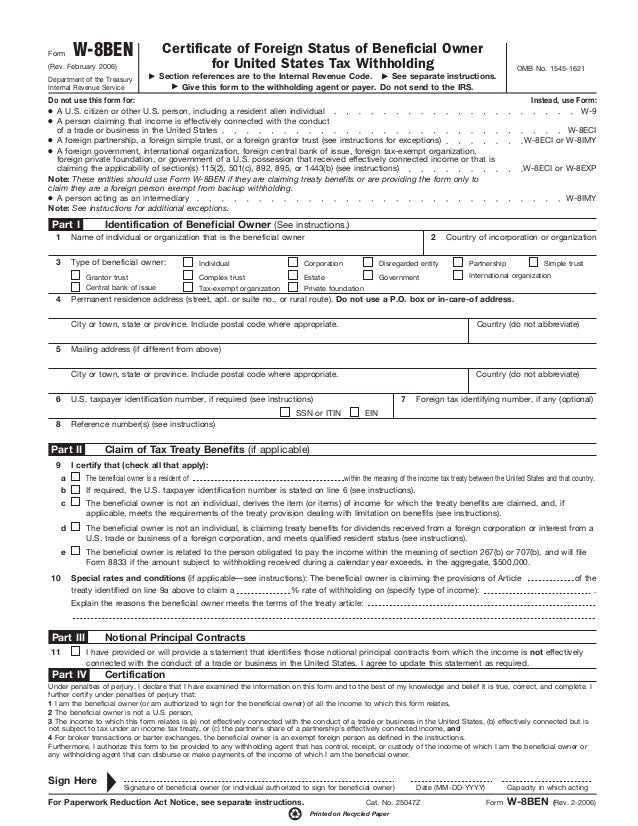

What Is Form W-8Ben

What Is Form W-8Ben - To claim an exemption from withholding taxes from income earned or derived in the u.s. Tax withholding for income earned in the u.s. Web i am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income or proceeds to which this form relates or am using this form to document myself for chapter 4 purposes; Tax withholding is used by a foreign person to establish both foreign status and beneficial ownership, and to claim income tax treaty benefits with respect to income other than compensation for personal services. Once complete, it is effective starting on the date signed and it expires on the last day of the third following calendar year. Client in order to avoid. October 2021) department of the treasury internal revenue service do not use this form if: October 2021) certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) section references are to the internal revenue code unless otherwise noted. This covers dividends from u.s. Companies or interest income from u.s.

These forms document taxpayer information that the irs requires us to collect for people and businesses receiving payments through our platform. Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. • this form relates to: Income you may receive in your account. Companies or interest income from u.s. This covers dividends from u.s. To claim an exemption from withholding taxes from income earned or derived in the u.s. Tax withholding for income earned in the u.s. October 2021) department of the treasury internal revenue service do not use this form if: Client in order to avoid.

These forms document taxpayer information that the irs requires us to collect for people and businesses receiving payments through our platform. To claim an exemption from withholding taxes from income earned or derived in the u.s. Any individual who provides a service or product for the us market, but does not live there, needs to know the complexities of paying income tax in more than one country. October 2021) certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) section references are to the internal revenue code unless otherwise noted. What's new guidance under section 1446 (f). Income you may receive in your account. Companies or interest income from u.s. Once complete, it is effective starting on the date signed and it expires on the last day of the third following calendar year. Tax withholding for income earned in the u.s. Tax withholding is used by a foreign person to establish both foreign status and beneficial ownership, and to claim income tax treaty benefits with respect to income other than compensation for personal services.

