What Is 941 Form 2022

What Is 941 Form 2022 - Employers use tax form 941 to report federal income tax withheld, social. It also provides space to calculate and. Ad irs 941 inst & more fillable forms, register and subscribe now! Try it for free now! The draft form 941 ,. The irs form 941 is an employer's quarterly tax return. Web payroll tax returns. Web overview you must file irs form 941 if you operate a business and have employees working for you. Get ready for tax season deadlines by completing any required tax forms today. Form 941 reports federal income and fica taxes each.

Get ready for tax season deadlines by completing any required tax forms today. The last time form 941 was. Certain employers whose annual payroll tax and withholding. The irs form 941 is an employer's quarterly tax return. Employers use tax form 941 to report federal income tax withheld, social. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. Form 941 reports federal income and fica taxes each. Ad irs 941 inst & more fillable forms, register and subscribe now! You must complete all five pages.

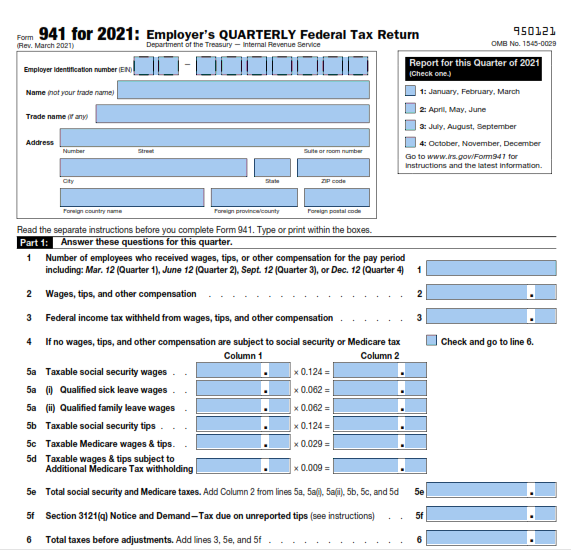

Web report for this quarter of 2022 (check one.) 1: Web overview you must file irs form 941 if you operate a business and have employees working for you. Get ready for tax season deadlines by completing any required tax forms today. Employers use tax form 941 to report federal income tax withheld, social. The deadline is the last day of the month following the end of the quarter. Web payroll tax returns. Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. Web this is the form your business uses to report income taxes and payroll taxes that you withheld from your employees’ wages. Form 941 reports federal income and fica taxes each. 26 by the internal revenue service.

Printable 941 Form Printable Form 2021

It also provides space to calculate and. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. Ad upload, modify or create forms. Employers use tax form 941 to report federal income tax withheld, social. Web irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs.

