What Is Form 712

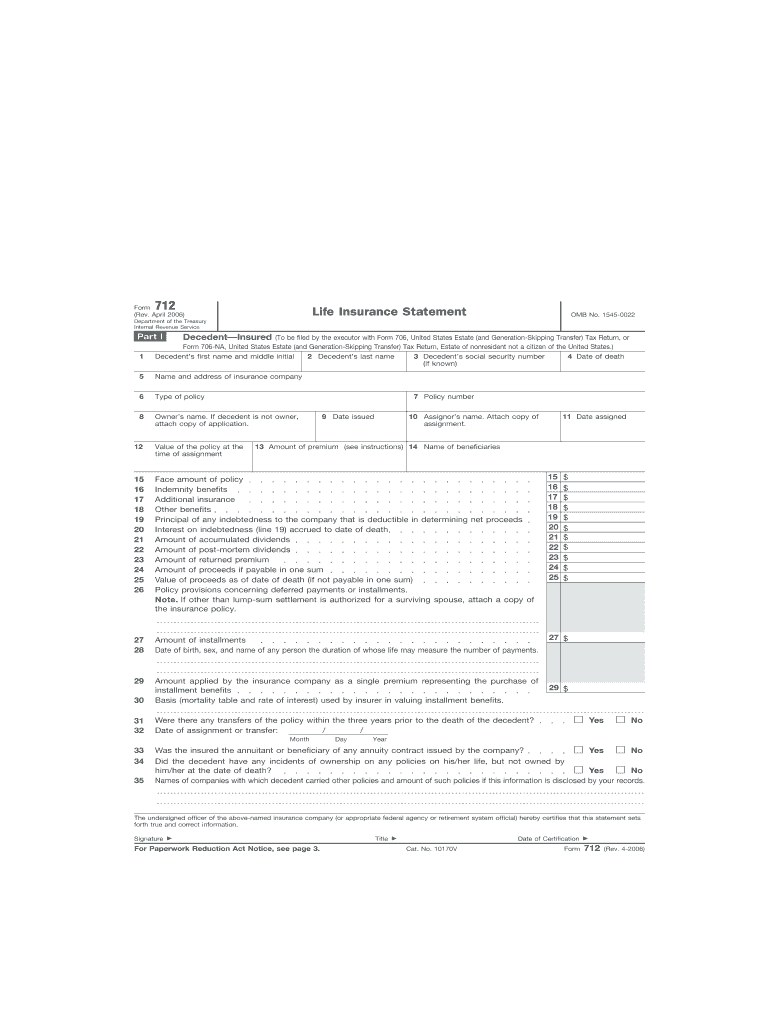

What Is Form 712 - The irs form 712 is used to report the value of the decedent's life insurance policy. Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at a time a life insurance policy is transferred as a gift. Web available filing your taxes after a life security policy's been remunerated out, it is necessary to file federal form 712 as fine. A policy’s terminal reserve is the amount of money that the life insurance carrier has set aside by law to guarantee the payment of policy benefits and is. Find out more concerning form 712 here. Web find and fill out the correct form 712 life insurance statement. April 2006) life insurance statement omb no. One will be provided upon request and will be prepared at the time we make the life insurance payment. If your spouse is your beneficiary , the life insurance payout is not taxed and will be passed on to them fully, along with the rest of your estate that was left to them. Web what is irs form 712?

Web what is irs form 712? Web form 712 a form one files with the irs to state the value of a life insurance policy at the time of death of the policyholder or when it is transferred (as a gift) to another party. Web life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. Choose the correct version of the editable pdf form from the list and get started filling it out. Web we last updated the life insurance statement in february 2023, so this is the latest version of form 712, fully updated for tax year 2022. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: The irs form 712 is used to report the value of the decedent's life insurance policy. Web irs form 712 is a document used for the valuation of life insurance policies and gift tax returns. What value is reported on this form? This is a summary only.

Web what is an irs form 712? Choose the correct version of the editable pdf form from the list and get started filling it out. If your spouse is your beneficiary , the life insurance payout is not taxed and will be passed on to them fully, along with the rest of your estate that was left to them. Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at a time a life insurance policy is transferred as a gift. A complete description of benefits, limitations, exclusions and termination of coverage is provided Web available filing your taxes after a life security policy's been remunerated out, it is necessary to file federal form 712 as fine. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. At the request of the estate’s administrator/executor, we will complete this form to provide the. You can print other federal tax forms here.

