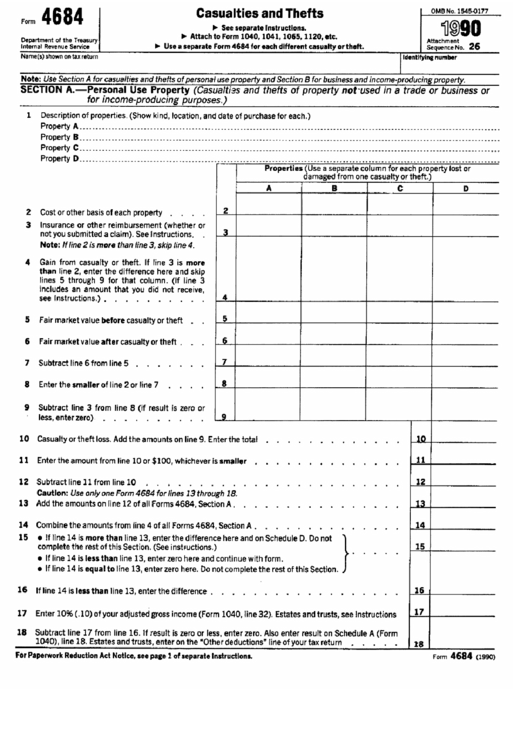

What Is Form 4684

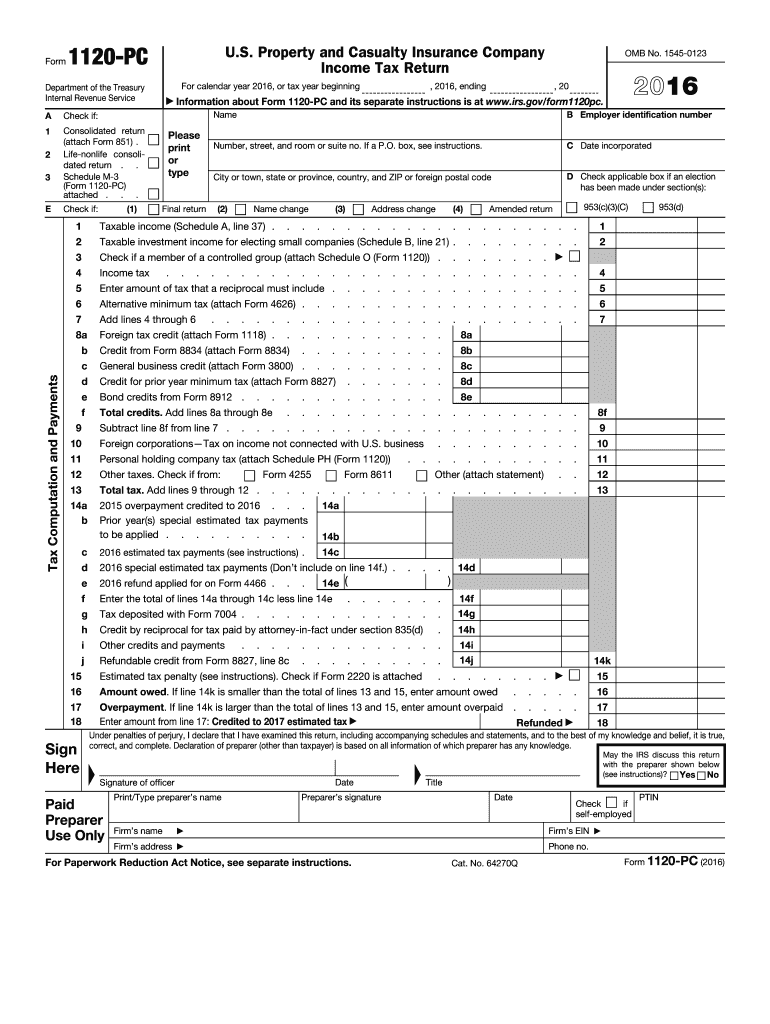

What Is Form 4684 - This year, the casualty losses you can deduct are mainly limited to those caused by federally declared disasters. Federal tax form, is utilized to provide a detailed account of any casualties or thefts and the corresponding financial losses that have occurred within a tax. This article will assist you with entering a casualty or theft for form 4684 in. Name(s) shown on tax return identifying number. Web the 2018 form 4684 is available at irs.gov/form4684. Web taxslayer support what is considered a casualty loss deduction (form 4684)? Beginning in 2018, the tax cuts and jobs act suspended the itemized deduction for personal. Purpose of form use form 4684 to report gains and losses from casualties and thefts. Car, boat, and other accidents;. Web claiming the deduction requires you to complete irs form 4684.

