What Is A 1088 Form

What Is A 1088 Form - Get your fillable template and complete it online using the instructions provided. Specifically, the form requires information about the mortgage lender,. Gross receipts or sales (. Forget about scanning and printing out forms. Web the dp 1088 is an electronic form and shall be completed and maintained electronically by both the provider and odp. Web fair labor standards act (flsa) minimum wage poster. Web selling & servicing guide forms. Web quick guide on how to complete 1088 form irs. The dp 1088 includes detailed instructions on how providers. Web as of the 2018 tax year, form 1040, u.s.

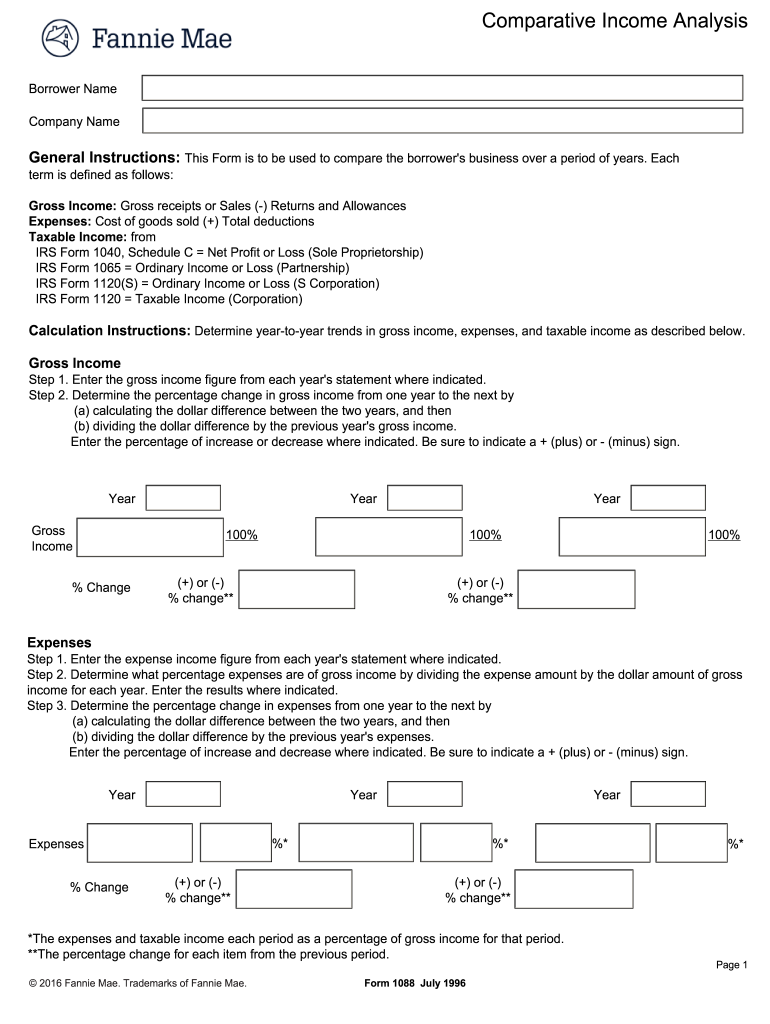

Each term is defined as follows: Web personal service corporations and closely held corporations use this form to: Gross receipts or sales (. Every employer of employees subject to the fair labor standards act's minimum wage provisions must post, and keep. The internal revenue service uses the information on this form to. Figure the amount of any passive activity loss (pal) or credit for the current tax year and. These forms are provided for use in meeting our selling and servicing guides requirements. Web the dp 1088 is an electronic form and shall be completed and maintained electronically by both the provider and odp. Web up to $40 cash back the 1088 tax form is used to report mortgage interest, payments, and premiums. Specifically, the form requires information about the mortgage lender,.

