Where To Send Form 2848

Where To Send Form 2848 - Web note that the submit forms 2848 and 8821 online tool allows both form 2848 and form 8821 authorizations to be uploaded online but still requires manual. It also has friendly web addresses that can be bookmarked: Web generating form 2848 power of attorney (poa) in lacerte. When filing the form, include a copy. Irs allows remote signing and submission of forms 2848 and 8821. Web submit your form 2848 securely at irs.gov/ submit2848. Web when you’re ready to submit form 2848, you can fax or mail it to one of the addresses listed on the form’s instructions. Most practitioners will simply fax your completed form 2848 to the irs caf unit. For form 2848, use the power of attorney input fields to designate a power of attorney representative. Web you must file form 2848 if you would like your attorney, family member or accountant to be able to act on your behalf for tax matters.

Web new system to ‘submit forms 2848 and 8821 online’. For more information on specific use, see the instructions for line 4 on page 2. It also has friendly web addresses that can be bookmarked: You may file it electronically or by mail. Web you must file form 2848 if you would like your attorney, family member or accountant to be able to act on your behalf for tax matters. Web note that the submit forms 2848 and 8821 online tool allows both form 2848 and form 8821 authorizations to be uploaded online but still requires manual. Web is it a, send the irs a new form 2848 for every client showing your new address, b, send a letter, fax or mail to the caf function with every client's identifying information, c,. Web form 2848 fax number. Form 2848 is called “power of. Web if form 2848 is for a specific use, mail or fax it to the office handling that matter.

Web new system to ‘submit forms 2848 and 8821 online’. Tax professionals can find the new “submit forms 2848 and 8821 online” tool on the irs.gov/taxpro page. You may file it electronically or by mail. When filing the form, include a copy. Web is it a, send the irs a new form 2848 for every client showing your new address, b, send a letter, fax or mail to the caf function with every client's identifying information, c,. Web submit your form 2848 securely at irs.gov/ submit2848. Web to access form 2848, from the main menu of the tax return (form 1040) select: Web if form 2848 is for a specific use, mail or fax it to the office handling that matter. Form 2848 is called “power of. Bottom line by filing form 2848, you’re essentially.

