What Is Form 8615

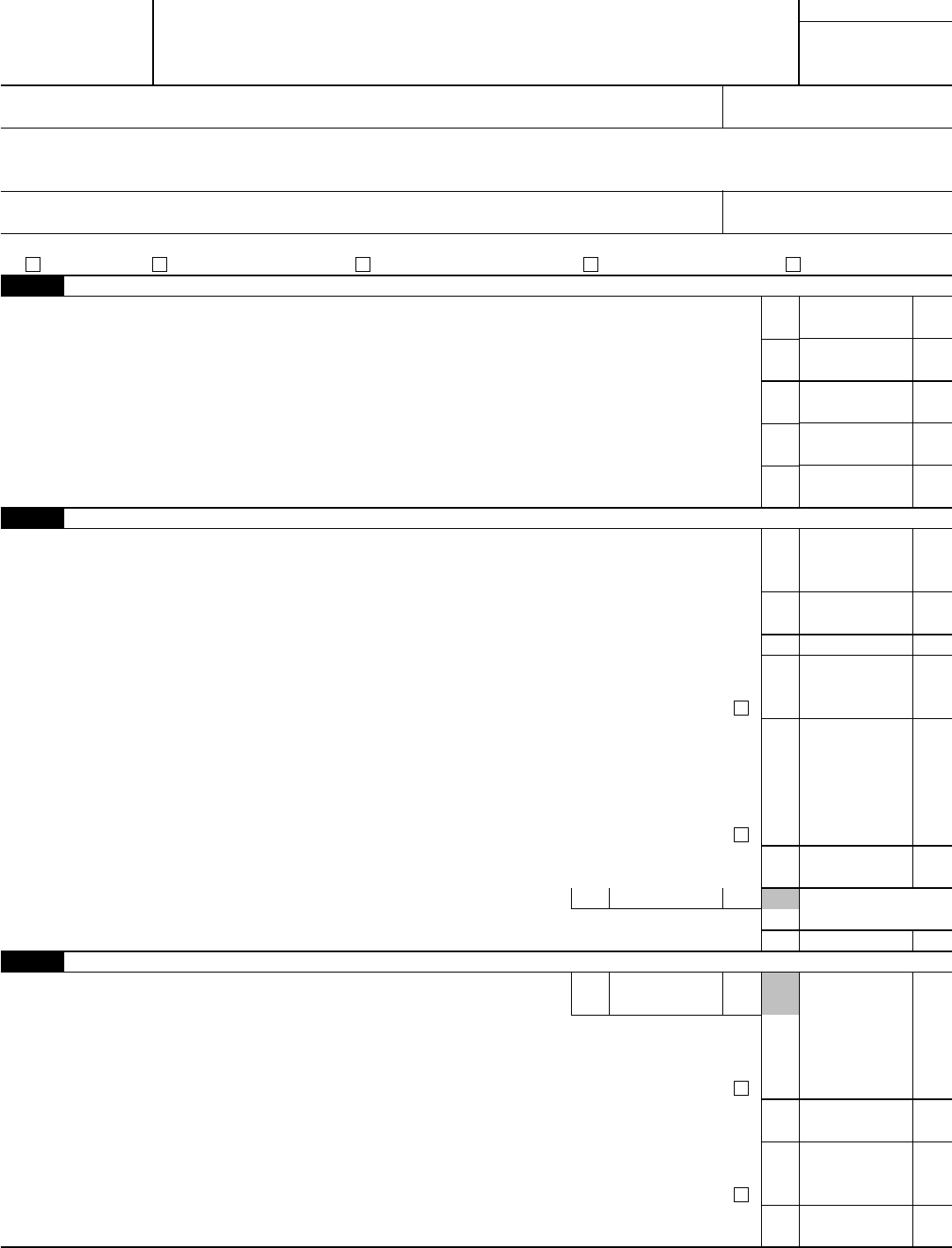

What Is Form 8615 - Web what is form 8615, tax for children under age 18? The child is required to file a tax return. Web form 8615 must be filed for any child who meets all of the following conditions. Refer to each child's taxpayer's information for use when. Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Form 8615 must be filed with the child’s tax return if all of the following apply: Web form 8615, tax for certain children who have unearned income, which reports the kiddie tax, calculates unearned income for a qualifying child by taking all the. Under age 18, age 18 and did. The child had more than $2,000 of unearned income. Web to fill out form 8615 in turbotax:

The child is required to file a tax return. Web form 8615, tax for certain children who have unearned income, which reports the kiddie tax, calculates unearned income for a qualifying child by taking all the. Web what is form 8615 used for. Web what is form 8615, tax for children under age 18? Refer to each child's taxpayer's information for use when. Web form 8615, tax for certain children who have unearned income. The child had more than $2,000 of unearned income. Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: For 2020, a child must file form 8615 if all of the. Type child’s income in search in the upper right;

Form 8615 must be filed with the child’s tax return if all of the following apply: Continue with the interview process to enter all of the appropriate. Web the line 5 ratio is the last line of the appropriate line 5 worksheet divided by the first line of the line 5 worksheet. Web form 8615, tax for certain children who have unearned income. Web click + add form 8814 to create a new copy of the form or click edit to review a form already created. Type child’s income in search in the upper right; For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the. Refer to each child's taxpayer's information for use when. Web form 8615 must be filed for any child who meets all of the following conditions. Web what is form 8615, tax for children under age 18?

