What Is A Form 8300 Used For

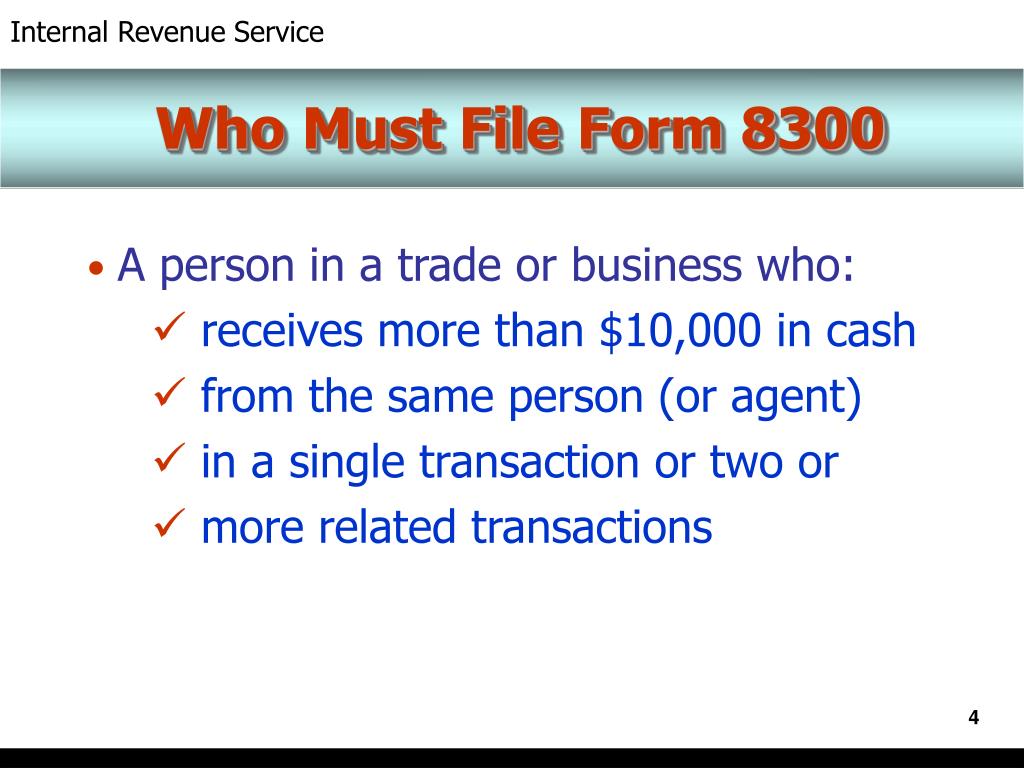

What Is A Form 8300 Used For - Web irs form 8300 & what it means for you. Web at the most basic level, form 8300 is an official report to the irs stating that you received $10,000 in cash or more as a payment. Web form 8300 is a reporting form used by businesses to report cash transactions exceeding $10,000 in a single transaction or in a series of related transactions. This guide is provided to educate and assist u.s. And for the tax professionals who prepare and file form 8300 on behalf of. The main purpose of the irs is to collect funds that are due and payable to the us government’s treasury department. Do not use prior versions after this date. August 2014) department of the treasury internal revenue service. Persons in the continental u.s. While this amount may seem excessive at first glance, there are a lot of reasons why.

