What Is Form 8862 Used For

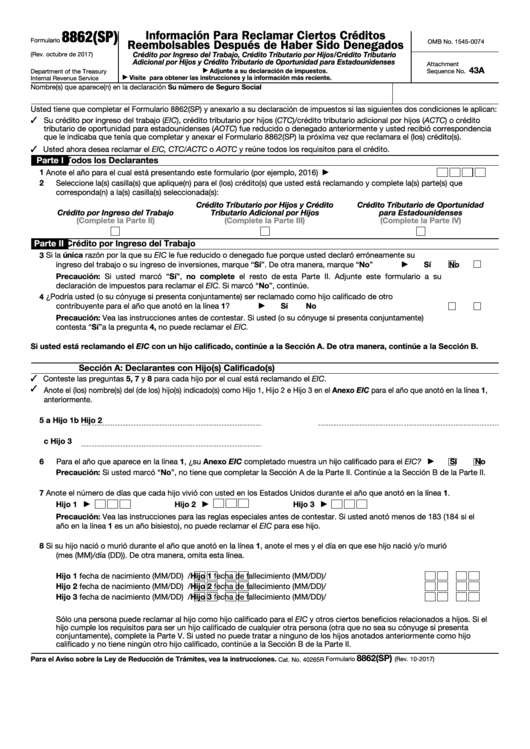

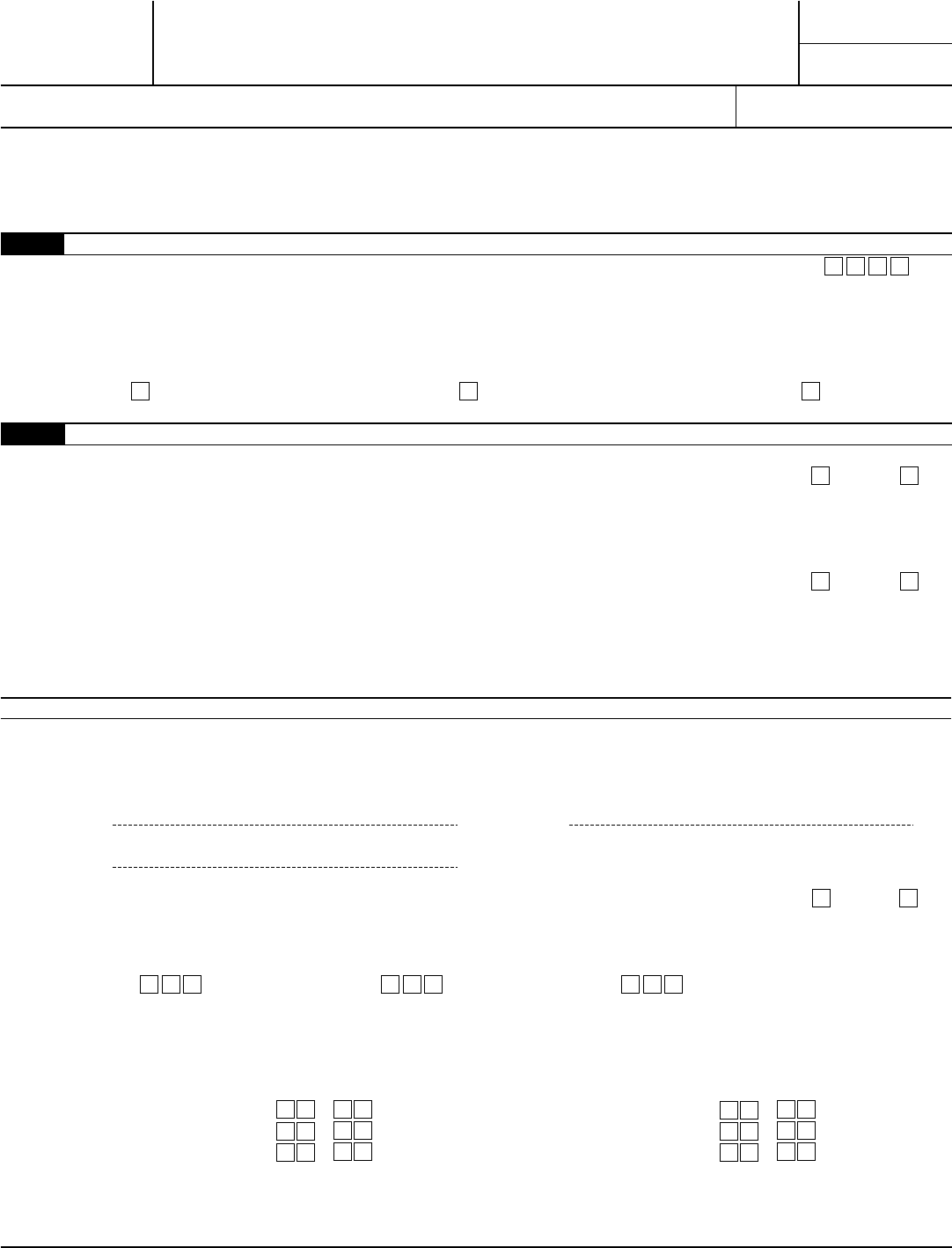

What Is Form 8862 Used For - Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. If you file your taxes online, your online tax software will fill it out for you when you indicate you were previously disallowed to claim. Guide to head of household. Web information to claim earned income credit after disallowance before you begin:usee your tax return instructions or pub. Ad access irs tax forms. Web how do i enter form 8862? You can generate form 8862, information to claim certain credits after disallowance, in the individual module. Ad access irs tax forms. Web what is form 8862?

Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Get ready for tax season deadlines by completing any required tax forms today. Web information to claim earned income credit after disallowance before you begin:usee your tax return instructions or pub. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Ad access irs tax forms. Web it’s easy to do in turbotax. Put your name and social security number on the statement and attach it at. Number each entry on the statement to correspond with the line number on form 8862. Web what is form 8862? You can generate form 8862, information to claim certain credits after disallowance, in the individual module.