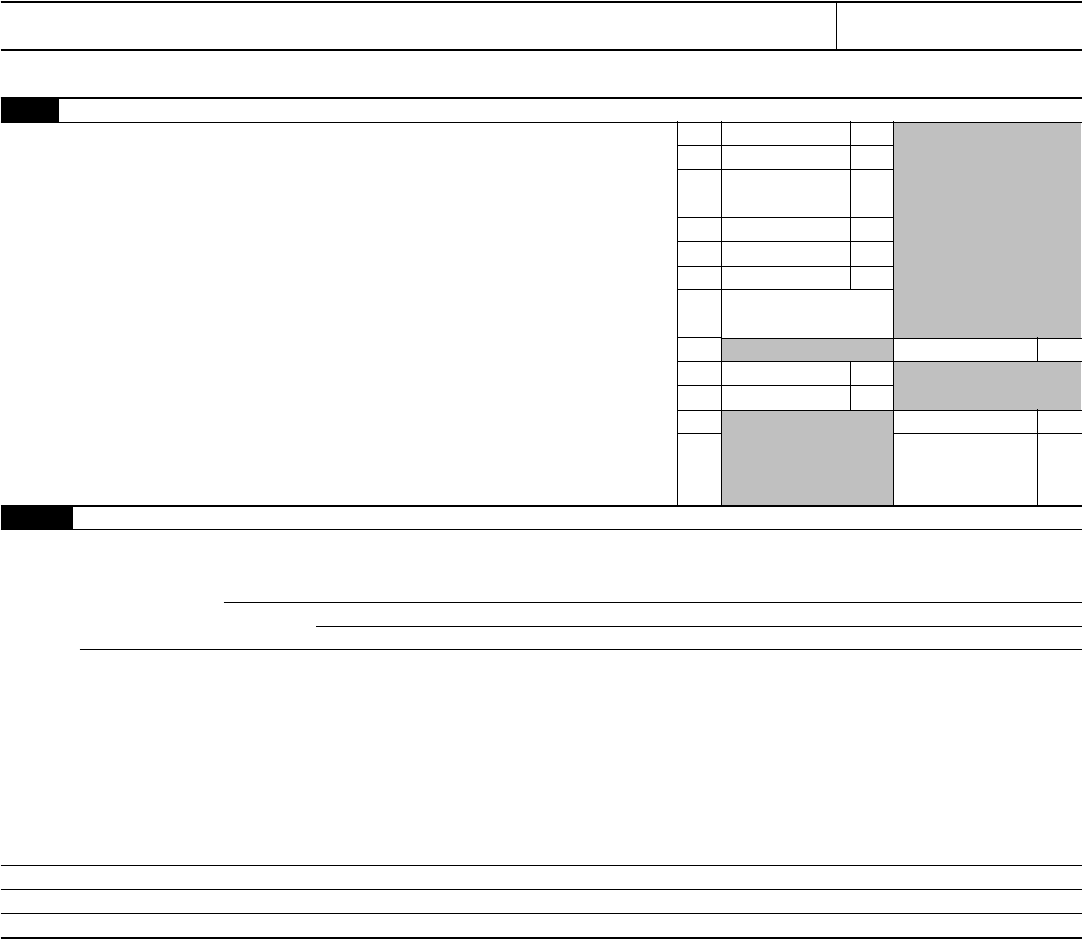

See form 8949 for how to make the election. Web entering a casualty or theft for form 4684. Web use form 4684 to report gains and losses from casualties and thefts. Web taxslayer support what is considered a casualty loss deduction (form 4684)? Attach form 4684 to your tax return. Car, boat, and other accidents;. This article will assist you with entering a casualty or theft for form 4684 in. Web you can calculate and report casualty and theft losses on irs form 4684. Certain taxpayers affected by federally declared disasters. You must enter the fema disaster declaration number on that form.

How the casualty and theft losses deduction works you can only deduct casualty and. Web the 2018 form 4684 is available at irs.gov/form4684. Web use a separate form 4684 for each casualty or theft. You may be able to deduct part or all of each loss caused by theft, vandalism, fire, storm, or similar causes; Web to compute and report casualty losses, you need to fill out irs form 4684. Car, boat, and other accidents;. You must enter the fema disaster declaration number on that form. Name(s) shown on tax return identifying number. Web entering a casualty or theft for form 4684. Web form 4684 is a form provided by the internal revenue service (irs) that taxpayers who itemize deductions can use with the purpose of reporting gains or.