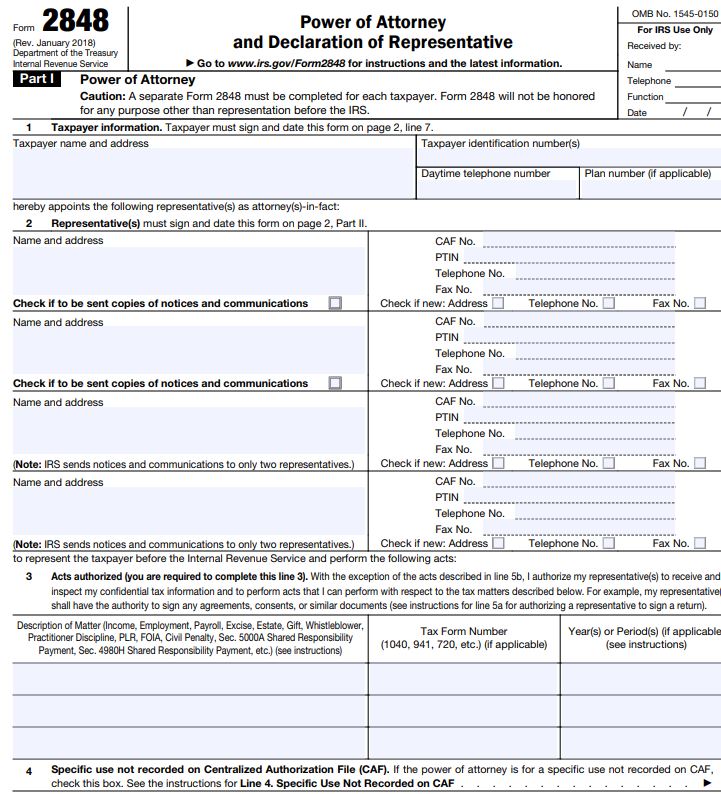

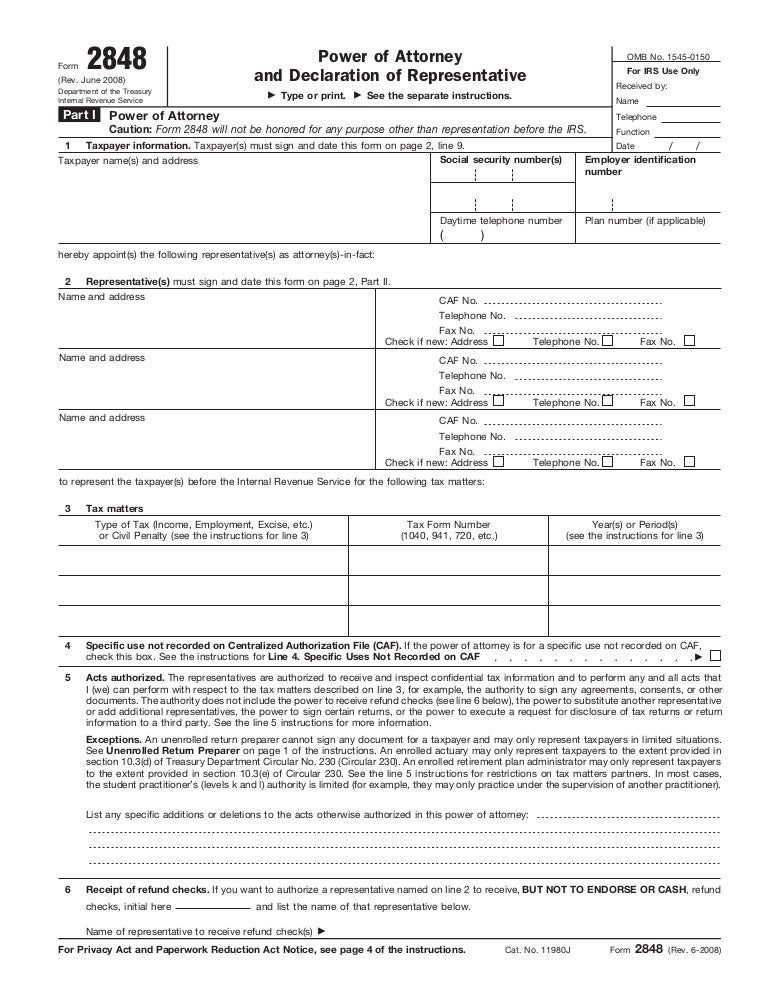

Form 2848 IRS Power of Attorney (2023)

Web form 2848 is an internal revenue service form where you can designate someone to act on your behalf when dealing with them. You will need to have a secure access account to submit your form 2848 online. For more information on specific use, see the instructions for line 4 on page 2. For form 2848, use the power of.

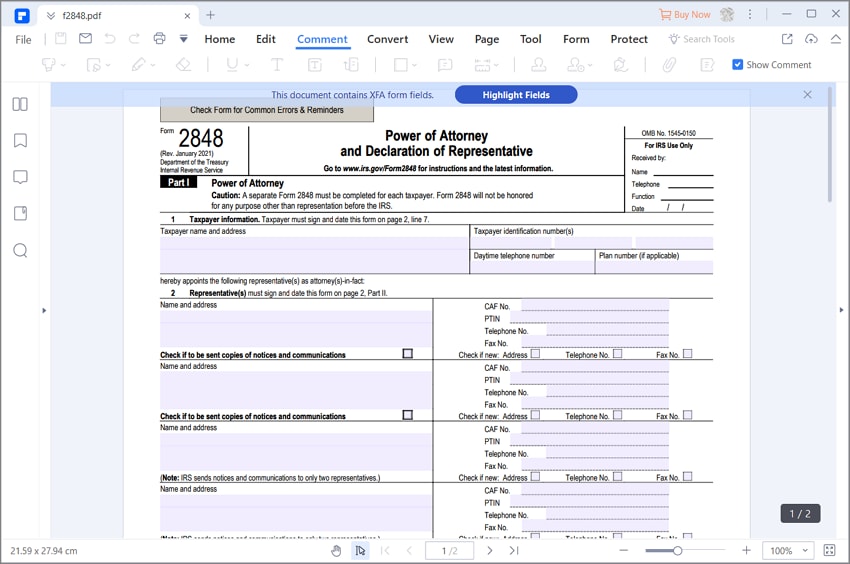

IRS Form 2848 Filling Instructions You Can’t Miss

Web the instructions for form 2848 provide the address where you should file the form depending on the state where your parent lives. Tax professionals must have a secure access account,. Web when you’re ready to submit form 2848, you can fax or mail it to one of the addresses listed on the form’s instructions. Web if form 2848 is.

