What Is Turbo Tax Consent Form

What Is Turbo Tax Consent Form - Be sure to mention that you’d like to revoke your “consent for use of tax return information.” Web what is the consent to use of tax return information? Web 1 best answer. Easily file federal and state income tax returns with 100% accuracy to get your maximum tax refund. I consent to allow my intermediate. Web can someone explain consent required for paying turbo tax with my federal refund? If you are not required to file this form follow the steps to delete it: Web full service for personal taxes full service for business taxes. In fact, this consent form allows intuit and their. Web understanding the purpose of the turbotax consent form • unlock the mystery of the turbotax consent form:

It may seem silly, but. Web 2.1k views 1 year ago. Web understanding the purpose of the turbotax consent form • unlock the mystery of the turbotax consent form: This is a requirement from the irs in order to file your return. Log in to your account. Web full service for personal taxes full service for business taxes. Web what is the consent to use of tax return information? The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. Web consent to access and store account data. Web for turbotax, you have to email privacy@intuit.com.

Easily file federal and state income tax returns with 100% accuracy to get your maximum tax refund. Log in to your account. Web 2.1k views 1 year ago. This is what the consent form is allowing us to do. Be sure to mention that you’d like to revoke your “consent for use of tax return information.” If you are not required to file this form follow the steps to delete it: Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web this year's scam is a bogus consent form at the start of the process that looks as if the irs requires that it be signed. Web for turbotax, you have to email privacy@intuit.com. Web 1 best answer.

View larger

This is a requirement from the irs in order to file your return. Web 2.1k views 1 year ago. This is what the consent form is allowing us to do. Web what is the consent to use of tax return information? Web 1 best answer.