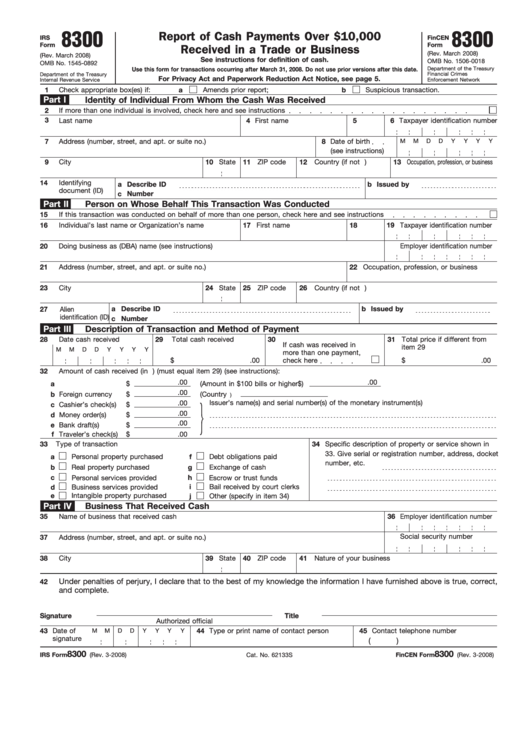

Web at the most basic level, form 8300 is an official report to the irs stating that you received $10,000 in cash or more as a payment. Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement network (fincen) in their efforts to combat money laundering. This guide is provided to educate and assist u.s. This system is known as voluntary compliance. Web reference guide on the irs/fincen form 8300, report of cash payments over $10,000 received in a trade or business. Persons in the continental u.s. Web irs form 8300 & what it means for you. Other items you may find useful all form. Web form 8300 is essentially for the irs’s record keeping to make sure that your business is being honest about its transactional reporting. A report of cash payments on a form 8300 can be filed by mail, online, or through a tax professional.

How to file form 8300. Web generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or related transactions must complete a form 8300, report of cash payments over $10,000 received in a trade or business pdf. Web irs form 8300 & what it means for you. While this amount may seem excessive at first glance, there are a lot of reasons why. Territories who have the obligation to file form 8300; August 2014) department of the treasury internal revenue service. The main purpose of the irs is to collect funds that are due and payable to the us government’s treasury department. Web at the most basic level, form 8300 is an official report to the irs stating that you received $10,000 in cash or more as a payment. Use this form for transactions occurring after august 29, 2014. Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement network (fincen) in their efforts to combat money laundering.

88 FORM 8300 LETTER, LETTER 8300 FORM Form

Web what is a form 8300 used for? Current revision form 8300 pdf recent developments none at this time. Do not use prior versions after this date. The form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement network (fincen) in their efforts to.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Usd Received

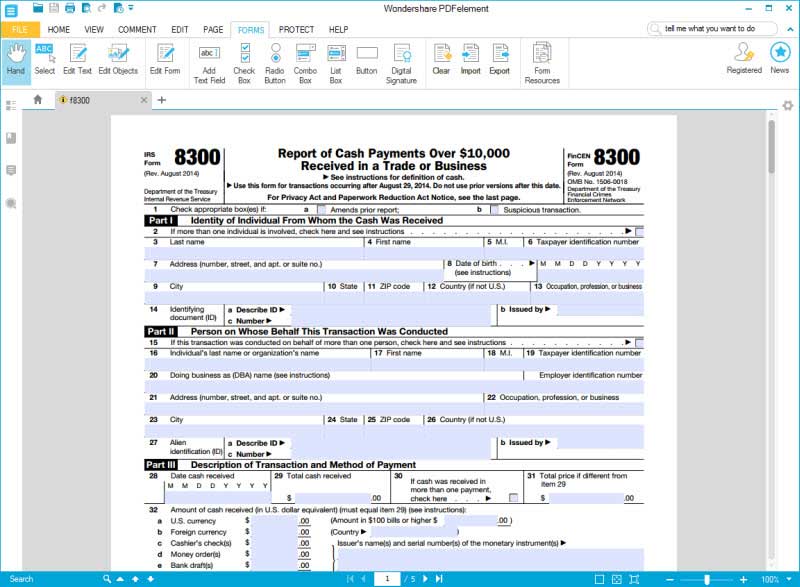

How to file form 8300. Web generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or related transactions must complete a form 8300, report of cash payments over $10,000 received in a trade or business pdf. August 2014) department of the treasury internal revenue service. Use this form for transactions.

EFile 8300 File Form 8300 Online

While this amount may seem excessive at first glance, there are a lot of reasons why. Persons in the continental u.s. August 2014) department of the treasury internal revenue service. Form 8300 is a joint form issued by the irs and the financial crimes enforcement network (fincen) and is used. And for the tax professionals who prepare and file form.

The IRS Form 8300 and How it Works

Web english español each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related transactions, must file this form. See instructions for definition of cash. Report of cash payments over $10,000 received in a trade or business. While this.

88 FORM 8300 LETTER, LETTER 8300 FORM Form

Web what is a form 8300 used for? Other items you may find useful all form. Persons in the continental u.s. Territories who have the obligation to file form 8300; Web generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or related transactions must complete a form 8300, report of.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Received In A

Web what is a form 8300 used for? Persons in the continental u.s. Other items you may find useful all form. A report of cash payments on a form 8300 can be filed by mail, online, or through a tax professional. The form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the.

IRS Form 8300 Fill it in a Smart Way

Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement network (fincen) in their efforts to combat money laundering. How to file form 8300. Web english español each person engaged in a trade or business who, in the course of that trade.

PPT Form 8300 PowerPoint Presentation, free download ID6864711

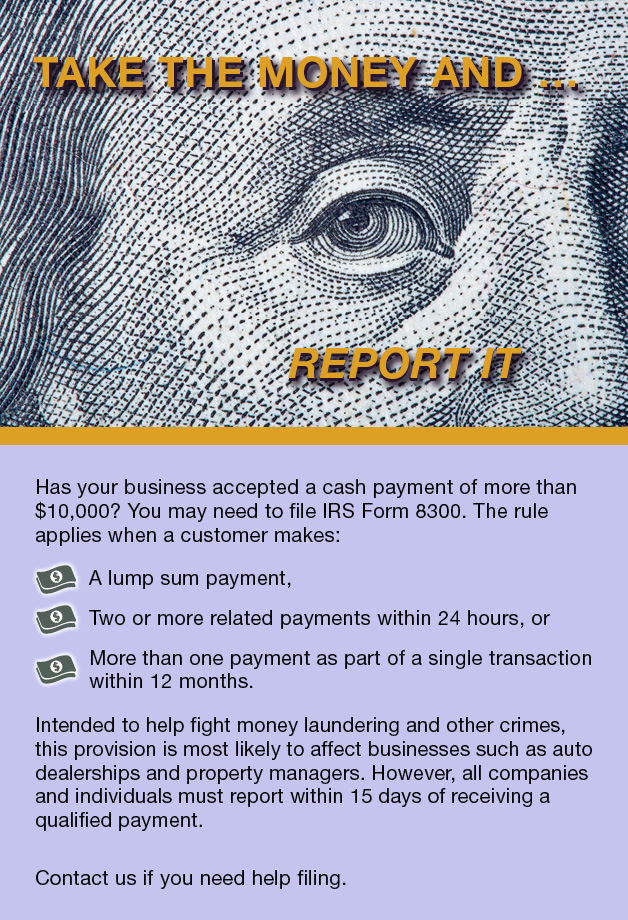

While this amount may seem excessive at first glance, there are a lot of reasons why. To that end, taxpayers are required to report their taxable income and pay taxes on that income. The form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement.

When Must Your Business File IRS Form 8300? Roger Rossmeisl, CPA

This guide is provided to educate and assist u.s. Web form 8300 is a reporting form used by businesses to report cash transactions exceeding $10,000 in a single transaction or in a series of related transactions. How to file form 8300. Form 8300 is a joint form issued by the irs and the financial crimes enforcement network (fincen) and is.

Form 8300 Do You Have Another IRS Issue? ACCCE

Use this form for transactions occurring after august 29, 2014. See instructions for definition of cash. Current revision form 8300 pdf recent developments none at this time. Web english español each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or.

Report Of Cash Payments Over $10,000 Received In A Trade Or Business.

Web at the most basic level, form 8300 is an official report to the irs stating that you received $10,000 in cash or more as a payment. See instructions for definition of cash. Do not use prior versions after this date. Web what is a form 8300 used for?

Persons In The Continental U.s.

A report of cash payments on a form 8300 can be filed by mail, online, or through a tax professional. To that end, taxpayers are required to report their taxable income and pay taxes on that income. Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement network (fincen) in their efforts to combat money laundering. Web irs form 8300 & what it means for you.

Form 8300 Is A Joint Form Issued By The Irs And The Financial Crimes Enforcement Network (Fincen) And Is Used.

It is required by the irs as part of the bsa and is used to help. Web form 8300 is essentially for the irs’s record keeping to make sure that your business is being honest about its transactional reporting. How to file form 8300. The form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement network (fincen) in their efforts to combat money laundering.

This System Is Known As Voluntary Compliance.

Other items you may find useful all form. And for the tax professionals who prepare and file form 8300 on behalf of. Web english español each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related transactions, must file this form. The main purpose of the irs is to collect funds that are due and payable to the us government’s treasury department.