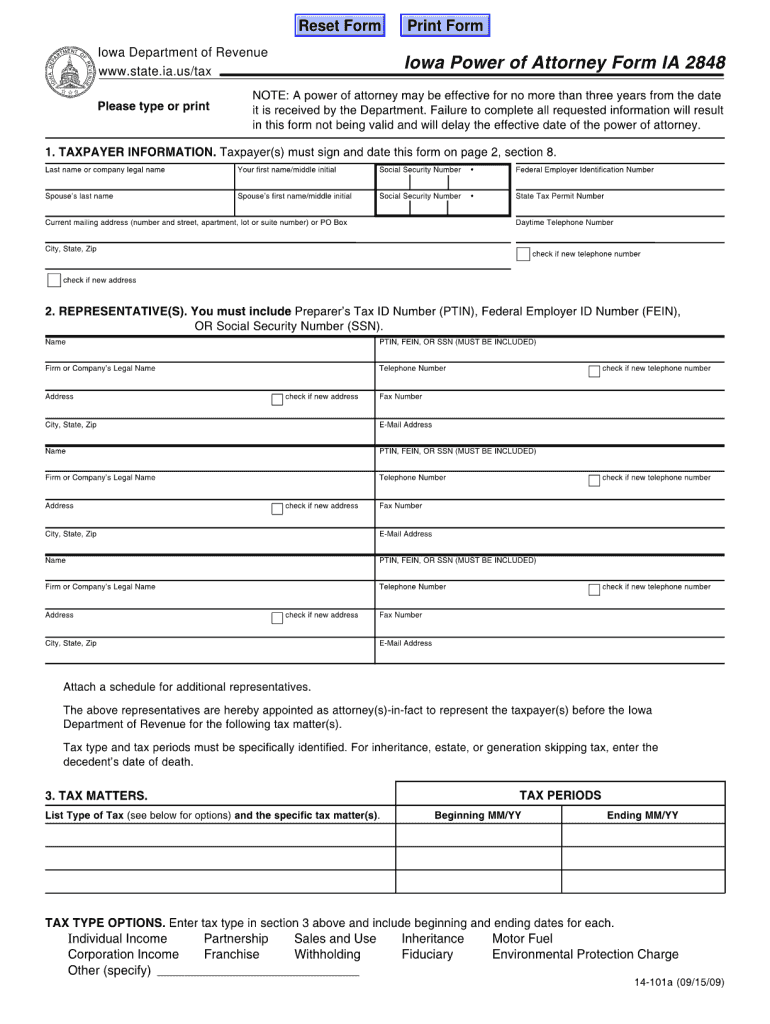

Iowa Form 2848 Fill Out and Sign Printable PDF Template signNow

Web if form 2848 is for a specific use, mail or fax it to the office handling that matter. You will need to have a secure access account to submit your form 2848 online. Irs allows remote signing and submission of forms 2848 and 8821. For more information on specific use, see the instructions for line 4 on page 2..

Form 2848Power of Attorney and Declaration of Representative

Web submit your form 2848 securely at irs.gov/ submit2848. You will need to have a secure access account to submit your form 2848 online. You may file it electronically or by mail. Web you must file form 2848 if you would like your attorney, family member or accountant to be able to act on your behalf for tax matters. For.

Form 2848 Instructions for IRS Power of Attorney Community Tax

Web form 2848 is an internal revenue service form where you can designate someone to act on your behalf when dealing with them. Web form 2848 fax number. Web is it a, send the irs a new form 2848 for every client showing your new address, b, send a letter, fax or mail to the caf function with every client's.