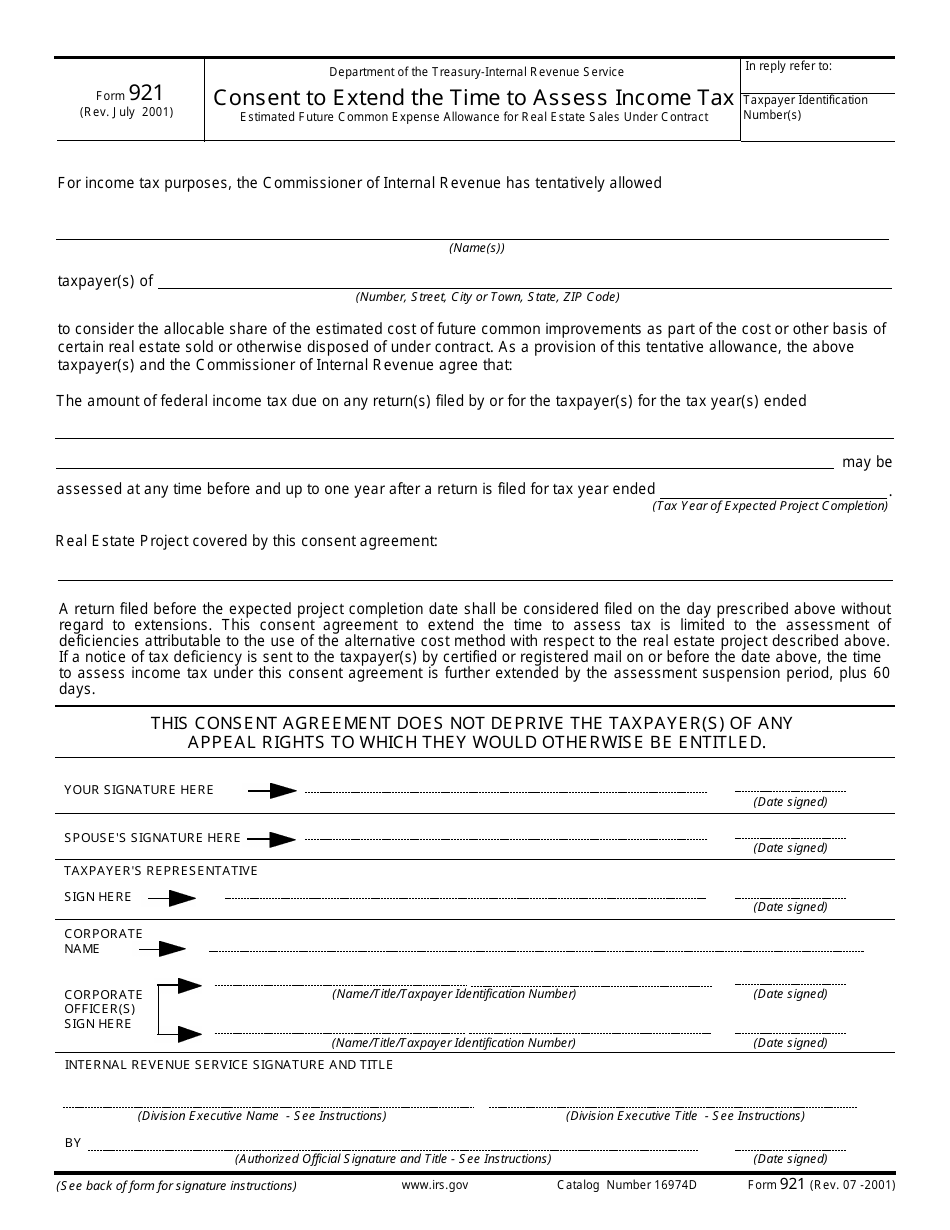

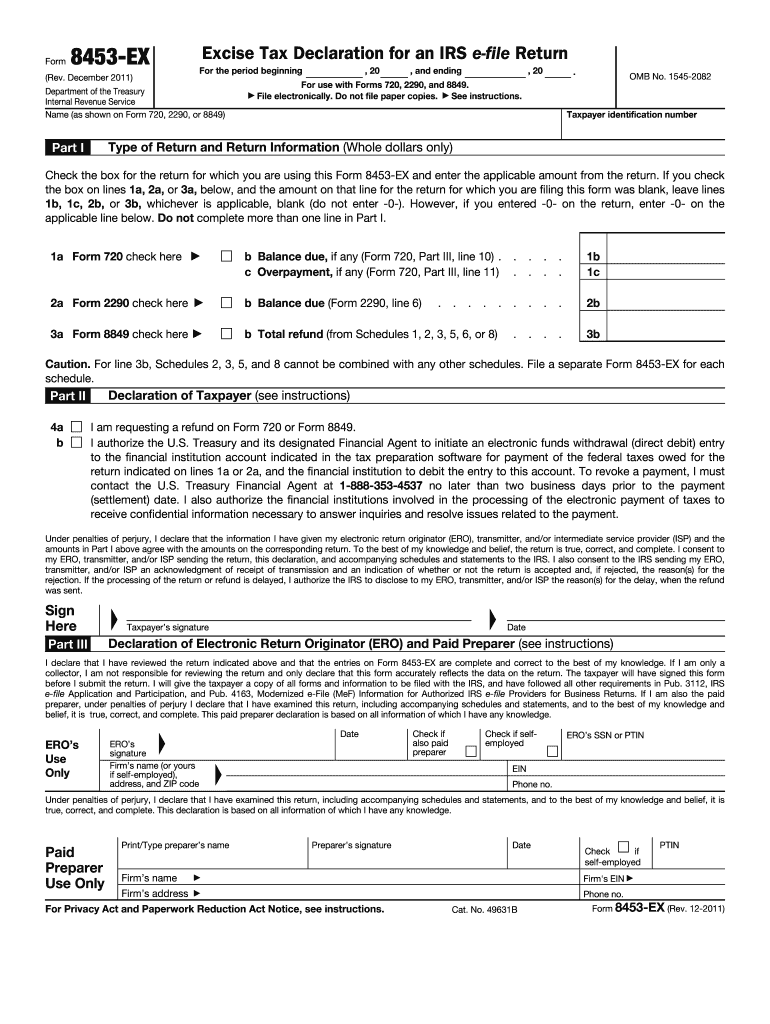

IRS Form 921 Download Fillable PDF or Fill Online Consent to Extend the

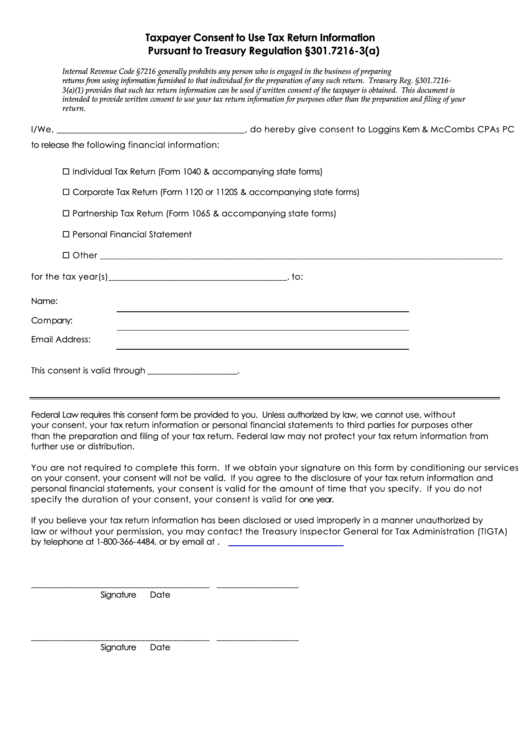

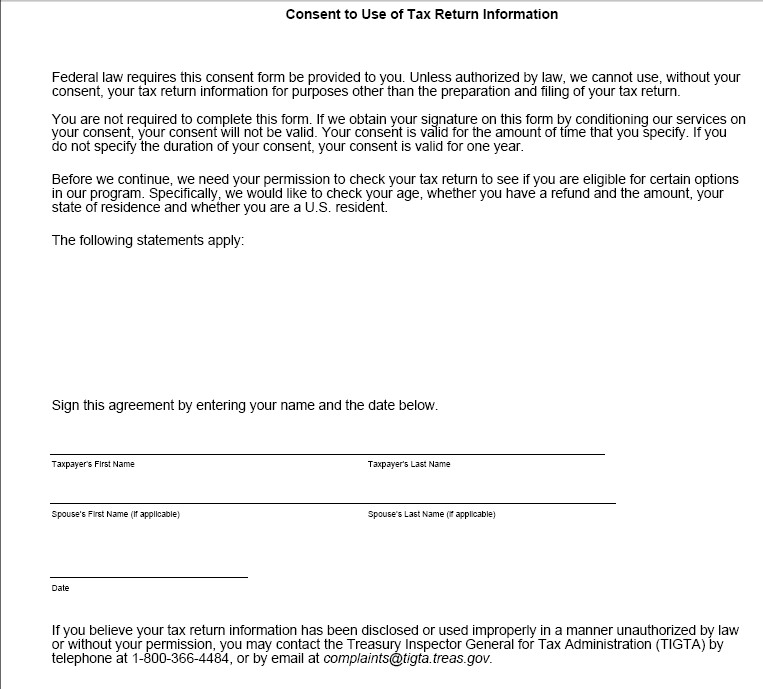

Web 1 best answer bluedeb level 15 consent for use of tax return information unless authorized by law, we cannot use your tax return information for purposes other. Web what is the consent to use of tax return information? This is a requirement from the irs in order to file your return. This consent form is not to sell or.