Create professional documents with signnow. Web fair labor standards act (flsa) minimum wage poster. Web form 8810 2021 corporate passive activity loss and credit limitations department of the treasury internal revenue service attach to your tax return (personal service and. Web form 6088 is used to report the 25 highest participants of a deferred compensation plan. Web personal service corporations and closely held corporations use this form to: This form is to be used to compare the borrower's business over a period of years. Forget about scanning and printing out forms. Web use this quick reference guide for fannie mae’s comparative analysis form (form 1088). The internal revenue service uses the information on this form to. Web what is a 1088 form?

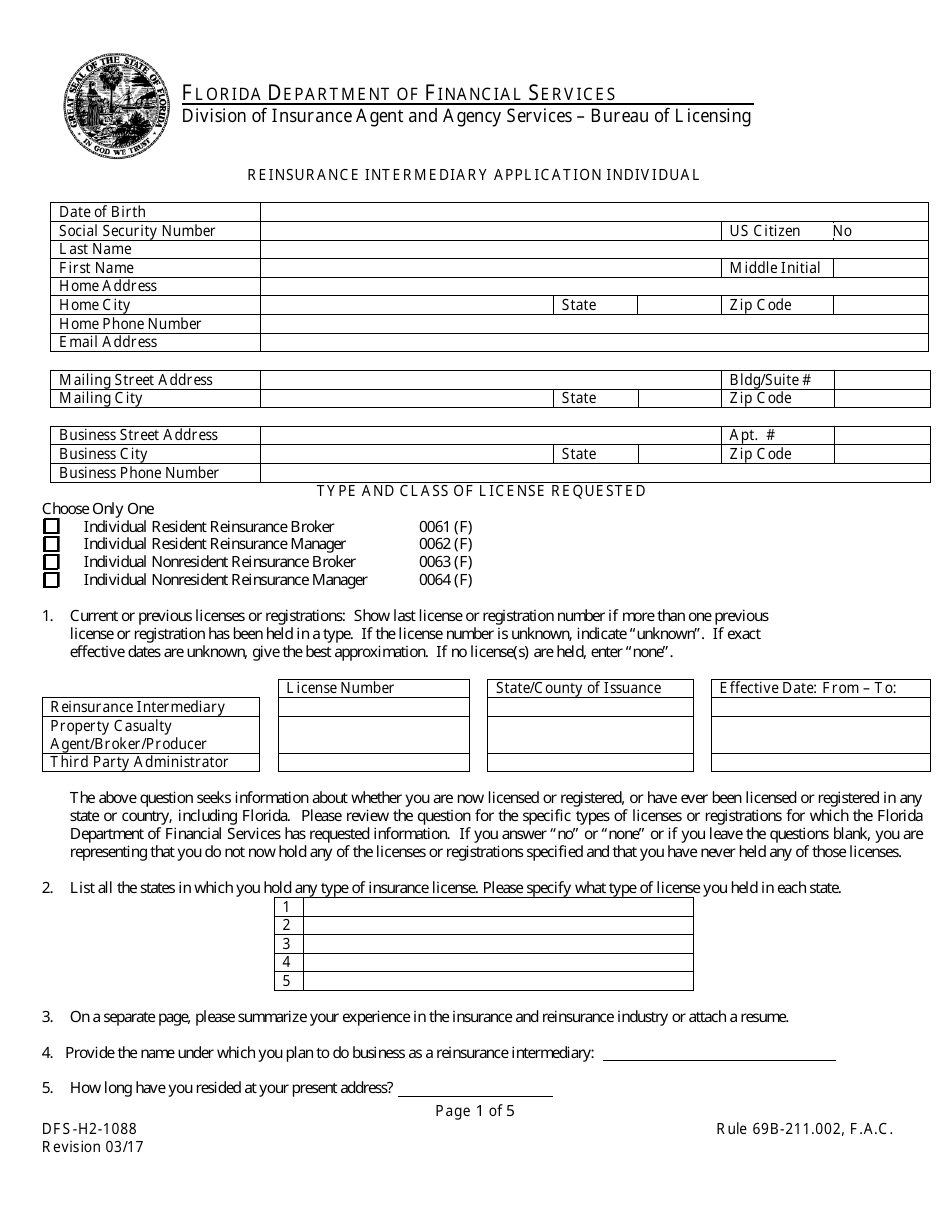

Form DFSH21088 Download Fillable PDF or Fill Online Reinsurance

The 1088 tax form is used by businesses who have received payments from other companies in what's called barter transactions. Use our detailed instructions to fill out and esign your documents online. Gross receipts or sales (. Fannie mae comparative analysis form 1088 calculate increases/decreases in gross. Individual income tax return,” is a form that taxpayers can file with the.

