When To File Form 56

When To File Form 56 - In order to keep file sizes under this limit, yet still provide for quality documents, the court recommends the. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Individuals who are establishing a fiduciary relationship with a. Web 6) the file size per document for esubmit is limited to 50 mb. Knott 9.86k subscribers join subscribe 208 share save 10k views 1 year ago #irs #estatetax. His income was less than $600 for 2016. Form 56 differs from a form 2848,. For example, if you are. Web a fiduciary files form 56 to notify the irs about any changes in a fiduciary relationship. Web do i need to complete the form 56?

In order to keep file sizes under this limit, yet still provide for quality documents, the court recommends the. Form 56 differs from a form 2848,. Do i need to send form 56 if i. Web do i need to complete the form 56? For example, if you are. Web 6) the file size per document for esubmit is limited to 50 mb. Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Web when and where to file. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Web the fiduciary (usually a trustee or an executor) of an estate or trust or a guardian should use this form to notify the irs of the creation or termination of a fiduciary relationship.

Do i need to send form 56 if i. Form 56 differs from a form 2848,. Web you may need to file form 56, notice concerning fiduciary relationship to notify the irs of the existence of a fiduciary relationship. 2 part ii revocation or termination of notice section a—total revocation or termination 6 check this box if you are revoking or terminating. Web this form is typically filed when an individual becomes incapacitated, decides to delegate his or her tax responsibilities, or the individual dies. His income was less than $600 for 2016. Individuals who are establishing a fiduciary relationship with a. This form changes the estate's notification address to the fiduciary's address. Web 6 rows file form 56 at internal revenue service center where the person for whom you are acting is required. Web trustees can file form 56 when they gain or lose responsibility over a decedent or a decedent’s estate.

Patrick Devine Documents Fill Online, Printable, Fillable, Blank

Web this form is typically filed when an individual becomes incapacitated, decides to delegate his or her tax responsibilities, or the individual dies. Web 6 rows file form 56 at internal revenue service center where the person for whom you are acting is required. Form 56 differs from a form 2848,. Web do i need to complete the form 56?.

Fill Free fillable Notice Concerning Fiduciary Relationship of

Web 6 rows file form 56 at internal revenue service center where the person for whom you are acting is required. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. In order to keep file sizes under this limit, yet still.

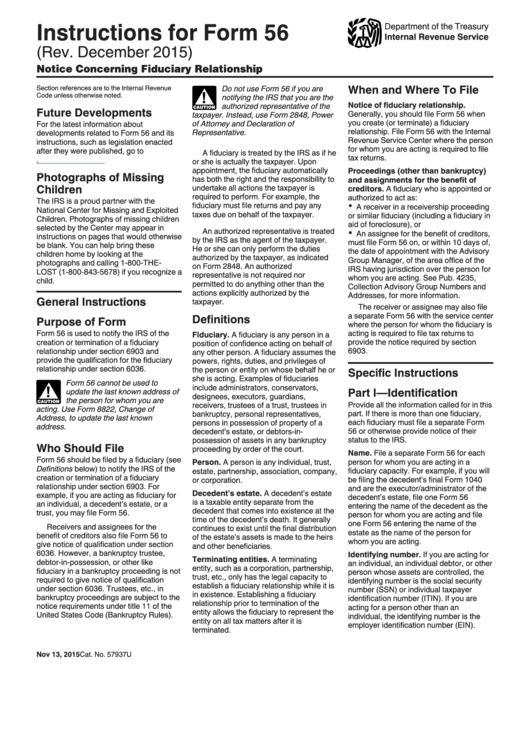

Instructions For Form 56 Notice Concerning Fiduciary Relationship

Knott 9.86k subscribers join subscribe 208 share save 10k views 1 year ago #irs #estatetax. Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Individuals who are establishing a fiduciary relationship with a. Do i need to send form 56 if i. Web form 56 should be filed by a fiduciary (see definitions below) to.

Form 56 Notice Concerning Fiduciary Relationship (2012) Free Download

Web 6 rows file form 56 at internal revenue service center where the person for whom you are acting is required. Web 6) the file size per document for esubmit is limited to 50 mb. 2 part ii revocation or termination of notice section a—total revocation or termination 6 check this box if you are revoking or terminating. Web when.

Form 56 About IRS Tax Form 56 & Filing Instructions Community Tax

In order to keep file sizes under this limit, yet still provide for quality documents, the court recommends the. Web do i need to complete the form 56? Do i need to send form 56 if i. Web 6) the file size per document for esubmit is limited to 50 mb. Web a fiduciary files form 56 to notify the.