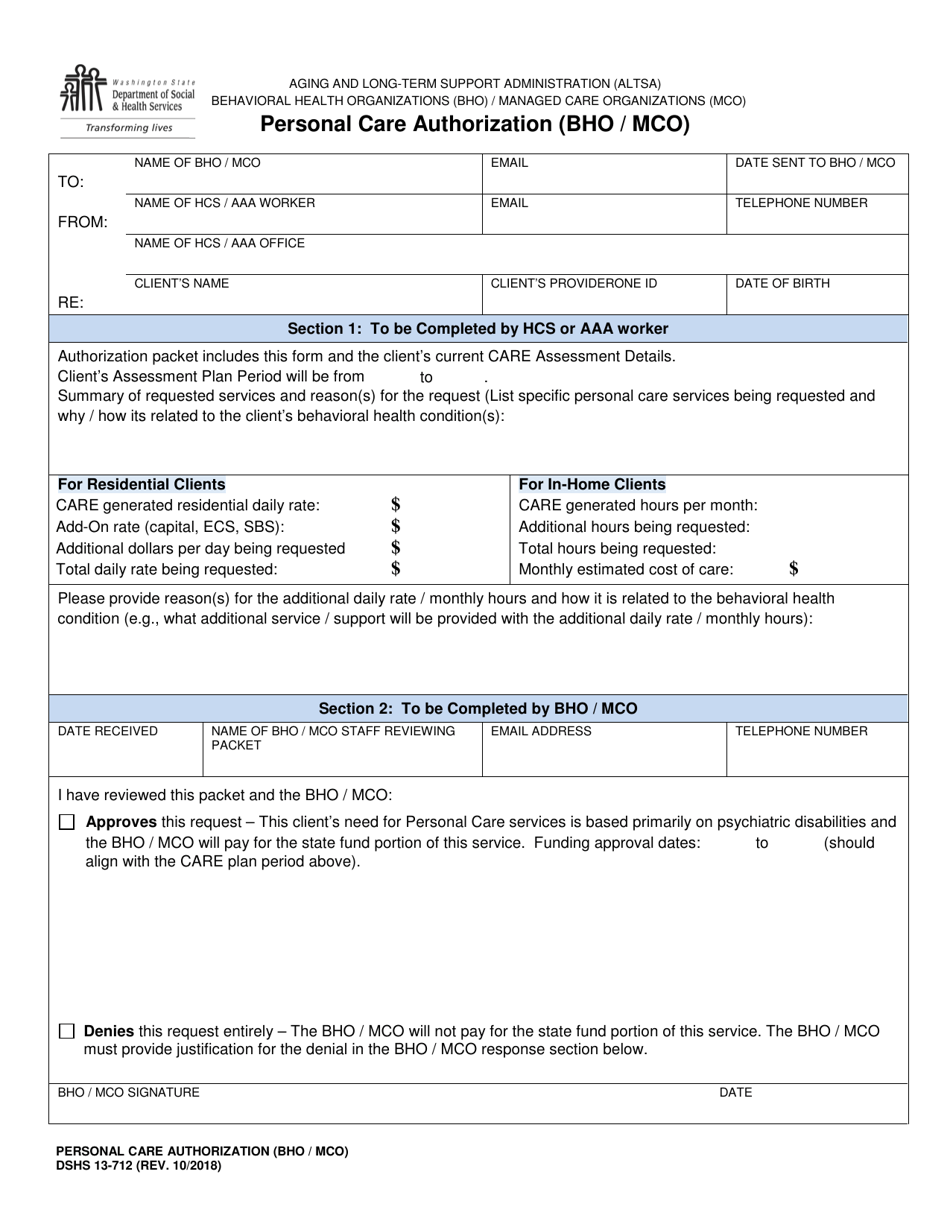

DSHS Form 13712 Download Printable PDF or Fill Online Personal Care

At the request of the estate’s administrator/executor, we will complete this form to provide the. Web what is irs form 712? Irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. April 2006) life insurance statement omb no. If your spouse is your beneficiary.

