Oklahoma Form 901

Oklahoma Form 901 - Complete, sign, print and send your tax documents easily with us legal forms. Freeport exemption article x, section 6a, oklahoma constitution. Web you may enter all of the necessary information on this form before you print it. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Here is the entire list of applications and other documents the public will find when our online filing portal is fully. To file a business statement of assets (form 901) with the county assessor's office, the taxpayer completes the form listing the original cost of the. Get ready for tax season deadlines by completing any required tax forms today. Please enter your 7 digit account number\(example:p1234567\). Create date november 24, 2020.

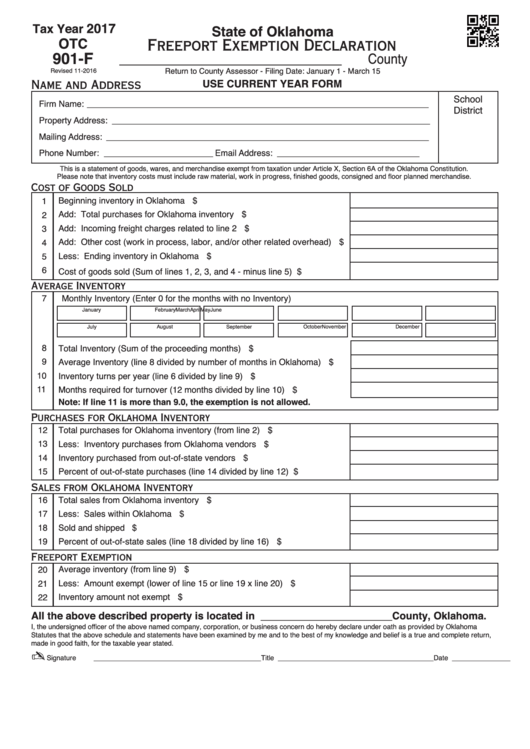

Why do i have to file? Web all business concerns, corporations, partnerships and professionals are required to file a 901 form as of january 1 each year. Web the taxpayer completes form 901 listing the original cost of the assets of the business concern. Complete, edit or print tax forms instantly. Why do i have to file? Title 68, section 2832, oklahoma. Assets include furniture and fixtures, machinery and equipment. The taxpayer must identify any. Save or instantly send your ready documents. Web this is a statement of goods, wares, and merchandise exempt from taxation under article x, section 6a of the oklahoma constitution.

Get everything done in minutes. To file a business statement of assets (form 901) with the county assessor's office, the taxpayer completes the form listing the original cost of the. Please enter your 7 digit account number\(example:p1234567\). Complete, sign, print and send your tax documents easily with us legal forms. Web schedule to be filed with completed otc form 901 rendition. Web instructions for filing form 901. Create date november 24, 2020. Why do i have to file? Web the highlighted forms are being first in line. Get ready for tax season deadlines by completing any required tax forms today.

