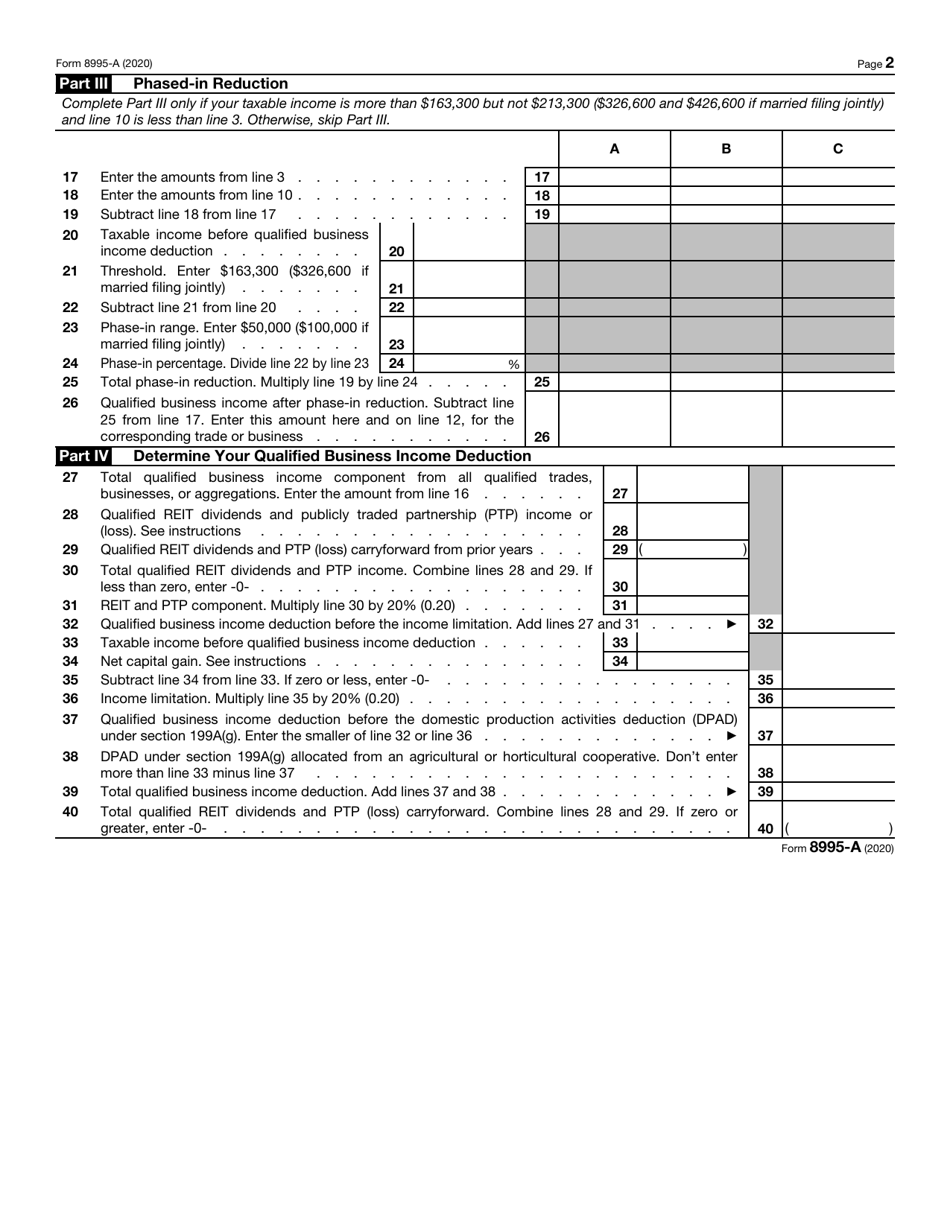

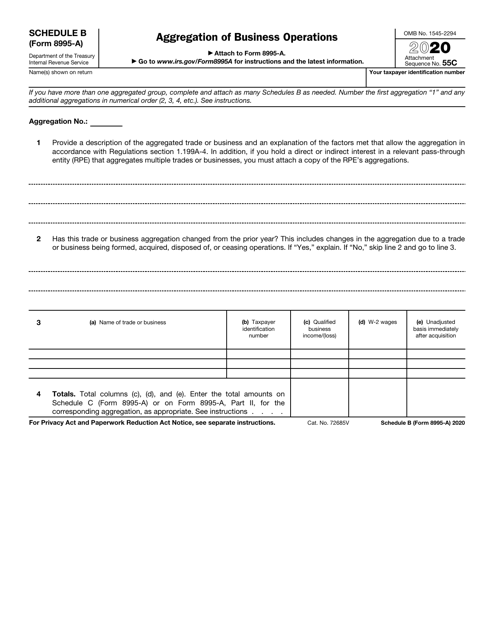

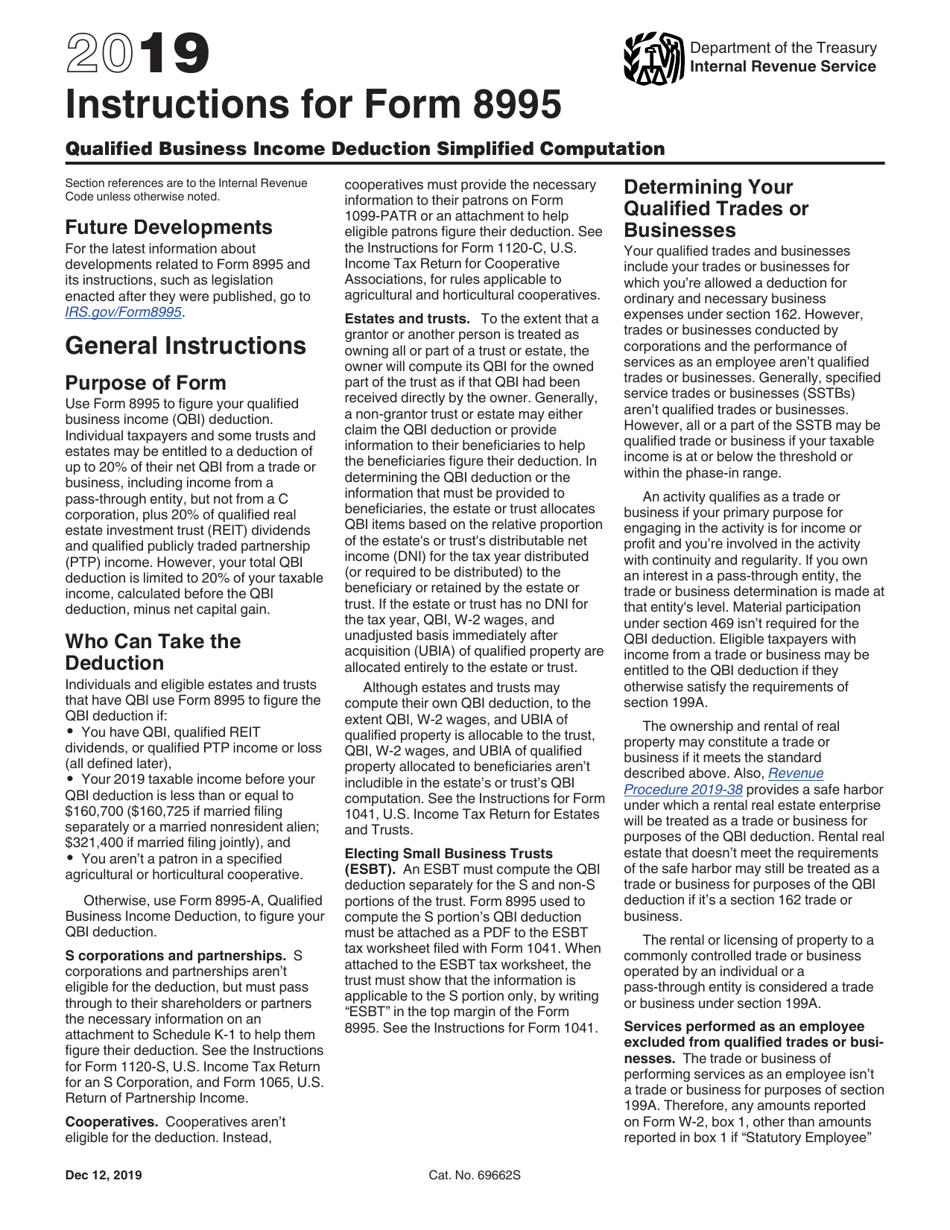

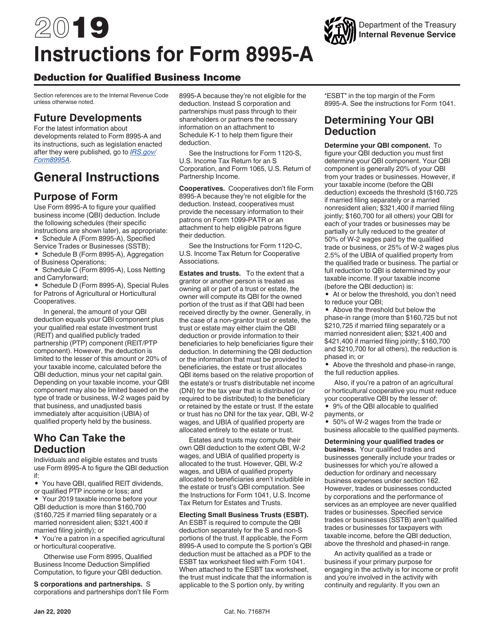

What Is Form 8995-A Used For

What Is Form 8995-A Used For - Form 8995 is a simplified. In addition to form 8995, the irs also has form. Web use form 8995 to calculate your qualified business income (qbi) deduction. Include the following schedules (their specific instructions are. You have qbi, qualified reit dividends, or qualified ptp income or loss (all. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: The partnership shows a reduction for loss netting of $2500 in column b ($12,500 x 0.20= 2500). If a person within a household had a marketplace insurance plan in the previous year, they should receive a health insurance marketplace. This includes their name, address, employer identification number (ein),. Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of.

Form 8995 is the simplified form and is used if all of the following are true: Include the following schedules (their specific instructions are. Form 8995 cannot be used by all businesses. Web the form 8995 is used to figure your qualified business income (qbi) deduction. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web march 7, 2022. This includes their name, address, employer identification number (ein),. Web what is form 8995? In addition to form 8995, the irs also has form. The partnership shows a reduction for loss netting of $2500 in column b ($12,500 x 0.20= 2500).

Web what is form 8995? Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Form 8995 cannot be used by all businesses. If a person within a household had a marketplace insurance plan in the previous year, they should receive a health insurance marketplace. Web march 7, 2022. Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of. Form 8995 is a simplified. The partnership shows a reduction for loss netting of $2500 in column b ($12,500 x 0.20= 2500). This includes their name, address, employer identification number (ein),.

Using Form 8995 To Determine Your Qualified Business Deduction

Web the form 8995 is used to figure your qualified business income (qbi) deduction. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). In addition to form 8995, the irs also has form. Who can use form 8995? This includes their name, address, employer identification number (ein),.

Other Version Form 8995A 8995 Form Product Blog

Include the following schedules (their specific instructions are. The partnership shows a reduction for loss netting of $2500 in column b ($12,500 x 0.20= 2500). Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Form 8995 is the simplified form and is used if all of the following are true:.

IRS Form 8995A Download Fillable PDF or Fill Online Qualified Business

Form 8995 is the simplified form and is used if all of the following are true: Web the form 8995 is used to figure your qualified business income (qbi) deduction. Web what is form 8995? Who can use form 8995? Form 8995 cannot be used by all businesses.

Form 8995a Qualified Business Deduction Phrase on the Sheet

Web the form 8995 is used to figure your qualified business income (qbi) deduction. Web what is form 8995? Form 8995 is a simplified. Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid).

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

If you have a business (1099 income), or an amount in box 5 of a form 1099. Form 8995 is the simplified form and is used if all of the following are true: You have qbi, qualified reit dividends, or qualified ptp income or loss (all. If a person within a household had a marketplace insurance plan in the previous.

Download Instructions for IRS Form 8995 Qualified Business

The individual has qualified business income. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of. Form 8995 is the simplified form and is used if all of the following are true: In addition.

