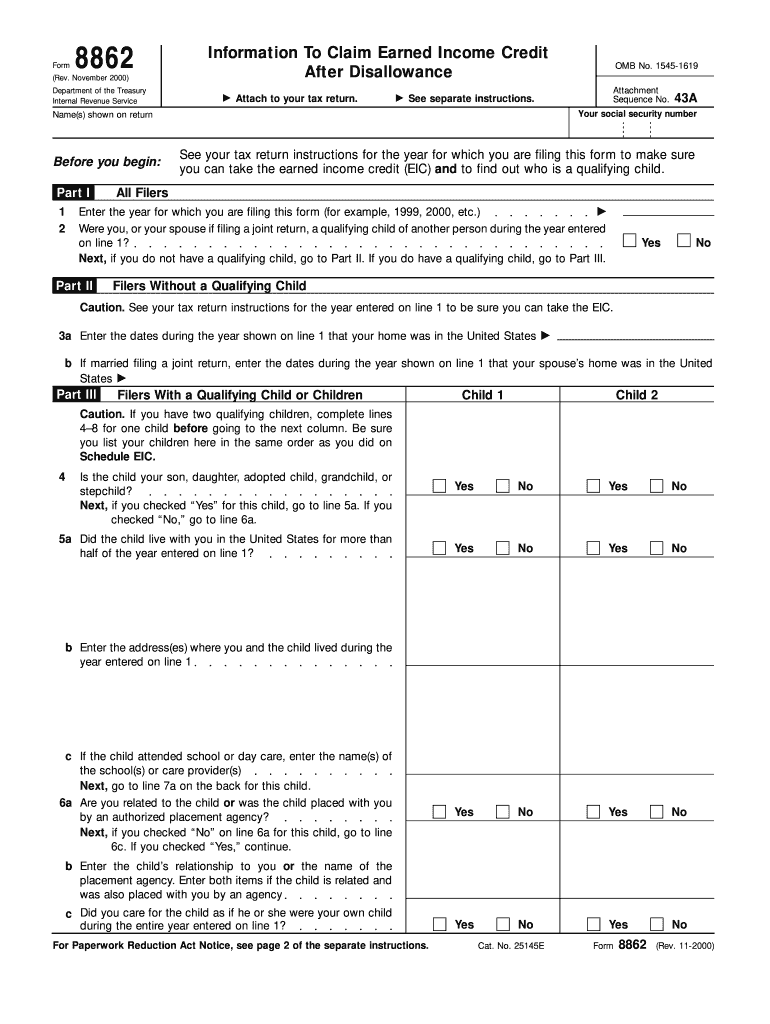

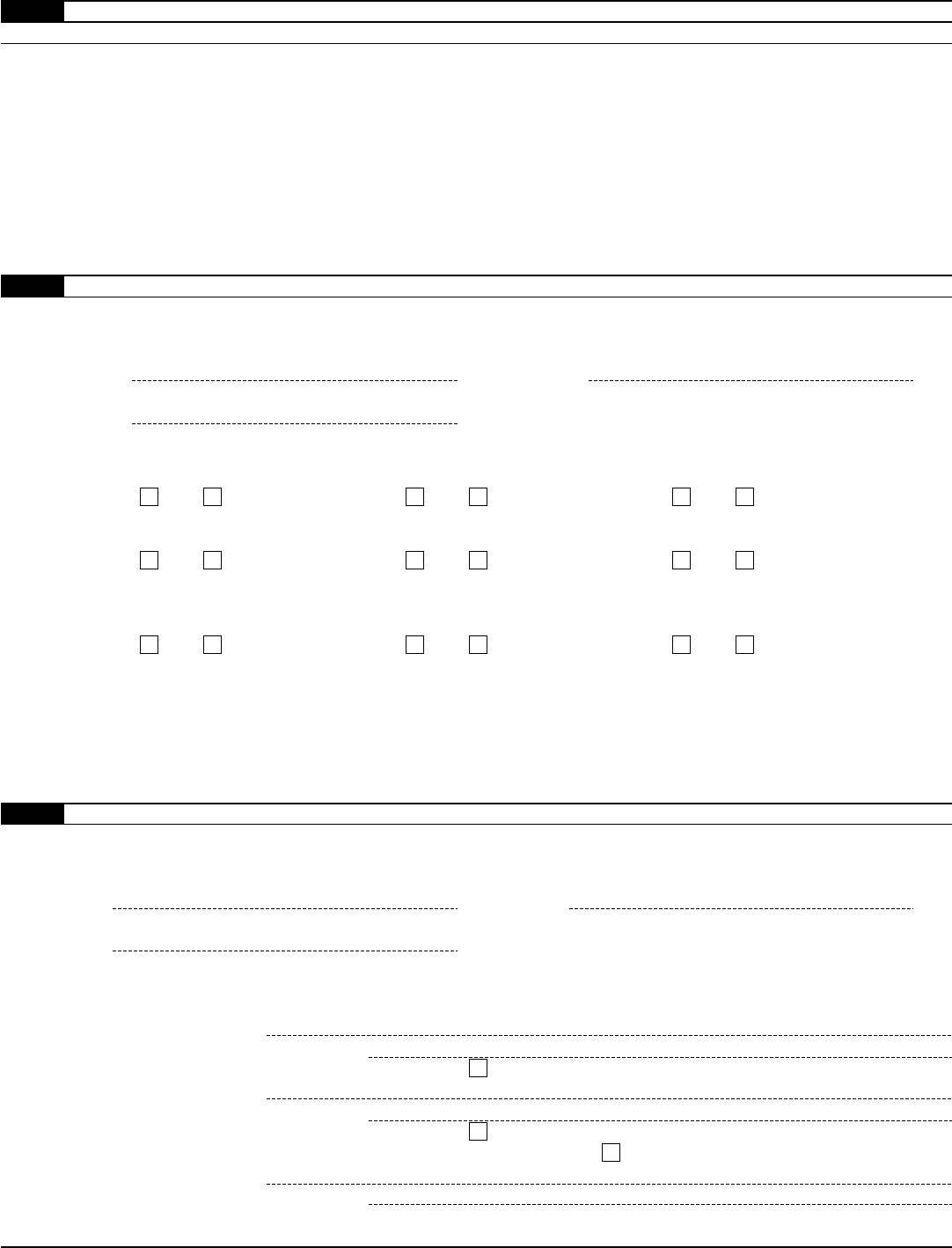

What Is Form 8862

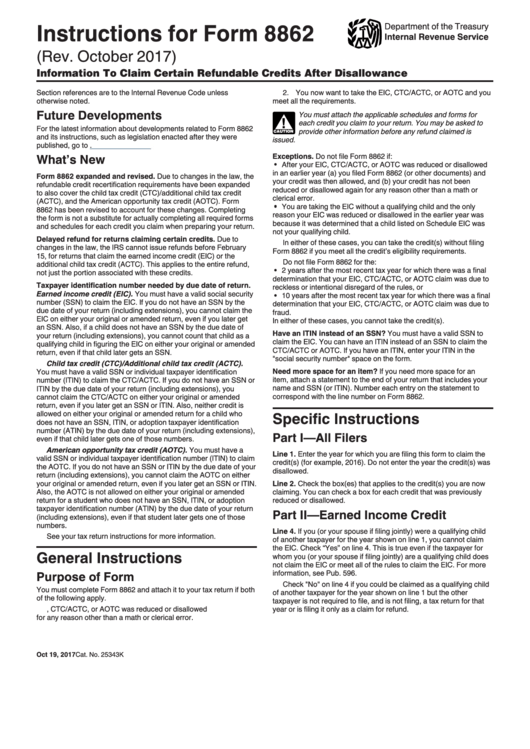

What Is Form 8862 - In most cases, the irs would have notified you in the year you were. Web several standards must be met for you to claim the eic: An edocument can be viewed as legally binding given that. This form is for income earned in tax year 2022, with tax returns due in april. If you wish to take the credit in a. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. If your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. When you review your return, the form 8862.

When you review your return, the form 8862. If your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to. Web by filing irs form 8862, you may be able to provide additional information and demonstrate that you meet the requirements for that tax credit. Complete, edit or print tax forms instantly. Fill in the applicable credit information (earned income credit, child tax credit, etc.). Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web what is form 8862? Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service.