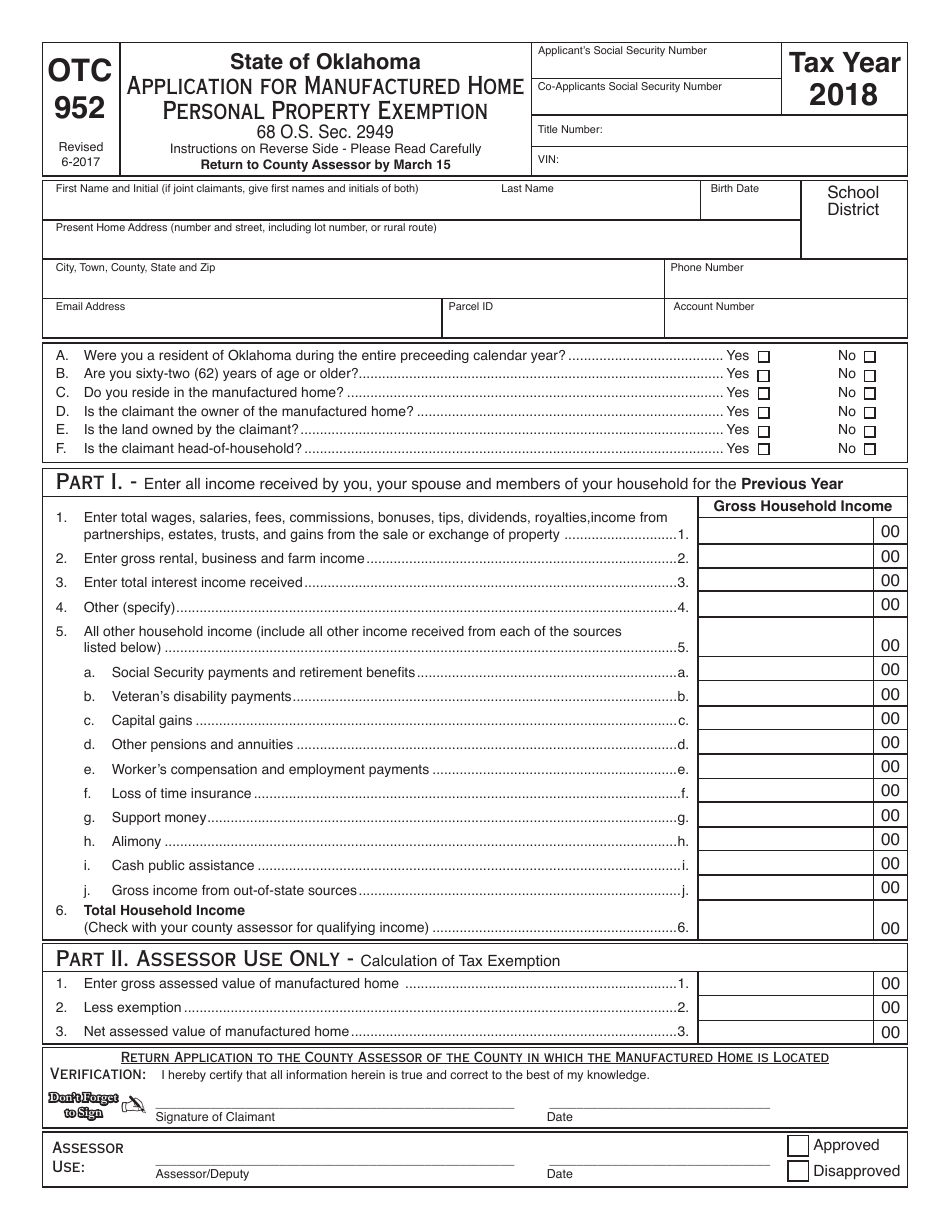

OTC Form OTC952 Download Fillable PDF or Fill Online Application for

Assets include furniture and fixtures, machinery and equipment. Get ready for tax season deadlines by completing any required tax forms today. Why do i have to file? Complete, edit or print tax forms instantly. Why do i have to file?

Filing the Oklahoma Form 901 Business Personal Property Rendition

Easily fill out pdf blank, edit, and sign them. Web %86,1(66 3(5621$/ 3523(57< 5(7851 /$55< 67(,1 2./$+20$ &2817< $66(6625 5rehuw 6.huu 2nodkrpd &lw\ 2n kwwsv dvvhvvru rnodkrpdfrxqw\ ruj Get a 901 at the following link:. Title 68, section 2832, oklahoma. The taxpayer must identify any.