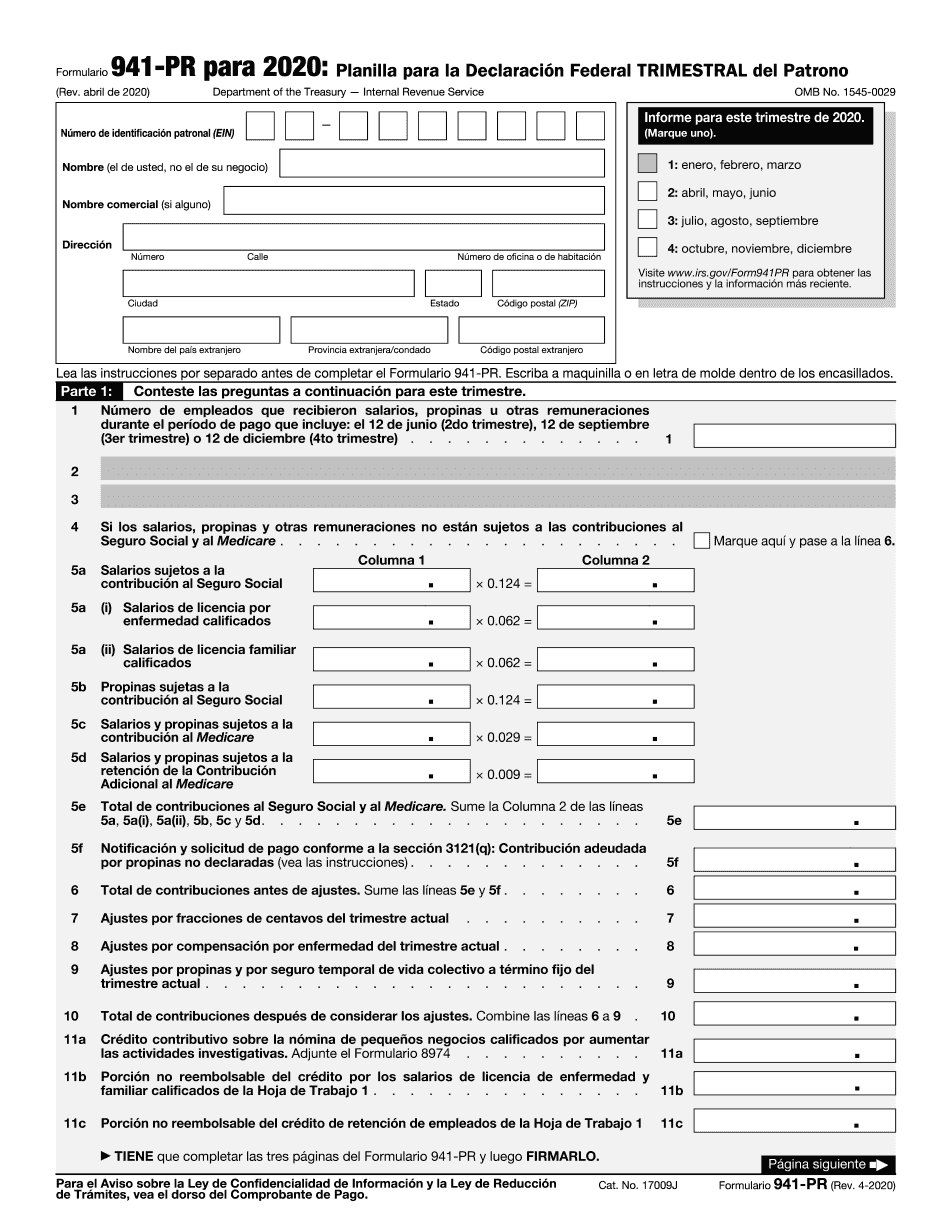

Form 941 Is Revised Yet Again For The Third Quarter Of 2020 Blog

Web report for this quarter of 2022 (check one.) 1: Web irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs. The draft form 941 ,. The last time form 941 was. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

You must complete all five pages. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Certain employers whose annual payroll tax and withholding. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. These instructions have been updated for changes due to the.

How to Complete Form 941 in 5 Simple Steps

Web irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs. These instructions have been updated for changes due to the. Employers use this form to report income taxes, social security. The last time form 941 was. Web given that most us employers are required to file quarterly federal tax returns, 2022 form.

New 941 form for second quarter payroll reporting

Try it for free now! Type or print within the boxes. 26 by the internal revenue service. Web given that most us employers are required to file quarterly federal tax returns, 2022 form 941, the employer’s quarterly tax form, is an essential tax form for. Web this is the form your business uses to report income taxes and payroll taxes.