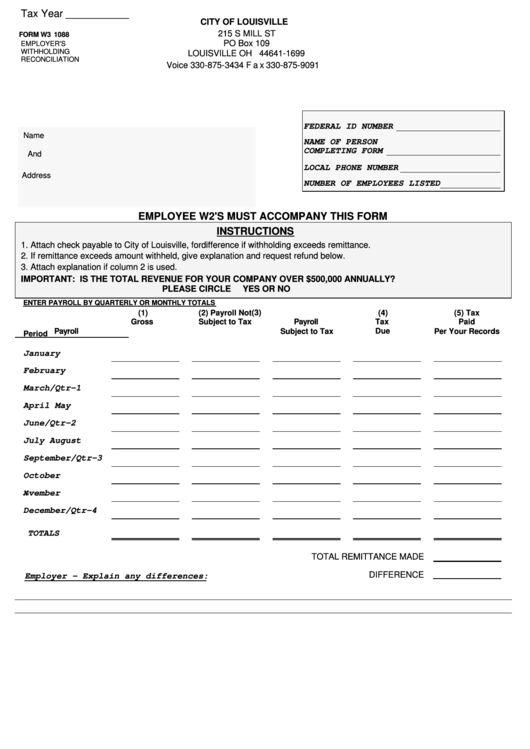

Fillable Form W3 1088 Employer'S Withholding Reconciliation City Of

Fannie mae comparative analysis form 1088 calculate increases/decreases in gross. Forget about scanning and printing out forms. Get your fillable template and complete it online using the instructions provided. Web fair labor standards act (flsa) minimum wage poster. Web quick guide on how to complete 1088 form irs.