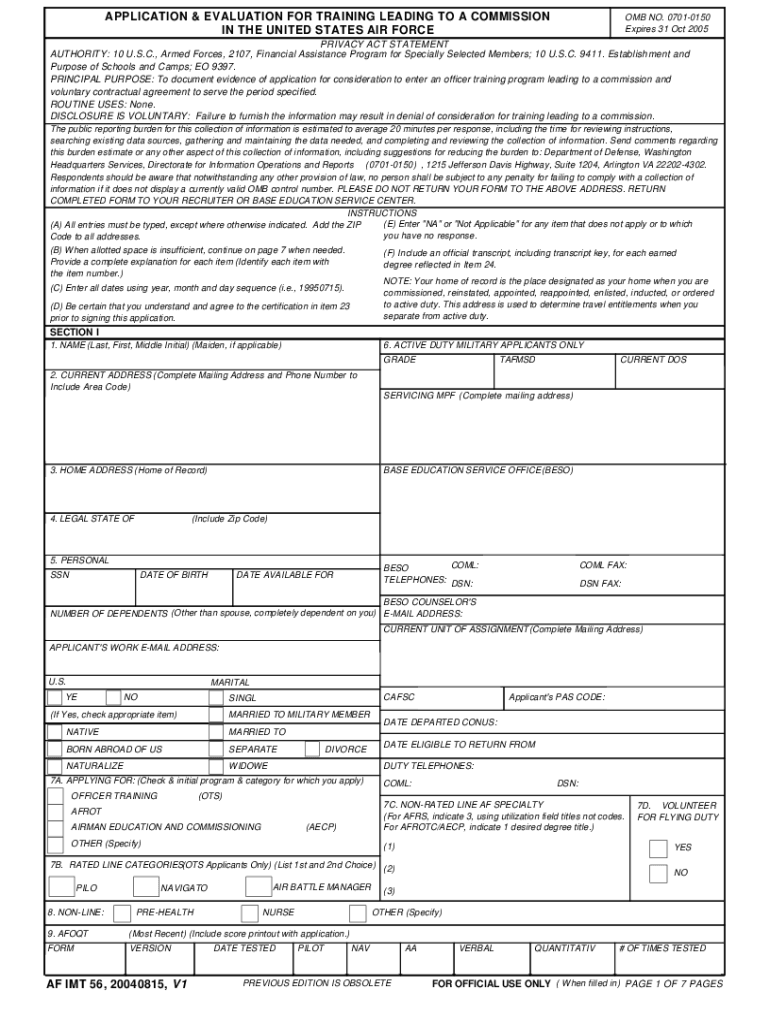

Af Form 56 Fill Out and Sign Printable PDF Template signNow

This form changes the estate's notification address to the fiduciary's address. 2 part ii revocation or termination of notice section a—total revocation or termination 6 check this box if you are revoking or terminating. Web do i need to complete the form 56? Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of.