Form 8615 Kiddie Tax Question tax

Web what is form 8615 used for. The child is required to file a tax return. Web the line 5 ratio is the last line of the appropriate line 5 worksheet divided by the first line of the line 5 worksheet. Web what is form 8615, tax for children under age 18? 2) the child is required to file a.

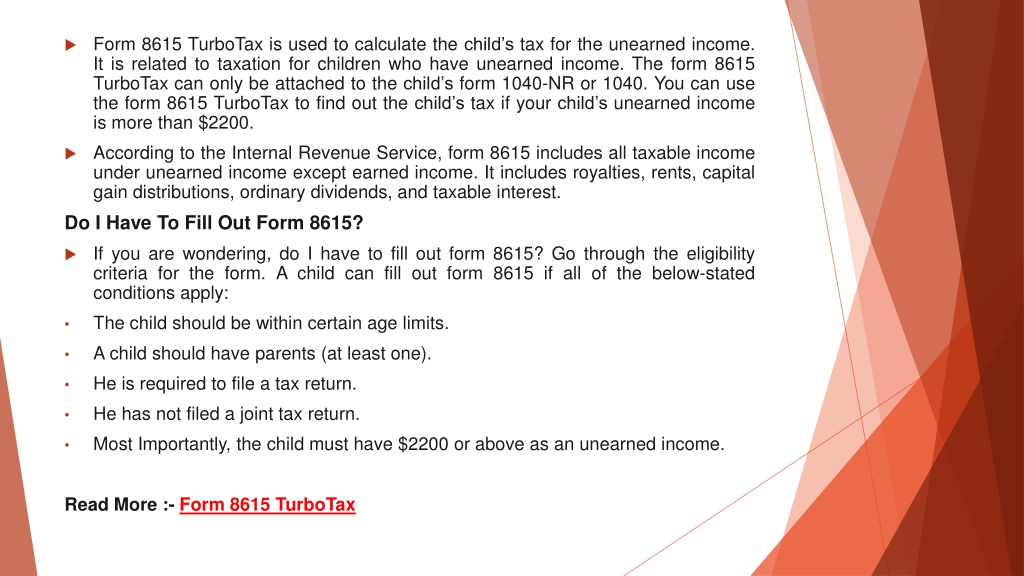

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

Web form 8615, tax for certain children who have unearned income. 1) the child's unearned income was more than $2,100. For 2020, a child must file form 8615 if all of the. See who must file, later. 2) the child is required to file a.

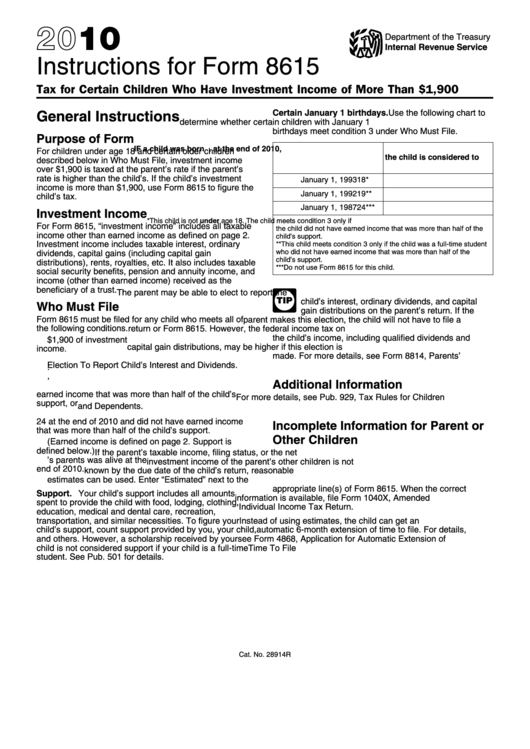

Instructions For Form 8615 Tax For Certain Children Who Have

See who must file, later. Web to fill out form 8615 in turbotax: Refer to each child's taxpayer's information for use when. Texas health and human services subject: Web click + add form 8814 to create a new copy of the form or click edit to review a form already created.

What Is Form 8615 Used For?