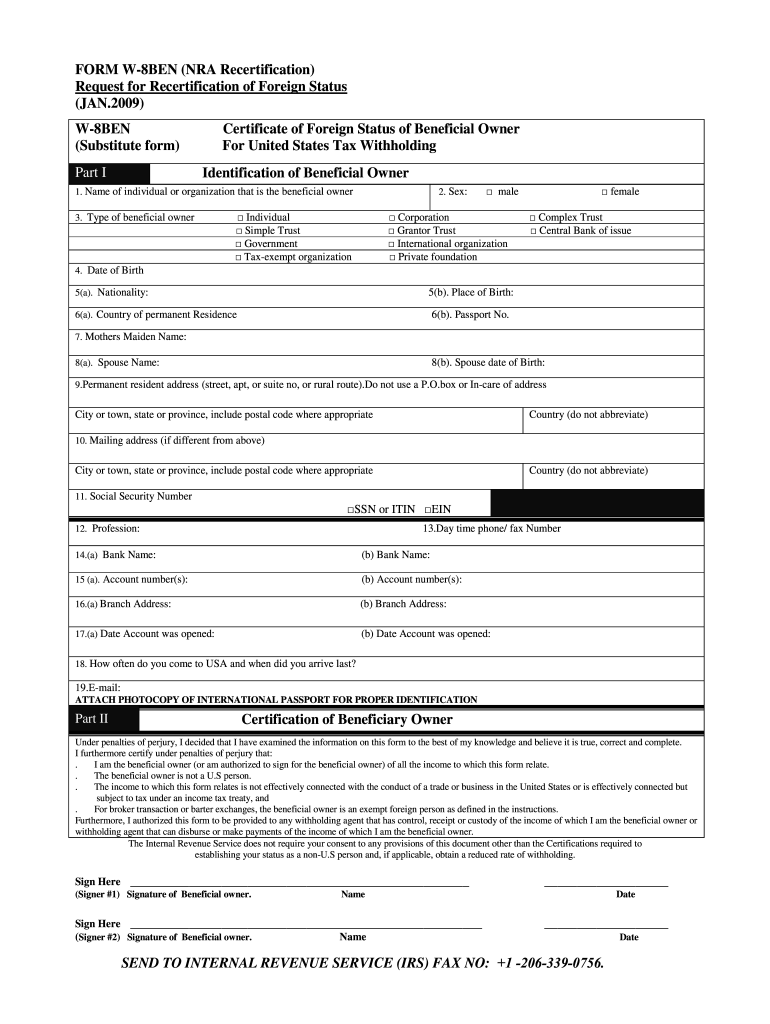

W8BENE

Sources subject to income tax withholding or the nra account holder at a foreign financial institution (ffi). Any individual who provides a service or product for the us market, but does not live there, needs to know the complexities of paying income tax in more than one country. October 2021) department of the treasury internal revenue service do not use.

How do I submit the W8BEN form for Saxotrader? Seedly

This covers dividends from u.s. • this form relates to: Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. Companies or interest income from u.s. Client in order to avoid.

W8BEN Form

Once complete, it is effective starting on the date signed and it expires on the last day of the third following calendar year. What's new guidance under section 1446 (f). Web i am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income or proceeds to.

Form W8BENE Certificate of Entities Status of Beneficial Owner for

Any individual who provides a service or product for the us market, but does not live there, needs to know the complexities of paying income tax in more than one country. What's new guidance under section 1446 (f). October 2021) department of the treasury internal revenue service do not use this form if: Web i am the individual that is.

W 8ben India Fill Online, Printable, Fillable, Blank PDFfiller

Tax withholding for income earned in the u.s. Tax withholding is used by a foreign person to establish both foreign status and beneficial ownership, and to claim income tax treaty benefits with respect to income other than compensation for personal services. October 2021) certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) section references.

How To Fill Up W8BEN Form For US Manulife REIT My Sweet Retirement

• the person named on line 1 of this form is not a u.s. This covers dividends from u.s. Sources subject to income tax withholding or the nra account holder at a foreign financial institution (ffi). October 2021) department of the treasury internal revenue service do not use this form if: What's new guidance under section 1446 (f).

W 8ben Instructions Create A Digital Sample in PDF

Client in order to avoid. What's new guidance under section 1446 (f). October 2021) department of the treasury internal revenue service do not use this form if: This covers dividends from u.s. October 2021) certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) section references are to the internal revenue code unless otherwise noted.

IRS W8BEN Form Template Fill & Download Online [+ Free PDF]

To claim an exemption from withholding taxes from income earned or derived in the u.s. October 2021) certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) section references are to the internal revenue code unless otherwise noted. Web i am the individual that is the beneficial owner (or am authorized to sign for the.

Form W 8ben Fill Online, Printable, Fillable, Blank pdfFiller

Companies or interest income from u.s. Any individual who provides a service or product for the us market, but does not live there, needs to know the complexities of paying income tax in more than one country. These forms document taxpayer information that the irs requires us to collect for people and businesses receiving payments through our platform. Citizen or.

Form W8BEN Retroactive Statement existing vendors Fill and Sign

Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. These forms document taxpayer information that the irs requires us to collect for people and businesses receiving payments through our platform. To claim an exemption from withholding taxes from income earned or derived in the u.s. Companies or interest income from.

October 2021) Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting (Individuals) Section References Are To The Internal Revenue Code Unless Otherwise Noted.

Tax withholding for income earned in the u.s. Income you may receive in your account. Companies or interest income from u.s. Sources subject to income tax withholding or the nra account holder at a foreign financial institution (ffi).

October 2021) Department Of The Treasury Internal Revenue Service Do Not Use This Form If:

Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. Any individual who provides a service or product for the us market, but does not live there, needs to know the complexities of paying income tax in more than one country. • the person named on line 1 of this form is not a u.s. • this form relates to:

Tax Withholding Is Used By A Foreign Person To Establish Both Foreign Status And Beneficial Ownership, And To Claim Income Tax Treaty Benefits With Respect To Income Other Than Compensation For Personal Services.

Web i am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income or proceeds to which this form relates or am using this form to document myself for chapter 4 purposes; Client in order to avoid. Key takeaways individuals or entities outside the u.s. Citizen or resident alien is entitled to certain benefits under the internal revenue code.

These Forms Document Taxpayer Information That The Irs Requires Us To Collect For People And Businesses Receiving Payments Through Our Platform.

What's new guidance under section 1446 (f). To claim an exemption from withholding taxes from income earned or derived in the u.s. This covers dividends from u.s. Once complete, it is effective starting on the date signed and it expires on the last day of the third following calendar year.

![IRS W8BEN Form Template Fill & Download Online [+ Free PDF]](https://www.pandadoc.com/app/uploads/form-w-8ben.png)