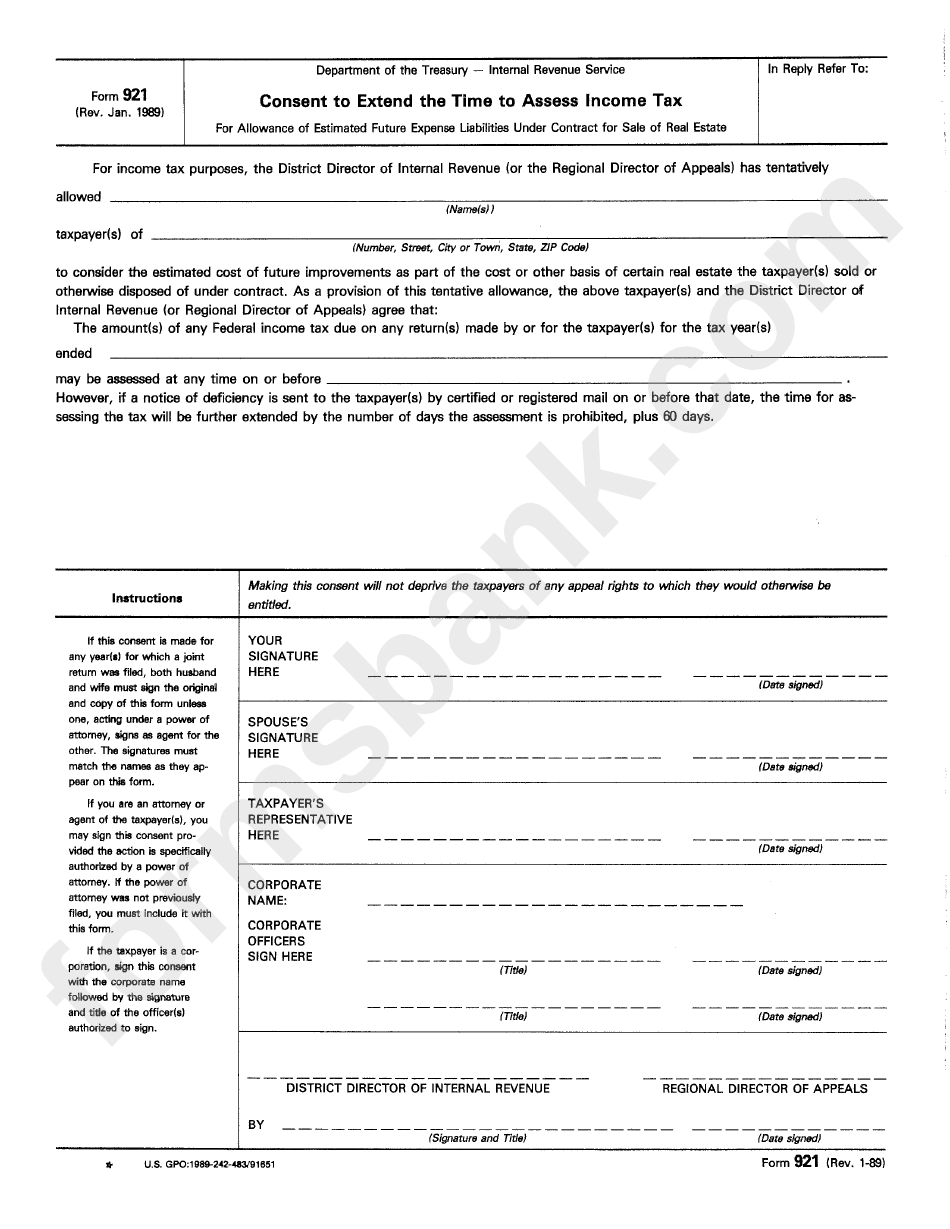

Form 921 Consent To Extend The Time To Assess Tax Internal

The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web 1 best answer bluedeb level 15 consent for use of tax return information unless authorized by.