Number each entry on the statement to correspond with the line number on form 8862. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for. Get ready for tax season deadlines by completing any required tax forms today. Web information to claim earned income credit after disallowance before you begin:usee your tax return instructions or pub. Taxpayers complete form 8862 and attach it to their tax return if their earned income credit (eic) , child tax credit (ctc)/additional child tax credit. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. This form is for income earned in tax year 2022, with tax returns due in april. 596, earned income credit (eic), for the year for which.

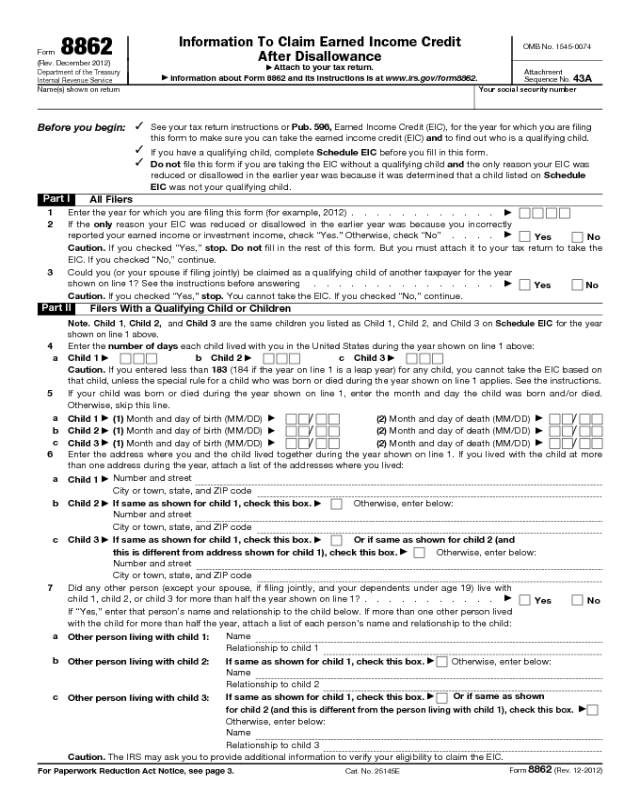

Form 8862 Edit, Fill, Sign Online Handypdf

Answer the questions accordingly, and we’ll include form 8862 with your return. Web information to claim earned income credit after disallowance before you begin:usee your tax return instructions or pub. 596, earned income credit (eic), for the year for which. Search for 8862 and select the link to go to the section. If you file your taxes online, your online.