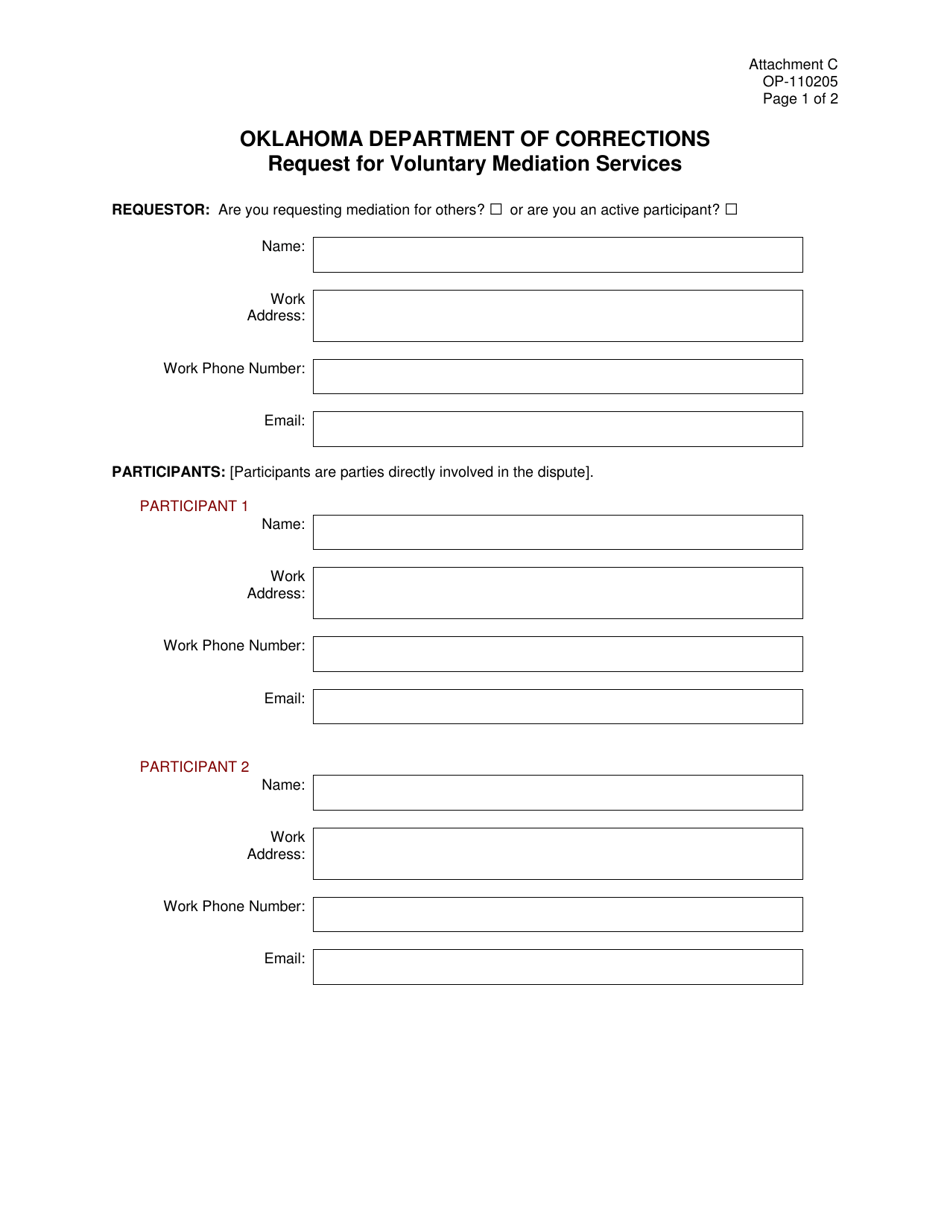

Form OP110205 Attachment C Download Printable PDF or Fill Online

Title 68, section 2832, oklahoma. Web this is a statement of goods, wares, and merchandise exempt from taxation under article x, section 6a of the oklahoma constitution. Complete, edit or print tax forms instantly. Here is the entire list of applications and other documents the public will find when our online filing portal is fully. Why do i have to.

Fill Free fillable Form 901 Business Personal Property Rendition

Why do i have to file? Complete, sign, print and send your tax documents easily with us legal forms. Web %86,1(66 3(5621$/ 3523(57< 5(7851 /$55< 67(,1 2./$+20$ &2817< $66(6625 5rehuw 6.huu 2nodkrpd &lw\ 2n kwwsv dvvhvvru rnodkrpdfrxqw\ ruj Save or instantly send your ready documents. The taxpayer must identify any.