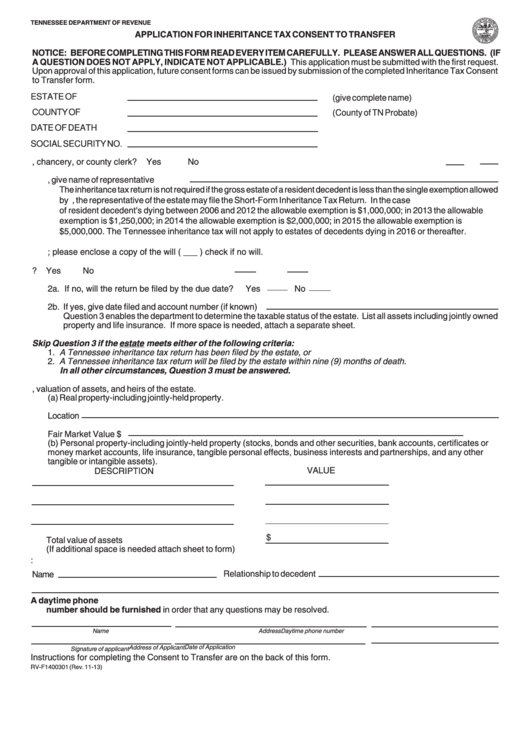

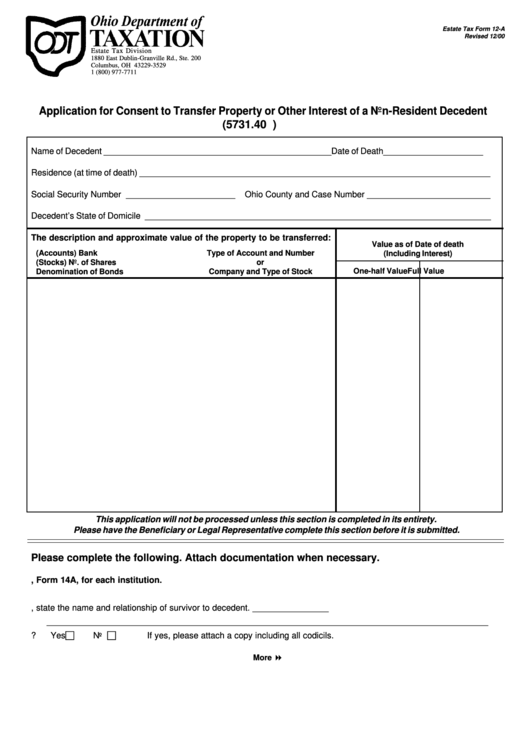

Form RvF1400301 Application For Inheritance Tax Consent To Transfer

Be sure to mention that you’d like to revoke your “consent for use of tax return information.” Web consent to access and store account data. It may seem silly, but. The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. This is a requirement from.

Fillable Taxpayer Consent To Use Tax Return Information printable pdf

Web for turbotax, you have to email privacy@intuit.com. Log in to your account. Web consent to access and store account data. This consent form is not to sell or market your information. This is what the consent form is allowing us to do.

How Accurate Is Turbo Tax Calculator? Tax Relief Center

Web can someone explain consent required for paying turbo tax with my federal refund? Web what is the consent to use of tax return information? I consent to allow my intermediate. This is a requirement from the irs in order to file your return. This consent form is not to sell or market your information.

form 2106 turbotax Fill Online, Printable, Fillable Blank

Web form 8615 is used to figure your child’s tax on unearned income. Easily sort by irs forms to find the product that best fits your tax situation. This is a requirement from the irs in order to file your return. Web what is the consent to use of tax return information? Log in to your account.

How To Upload Your Form 1099 To Turbotax Turbo Tax

Web understanding the purpose of the turbotax consent form • unlock the mystery of the turbotax consent form: In fact, this consent form allows intuit and their. This is a requirement from the irs in order to file your return. Web 1 best answer bluedeb level 15 consent for use of tax return information unless authorized by law, we cannot.

Warning TurboTax 2009's Fraudulent Consent to Steal Your Tax Data

This is what the consent form is allowing us to do. The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. Web this year's scam is a bogus consent form at the start of the process that looks as if the irs requires that it.

Estate Tax Form 12A Application For Consent To Transfer Property

Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. This consent form is not to sell or market your information. Web 1 best answer. Web for turbotax, you have to email privacy@intuit.com. When setting up your account, you will review a page titled personalize your taxslayer experience with two consents (for.

Web 1 Best Answer Bluedeb Level 15 Consent For Use Of Tax Return Information Unless Authorized By Law, We Cannot Use Your Tax Return Information For Purposes Other.

This is a requirement from the irs in order to file your return. Web understanding the purpose of the turbotax consent form • unlock the mystery of the turbotax consent form: Easily file federal and state income tax returns with 100% accuracy to get your maximum tax refund. When setting up your account, you will review a page titled personalize your taxslayer experience with two consents (for.

Web What Is The Consent To Use Of Tax Return Information?

Easily sort by irs forms to find the product that best fits your tax situation. Log in to your account. Web can someone explain consent required for paying turbo tax with my federal refund? This is what the consent form is allowing us to do.

Web No, The Disclosure Agreement Is To Allow The Turbotax Program To Access Your Information To Determine If You Qualify For Things Such As Using Your Refund To Pay Your.

It may seem silly, but. The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. Web for turbotax, you have to email privacy@intuit.com. I consent to allow my intermediate.

If You Are Not Required To File This Form Follow The Steps To Delete It:

This consent form is not to sell or market your information. Web 1 best answer. Web 1 best answer. Web this year's scam is a bogus consent form at the start of the process that looks as if the irs requires that it be signed.