 Form For Truck Drivers

1099 Form For Truck Drivers - Web 1099 truck drivers legal or not. Ad get ready for tax season deadlines by completing any required tax forms today. Web forms that you should file as a truck driver depends on your type of employment: Web 1099 drivers may be like doordash contractors, postmates, instacart, uber, lyft, or other related gig jobs truck drivers for freight services deliveries are also 1099. Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the time of. Web feb 4, 2022 5 min read 1099 vs. We are adding new 2024 model trucks this year Web truck drivers working as independent contractors are able to claim a number of deductions when filing their tax returns. Web you'll use those 1099s, plus your own records of income and expenses, to report your trucking income and expenses on schedule c. Web actively working as a driver within the past 6 months.

Ad shrock trucking is now hiring class a cdl otr solo and team drivers out of springfield, mo. Web tax deductions for truck drivers. However, if you are classified as an 'independent contractor'. Web you'll use those 1099s, plus your own records of income and expenses, to report your trucking income and expenses on schedule c. We were asked a question. Truck driver tax deductions the irs allows truck drivers to deduct “ordinary and necessary” business expenses. The entire gross sum would be. Web 23,907 1099 driver jobs available on indeed.com. Web many professional truck drivers choose to contract their services to carriers and fleets. Web actively working as a driver within the past 6 months.

The entire gross sum would be. Our fleet consists of 2021 to 2023’s. Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the time of. We were asked a question. As opposed to truck drivers who. Web 23,907 1099 driver jobs available on indeed.com. You may also need to. Web 1099 truck drivers legal or not. Web this form is used to assess business profit and loss. Web actively working as a driver within the past 6 months.

Efile 2022 Form 1099R Report the Distributions from Pensions

Ad electronically file 1099 forms. Web truck drivers working as independent contractors are able to claim a number of deductions when filing their tax returns. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. We are adding new 2024 model trucks this year

9 Form Uber Ten Quick Tips Regarding 9 Form Uber AH STUDIO Blog

Web you'll use those 1099s, plus your own records of income and expenses, to report your trucking income and expenses on schedule c. Apply to van driver, delivery driver, truck driver and more! As opposed to truck drivers who. We are adding new 2024 model trucks this year Web forms that you should file as a truck driver depends on.

When is tax form 1099MISC due to contractors? GoDaddy Blog

We are adding new 2024 model trucks this year Web truck drivers working as independent contractors are able to claim a number of deductions when filing their tax returns. Web 1099 drivers may be like doordash contractors, postmates, instacart, uber, lyft, or other related gig jobs truck drivers for freight services deliveries are also 1099. Web actively working as a.

How To Fill Out A 1099 Misc Form For Employee Armando Friend's Template

Ad shrock trucking is now hiring class a cdl otr solo and team drivers out of springfield, mo. We recently sat down in the studio and talked about the ever growing pool of 1099 truck drivers. We were asked a question. You may also need to. We are adding new 2024 model trucks this year

Fast Answers About 1099 Forms for Independent Workers

The entire gross sum would be. Since they are considered contractors, 1099 workers do not have taxes deducted from their salary. Complete, edit or print tax forms instantly. Web let’s take a look into 1099 for truck drivers. Web 1099 truck drivers legal or not.

Hiring 1099 Drivers May Not Be Worth the Risk Gorilla Safety

As opposed to truck drivers who. Ad get ready for tax season deadlines by completing any required tax forms today. Web forms that you should file as a truck driver depends on your type of employment: Web tax deductions for truck drivers. We were asked a question.

Ultimate Tax Guide for Uber & Lyft Drivers [Updated for 2020]

Web tax deductions for truck drivers. Web 23,907 1099 driver jobs available on indeed.com. Truck driver tax deductions the irs allows truck drivers to deduct “ordinary and necessary” business expenses. We were asked a question. Web 1099 truck drivers legal or not.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Web actively working as a driver within the past 6 months. We were asked a question. Truck driver tax deductions the irs allows truck drivers to deduct “ordinary and necessary” business expenses. We are adding new 2024 model trucks this year Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross.