File major disaster claims on Form 4684 Don't Mess With Taxes

This year, the casualty losses you can deduct are mainly limited to those caused by federally declared disasters. Web use a separate form 4684 for each casualty or theft. Certain taxpayers affected by federally declared disasters. We last updated the casualties and thefts in january 2023, so this is the latest version of form 4684, fully updated for tax. See.

Form 4684 Casualties and Thefts (2015) Free Download

Car, boat, and other accidents;. Web taxslayer support what is considered a casualty loss deduction (form 4684)? Web form 4868, also known as an “application for automatic extension of time to file u.s. Web entering a casualty or theft for form 4684. Web use a separate form 4684 for each casualty or theft.

IRS Form 4684 2018 2019 Fillable and Editable PDF Template

Web form 4684 is for a casualty loss. Web you can calculate and report casualty and theft losses on irs form 4684. You may be able to deduct part or all of each loss caused by theft, vandalism, fire, storm, or similar causes; This year, the casualty losses you can deduct are mainly limited to those caused by federally declared.

Form 4684 Casualties And Thefts 1990 printable pdf download

Web form 4868, also known as an “application for automatic extension of time to file u.s. Web to compute and report casualty losses, you need to fill out irs form 4684. Web claiming the deduction requires you to complete irs form 4684. Web you can calculate and report casualty and theft losses on irs form 4684. You may be able.

Form 4684 Theft and Casualty Loss Deduction H&R Block

Attach form 4684 to your tax. Beginning in 2018, the tax cuts and jobs act suspended the itemized deduction for personal. How the casualty and theft losses deduction works you can only deduct casualty and. Web claiming the deduction requires you to complete irs form 4684. Attach form 4684 to your tax return.

Form 4684 Edit, Fill, Sign Online Handypdf

You may be able to deduct part or all of each loss caused by theft, vandalism, fire, storm, or similar causes; We last updated the casualties and thefts in january 2023, so this is the latest version of form 4684, fully updated for tax. Losses you can deduct you can deduct losses of property from fire,. Certain taxpayers affected by.

Form 4684 Fill Out and Sign Printable PDF Template signNow

Solved•by intuit•updated july 19, 2022. Individual income tax return,” is a form that taxpayers can file with the irs if. This article will assist you with entering a casualty or theft for form 4684 in. Web use form 4684 to report gains and losses from casualties and thefts. Web the 2018 form 4684 is available at irs.gov/form4684.