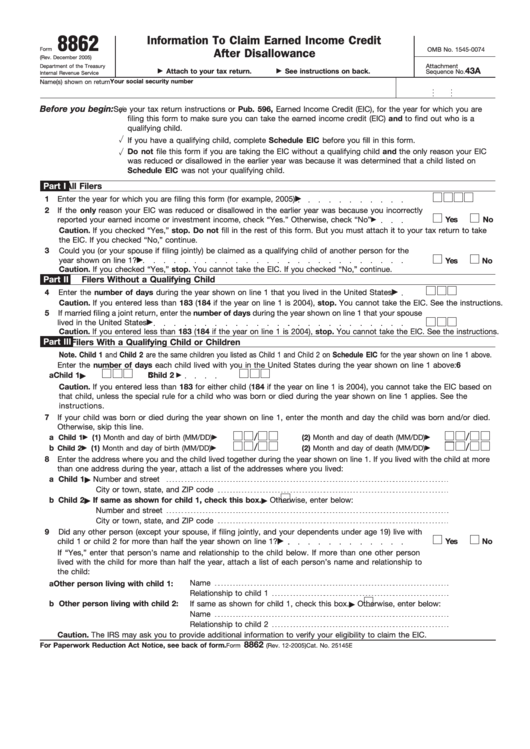

Form 8862 Information To Claim Earned Credit After

Web solved•by intuit•8•updated january 10, 2023. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Complete, edit or print tax forms instantly. Taxpayers complete form 8862 and attach it to their tax return.

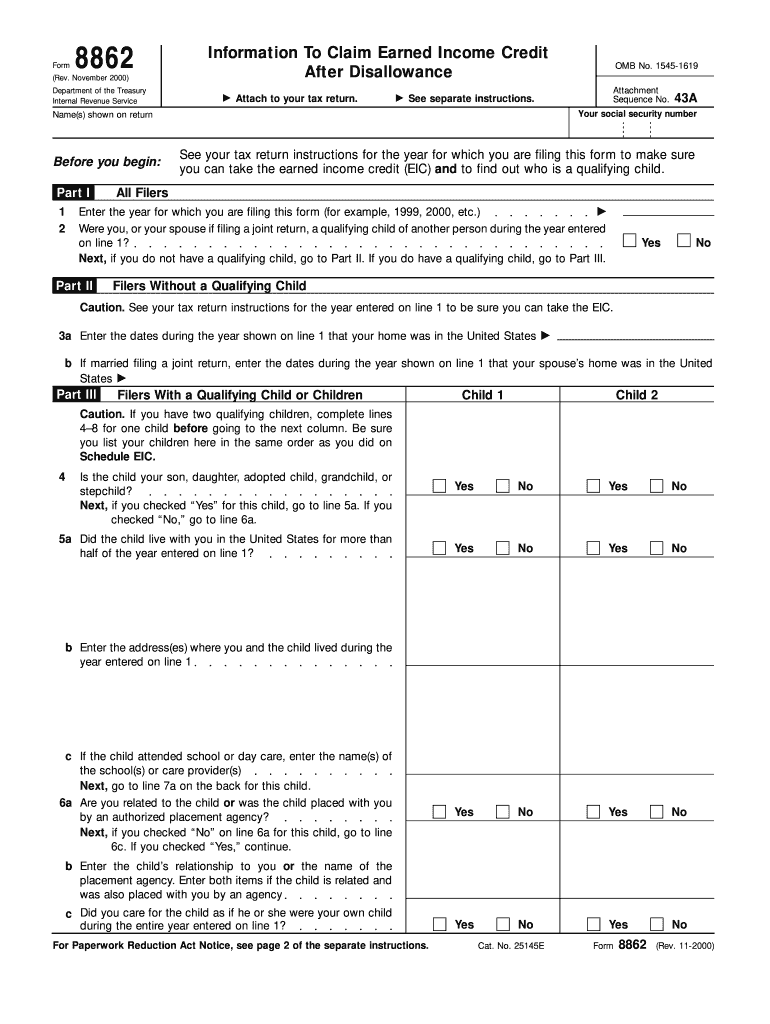

Irs Form 8862 Printable Master of Documents

Complete irs tax forms online or print government tax documents. Do not file form 8862 and do not take the eic for the: Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Solved.