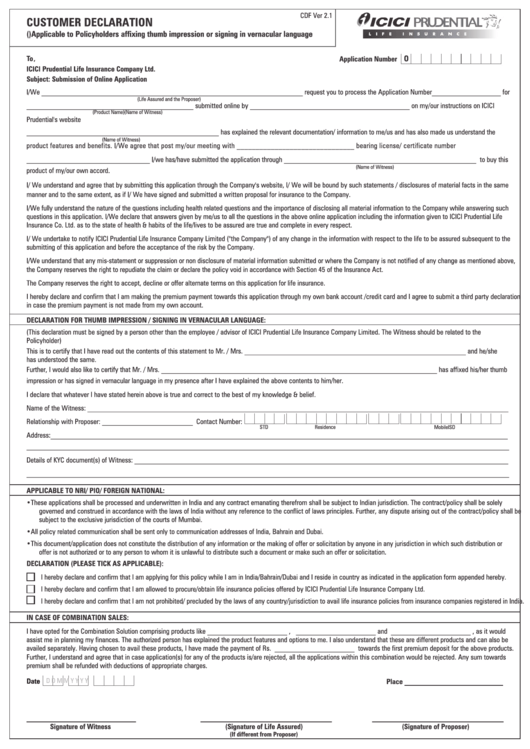

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Choose the correct version of the editable pdf form from the list and get started filling it out. The irs requires that this statement be included. Web form 712 reports the value of life insurance policies for.

Form 712 Life Insurance Statement (2006) Free Download

Web irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at the time a life insurance policy is transferred as a gift. Find out more concerning form 712 here. Web life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4.

Form 712 Fill Out and Sign Printable PDF Template signNow

Web life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. Web what is an irs form 712? A complete description of benefits, limitations, exclusions and termination of coverage is provided Web form 712 states the value of your life insurance policies based upon when you.

Form 712 Life Insurance Statement (2006) Free Download

Web itr is most typically used to value a life insurance policy for transfer tax purposes and is provided by the issuing life insurance carrier via form 712, life insurance statement. Web what is irs form 712? Web what is form 712? The irs form 712 is used to report the value of the decedent's life insurance policy. What value.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

One will be provided upon request and will be prepared at the time we make the life insurance payment. Web form 712 states the value of your life insurance policies based upon when you died. Form 712 is submitted along with forms used to calculate an estate tax or gift tax. Web available filing your taxes after a life security.

Form 712 Life Insurance Statement (2006) Free Download

What is the value of a life insurance policy when it is sold for consideration? A complete description of benefits, limitations, exclusions and termination of coverage is provided Irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web we last updated the life.

What is form 712? Protective Life

This is a summary only. Web what is an irs form 712? Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Web itr is most typically used to value a life insurance policy for transfer tax purposes and is provided by the issuing life insurance carrier.

Fill Free fillable Form 712 Life Insurance Statement 2006 PDF form

A policy’s terminal reserve is the amount of money that the life insurance carrier has set aside by law to guarantee the payment of policy benefits and is. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Irs form 712 is an informational tax form that is used.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

The value of all policies on the decedent’s life must be reported on the estate tax return on schedule d, regardless of whether they were owned inside the estate or not. What is the value of a life insurance policy when it is sold for consideration? Web life insurance death proceeds form 712 if your mother's estate was less than.

Web What Is Form 712?

What value is reported on this form? Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. A complete description of benefits, limitations, exclusions and termination of coverage is provided Get an irs form 712?

At The Request Of The Estate’s Administrator/Executor, We Will Complete This Form To Provide The.

Web find and fill out the correct form 712 life insurance statement. Web we last updated the life insurance statement in february 2023, so this is the latest version of form 712, fully updated for tax year 2022. Web itr is most typically used to value a life insurance policy for transfer tax purposes and is provided by the issuing life insurance carrier via form 712, life insurance statement. Web life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706.

What Is The Value Of A Life Insurance Policy When It Is Sold For Consideration?

Web what is an irs form 712? Web form 712 reports the value of a policy in order to prepare the estate tax forms. Web form 712 reports the value of life insurance policies for estate tax purposes. April 2006) life insurance statement omb no.

This Is A Summary Only.

Web available filing your taxes after a life security policy's been remunerated out, it is necessary to file federal form 712 as fine. It is not an income tax filing or information. If your spouse is your beneficiary , the life insurance payout is not taxed and will be passed on to them fully, along with the rest of your estate that was left to them. A policy’s terminal reserve is the amount of money that the life insurance carrier has set aside by law to guarantee the payment of policy benefits and is.