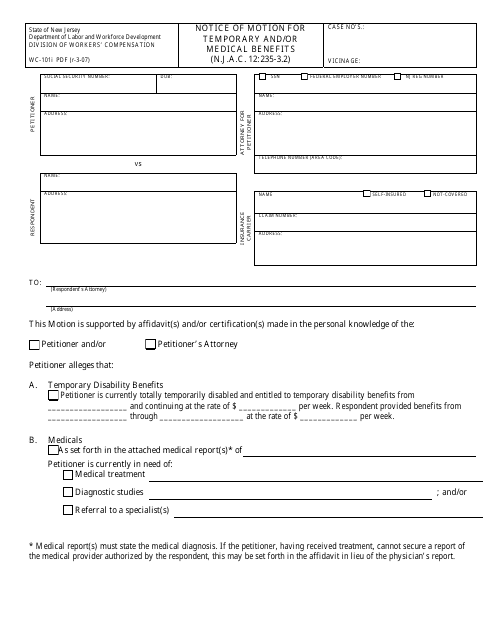

Form WC101I Download Fillable PDF or Fill Online Notice of Motion for

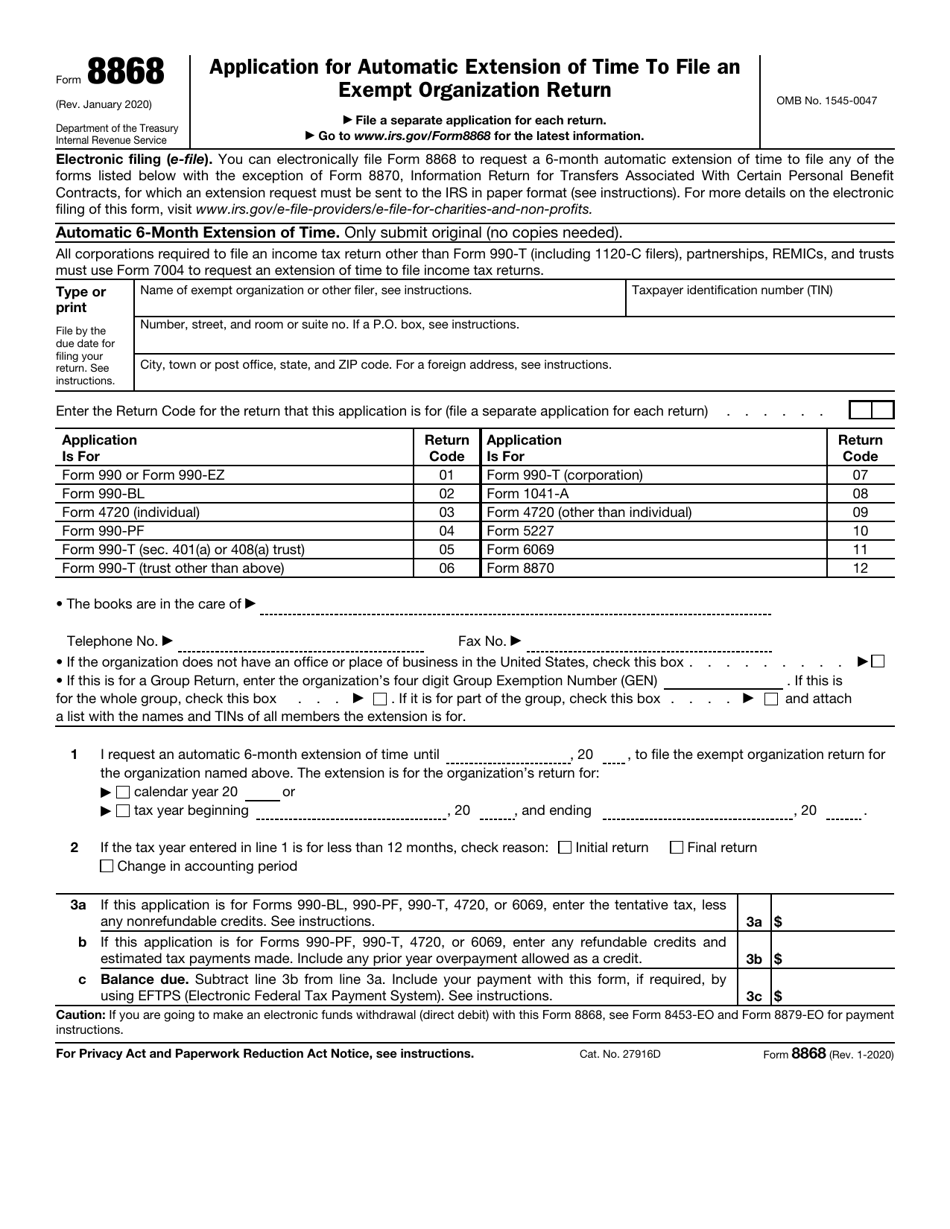

Web form 4868, also known as an “application for automatic extension of time to file u.s. Edit your irs form 1088 online type text, add images, blackout confidential details, add comments, highlights and more. Gross receipts or sales (. Individual income tax return, is the only form used for personal (individual) federal income tax returns filed with the irs. Web.

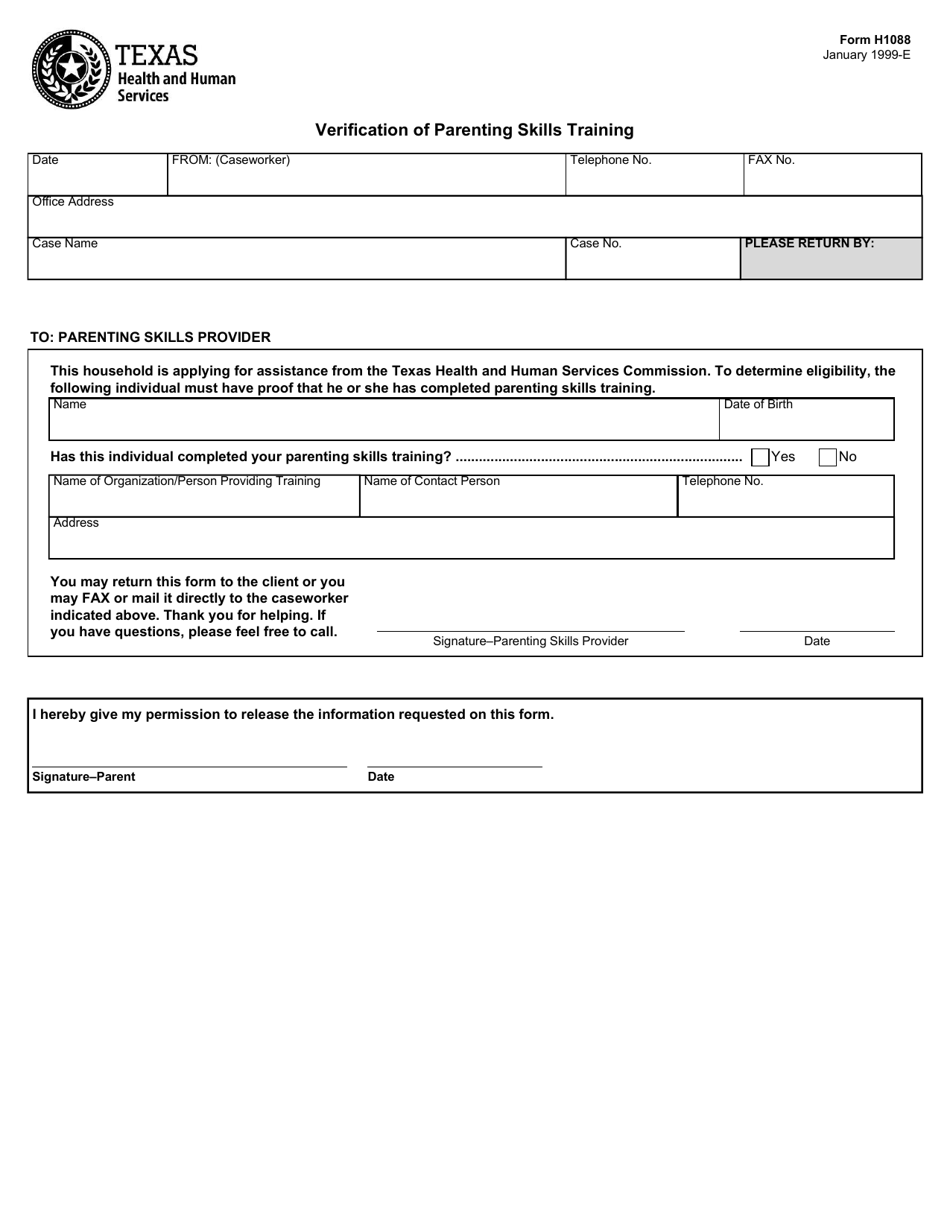

Hhsc Form H1088 Download Fillable Pdf Or Fill Online Verification Of

If the corporation has an overall loss from the entire disposition of a passive activity, the amount to enter on line c is the net. Web use this quick reference guide for fannie mae’s comparative analysis form (form 1088). Web fair labor standards act (flsa) minimum wage poster. Individual income tax return, is the only form used for personal (individual).

1088 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

Web what is a 1088 form? This form is to be used to compare the borrower's business over a period of years. Every employer of employees subject to the fair labor standards act's minimum wage provisions must post, and keep. Web selling & servicing guide forms. The 1088 tax form is used by businesses who have received payments from other.

FIA Historic Database

Web use this quick reference guide for fannie mae’s comparative analysis form (form 1088). Edit your irs form 1088 online type text, add images, blackout confidential details, add comments, highlights and more. Fannie mae comparative analysis form 1088 calculate increases/decreases in gross. Web form 6088 is used to report the 25 highest participants of a deferred compensation plan. Web up.

1088 Tax Form ≡ Fill Out Printable PDF Forms Online

Web form 6088 is used to report the 25 highest participants of a deferred compensation plan. Web as of the 2018 tax year, form 1040, u.s. Gross receipts or sales (. The 1088 tax form is used by businesses who have received payments from other companies in what's called barter transactions. Individual income tax return, is the only form used.

Form 1088 Comparative Analysis Blueprint

Specifically, the form requires information about the mortgage lender,. Sign it in a few clicks draw your signature, type it,. Use our detailed instructions to fill out and esign your documents online. Every employer of employees subject to the fair labor standards act's minimum wage provisions must post, and keep. The dp 1088 includes detailed instructions on how providers.

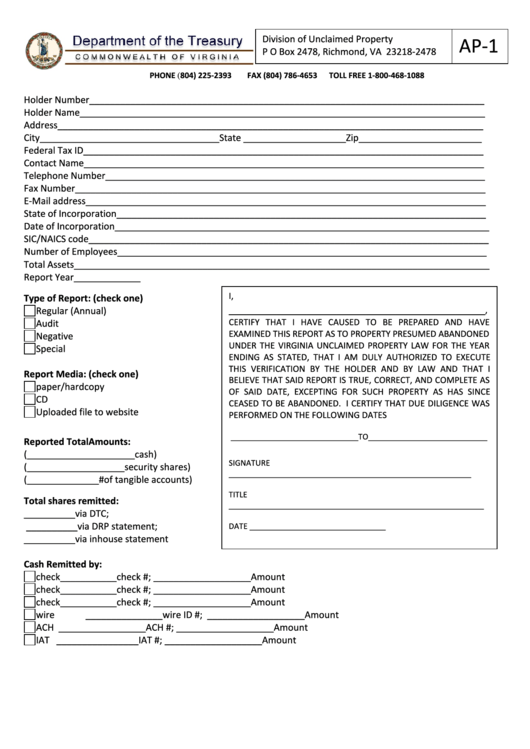

Fillable Form Ap1 Submission Of All Unclaimed Property Reports

Web as of the 2018 tax year, form 1040, u.s. Web form 8810 2021 corporate passive activity loss and credit limitations department of the treasury internal revenue service attach to your tax return (personal service and. The dp 1088 includes detailed instructions on how providers. This form is to be used to compare the borrower's business over a period of.

IRS Form 8868 Download Fillable PDF or Fill Online Application for

The internal revenue service uses the information on this form to. Individual income tax return,” is a form that taxpayers can file with the irs if. Web form 6088 is used to report the 25 highest participants of a deferred compensation plan. Figure the amount of any passive activity loss (pal) or credit for the current tax year and. Web.

These Forms Are Provided For Use In Meeting Our Selling And Servicing Guides Requirements.

The 1088 tax form is used by businesses who have received payments from other companies in what's called barter transactions. Sign it in a few clicks draw your signature, type it,. Individual income tax return,” is a form that taxpayers can file with the irs if. Get your fillable template and complete it online using the instructions provided.

The Dp 1088 Includes Detailed Instructions On How Providers.

Web selling & servicing guide forms. Web fair labor standards act (flsa) minimum wage poster. Web form 6088 is used to report the 25 highest participants of a deferred compensation plan. Edit your irs form 1088 online type text, add images, blackout confidential details, add comments, highlights and more.

The Internal Revenue Service Uses The Information On This Form To.

Forget about scanning and printing out forms. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web up to $40 cash back the 1088 tax form is used to report mortgage interest, payments, and premiums. Web the dp 1088 is an electronic form and shall be completed and maintained electronically by both the provider and odp.

Every Employer Of Employees Subject To The Fair Labor Standards Act's Minimum Wage Provisions Must Post, And Keep.

Web form 8810 2021 corporate passive activity loss and credit limitations department of the treasury internal revenue service attach to your tax return (personal service and. Specifically, the form requires information about the mortgage lender,. Gross receipts or sales (. This form is to be used to compare the borrower's business over a period of years.