Under age 18, age 18 and did. Web click + add form 8814 to create a new copy of the form or click edit to review a form already created. Texas health and human services subject: The child is required to file a tax return. Web form 8615 must be filed for any child who meets all of the following.

Publication 929 Tax Rules for Children and Dependents; Tax Rules for

Web what is form 8615, tax for children under age 18? 2) the child is required to file a. Web form 8615 must be filed for any child who meets all of the following conditions. Texas health and human services subject: For 2020, a child must file form 8615 if all of the.

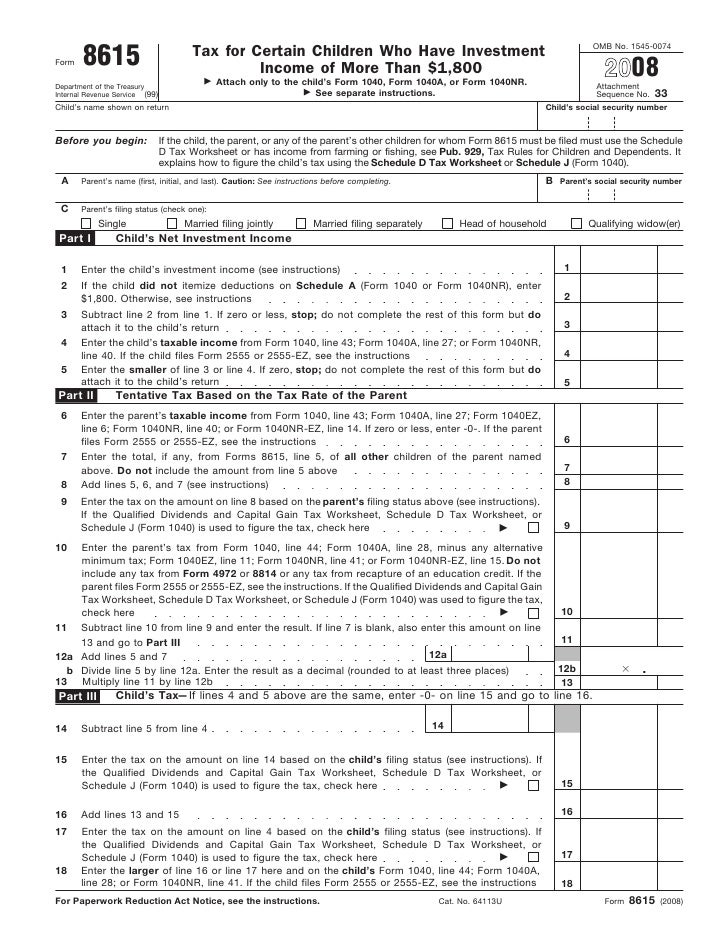

Form 8615Tax for Children Under Age 14 With Investment of Mor…

Web form 8615 must be filed for any child who meets all of the following conditions. Web form 8615, tax for certain children who have unearned income, which reports the kiddie tax, calculates unearned income for a qualifying child by taking all the. Continue with the interview process to enter all of the appropriate. 1) the child's unearned income was.

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

The child is required to file a tax return. 2) the child is required to file a. Web purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. When using form 8615 in proseries, you should enter the child as the.

Form 8615 Office Depot

Web form 8615 must be filed for any child who meets all of the following conditions. Form 8615 must be filed with the child’s tax return if all of the following apply: The child had more than $2,000 of unearned income. Ad register and subscribe now to work on your irs 8615 form & more fillable forms. Web form 8615.

Fill Free fillable Form 8615 Tax for Children Who Have Unearned

2) the child is required to file a. Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Texas health and human services subject: Web form 8615 must be filed for any child who meets all of the following conditions. The child is required to file a tax return.

Texas Health And Human Services Subject:

Refer to each child's taxpayer's information for use when. 2) the child is required to file a. The child is required to file a tax return. Web what is form 8615, tax for children under age 18?

See Who Must File, Later.

Web click + add form 8814 to create a new copy of the form or click edit to review a form already created. Click jump to child’s income; For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the. Web form 8615 must be filed for any child who meets all of the following conditions.

Signnow Allows Users To Edit, Sign, Fill And Share All Type Of Documents Online.

Web form 8615, tax for certain children who have unearned income, which reports the kiddie tax, calculates unearned income for a qualifying child by taking all the. Type child’s income in search in the upper right; Web form 8615 must be filed for a child if all of the following statements are true. Web form 8615, tax for certain children who have unearned income.

You Had More Than $2,300 Of Unearned.

For 2020, a child must file form 8615 if all of the. Web form 8615 must be filed for any child who meets all of the following conditions. The child had more than $2,300 of unearned income. The child had more than $2,000 of unearned income.