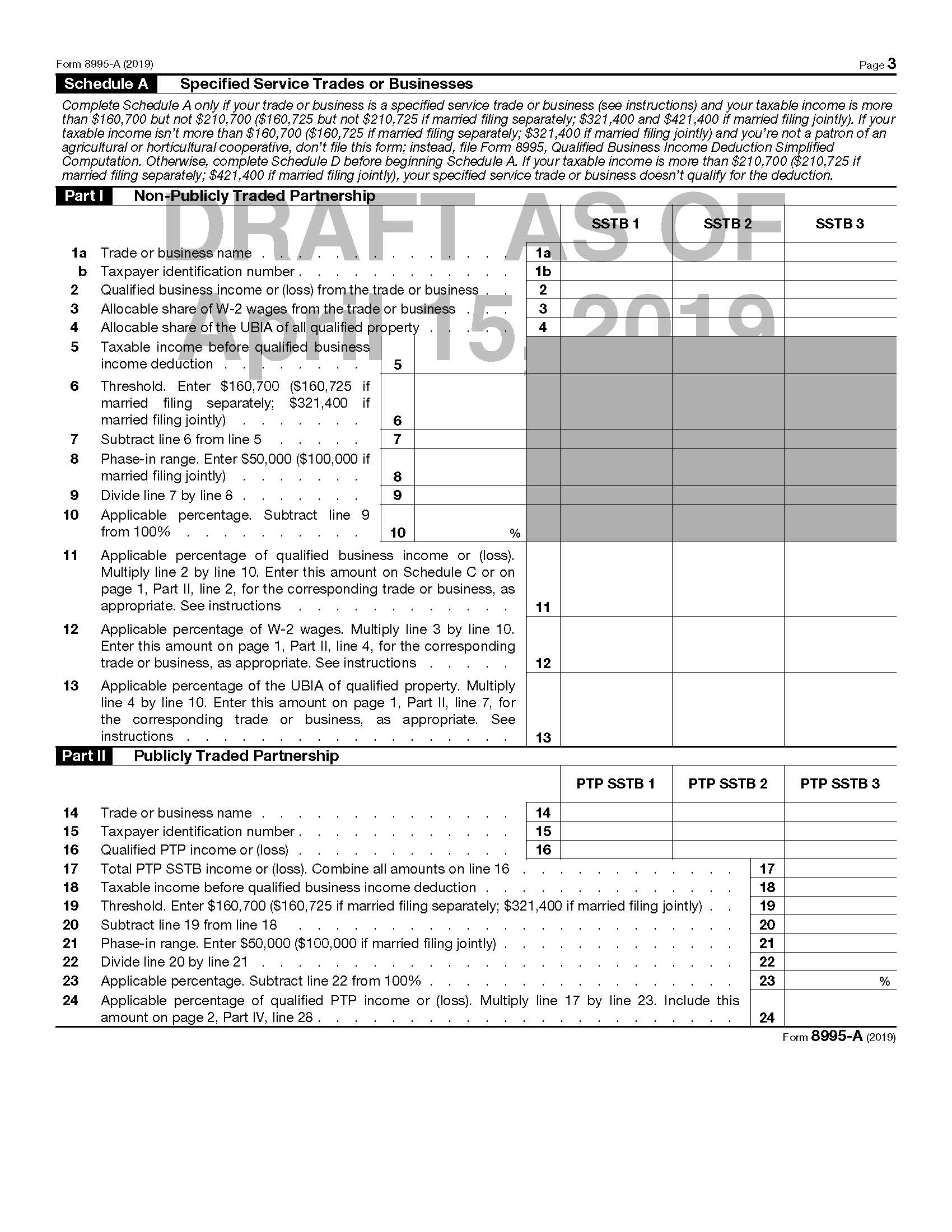

Form 8995A Draft WFFA CPAs

Web the form 8995 is used to figure your qualified business income (qbi) deduction. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web form 8995 department of the treasury internal revenue.

Download Instructions for IRS Form 8995A Deduction for Qualified

Form 8995 is the simplified form and is used if all of the following are true: Web what is form 8995? Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). This includes their name, address, employer identification number (ein),. Web form 8995 department of the treasury internal revenue service qualified business.

IRS Releases Drafts of Forms to Be Used to Calculate §199A Deduction on

Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of. You have qbi, qualified reit dividends, or qualified ptp income or loss (all. Web what is form 8995? Include the following schedules (their specific instructions are. Form 8995 cannot be used by all businesses.

8995 Instructions 2022 2023 IRS Forms Zrivo

Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of. The individual has qualified business income. Web march 7, 2022. Who can use form 8995? Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid).

The Partnership Shows A Reduction For Loss Netting Of $2500 In Column B ($12,500 X 0.20= 2500).

Form 8995 is the simplified form and is used if all of the following are true: Web use form 8995 to calculate your qualified business income (qbi) deduction. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if:

Web What Is Form 8995?

You have qbi, qualified reit dividends, or qualified ptp income or loss (all. The individual has qualified business income. Who can use form 8995? Include the following schedules (their specific instructions are.

Form 8995 Cannot Be Used By All Businesses.

Web the form 8995 is used to figure your qualified business income (qbi) deduction. Web march 7, 2022. If a person within a household had a marketplace insurance plan in the previous year, they should receive a health insurance marketplace. If you have a business (1099 income), or an amount in box 5 of a form 1099.

Individual Taxpayers And Some Trusts And Estates May Be Entitled To A Deduction Of Up To 20% Of.

In addition to form 8995, the irs also has form. Form 8995 is a simplified. This includes their name, address, employer identification number (ein),. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid).