What Is A Form 712

What Is A Form 712 - The value of all policies on the decedent’s life must be reported on the estate tax. Web thefreedictionary form 712 form 712 a form one files with the irs to state the value of a life insurance policy at the time of death of the policyholder or when it is transferred (as a. Find out more concerning form 712 here. Web form 712 reports the value of a policy in order to prepare the estate tax forms. Web available filing your taxes after a life security policy's been remunerated out, it is necessary to file federal form 712 as fine. Irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. The irs form 712 is. The form is also known as the life insurance statement. Web when you pass away, the executor of your estate will have to file irs form 712 as part of your estate tax return. Web a form one files with the irs to state the value of a life insurance policy at the time of death of the policyholder or when it is transferred (as a gift) to another party.

Web irs form 712 is a document used for the valuation of life insurance policies and gift tax returns. Web what is an irs form 712? The value of all policies on the decedent’s life must be reported on the estate tax. Choose the correct version of the editable pdf. At the request of the estate’s. Web federal life insurance statement form 712 pdf form content report error it appears you don't have a pdf plugin for this browser. If your mother's estate was less than (approximately) $5.4 million,. Web available filing your taxes after a life security policy's been remunerated out, it is necessary to file federal form 712 as fine. The irs form 712 is. Irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return.

Life insurance death proceeds form 712. Web when you pass away, the executor of your estate will have to file irs form 712 as part of your estate tax return. Web irs form 712 is a document used for the valuation of life insurance policies and gift tax returns. Form 712 states the value of your life insurance. Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Web irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at the time a life insurance policy is transferred as a. Find out more concerning form 712 here. The irs form 712 is. Web itr is most typically used to value a life insurance policy for transfer tax purposes and is provided by the issuing life insurance carrier via form 712, life insurance statement. If your mother's estate was less than (approximately) $5.4 million,.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Web itr is most typically used to value a life insurance policy for transfer tax purposes and is provided by the issuing life insurance carrier via form 712, life insurance statement. Find out more concerning form 712 here. Web what is irs form 712? Please use the link below to download 2022. Choose the correct version of the editable pdf.

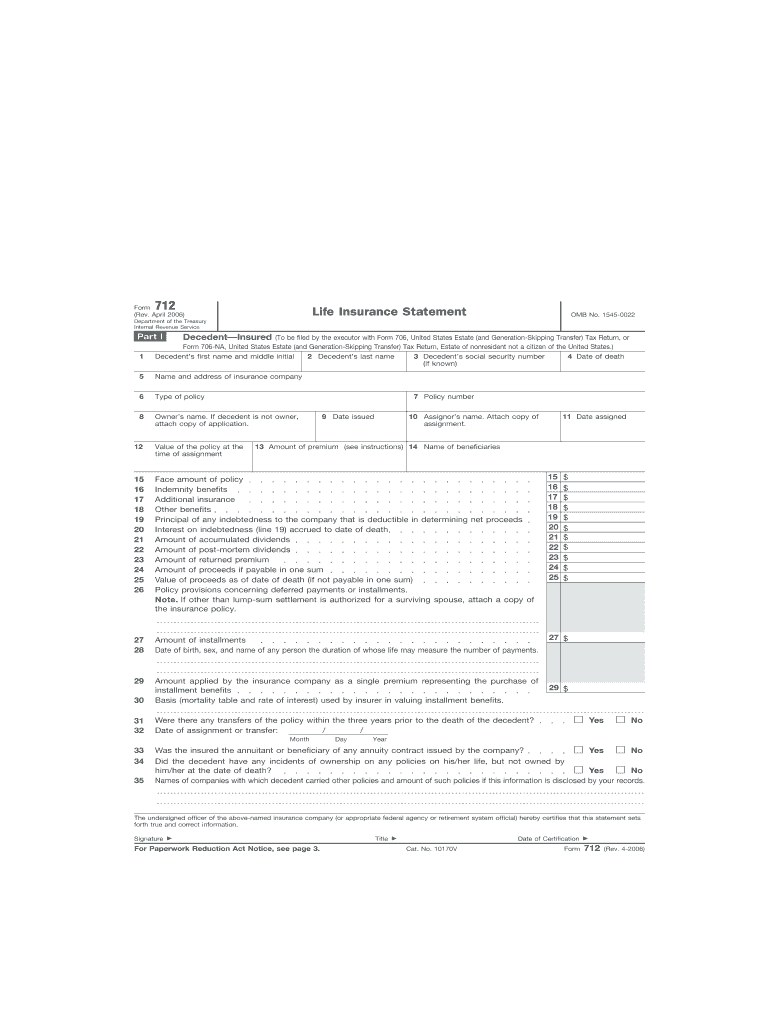

Form 712 Life Insurance Statement (2006) Free Download

Form 712 states the value of your life insurance. Find out more concerning form 712 here. Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Web form 712 reports the value of a policy in order to prepare the estate tax forms. Web what is irs.

What is form 712? Protective Life

Web when you pass away, the executor of your estate will have to file irs form 712 as part of your estate tax return. The form is also known as the life insurance statement. Web what is irs form 712? Form 712 states the value of your life insurance. At the request of the estate’s.

Form 712 Fill Out and Sign Printable PDF Template signNow

The form is also known as the life insurance statement. Web itr is most typically used to value a life insurance policy for transfer tax purposes and is provided by the issuing life insurance carrier via form 712, life insurance statement. Irs form 712 is an informational tax form that is used to report the value of life insurance policies.

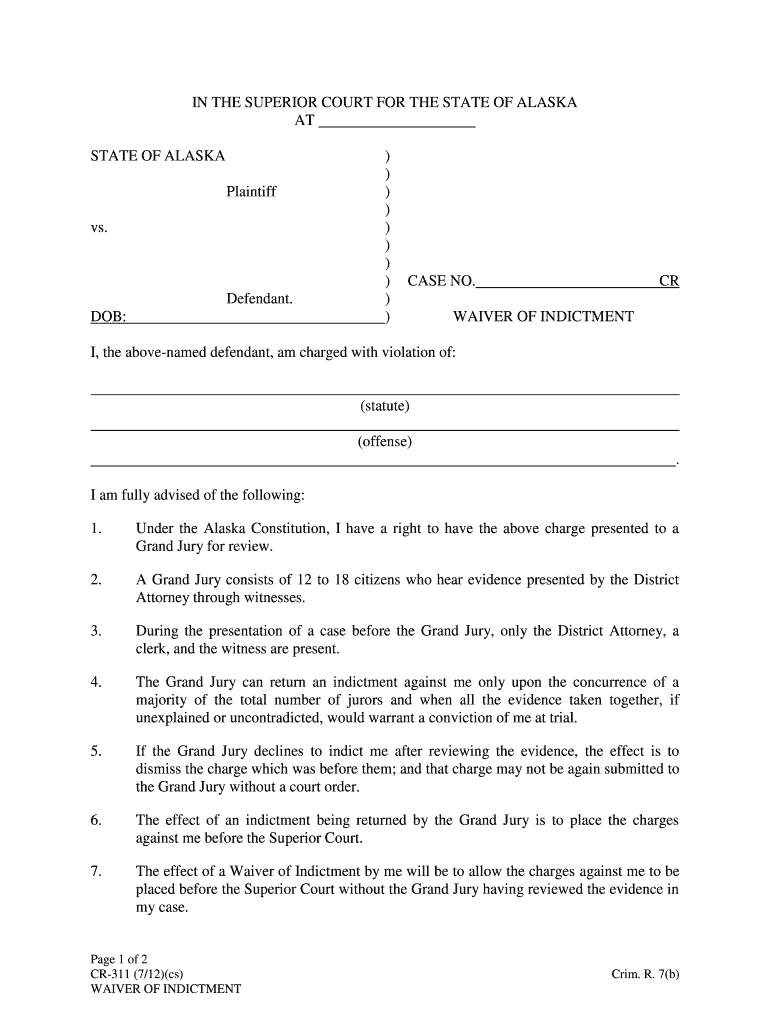

CR 311 Waiver of Indictment 712 Criminal Forms Fill Out and Sign

Web irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at the time a life insurance policy is transferred as a. Irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate.

Form 712 Life Insurance Statement (2006) Free Download

Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Find out more concerning form 712 here. Web available filing your taxes after a life security policy's been remunerated out, it is necessary to file federal form 712 as fine. Web what is an irs form 712?.

KY AOC712 2008 Complete Legal Document Online US Legal Forms

Choose the correct version of the editable pdf. Web a form one files with the irs to state the value of a life insurance policy at the time of death of the policyholder or when it is transferred (as a gift) to another party. Irs form 712 is an informational tax form that is used to report the value of.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

The irs form 712 is. Web a form one files with the irs to state the value of a life insurance policy at the time of death of the policyholder or when it is transferred (as a gift) to another party. Choose the correct version of the editable pdf. If your mother's estate was less than (approximately) $5.4 million,. At.

Form 712 Life Insurance Statement (2006) Free Download

Web irs form 712 is a document used for the valuation of life insurance policies and gift tax returns. The irs form 712 is. Web federal life insurance statement form 712 pdf form content report error it appears you don't have a pdf plugin for this browser. Find out more concerning form 712 here. The value of all policies on.

Form 712 Life Insurance Statement (2006) Free Download

The value of all policies on the decedent’s life must be reported on the estate tax. Web find and fill out the correct form 712 life insurance statement. Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at a time a life insurance.

Web Irs Form 712 Is A Document Used For The Valuation Of Life Insurance Policies And Gift Tax Returns.

Web a form one files with the irs to state the value of a life insurance policy at the time of death of the policyholder or when it is transferred (as a gift) to another party. Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at a time a life insurance policy is transferred as. The value of all policies on the decedent’s life must be reported on the estate tax. Web what is an irs form 712?

Web A Form One Files With The Irs To State The Value Of A Life Insurance Policy At The Time Of Death Of The Policyholder Or When It Is Transferred (As A Gift) To Another Party.

The form is also known as the life insurance statement. Web when you pass away, the executor of your estate will have to file irs form 712 as part of your estate tax return. Web what is irs form 712? Web thefreedictionary form 712 form 712 a form one files with the irs to state the value of a life insurance policy at the time of death of the policyholder or when it is transferred (as a.

Find Out More Concerning Form 712 Here.

Form 712 states the value of your life insurance. Life insurance death proceeds form 712. At the request of the estate’s. Web available filing your taxes after a life security policy's been remunerated out, it is necessary to file federal form 712 as fine.

Irs Form 712 Is A Gift Or Estate Tax Form That May Need To Be Filed With The Deceased’s Final Estate Tax Return.

Web irs form 712 is a statement that provides life insurance policy values as of the date of an insured's or policy owner's death, or at the time a life insurance policy is transferred as a. Web form 712 reports the value of a policy in order to prepare the estate tax forms. Please use the link below to download 2022. Web find and fill out the correct form 712 life insurance statement.