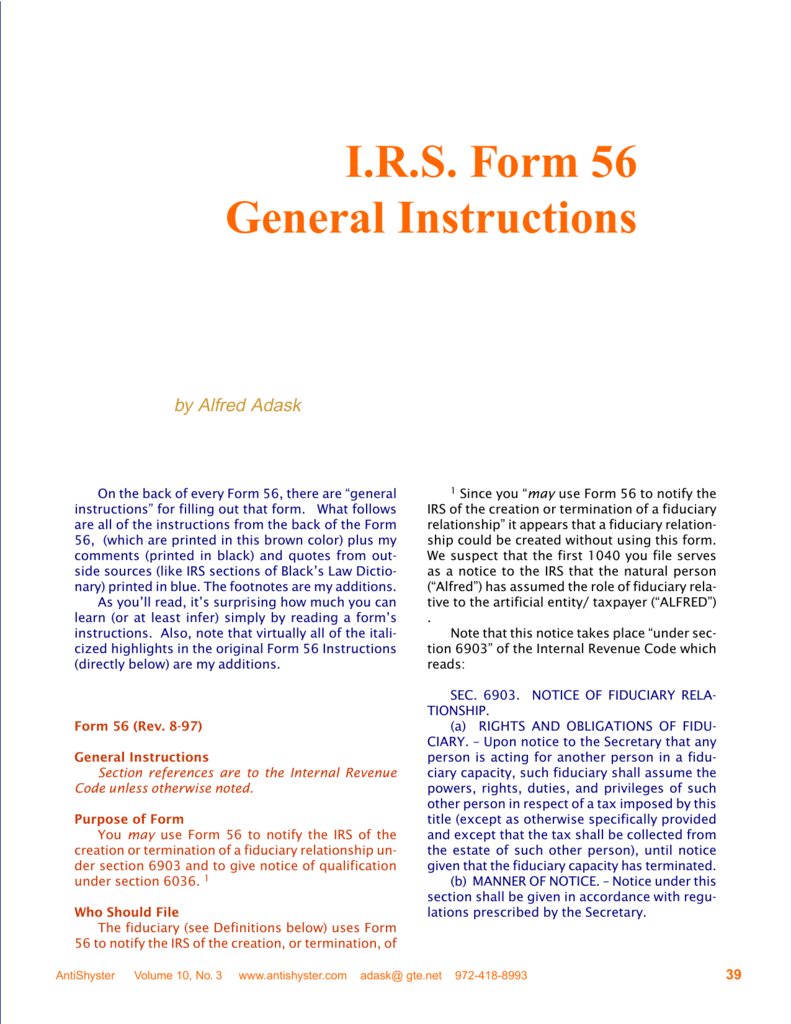

I.R.S. Form 56 General Instructions

2 part ii revocation or termination of notice section a—total revocation or termination 6 check this box if you are revoking or terminating. In order to keep file sizes under this limit, yet still provide for quality documents, the court recommends the. I'm the successor trustee for my deceased father's trust. His income was less than $600 for 2016. Do.

All About IRS Form 56 Tax Resolution Services

Web you may need to file form 56, notice concerning fiduciary relationship to notify the irs of the existence of a fiduciary relationship. Web 6) the file size per document for esubmit is limited to 50 mb. 2 part ii revocation or termination of notice section a—total revocation or termination 6 check this box if you are revoking or terminating..

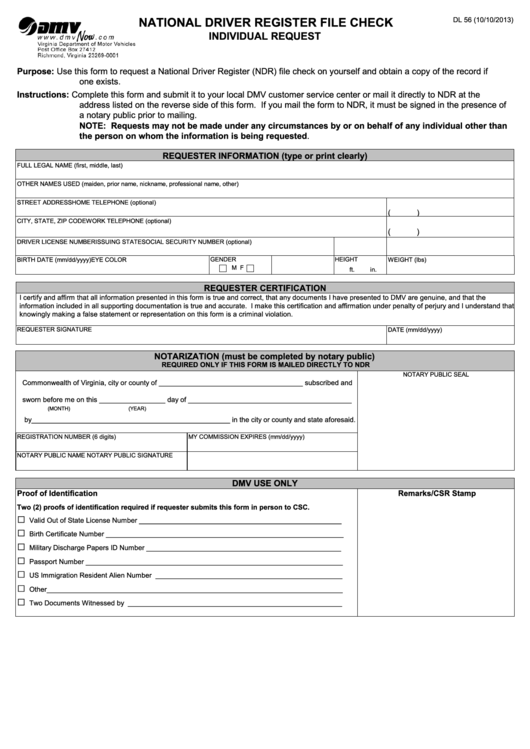

Fillable Form Dl 56 National Driver Register File Check Individual

Web 6 rows file form 56 at internal revenue service center where the person for whom you are acting is required. Web this form is typically filed when an individual becomes incapacitated, decides to delegate his or her tax responsibilities, or the individual dies. Web do i need to complete the form 56? In order to keep file sizes under.

Form 56 IRS Template PDF

Form 56 differs from a form 2848,. I'm the successor trustee for my deceased father's trust. 2 part ii revocation or termination of notice section a—total revocation or termination 6 check this box if you are revoking or terminating. This form changes the estate's notification address to the fiduciary's address. Web this form is typically filed when an individual becomes.

Generally, You Should File Form 56 When You Create (Or Terminate) A Fiduciary Relationship.

Web 6 rows file form 56 at internal revenue service center where the person for whom you are acting is required. Web 6) the file size per document for esubmit is limited to 50 mb. Do i need to send form 56 if i. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903.

Form 56 Differs From A Form 2848,.

Web you may need to file form 56, notice concerning fiduciary relationship to notify the irs of the existence of a fiduciary relationship. Knott 9.86k subscribers join subscribe 208 share save 10k views 1 year ago #irs #estatetax. Web when and where to file. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).

Web This Form Is Typically Filed When An Individual Becomes Incapacitated, Decides To Delegate His Or Her Tax Responsibilities, Or The Individual Dies.

Web the fiduciary (usually a trustee or an executor) of an estate or trust or a guardian should use this form to notify the irs of the creation or termination of a fiduciary relationship. His income was less than $600 for 2016. Web trustees can file form 56 when they gain or lose responsibility over a decedent or a decedent’s estate. For example, if you are.

Web Do I Need To Complete The Form 56?

I'm the successor trustee for my deceased father's trust. In order to keep file sizes under this limit, yet still provide for quality documents, the court recommends the. Individuals who are establishing a fiduciary relationship with a. This form changes the estate's notification address to the fiduciary's address.