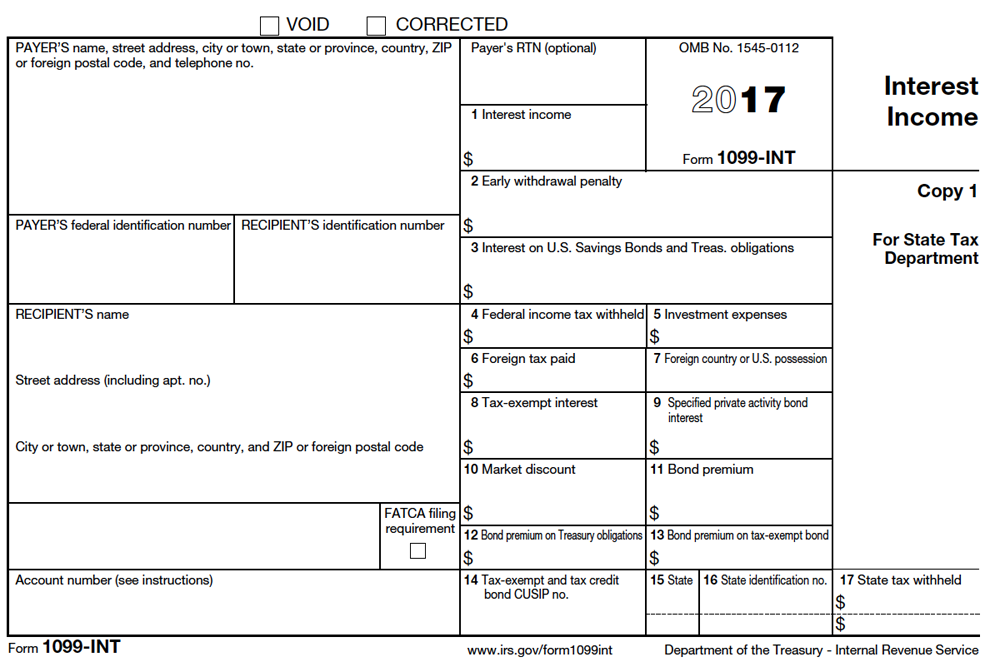

Tax Information Regarding Forms 1099R and 1099INT That We Send

As opposed to truck drivers who. Web 1099 truck drivers legal or not. It is used by truck drivers who work as independent contractors or owner. Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the time of. Web 23,907.

What is a 1099 & 5498? uDirect IRA Services, LLC

We are adding new 2024 model trucks this year We were asked a question. Apply to van driver, delivery driver, truck driver and more! Since they are considered contractors, 1099 workers do not have taxes deducted from their salary. Web truck drivers working as independent contractors are able to claim a number of deductions when filing their tax returns.

Ad Shrock Trucking Is Now Hiring Class A Cdl Otr Solo And Team Drivers Out Of Springfield, Mo.

It is used by truck drivers who work as independent contractors or owner. Web 1099 truck drivers legal or not. Apply to van driver, delivery driver, truck driver and more! Web truck drivers working as independent contractors are able to claim a number of deductions when filing their tax returns.

The Entire Gross Sum Would Be.

Web let’s take a look into 1099 for truck drivers. We were asked a question. You may also need to. We are adding new 2024 model trucks this year

Web Feb 4, 2022 5 Min Read 1099 Vs.

Web 1099 drivers may be like doordash contractors, postmates, instacart, uber, lyft, or other related gig jobs truck drivers for freight services deliveries are also 1099. Web actively working as a driver within the past 6 months. Web this form is used to assess business profit and loss. However, if you are classified as an 'independent contractor'.

Complete, Edit Or Print Tax Forms Instantly.

Truck driver tax deductions the irs allows truck drivers to deduct “ordinary and necessary” business expenses. Web form 1099 if your truck driving services are classified as an independent contractor and your payment equals $600 or more you will receive form 1099 from your. Since they are considered contractors, 1099 workers do not have taxes deducted from their salary. Web forms that you should file as a truck driver depends on your type of employment:

![Ultimate Tax Guide for Uber & Lyft Drivers [Updated for 2020]](https://i0.wp.com/therideshareguy.com/wp-content/uploads/2019/01/7f581fca-dac6-422f-9c38-471384c398f1_example20of20uber201099misc.jpg?ssl=1)

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)