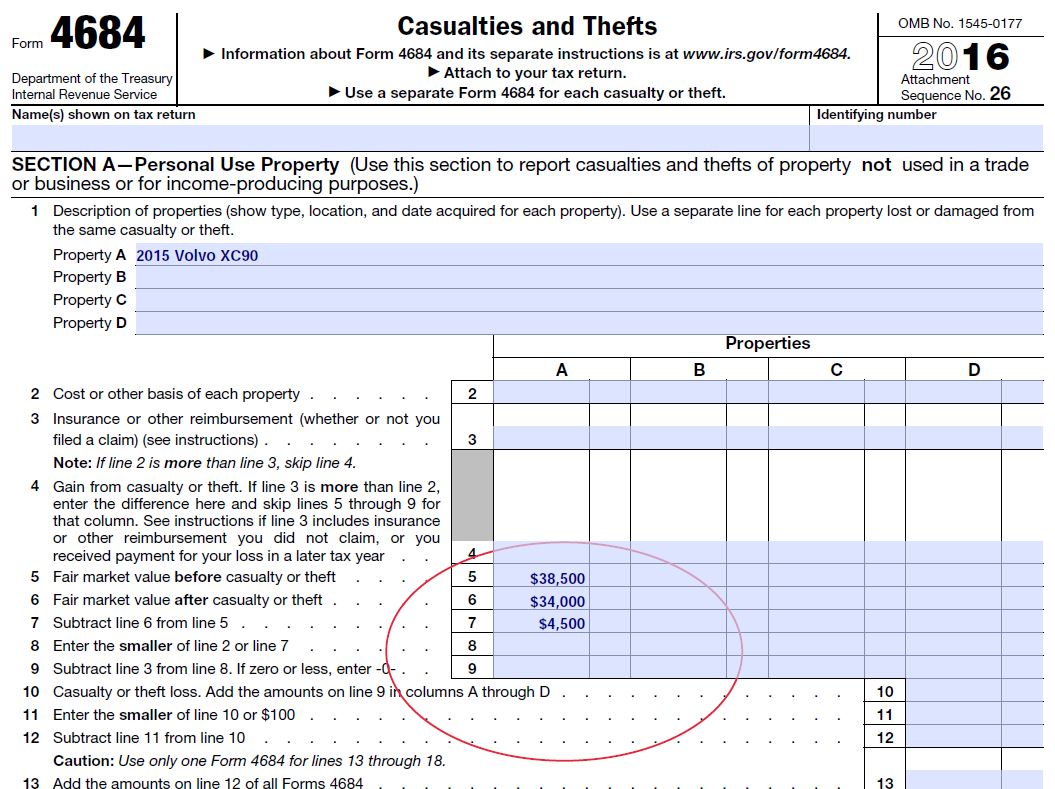

Diminished Value and Taxes, IRS form 4684 Diminished Value of

Web use a separate form 4684 for each casualty or theft. Web you can calculate and report casualty and theft losses on irs form 4684. Beginning in 2018, the tax cuts and jobs act suspended the itemized deduction for personal. This article will assist you with entering a casualty or theft for form 4684 in. Web the 2018 form 4684.

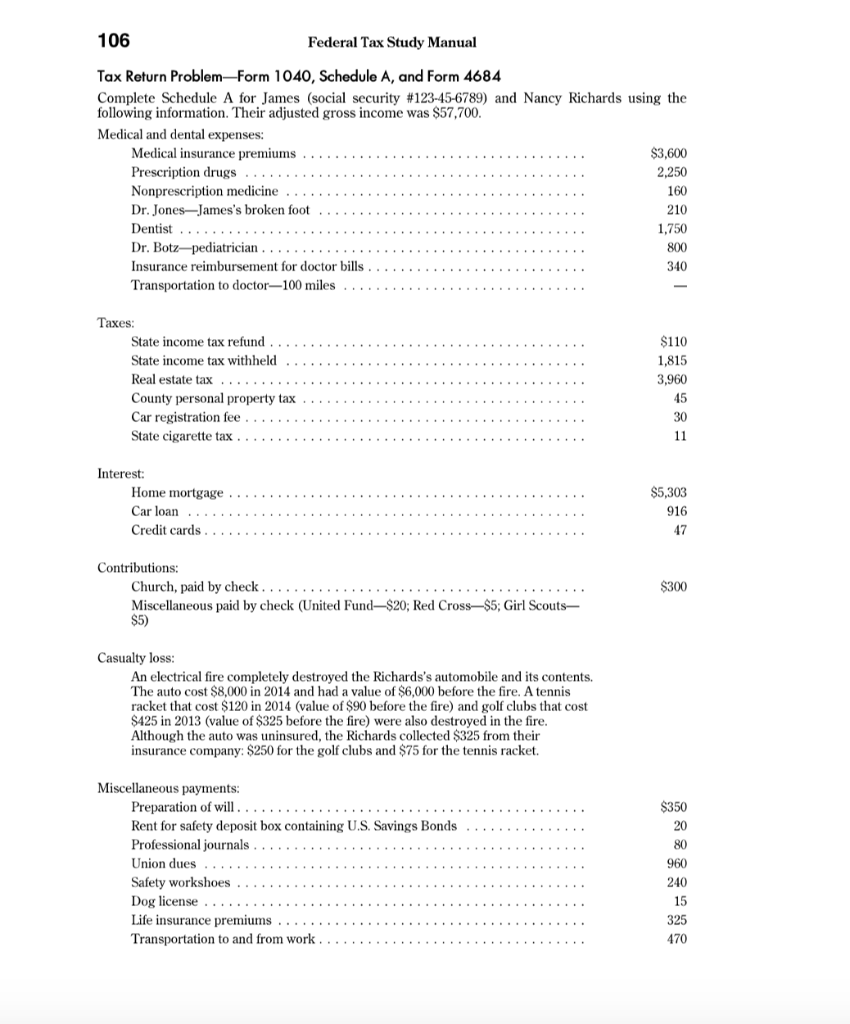

106 Federal Tax Study Manual Tax Return ProblemForm

Web form 4684 is for a casualty loss. See form 8949 for how to make the election. Web you can calculate and report casualty and theft losses on irs form 4684. Web use a separate form 4684 for each casualty or theft. Attach form 4684 to your tax return.