Get ready for tax season deadlines by completing any required tax forms today. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web you are single and are filing form 8862 for2008. Ad access irs tax forms. Your home was in the united states for all of 2008.on line 4, you would enter “366.” members of the military. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. If you wish to take the credit in a. Web what is form 8862?

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Handling it using digital means is different from doing so in the physical world. Web how do i enter form 8862? Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed.

How Do I File My Form 8862? StandingCloud

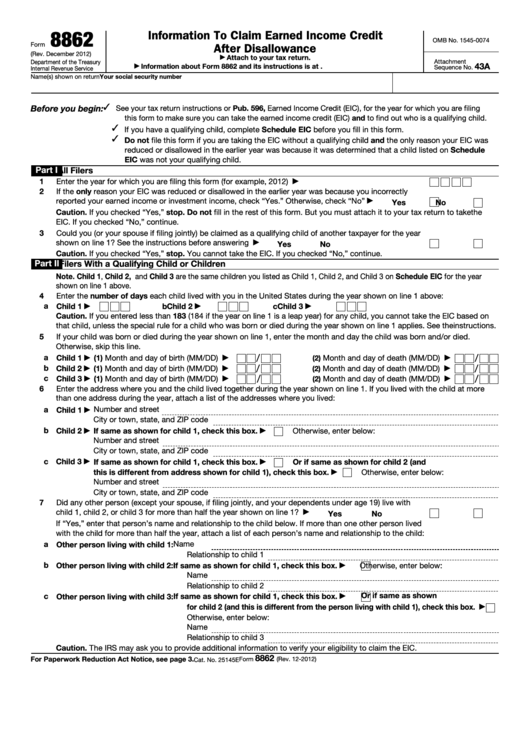

Turbotax can help you fill out your. Adhere to our simple actions to get your irs 8862 prepared quickly: This form is for income earned in tax year 2022, with tax returns due in april. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax.

8862 Form Fill Out and Sign Printable PDF Template signNow

Fill in the applicable credit information (earned income credit, child tax credit, etc.). Web you are single and are filing form 8862 for2008. When you review your return, the form 8862. Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. Part i is.

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Turbotax can help you fill out your. If you wish to take the credit in a.

Fillable Form 8862 Information To Claim Earned Credit After

Web several standards must be met for you to claim the eic: For more than half of the year. An edocument can be viewed as legally binding given that. Web how do i enter form 8862? This form is for income earned in tax year 2022, with tax returns due in april.

how do i add form 8862 TurboTax® Support

You must be a citizen of the united states, and must live in the u.s. In most cases, the irs would have notified you in the year you were. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed.

Top 14 Form 8862 Templates free to download in PDF format

Web you are single and are filing form 8862 for2008. This form is for income earned in tax year 2022, with tax returns due in april. Web if the irs rejected one or more of these credits: When you review your return, the form 8862. Web file form 8862 if we denied or reduced your eitc for a tax year.

Form 8862Information to Claim Earned Credit for Disallowance

Your home was in the united states for all of 2008.on line 4, you would enter “366.” members of the military. If you wish to take the credit in a. Part i is where you record annual and monthly contribution amounts using your family size, modified. Web by filing irs form 8862, you may be able to provide additional information.

IRS Form 8862 Diagram Quizlet

Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. Web what is form 8862? In most cases, the irs would have notified you in the year.

Form 8862 For 2019 PERINGKAT

Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web you are single and are filing form 8862 for2008. Web file form 8862 if we denied or reduced your eitc for a tax year.

Handling It Using Digital Means Is Different From Doing So In The Physical World.

Your home was in the united states for all of 2008.on line 4, you would enter “366.” members of the military. Complete, edit or print tax forms instantly. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. For more than half of the year.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Ad access irs tax forms. Ad access irs tax forms. In most cases, the irs would have notified you in the year you were. Get ready for tax season deadlines by completing any required tax forms today.

Web What Is Form 8862?

If you wish to take the credit in a. Turbotax can help you fill out your. Part i is where you record annual and monthly contribution amounts using your family size, modified. Web you are single and are filing form 8862 for2008.

Eitc, Ctc, Actc Or Aotc, You May Have Received A Letter Stating That The Credit Was Disallowed.

Fill in the applicable credit information (earned income credit, child tax credit, etc.). Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math.

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-05-05at3.12.40PM-ad486e92d61441a9b09a3e39b758696c.png)