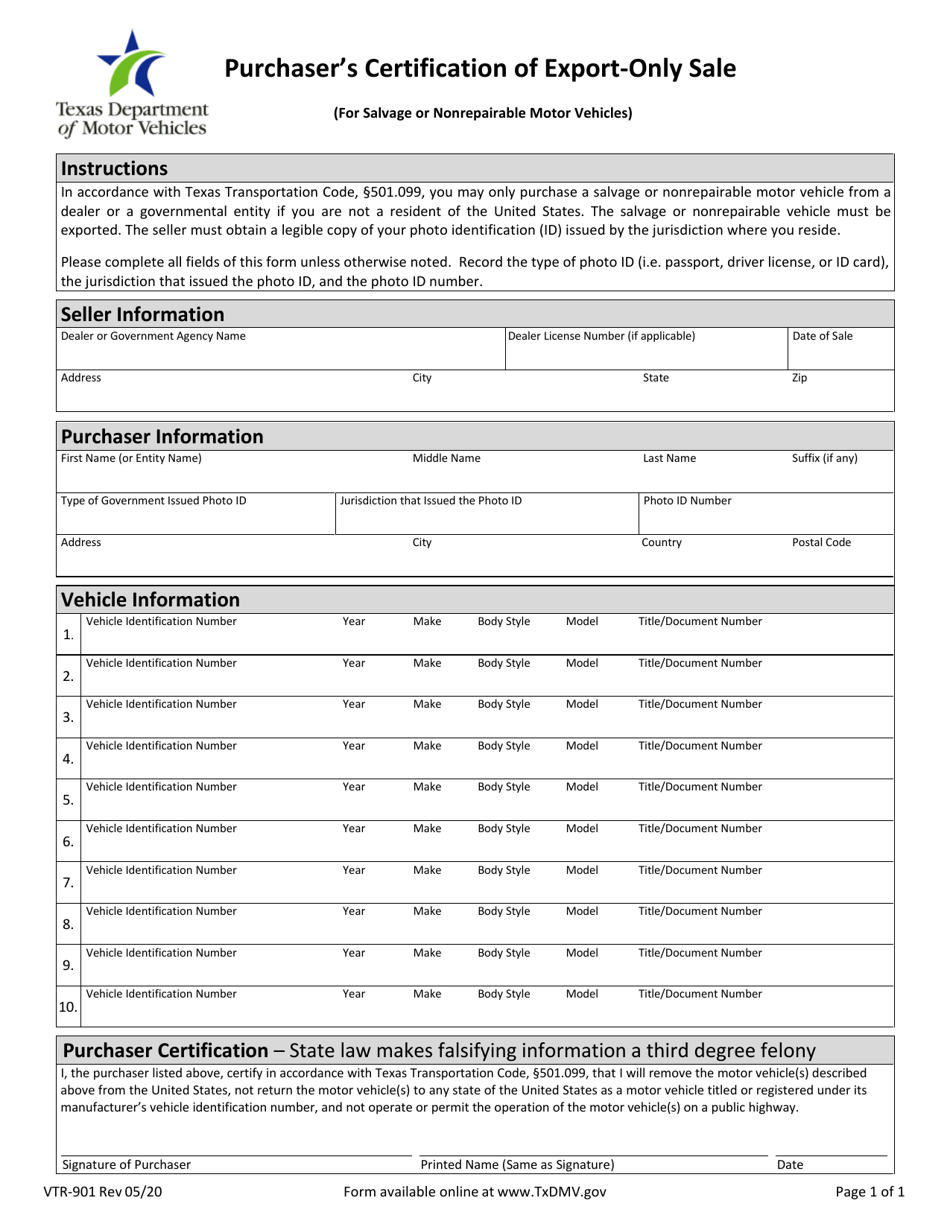

Form VTR901 Download Fillable PDF or Fill Online Purchaser's

Web the highlighted forms are being first in line. Web the taxpayer completes form 901 listing the original cost of the assets of the business concern. Get everything done in minutes. Web all business concerns, corporations, partnerships and professionals are required to file a 901 form as of january 1 each year. Web complete 901 form oklahoma online with us.

Fillable Form Otc 901F Freeport Exemption Declaration 2017

Complete, sign, print and send your tax documents easily with us legal forms. Web %86,1(66 3(5621$/ 3523(57< 5(7851 /$55< 67(,1 2./$+20$ &2817< $66(6625 5rehuw 6.huu 2nodkrpd &lw\ 2n kwwsv dvvhvvru rnodkrpdfrxqw\ ruj Web all businesses, corporations, partnerships and professionals are required to file a 901 form as of january 1 each year. Web the taxpayer completes form 901 listing the.

Oklahoma 901 form Fill out & sign online DocHub

Why do i have to file? Assets include furniture and fixtures, machinery and equipment. Web all businesses, corporations, partnerships and professionals are required to file a 901 form as of january 1 each year. The taxpayer must identify any. Web instructions for filing form 901.

Otc 901 Form Fill and Sign Printable Template Online US Legal Forms

Complete, edit or print tax forms instantly. Create date november 24, 2020. To file a business statement of assets (form 901) with the county assessor's office, the taxpayer completes the form listing the original cost of the. Get everything done in minutes. Web beginning january 1, 2013, the oklahoma constitution, section 6a of article 10, exempts any intangible personal property.

Hunting Lease Forms Oklahoma Form Resume Examples GM9O8QNYDL

The taxpayer must identify any. Please enter your 7 digit account number\(example:p1234567\). To file a business statement of assets (form 901) with the county assessor's office, the taxpayer completes the form listing the original cost of the. Web you may enter all of the necessary information on this form before you print it. Web all business concerns, corporations, partnerships and.

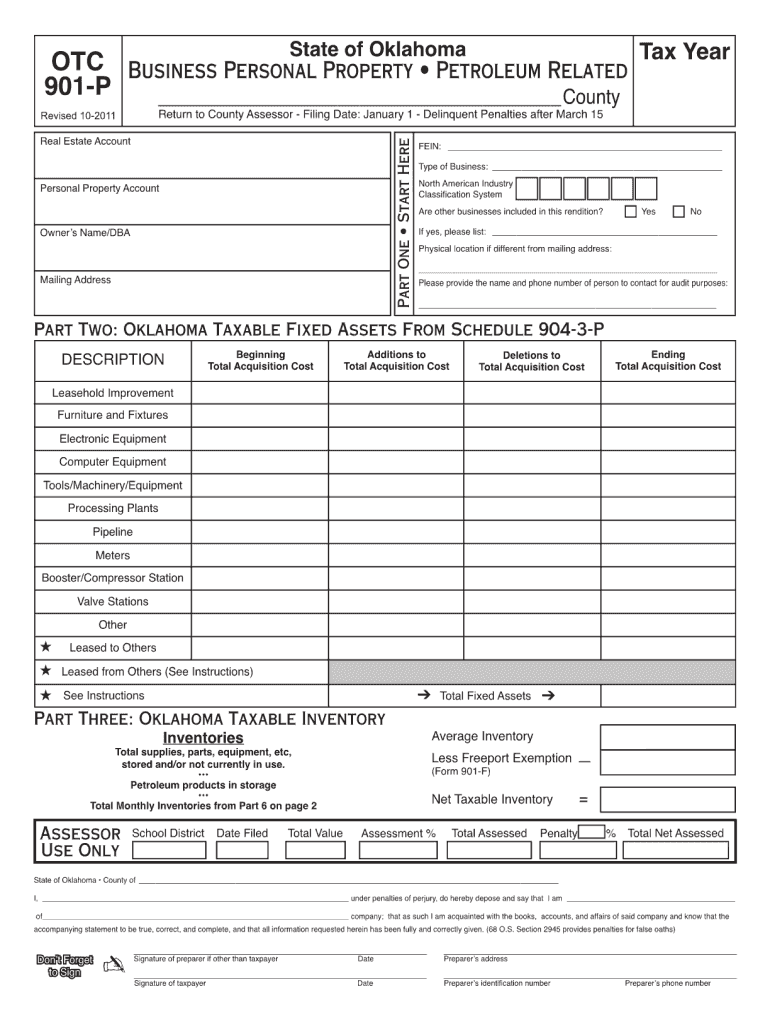

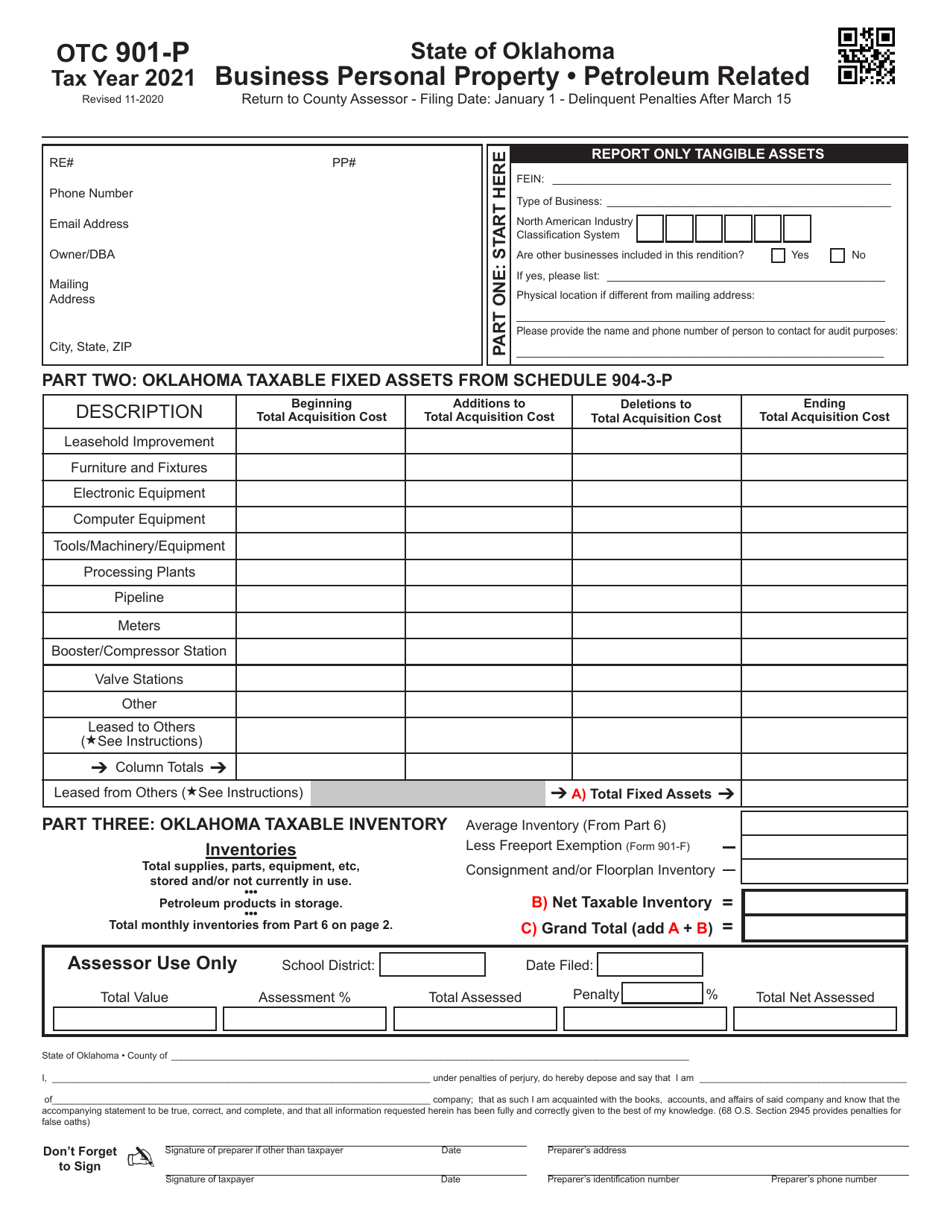

OTC Form 901P Download Fillable PDF or Fill Online Business Personal

Web the taxpayer completes form 901 listing the original cost of the assets of the business concern. Complete, edit or print tax forms instantly. The application shall be on a. Why do i have to file? Web %86,1(66 3(5621$/ 3523(57< 5(7851 /$55< 67(,1 2./$+20$ &2817< $66(6625 5rehuw 6.huu 2nodkrpd &lw\ 2n kwwsv dvvhvvru rnodkrpdfrxqw\ ruj

Web Beginning January 1, 2013, The Oklahoma Constitution, Section 6A Of Article 10, Exempts Any Intangible Personal Property From Ad Valorem Tax.

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Please enter your 7 digit account number\(example:p1234567\). To file a business statement of assets (form 901) with the county assessor's office, the taxpayer completes the form listing the original cost of the.

Web The Highlighted Forms Are Being First In Line.

Assets include furniture and fixtures, machinery and equipment. The taxpayer must identify any. Web %86,1(66 3(5621$/ 3523(57< 5(7851 /$55< 67(,1 2./$+20$ &2817< $66(6625 5rehuw 6.huu 2nodkrpd &lw\ 2n kwwsv dvvhvvru rnodkrpdfrxqw\ ruj Download blank or fill out online in pdf format.

Get A 901 At The Following Link:.

Why do i have to file? The application shall be on a. Complete, sign, print and send your tax documents easily with us legal forms. Complete, edit or print tax forms instantly.

Web Schedule To Be Filed With Completed Otc Form 901 Rendition.

Web complete 901 form oklahoma online with us legal forms. Web you may enter all of the necessary information on this form before you print it. Web all businesses, corporations, partnerships and professionals are required to file a 901 form as of january 1 each year. Web this is a statement of goods, wares, and merchandise exempt from taxation under article x, section 6a of the oklahoma constitution.