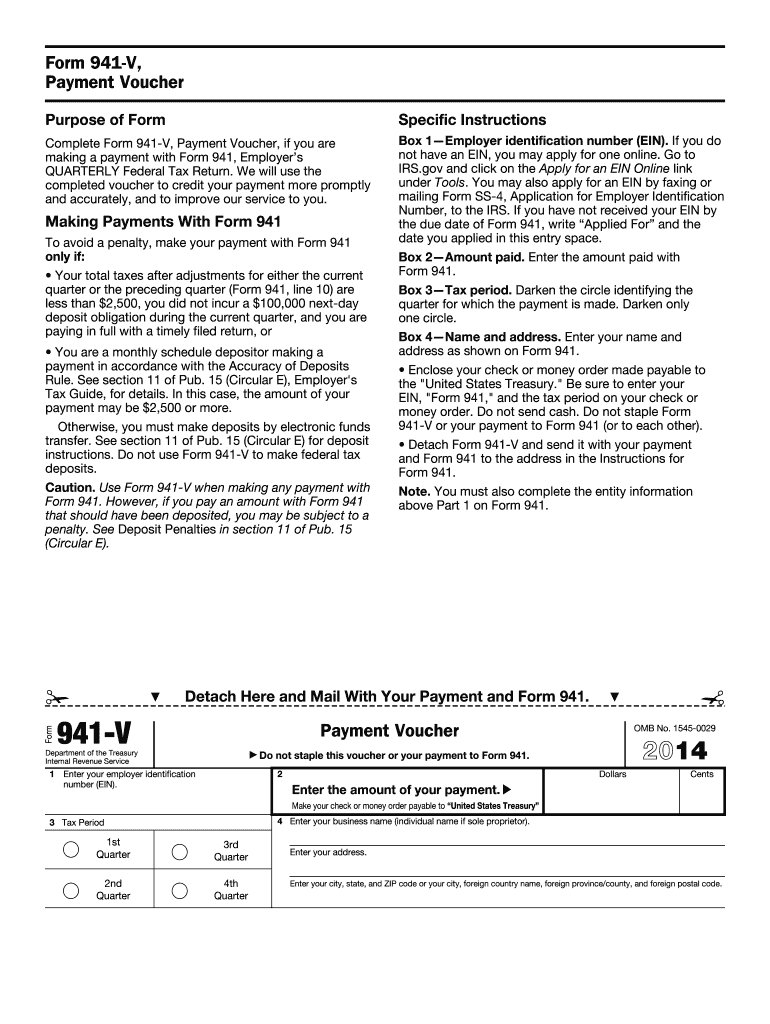

941 V Fill Out and Sign Printable PDF Template signNow

As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. It also provides space to calculate and. Web you file form 941 quarterly. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. Use the march 2022 revision of form 941 only to report taxes for.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Web form 941 is a internal revenue service (irs) tax form for employers in the u.s. Certain employers whose annual payroll tax and withholding. Ad irs 941 inst & more fillable forms, register and subscribe now! Type or print within the boxes. Ad upload, modify or create forms.

Top10 US Tax Forms in 2022 Explained PDF.co

It also provides space to calculate and. Web form 941 is a internal revenue service (irs) tax form for employers in the u.s. Ad upload, modify or create forms. 26 by the internal revenue service. Web payroll tax returns.

Fillable 941 Quarterly Form 2022 Printable Form, Templates and Letter

Employers use tax form 941 to report federal income tax withheld, social. Web form 941 for 2023: Use the march 2022 revision of form 941 only to report taxes for the quarter ending march 31, 2022. Ad irs 941 inst & more fillable forms, register and subscribe now! March 2023) employer’s quarterly federal tax return department of the treasury —.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

The draft form 941 ,. Employers use tax form 941 to report federal income tax withheld, social. Web what is irs form 941? These instructions have been updated for changes due to the.

Use The March 2022 Revision Of Form 941 Only To Report Taxes For The Quarter Ending March 31, 2022.

26 by the internal revenue service. Type or print within the boxes. The last time form 941 was. You must complete all five pages.

Those Returns Are Processed In.

Ad irs 941 inst & more fillable forms, register and subscribe now! Web given that most us employers are required to file quarterly federal tax returns, 2022 form 941, the employer’s quarterly tax form, is an essential tax form for. It also provides space to calculate and. The irs form 941 is an employer's quarterly tax return.

Employers Use This Form To Report Income Taxes, Social Security.

The deadline is the last day of the month following the end of the quarter. Web you file form 941 quarterly. Form 941 reports federal income and fica taxes each. Web form 941 for 2023: