What Is A 2290 Tax Form

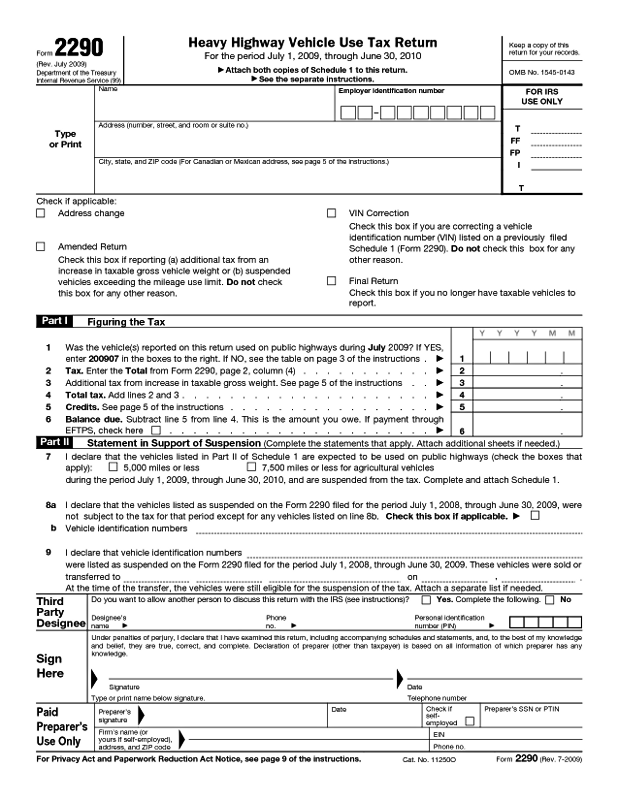

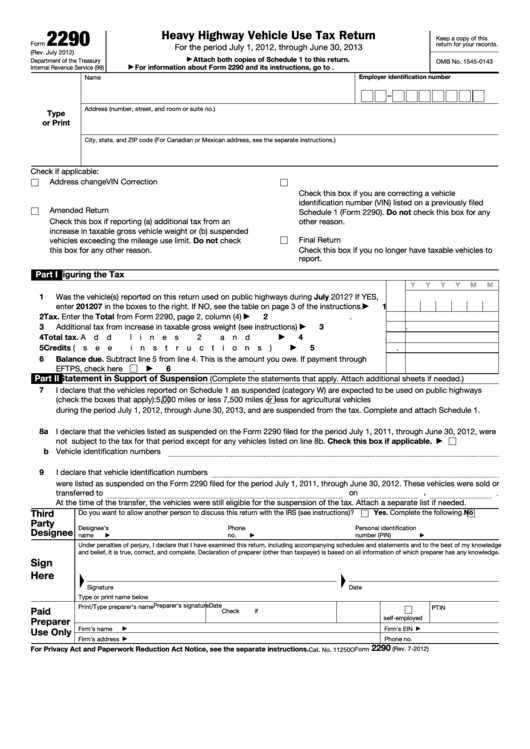

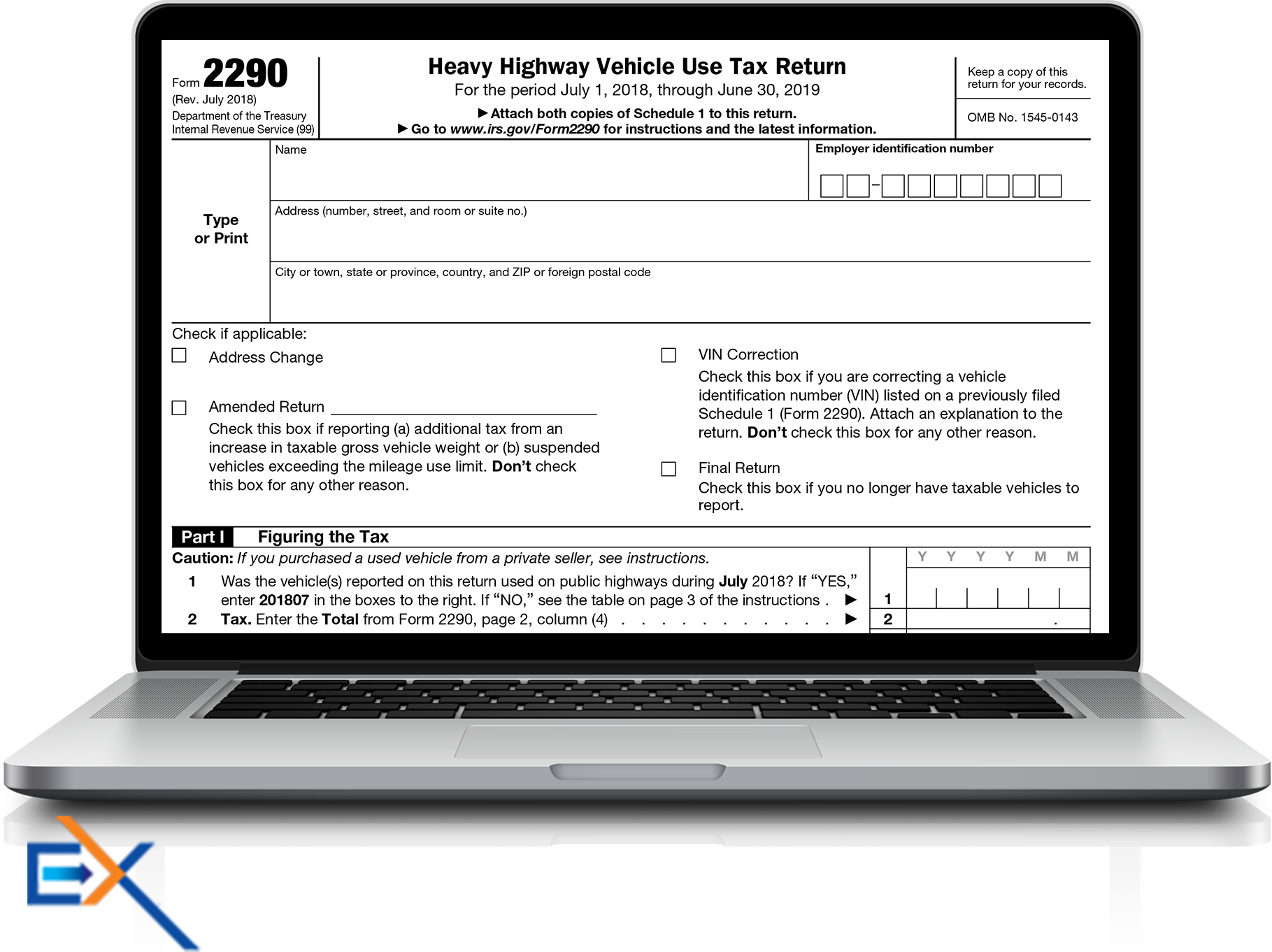

What Is A 2290 Tax Form - See when to file form 2290 for more details. Web the total penalty is 4.5% of the total tax due. Web 2290 tax form as defined by the irs, the 2290 tax form is used to: Calculate and pay the tax due on vehicles that weigh (fully loaded: Keep a copy of this return for your records. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. If you place an additional taxable truck registered in your name on the road during. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Then the penalty will be $300 x.045 or $313.50. July 2022) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach both copies of schedule 1 to this return.

It is due annually between july 1 and august 31 for vehicles that drive on american highways with a gross vehicle weight of 55,000 pounds or more. It must be filed and paid annually for every truck that drives on public highways and weighs over 55,000 lbs. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the tax period and the. Go to www.irs.gov/form2290 for instructions and the latest information. Web when form 2290 taxes are due. Keep a copy of this return for your records. See when to file form 2290 for more details. Then the penalty will be $300 x.045 or $313.50. Web the irs form 2290 is what you file to pay the heavy highway vehicle use tax. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file.

It is due annually between july 1 and august 31 for vehicles that drive on american highways with a gross vehicle weight of 55,000 pounds or more. For example, if the tax due is $300. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Go to www.irs.gov/form2290 for instructions and the latest information. Tractor and trailer) 55,000 lbs or more. Web the total penalty is 4.5% of the total tax due. Include the last two pages, if applicable. Then the penalty will be $300 x.045 or $313.50. For vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31. Web a 2290 form is the heavy highway vehicle use tax (hhvut).

Get your Form 2290 Schedule 1 in Minutes Efile Form 2290 Now

Apart from the penalty fee, the irs may also add interest fees. Web 2290 tax form as defined by the irs, the 2290 tax form is used to: Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Web a 2290 form is the heavy highway vehicle use tax (hhvut). Web when form.

2290 Tax Form 2017 Universal Network

If you place an additional taxable truck registered in your name on the road during. Apart from the penalty fee, the irs may also add interest fees. Web when form 2290 taxes are due. See when to file form 2290 for more details. Everyone must complete the first and second pages of form 2290 along with both pages of schedule.

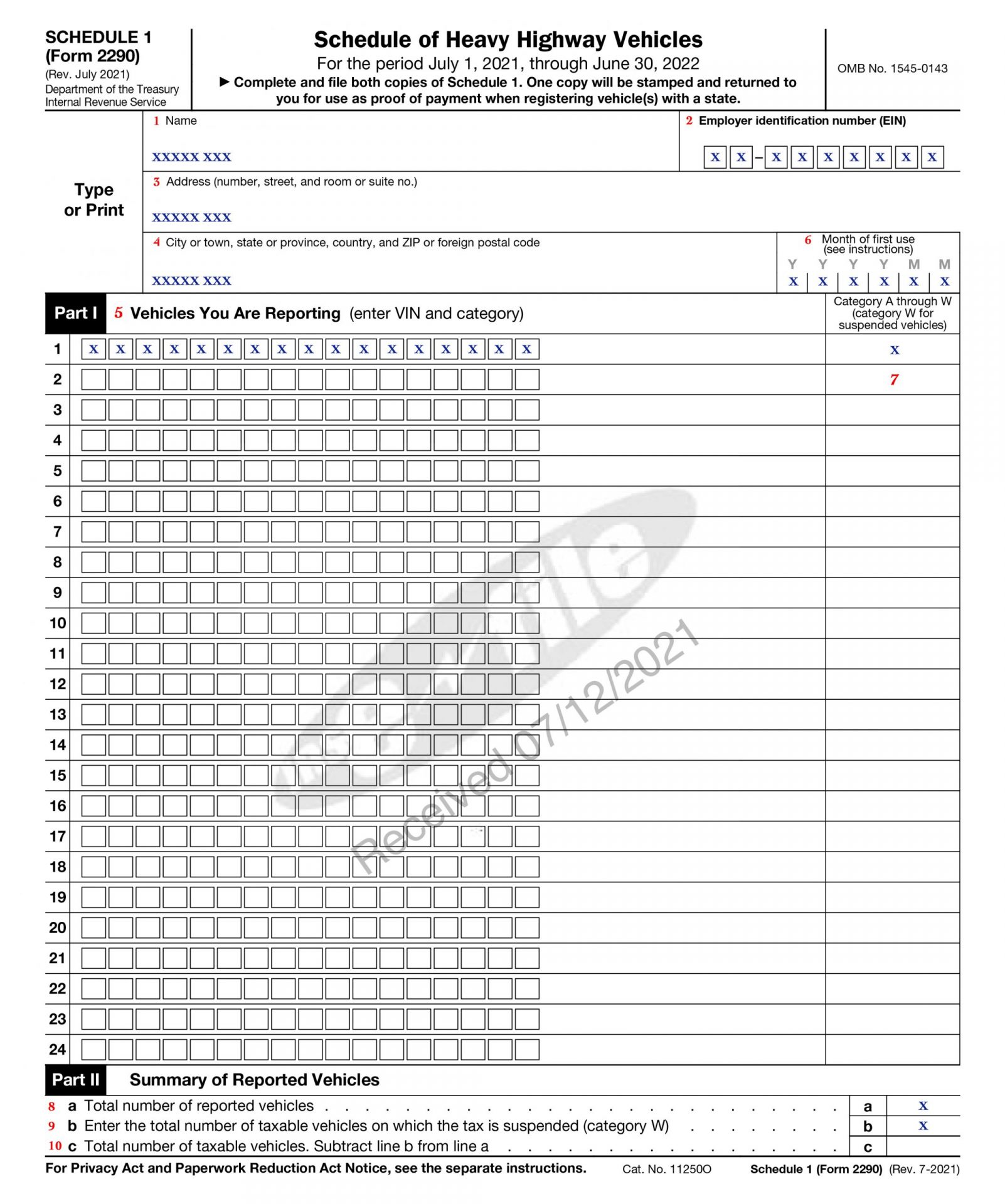

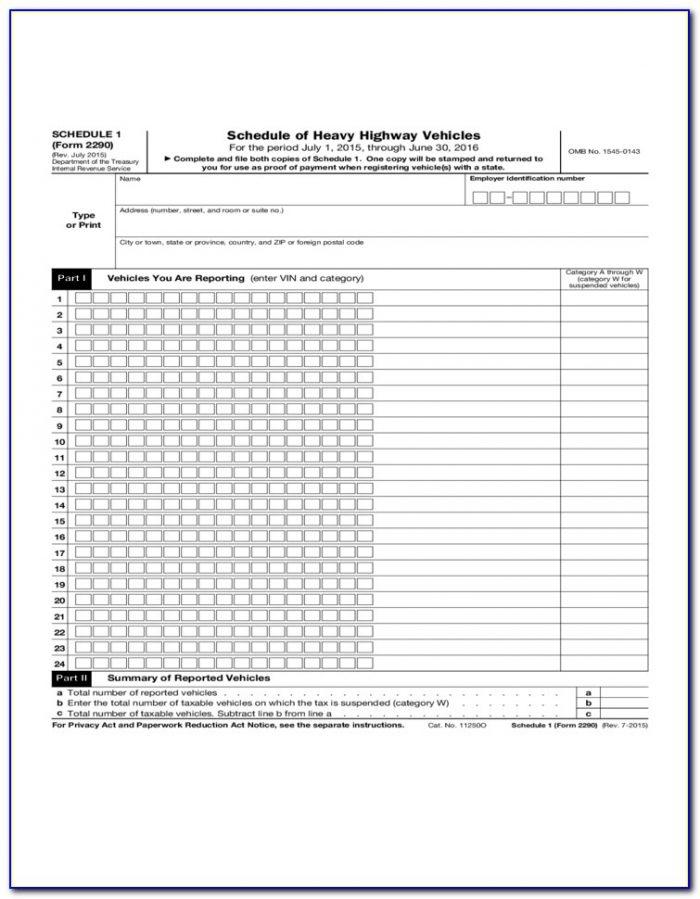

Schedule 1 2290 IRS Form 2290 Schedule 1 eForm 2290

If you place an additional taxable truck registered in your name on the road during. Keep a copy of this return for your records. Web 2290 tax form as defined by the irs, the 2290 tax form is used to: Calculate and pay the tax due on vehicles that weigh (fully loaded: Everyone must complete the first and second pages.

EFile Your Truck Tax Form 2290 Highway Heavy Vehicle Use Tax

Once you file your 2290 form, a stamped schedule 1 will be provided to you through this website as your receipt for this heavy highway vehicle use tax. Include the last two pages, if applicable. For example, if the tax due is $300. Web a 2290 form is the heavy highway vehicle use tax (hhvut). Web you must file form.

14 Form Irs Seven Signs You’re In Love With 14 Form Irs AH STUDIO Blog

Then the penalty will be $300 x.045 or $313.50. Apart from the penalty fee, the irs may also add interest fees. The tax amount due is based on the vehicle’s weight as well as mileage traveled during the year. Include the last two pages, if applicable. Once you file your 2290 form, a stamped schedule 1 will be provided to.

2290 Heavy Highway Tax Form 2017 Universal Network

Web 2290 tax form as defined by the irs, the 2290 tax form is used to: Complete the first four pages of form 2290. Once you file your 2290 form, a stamped schedule 1 will be provided to you through this website as your receipt for this heavy highway vehicle use tax. Web the total penalty is 4.5% of the.

Building Strong Independent Dealers Deadline Draws Near for FHUT 2290

For example, if the tax due is $300. The tax amount due is based on the vehicle’s weight as well as mileage traveled during the year. Web the total penalty is 4.5% of the total tax due. Tractor and trailer) 55,000 lbs or more. This penalty is added up for 5 months.

Fillable Form 2290 Heavy Highway Vehicle Use Tax Return printable pdf

The interest fee will be 0.05% for every month that the tax is past due. See when to file form 2290 for more details. Web a 2290 form is the heavy highway vehicle use tax (hhvut). Web 2290 tax form as defined by the irs, the 2290 tax form is used to: Then the penalty will be $300 x.045 or.

Printable 2290 Tax Form 2021 Printable Form 2022

Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Once you file your 2290 form, a stamped schedule 1 will be provided to you through this website as your receipt for this heavy highway vehicle use tax..

PreFile 2290 Form Online for 20222023 Tax Year & Pay HVUT Later

Calculate and pay the tax due on vehicles that weigh (fully loaded: The tax amount due is based on the vehicle’s weight as well as mileage traveled during the year. Web the total penalty is 4.5% of the total tax due. It is due annually between july 1 and august 31 for vehicles that drive on american highways with a.

Web 2290 Tax Form As Defined By The Irs, The 2290 Tax Form Is Used To:

Calculate and pay the tax due on vehicles that weigh (fully loaded: Web the irs form 2290 is what you file to pay the heavy highway vehicle use tax. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. It is due annually between july 1 and august 31 for vehicles that drive on american highways with a gross vehicle weight of 55,000 pounds or more.

If You Place An Additional Taxable Truck Registered In Your Name On The Road During.

See when to file form 2290 for more details. Web when form 2290 taxes are due. Tractor and trailer) 55,000 lbs or more. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles.

Web Information About Form 2290, Heavy Highway Vehicle Use Tax Return, Including Recent Updates, Related Forms, And Instructions On How To File.

This penalty is added up for 5 months. Once you file your 2290 form, a stamped schedule 1 will be provided to you through this website as your receipt for this heavy highway vehicle use tax. Web a 2290 form is the heavy highway vehicle use tax (hhvut). The interest fee will be 0.05% for every month that the tax is past due.

For Vehicles First Used On A Public Highway During The Month Of July, File Form 2290 And Pay The Appropriate Tax Between July 1 And August 31.

Keep a copy of this return for your records. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the tax period and the. Apart from the penalty fee, the irs may also add interest fees. For example, if the tax due is $300.