8862 Form Fill Out and Sign Printable PDF Template signNow

Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. Complete, edit or print tax forms instantly. Answer the questions accordingly, and we’ll include form 8862 with your return. Web form 8862 if you meet all the eic eligibility requirements. Put your name and.

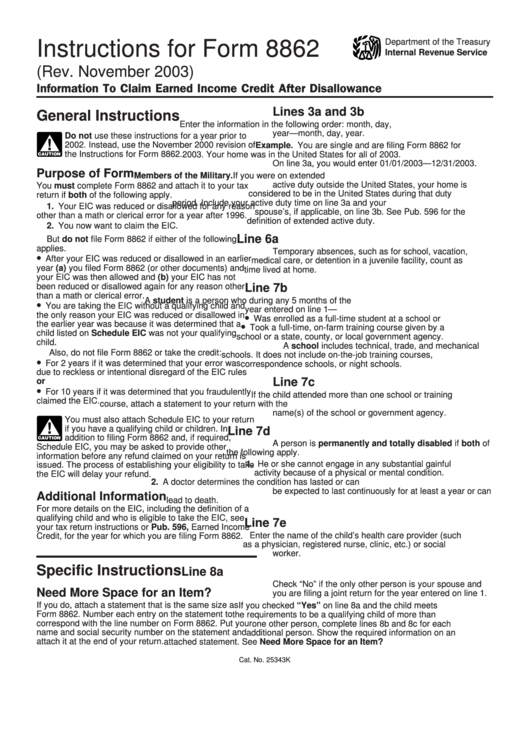

Instructions For Form 8862 Information To Claim Earned Credit

Complete, edit or print tax forms instantly. Web tax tips & video homepage. You can generate form 8862, information to claim certain credits after disallowance, in the individual module. Put your name and social security number on the statement and attach it at. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income.

Top 14 Form 8862 Templates free to download in PDF format

Guide to head of household. Web what is form 8862? This form is for income earned in tax year 2022, with tax returns due in april. Married filing jointly vs separately. Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year.

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

Complete irs tax forms online or print government tax documents. Web by filing irs form 8862, you may be able to provide additional information and demonstrate that you meet the requirements for that tax credit. Answer the questions accordingly, and we’ll include form 8862 with your return. Web we last updated federal form 8862 in december 2022 from the federal.

Instructions for IRS Form 8862 Information to Claim Certain Credits

Number each entry on the statement to correspond with the line number on form 8862. If you file your taxes online, your online tax software will fill it out for you when you indicate you were previously disallowed to claim. Turbotax can help you fill out your. Do not file form 8862 and do not take the eic for the:.

IRS 8862 2022 Form Printable Blank PDF Online

Answer the questions accordingly, and we’ll include form 8862 with your return. Web you can find tax form 8862 on the irs website. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Web.

Form 886 A Worksheet Worksheet List

Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Web by filing irs form 8862, you may be able to provide additional information and demonstrate that you meet the requirements for that tax credit. Web.

Web Form 8862 Is Required To Be Filed With A Taxpayer’s Tax Return If In A Prior Year The Taxpayer’s Claim For Any Of The Following Credits Was Reduced Or Disallowed For Any Reason Other Than.

Answer the questions accordingly, and we’ll include form 8862 with your return. Taxpayers complete form 8862 and attach it to their tax return if their earned income credit (eic) , child tax credit (ctc)/additional child tax credit. Web how do i enter form 8862? Web what is the form used for?

Complete, Edit Or Print Tax Forms Instantly.

Put your name and social security number on the statement and attach it at. Search for 8862 and select the link to go to the section. Complete, edit or print tax forms instantly. Web information to claim earned income credit after disallowance before you begin:usee your tax return instructions or pub.

Web Form 8862 If You Meet All The Eic Eligibility Requirements.

596, earned income credit (eic), for the year for which. • 2 years after the most recent tax year for which. Web tax tips & video homepage. Web what is form 8862?

Web You Can Find Tax Form 8862 On The Irs Website.

Web it’s easy to do in turbotax. Web solved•by intuit•8•updated january 10, 2023. Turbotax can help you fill out your. Married filing jointly vs separately.