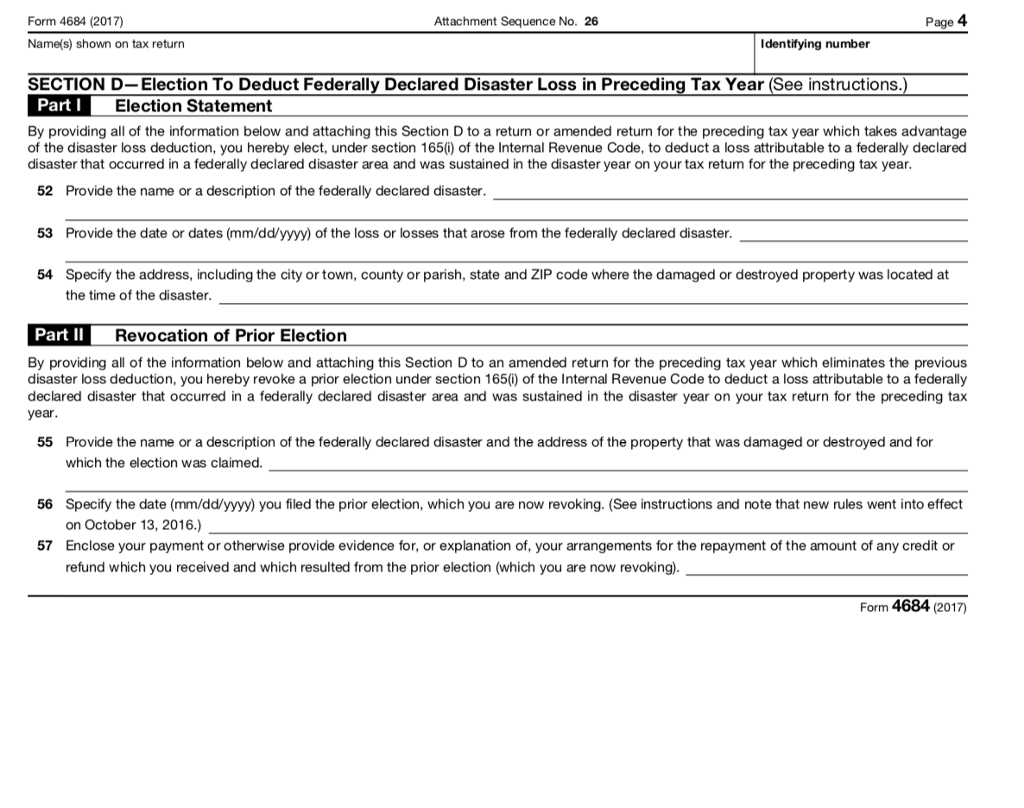

Please fill out an 2017 IRS Tax FORM 4684 Casualty

Beginning in 2018, the tax cuts and jobs act suspended the itemized deduction for personal. Web form 4684 is a form provided by the internal revenue service (irs) that taxpayers who itemize deductions can use with the purpose of reporting gains or. Certain taxpayers affected by federally declared disasters. Web use form 4684 to report gains and losses from casualties.

Name(S) Shown On Tax Return Identifying Number.

Web to compute and report casualty losses, you need to fill out irs form 4684. Web entering a casualty or theft for form 4684. Web taxslayer support what is considered a casualty loss deduction (form 4684)? Web claiming the deduction requires you to complete irs form 4684.

Certain Taxpayers Affected By Federally Declared Disasters.

Federal tax form, is utilized to provide a detailed account of any casualties or thefts and the corresponding financial losses that have occurred within a tax. Attach form 4684 to your tax return. You must enter the fema disaster declaration number on that form. Beginning in 2018, the tax cuts and jobs act suspended the itemized deduction for personal.

You May Be Able To Deduct Part Or All Of Each Loss Caused By Theft, Vandalism, Fire, Storm, Or Similar Causes;

Web form 4684 is a form provided by the internal revenue service (irs) that taxpayers who itemize deductions can use with the purpose of reporting gains or. See form 8949 for how to make the election. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web you can calculate and report casualty and theft losses on irs form 4684.

Web Form 4684 Is For A Casualty Loss.

If reporting a qualified disaster loss, see the instructions for special rules that apply. Car, boat, and other accidents;. Solved•by intuit•updated july 19, 2022. This year, the casualty losses you can deduct are mainly limited to those caused by federally declared disasters.