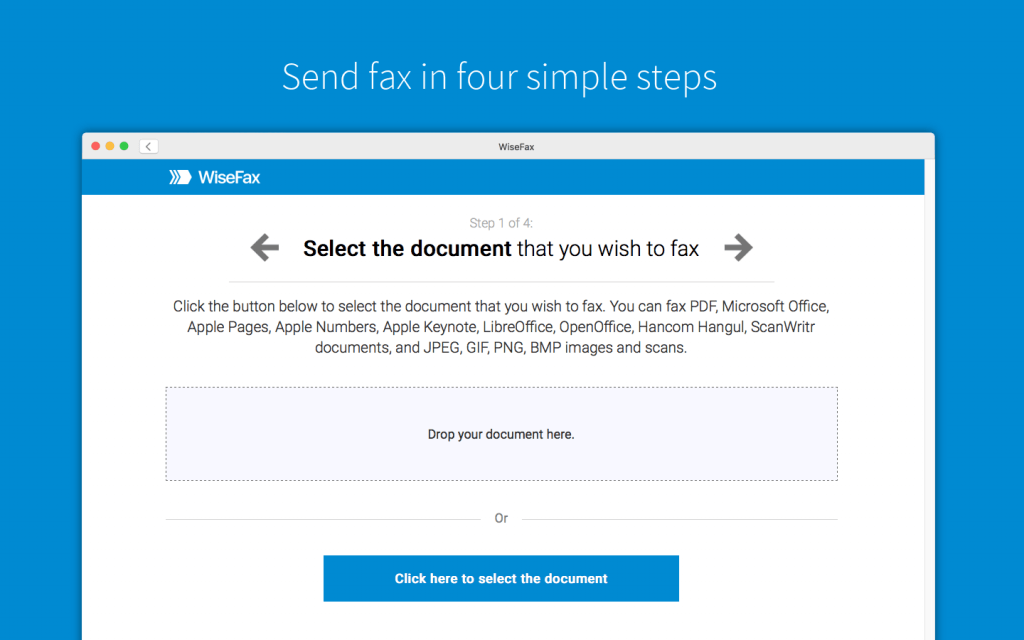

Send your Form 2848 to the IRS securely via fax Faxaroo

Web new system to ‘submit forms 2848 and 8821 online’. Web the submit forms 2848 and 8821 online tool is available from the irs.gov/taxpros page. When filing the form, include a copy. You will need to have a secure access account to submit your form 2848 online. Web note that the submit forms 2848 and 8821 online tool allows both.

Permission Too Speak On Behalf Form If you have a disability or

For form 2848, use the power of attorney input fields to designate a power of attorney representative. Web to access form 2848, from the main menu of the tax return (form 1040) select: Web the instructions for form 2848 provide the address where you should file the form depending on the state where your parent lives. Web tax professionals can.

Purpose of IRS Form 2848 How to fill & Instructions Accounts Confidant

Most practitioners will simply fax your completed form 2848 to the irs caf unit. For more information on specific use, see the instructions for line 4 on page 2. Web is it a, send the irs a new form 2848 for every client showing your new address, b, send a letter, fax or mail to the caf function with every.

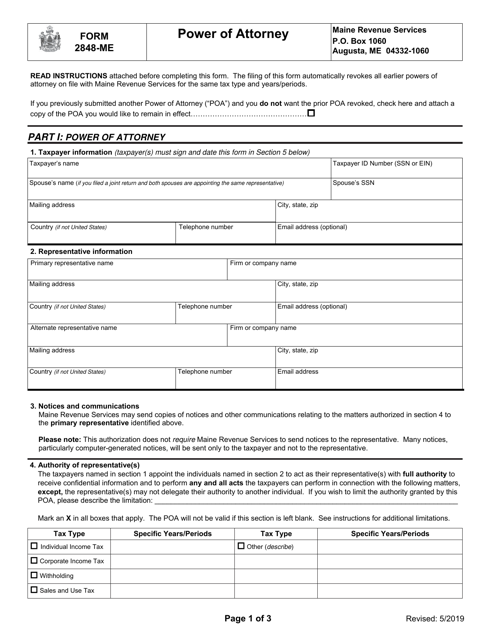

Form 2848ME Download Fillable PDF or Fill Online Power of Attorney

Web submit your form 2848 securely at irs.gov/ submit2848. Web is it a, send the irs a new form 2848 for every client showing your new address, b, send a letter, fax or mail to the caf function with every client's identifying information, c,. Web generating form 2848 power of attorney (poa) in lacerte. Web note that the submit forms.

Fax Form 2848 Online Quickly and Easily With WiseFax

Web note that the submit forms 2848 and 8821 online tool allows both form 2848 and form 8821 authorizations to be uploaded online but still requires manual. Tax professionals must have a secure access account,. You may file it electronically or by mail. You will need to have a secure access account to submit your form 2848 online. Web generating.

Bottom Line By Filing Form 2848, You’re Essentially.

Form 2848 is called “power of. Web is it a, send the irs a new form 2848 for every client showing your new address, b, send a letter, fax or mail to the caf function with every client's identifying information, c,. Web you must file form 2848 if you would like your attorney, family member or accountant to be able to act on your behalf for tax matters. Web if form 2848 is for a specific use, mail or fax it to the office handling that matter.

Web Form 2848 Fax Number.

For form 2848, use the power of attorney input fields to designate a power of attorney representative. Web submit your form 2848 securely at irs.gov/ submit2848. You may file it electronically or by mail. Irs allows remote signing and submission of forms 2848 and 8821.

Web When You’re Ready To Submit Form 2848, You Can Fax Or Mail It To One Of The Addresses Listed On The Form’s Instructions.

For more information on specific use, see the instructions for line 4 on page 2. Web note that the submit forms 2848 and 8821 online tool allows both form 2848 and form 8821 authorizations to be uploaded online but still requires manual. Web to access form 2848, from the main menu of the tax return (form 1040) select: Web generating form 2848 power of attorney (poa) in lacerte.

When Filing The Form, Include A Copy.

Tax professionals can find the new “submit forms 2848 and 8821 online” tool on the irs.gov/taxpro page. Web form 2848 is an internal revenue service form where you can designate someone to act on your behalf when dealing with them. Web tax professionals can find the new submit forms 2848 and 8821 online on the irs.gov/taxpros page. You will need to have a secure access account to submit your form 2848 online.

/2848POAandDeclarationofRepresentative-1-dc7262d52b53477e9bd16828e7429381.png)